What the fate of the US Bitcoin Reserve depends on and Trump’s attitude to crypto: an analyst’s clear answer

One of the key components of Donald Trump’s election campaign was the promise to create a US-wide Bitcoin reserve. According to the politician, this initiative would allow America to pay off some of its national debt in the future if the cryptocurrency market grows. And while such a prospect is indeed real, the likelihood of forming a stockpile of digital assets depends on a number of factors. More about them told the head of the CryptoQuant platform.

Earlier, representatives of the cryptoindustry have already shared doubts about the creation of a national Bitcoin reserve. According to the former head of the BitMEX exchange Arthur Hayes, it is not worth counting on the accumulation of BTC by America.

Cryptocurrency market growth

That’s not so scary, though. Still, expectations and speculation around the topic will make other countries and companies pay attention to the digital asset. In turn, the interest will turn into buying pressure and will obviously affect the coin rates.

Now, CryptoQuant platform manager Ki Young-Joo has shared a more in-depth analysis of the topic of a national Bitcoin reserve for the US.

Will the US buy bitcoins?

According to Ju, the newly elected US president’s policy towards Bitcoin and cryptocurrencies in general will depend on the strength of the US economy and the dollar. To be more precise, it is about the perception of the global investment community of these components.

According to the head of CryptoQuant, popular assets for preserving value like gold and Bitcoin rise sharply in price when holders of capital begin to doubt the economic hegemony of the United States. That is, uncertainty about the near-term prospects of the world’s main fiat currency forces investors to transfer funds to other assets.

Cryptocurrency investors

However, now there are no such trends, and major market players continue to believe in the stability of the US economy.

As a result, the strong position of the US on the world stage may end with the Trump administration abandoning plans to accumulate bitcoins. Still, the coins are needed to protect the dollar’s dominance around the world. And if the fiat currency retains its leading position, its additional support may not be needed. Moreover, buying crypto for this purpose can damage the dollar’s reputation.

Here is a commentary by Ki Young Ju, which is quoted by Cointelegraph.

Even before his inauguration, Trump was constantly reminding world leaders of the power gap between the US and other countries. Such rhetoric, combined with increased capital inflows into the dollar, is able to reinforce confidence in its superiority.

This theory supports the theory that there will be no point in additional concern about the dollar with the strengthened position of the U.S. economy.

Bitcoin’s struggle with the dollar

The head of CryptoQuant notes that many South Koreans choose the U.S. dollar rather than gold or Bitcoin as an instrument of value preservation. And this trend becomes especially pronounced during periods of weakening of the Korean won.

Young-ju adds that this trend is also relevant for people in emerging economies. Here people are helped by stablecoins, which make it much easier to access the value of the world’s main fiat currency.

