Which crypto exchanges are the future for: centralised or not? Discussion of Bitget and Deribit executives

November 2024 was a record month for decentralised exchanges. The trading volume on them reached 300 billion dollars, which allowed to bypass the previous maximum of 260 billion from May 2021. Obviously, this trend will only get stronger, as the interfaces of modern DEX platforms based on modern blockchains and their interactions are getting better and better. However, can both categories of platforms coexist?

Centralised and decentralised exchanges are fundamentally different phenomena. The former are the product of certain companies that have full control over what happens on the platform. In this case, users’ crypto lies on the wallet of the exchange, which allows customers to carry out the corresponding transactions.

Interface of the cryptocurrency exchange Binance

At the same time, technically, the coins belong just to the centralised exchange: one way or another, users need to obtain permission to withdraw their own cryptocurrency. However, this victim offers certain advantages in return: a clearer interface, staff support and general ease of use.

Decentralised platforms operate on the basis of smart contracts and use liquidity pools for transactions, which can usually be joined by everyone. The key feature of such exchanges is that users trade using their non-custodial wallets. That is, they do not top up other people’s addresses, but use their wallets directly, without losing ownership of crypto-assets.

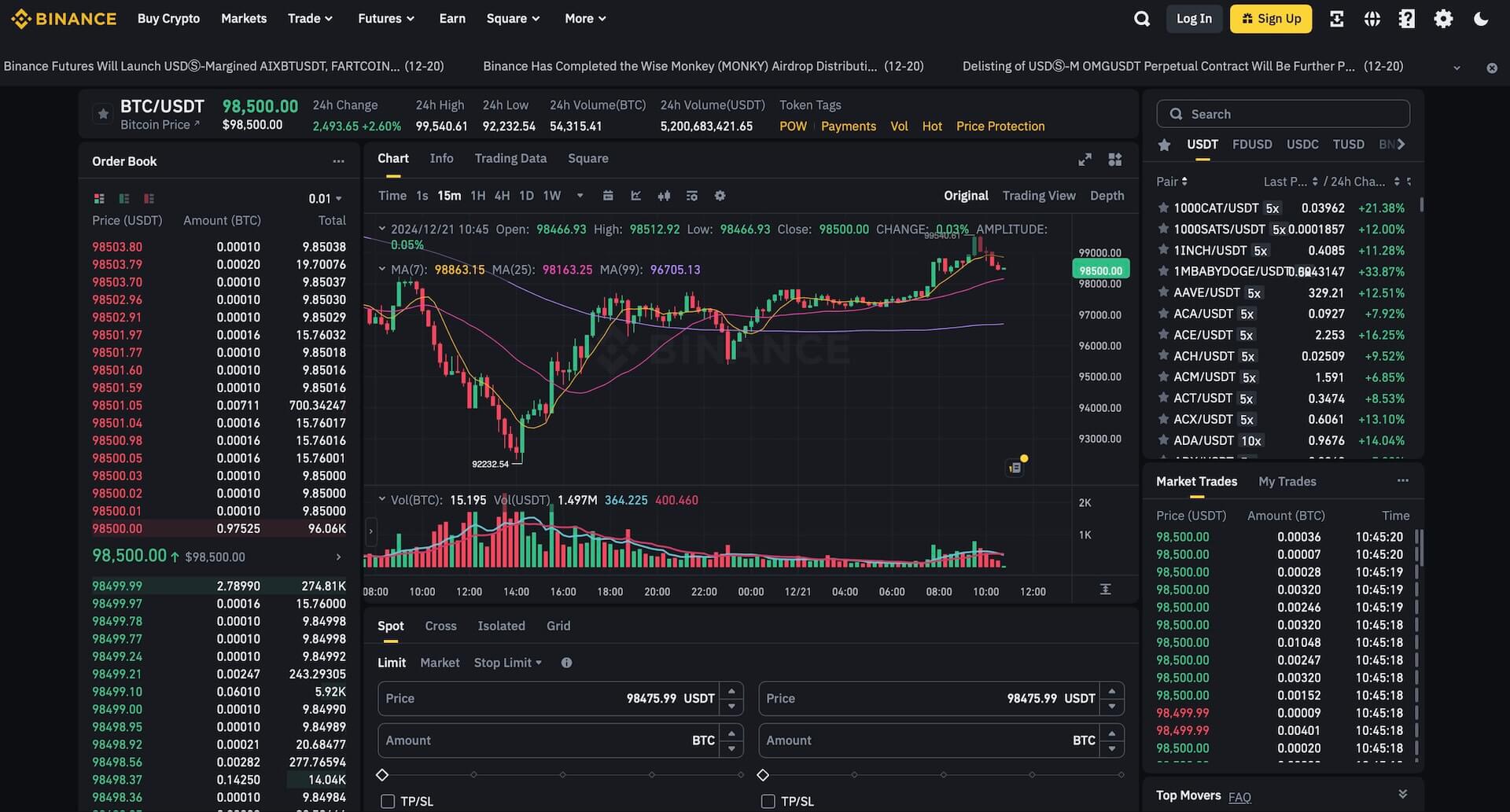

At the end of November, decentralised exchanges accounted for 11 percent of the trading amount of centralised platforms. Here is the corresponding graph.

Ratio between trading volumes on decentralised and centralised exchanges

The record of the indicator was recorded in May 2023 and amounted to 14.1 per cent. That is, decentralised platforms account for serious trading volumes. However, they cannot yet be called a competitor for centralised counterparts.

Which cryptocurrency exchanges are better to use

The prospects of cryptocurrency platforms were discussed by the participants of the conference called Emergence from The Block. In particular, they looked at the growing connection between the two categories of exchanges and the prospects for this trend.

Bitget platform manager Gracie Chen noted that centralised and decentralised exchanges are designed for different categories of users. Accordingly, they can easily exist together without the need for a pronounced struggle.

Bitget platform manager Gracie Chen

Here’s a rejoinder on the subject.

Centralised exchanges have better liquidity, customer service and overall user experience. At the same time, decentralised platforms are predominantly aimed at savvy users of the decentralised finance world who are looking for tokens that are not available on conventional exchanges.

This is a really important feature that properly explains the difference between the two categories of trading platforms. Using decentralised exchanges requires experience and understanding of non-custodial wallets, which are precisely used to conduct trading operations.

