Yet another public company has chosen Bitcoin as a strategic reserve asset. Why?

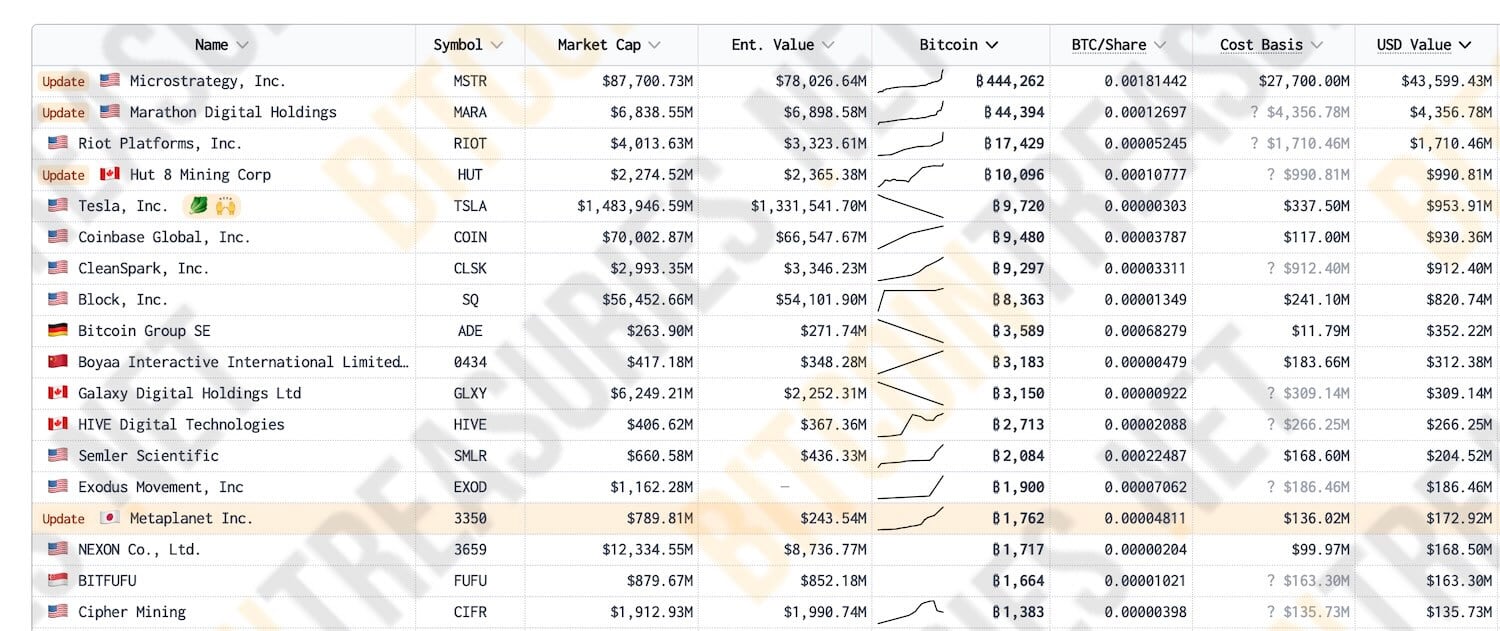

MicroStrategy continues to be the largest bitcoin holder among publicly traded companies. As of today, the giant has accumulated 444,262 BTC with $27.7 billion invested. Moreover, the company had earlier unveiled its “21/21” plan to invest 42 billion in the first crypto over the next three years. As a result, it has motivated other market participants who are also moving to the so-called Bitcoin standard.

MicroStrategy as a whole has already moved to implement this plan. Still the giant has been acquiring BTC every Monday for the past six weeks, investing billions of dollars in the cryptocurrency.

