What will happen to USDT in Europe from early 2025: possible scenarios from MiCA Crypto Alliance representatives

In April 2023, the European Parliament passed the MiCA bill on the regulation of digital assets, which stands for Markets in Crypto-Assets. Its essence boils down to the introduction of unified rules for the management of the coin sphere in the EU countries, so that startups only need to obtain a licence in one of the countries to operate in this region. The implementation phase of the bill ends on 30 December 2024, which primarily raises questions about the fate of popular stablecoins. This is especially true for USDT.

USDT is the largest stablecoin of the cryptocurrency industry and coincidentally the main bridge between the world of fiat currencies and digital assets. Still, when wishing to get in touch with crypto, large investors interact with Tether, pay them considerable sums and receive the corresponding equivalent of tokens based on the chosen network like Efirium, Tron or Solana.

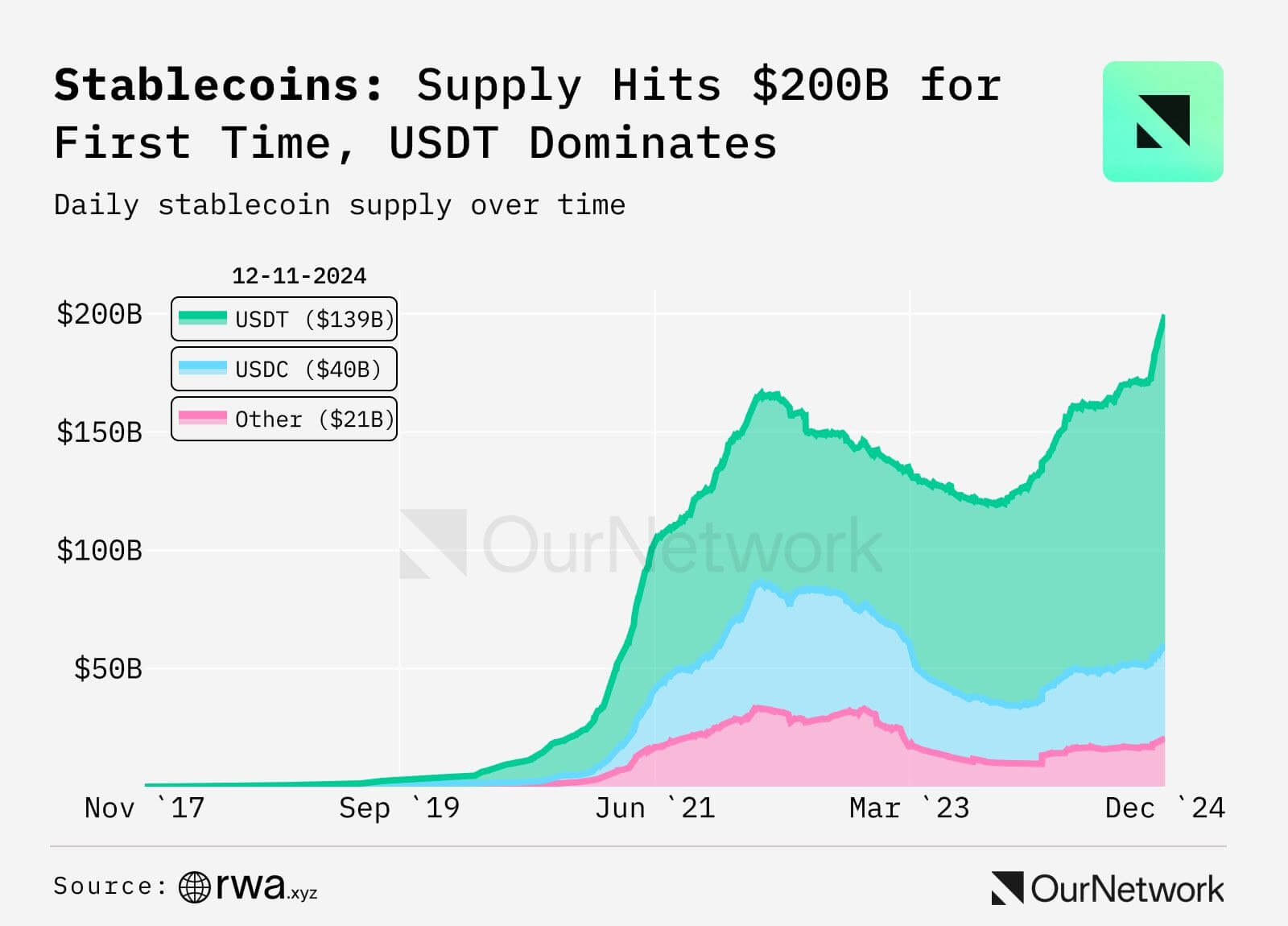

In December 2024, the total capitalisation of all niche stablecoins reached the $200 billion level for the first time. Of this, USDT accounted for 139 billion or almost 70 per cent of the total.