This brings its own bonuses, though. Usually new tokens, which eventually bring huge returns, first appear on DEX-platforms, not on conventional exchanges like Binance and Kraken. And this creates a space to make money.

It is decentralised exchanges that allow for relatively early exposure to the same meme tokens that have become a hit in the current bullrun because of their ability to grow. The ranking of the most profitable projects was shared by Bloomberg analyst Eric Balchunas.

He highlighted the top 20 most profitable memes, some of which have brought tens of thousands of per cent growth on a 2024 scale. Here’s the ranking.

The meme tokens with the best growth results in 2024

Topping the list was a token based on the popular “Chill Guy” meme, which recorded 52 thousand per cent growth.

Chen also spoke about Bitget’s desire to work on strategic partnerships for the platform to enter new markets – including the US. Here’s the line.

We’re now reconsidering entering the market through a joint venture with someone who has a lot of licences, and we’re also looking at buying a few banks to be more like new banks rather than traditional big institutions like HSBC or Bank of America.

😈 MORE INTERESTING STUFF TO COME FROM US AT YANDEX.ZEN!

At the same time, Deribit chief Luuk Stryers questioned the ability of many cryptocurrency exchanges to survive in the long term because of the intense regulatory pressure on the digital asset industry.

I think many of them will simply cease to exist. To put it more categorically, the regulatory framework will tighten globally and make many of the current numerous platforms simply unviable, either because their operating costs are too high or because regulators will simply shut them down.

Cryptocurrency trader

In other words, as the crypto industry matures, only a few companies will be able to develop at full speed. Luuk continues.

If you plan to work with clients around the world, whether they are large institutions or even equally important retail users, you already have to deal with a tight regulatory framework that will become even tighter over time. In the end, there will simply not be enough trading volumes for all platforms to survive. I think there is going to be a major shift with a focus on market leaders.

This view was echoed by Alain Kunz, Head of European Business Development at GSR. He emphasised the link between liquidity and regulation of the coin industry.

In an ideal world, liquidity would stretch to liquidity. In this case, there would be one universal player – for example, smart contracts through which any amount of value could be exchanged. However, this is unlikely to happen.

In Europe, most banks and regulated traders are required to be able to interact directly with the counterparty with whom they are transacting. And if you just log on to Uniswap and trade, it becomes almost impossible to know exactly who you are dealing with.