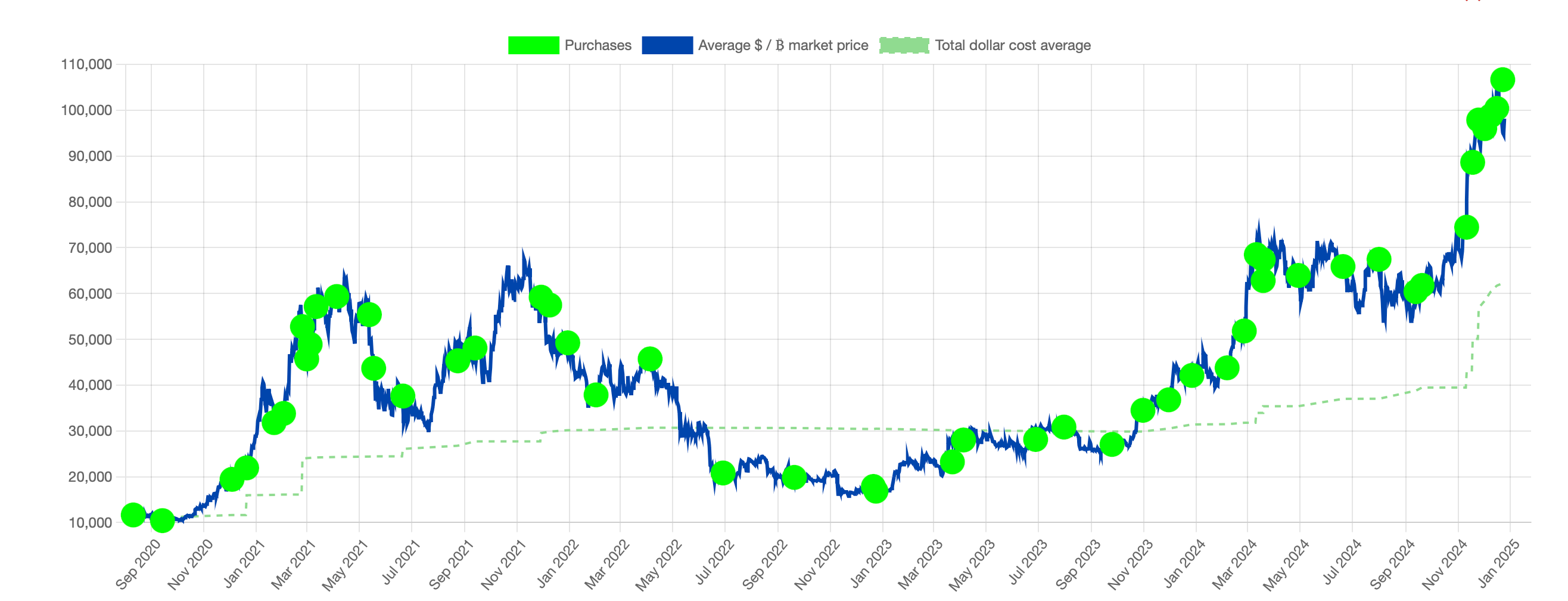

A graph of MicroStrategy’s bitcoin purchases

The company could end up becoming a Bitcoin bank of sorts, finding uses for its own coins. However, the former head of MicroStrategy Michael Saylor has repeatedly stated that they are not going to get rid of the bitcoins bought, because this cryptocurrency is the best asset of our time and a tool for investment.

Who is constantly buying bitcoins

The Canadian cryptocurrency company Matador Technologies announced the decision to use Bitcoin as a reserve asset. Accordingly, the organisation will purchase the cryptocurrency and store it for the long term. And the first purchase will take place later in December and will be the equivalent of $4.5 million.

According to Decrypt’s sources, Matador Technologies employees are developing a platform based on the Bitcoin network that will allow customers to purchase assets digitally representing gold. The platform is scheduled to launch in early 2025.

Matador was previously known as Scaling Capital 1, and trading of its shares on Canada’s TSX Venture EXchange began last week. The company’s market capitalisation is in the $50 million zone, which is relatively small.

It is important to note that MicroStrategy's example has indeed inspired many companies to connect with the first cryptocurrency. However, not all giants agree to acquire bitcoins.

For example, on 10 December, Microsoft shareholders opposed direct investment in BTC, an initiative that was previously presented by one of the company's investors. And even a three-minute presentation by Michael Saylor, with the help of which he wanted to explain the advantages of the crypto to its representatives, did not help to change the giant's decision.

.

Matador representatives said that the idea of investing in BTC was unanimously approved by the company’s board of directors. As part of this initiative, the company will convert most of its fiat reserves into U.S. dollars, thus abandoning the accumulation of the local Canadian dollar.

According to the management, the company also considered the prospect of developing its own platform based on Efirium and Solana. However, in the end, the BTC network was chosen because of its stability and reliability, which is determined by the blockchain’s huge hash rate.

Here is Matador president Sonny Ray’s rejoinder to the event.

Matador’s board of directors and management team are confident in Bitcoin’s ability to preserve a bright future for our reserves. This decision is also consistent with our mission to explore the use of BTC as a platform for our gold-based products.

Matador Technologies isn’t the only company that has started buying bitcoin this year. Japan’s Metaplanet, which first added BTC to its own balance sheet in April 2024, also made their list.

As of today, the company has purchased 1,762 coins with $136 million invested. At the same time, this amount of bitcoins is now valued at 172.9 million.

Table of the largest Bitcoin holders among publicly traded companies

It can be assumed that in the future the number of companies with bitcoins and other coins on the balance sheet will increase. However, the main catalyst for such purchases should be the creation of a national BTC reserve by the U.S. government, which will be possible after the newly elected President Donald Trump and the renewed Congress come to power.

Trump is still not giving up the idea of developing a cryptocurrency reserve on a nationwide scale. He last confirmed such plans in mid-December. So the inauguration of the politician on 20 January and his further actions are definitely worth waiting for.

More and more market participants are choosing Bitcoin as a reserve asset. Most likely, this trend will intensify in the coming months. And the reason for this will be not only the expectations for the development of a BTC reserve by the US authorities, but also the growing market as a whole.

More interesting things are in our crypto chat. Meet us there in a few seconds.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.