Distribution of steblicoins in the coin industry by their market capitalisation

Second place goes to Circle’s USDC with 40 billion or 20 per cent.

And since USDT’s role in the entire industry is huge, the possible delisting of the asset on popular trading platforms is causing investors to fear. Still, this could be another “black swan” for the crypto niche and lead to unknown consequences.

At the very least, the market could become much more volatile, as USDT provides liquidity in trading popular cryptocurrencies like Bitcoin and SOL. In such conditions, their rates will change faster and more significantly, which is unlikely to benefit the stability of the sphere.

Why USDT was removed from the crypto exchange Coinbase

In general, the reason for crypto investors’ concerns about the future fate of USDT was the delisting of the stablecoin from Coinbase Europe, Coinbase Germany and Coinbase Custody in mid-December. Then the representatives of the platform called the asset as such, which does not meet the requirements of MiCA. So essentially they decided to get rid of it to avoid possible problems with regulators.

Here is the rejoinder of the company’s representatives, with which they accompanied this news a fortnight ago.

As a reminder, due to the new European Crypto Asset Regulation (MiCA), crypto exchange Coinbase will impose restrictions on non-MiCA compliant Stablecoin services for retail customers of Coinbase Europe Limited and Coinbase Germany GmbH. The restrictions will take effect on 13 December 2024 at 23:59 CET.

Based on current information, we expect that we will have to restrict services for the following assets: USDT, PAX, PYUSD, GUSD, GYEN and DAI (collectively, “MiCA-restricted assets”). We regularly review the list of assets available to our clients on the platform to ensure regulatory compliance. In the future, the company will consider resuming support for MiCA-compliant stablecoins.

Please note that USDC and EURC are MiCA compliant and will continue to be traded on the Coinbase platform.

It is important to note that USDT was the second most popular crypto asset on Coinbase. It accounted for 12.7 per cent of the total trading volumes on the platform, which means this decision was not an easy one for the management.

The most popular crypto assets on Coinbase exchange

The representatives of Tether were quite predictably not happy about such an initiative. They noted that they disagree “with the hasty actions of certain exchanges, which may take a premature position either for their own benefit given the presence of investments in competitors, or because of superficial analyses of the situation.”

Here’s an archived quote from USDT issuer staff as quoted by Cointelegraph.

Tether is confident that it will successfully navigate these changes. In doing so, we will ensure that we continue to promote financial inclusion and innovation – especially in regions with limited or inefficient access to traditional financial systems.

Possible USDT delisting – is it worth the wait?

Although Coinbase representatives have labelled USDT as a token that does not comply with the new regulatory rules in Europe, government officials have not shared similar definitions. Here’s a rejoinder on the matter from MiCA Crypto Alliance technical committee member Juan Ignacio Ibáñez.

No regulator has yet directly stated that USDT does not meet the new requirements. However, this does not mean that the token fits into the regulatory concept.

Coinbase cryptocurrency exchange head Brian Armstrong

The expert also recalled that other popular crypto exchanges like Binance, OKX, Bybit, and Crypto-com continue to conduct transactions with stablecoin. However, in general, they have no reason to rush and conduct a premature delisting of USDT. The expert continues.

Coinbase’s decision may reflect a proactive approach to avoid the risks of last-minute compliance with new rules or regulatory uncertainty.

With this in mind, the analyst believes the prospect of USDT delisting on other popular platforms on 30 December remains. Here is his quote.

We should be focused on the 30th. The question is whether all exchanges will delist USDT at once, do it gradually or some will take a wait-and-see attitude, waiting for clarification from regulators.

Ibáñez adds that the latter approach hardly makes sense. Still, trying to wait for additional interpretations from European regulators could lead to financial problems – and exchanges are unlikely to go for it.

Therefore, this can be considered an argument in favour of the fact that delisting will not happen after all.

However, that didn’t stop some well-known personalities in the crypto world from claiming that USDT will still be removed from trading platforms on Monday. Here is one such tweet that has garnered over 660,000 views.

A tweet claiming the alleged impending delisting of USDT from cryptocurrency exchanges

Although in essence it is purely about speculation and not real facts.

Note that European exchanges are not as large as the operations of traders from the US or Asia. Therefore, if anything, USDT will still have a huge number of users in other regions.

The head of Tether, Paolo Ardoino, has reacted to what is happening. Here is his latest quote from Twitter.

If you study the background of the X social network users who are spreading misleading claims about USDT, their motive will be very clear. This is about a poorly managed campaign led by our competitors.