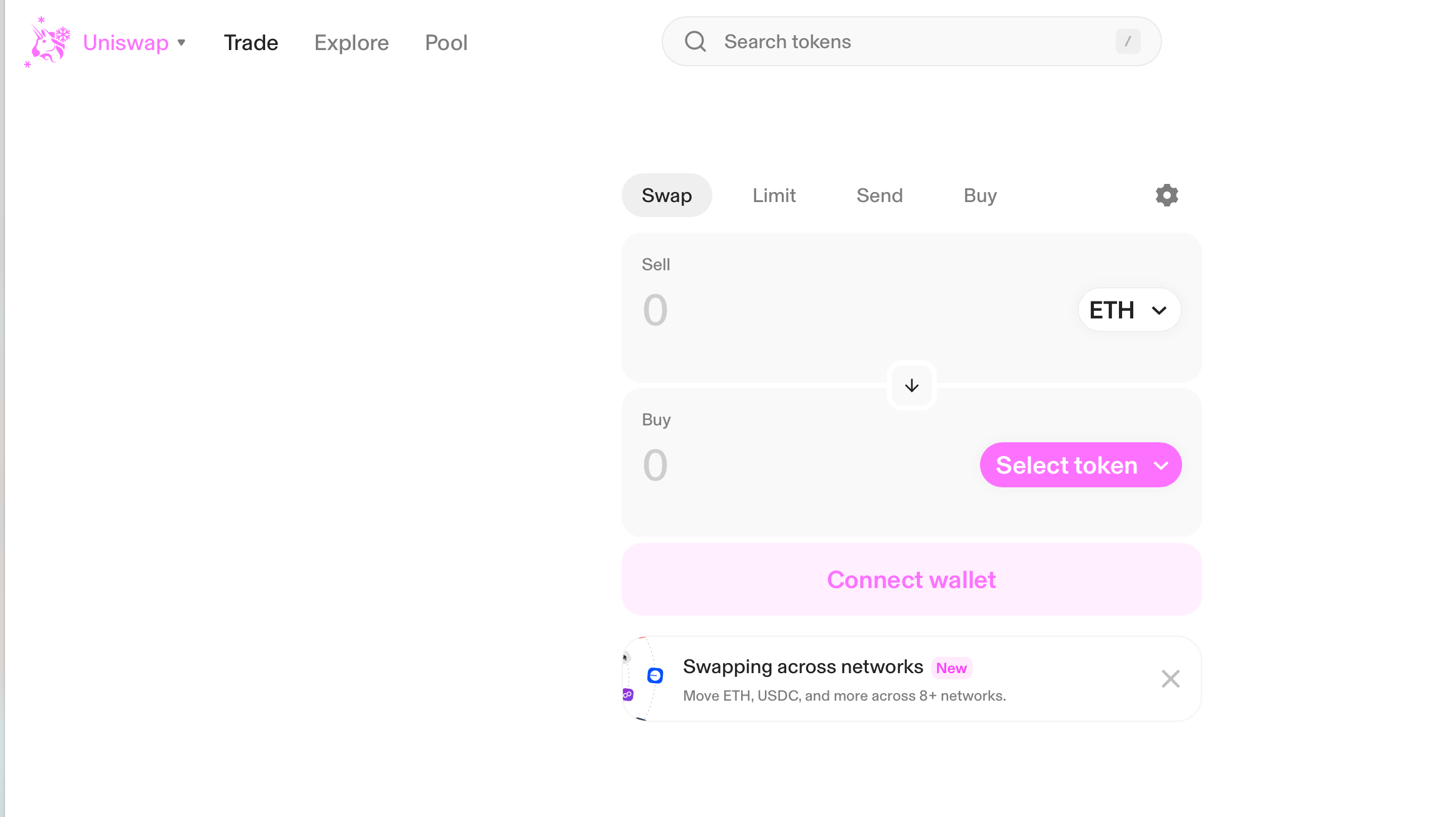

Interface of the decentralised exchange Uniswap

The conclusions from the experts in the discussion are obvious. Now the interest of large institutional investors in crypto is increasing, but along with this, the attention of regulators to what is happening is also growing. Therefore, experts agree that centralised and decentralised trading platforms can easily co-exist. However, in the long term, we will see a narrower list of leaders that will attract users because of security and convenience.

More interesting stuff is in our crypto chat. We’ll meet you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.