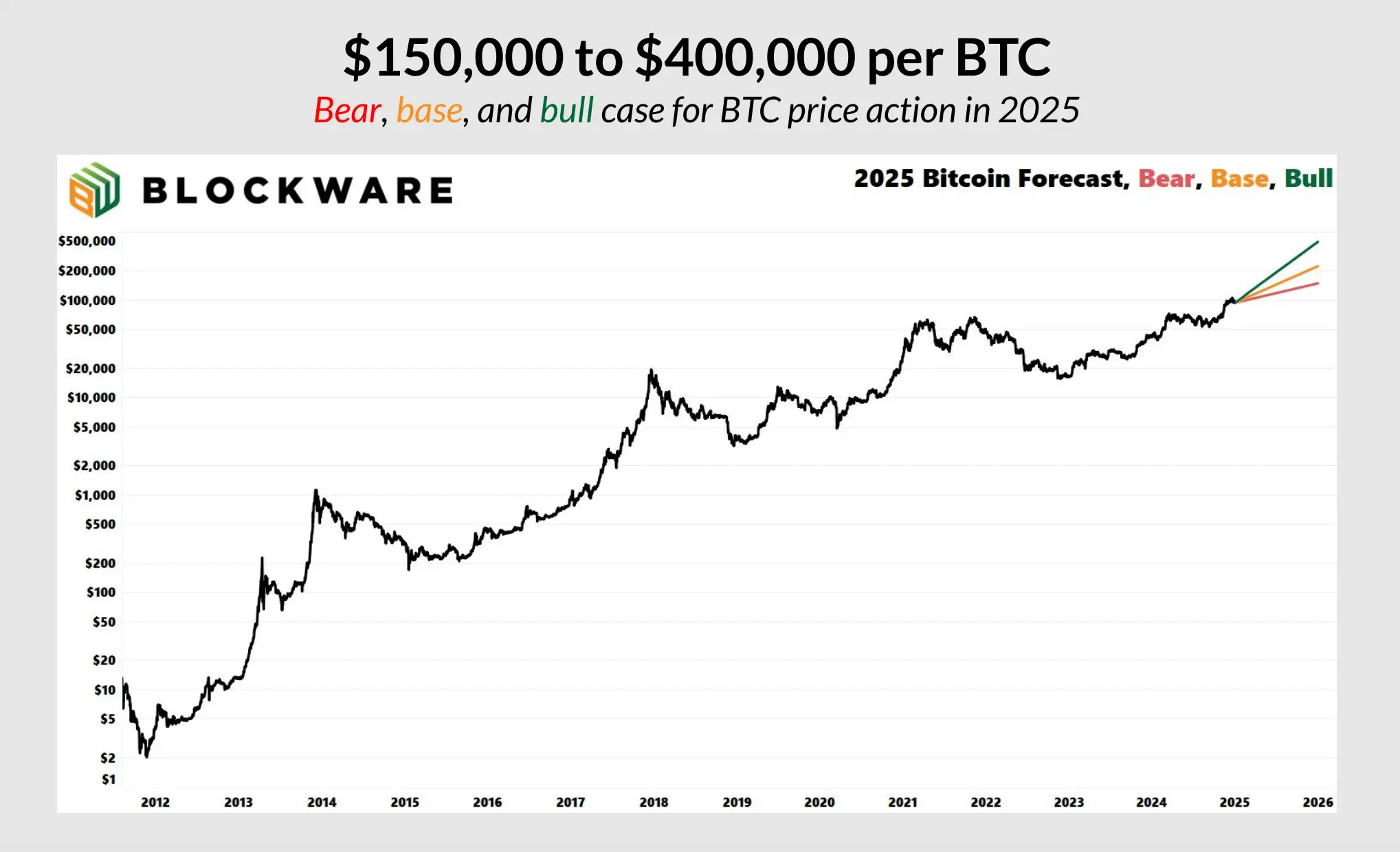

What should we expect from Bitcoin next year, if the Trump administration and Congress still do not deal with the creation of a national reserve of cryptocurrencies? The forecast for such a scenario was shared by experts of the mining company Blockware Solutions.

According to their version, the refusal of bitcoin accumulation by America will mean a bearish or negative scenario for the first cryptocurrency. In such a case, the peak value of BTC in 2025 will be at $150,000.

Bitcoin’s poor performance will also be aided by the US Federal Reserve’s unwillingness to significantly reduce the benchmark interest rate, which will provoke a tangible drain of coins by their long-term holders. We are talking about investors who have held bitcoins for at least 155 days.

Now let’s move on to more positive scenarios. If the U.S. government is engaged in creating a Bitcoin reserve, the U.S. Federal Reserve continues to reduce interest rates, and large companies continue to choose BTC as a reserve asset, then the target level of the first cryptocurrency at this stage of growth will be the 225,000 line.

Possible scenarios for Bitcoin growth at this bullrun according to Blockware Solutions analysts

Well, if the above factors affect the market in the best possible way, then the maximum of BTC on this bullrun will be 400 thousand dollars.

For this purpose, the leadership of the U.S. Federal Reserve should significantly weaken the current restrictions in the U.S. economy. Well, the largest companies in the world, i.e. Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia or Tesla, will be forced to purchase BTC.

Alas, on 10 December, Microsoft shareholders opposed the company’s direct investment in BTC. This happened despite MicroStrategy founder Michael Saylor’s attempt to convince them otherwise with a three-minute presentation. We wrote more about it in a separate piece.

So far, everything points to the fact that the issue of creating a Bitcoin reserve has not yet been resolved. However, Trump has already managed to surprise the cryptocommunity with his support during the election campaign. It is possible that he will do something similar this time too.

Look for more interesting stuff in our crypto chat. Do not linger outside of it.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.