It won’t work, just like it didn’t work before.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Tether CEO Paolo Ardoino

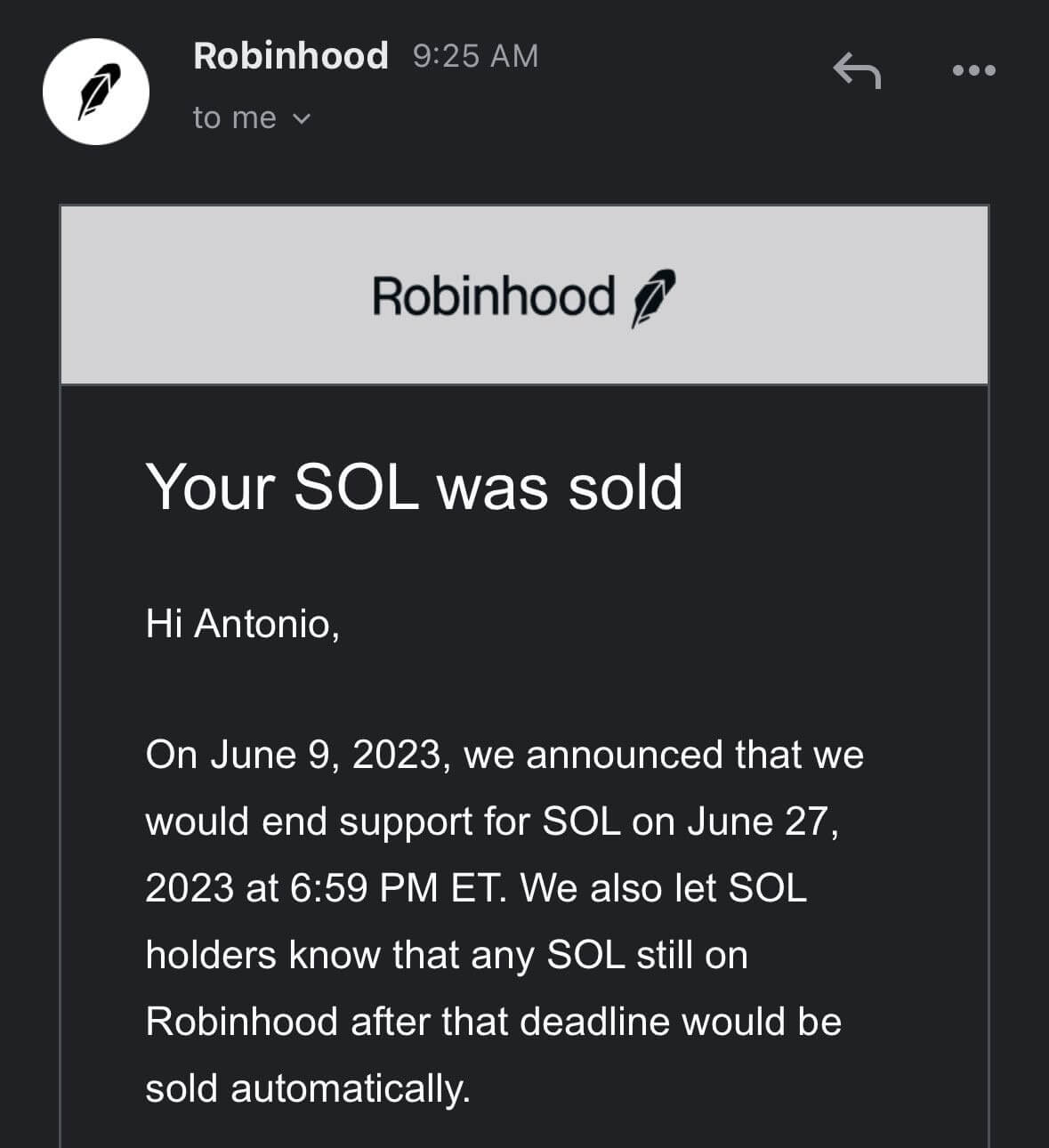

It’s worth noting that in the history of the blockchain industry, there have already been premature delistings of cryptocurrencies that ended up going nowhere. For example, in June 2023, the trading platform Robinhood reported the termination of trading in coins of networks Cardano, Polygon and Solana.

Thus, the company’s management responded to the statements of SEC representatives, who called the listed coins unregistered securities, wishing to avoid possible problems. Moreover, the platform forcibly sold the listed cryptocurrencies to users who did not withdraw them within the specified period.

Notification of the forced sale of Solana SOL by users of the Robinhood platform

However, in the end, it didn’t make sense. The coin industry took to fighting the SEC through the courts to stop such attacks. Well, in mid-November 2024, Robinhood resumed SOL and ADA trading as if nothing had happened.

Perhaps the same thing will happen to Coinbase.

Whether USDT is worth selling

Tether’s USDT remains one of the pillars of cryptonishness that has survived a lot of information and legal attacks in recent years. This means that the giant at least knows how to act in such situations, ensuring the stability of its own asset.

In addition, it is worth realising that even in the case of delisting, USDT will still be asset-backed at its core. And the mass withdrawal of stablecoin via Tether to get real dollars will not create problems for the safety of the token’s exchange rate.

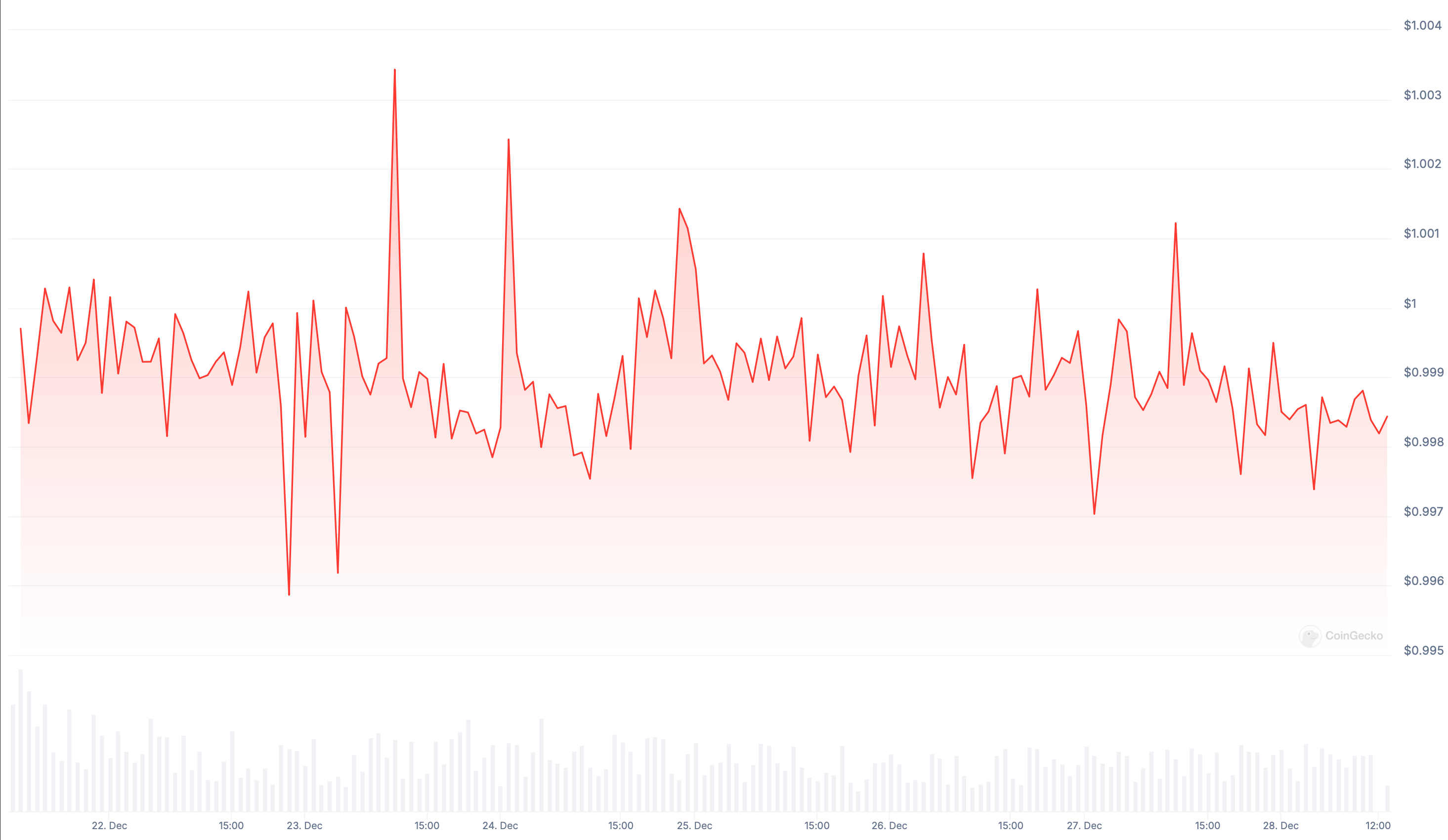

Here’s a chart of USDT over the past week. The asset is now valued at $0.9985.

USDT value changes over the last week

Major exchanges could have stopped trading USDT in advance similar to Coinbase, but they didn't go for it. Accordingly, they will either do so closer to 30 December, or they are cooperating with regulators and are not going to delist altogether.

However, even if Tether's stablecoin stops trading, the company's representatives should be able to cope with mass sales of the token and ensure the stability of its exchange rate. Still, in case USDT is decoupled from the dollar exchange rate, the coin industry will face serious problems, which are unlikely to be insured by a banal transfer of USDT to USDC. So here we hope for Paolo Ardoino and his team.

.

Look for more interesting information in our crypto chat room. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.