Bitcoin collapsed 5 per cent on fears of prolonged inflation. What happened to the cryptocurrency market today?

In mid-September, the US Federal Reserve lowered the benchmark interest rate by 50 basis points. The reduction was the first in four years, in addition, bankers decided to use not the minimum step of 0.25 per cent. With this in mind, crypto traders and participants in other markets began to expect a gradual economic recovery and an increase in investor activity. However, the data now indicates that the negative situation may be prolonged – and coins have already reacted to this.

Why Bitcoin fell today

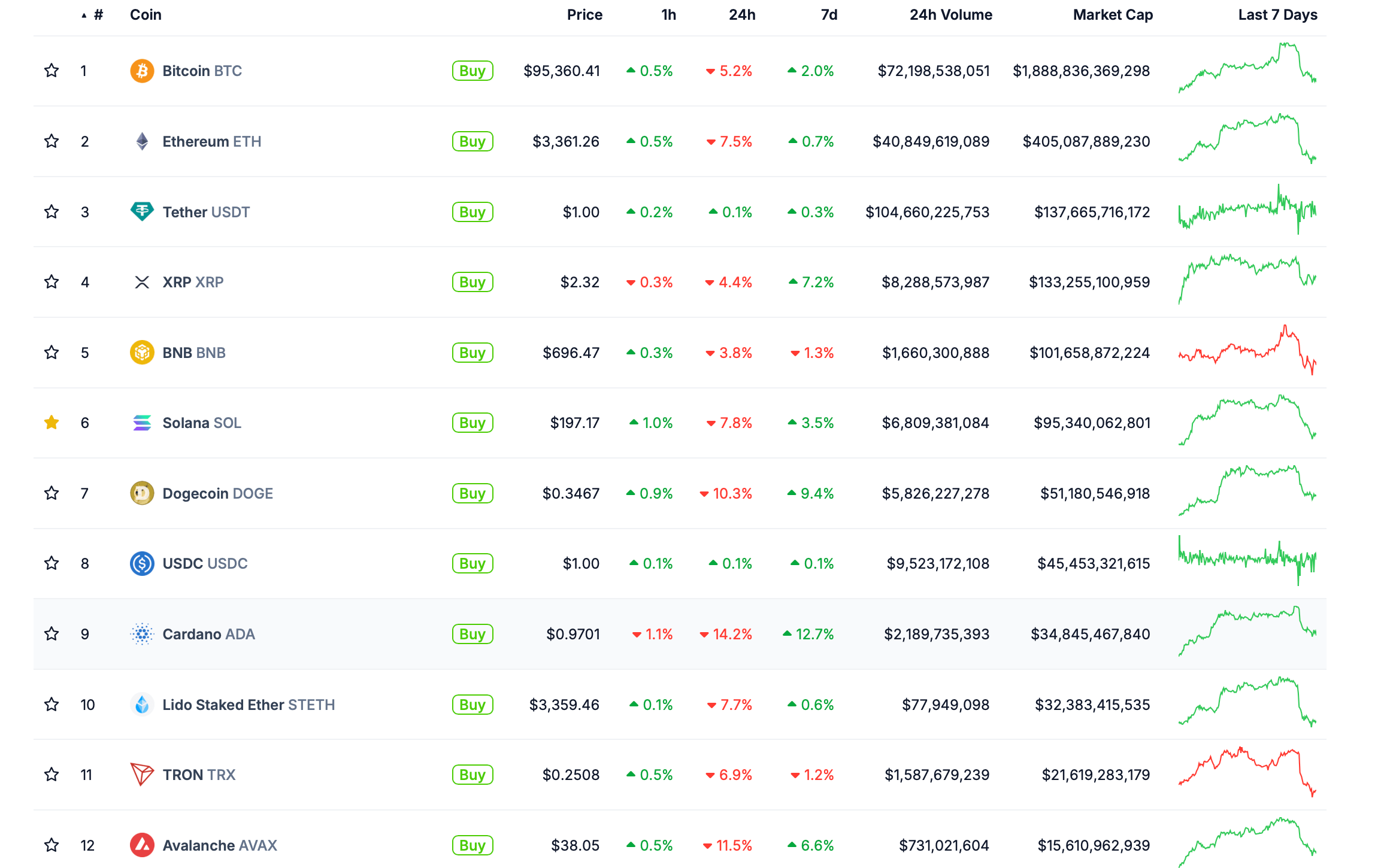

Over the past 24 hours, BTC has fallen in price by 5 per cent, Efirium and Solana have sagged by 7 per cent, while DOGE and ADA have collapsed by 10 and 14 per cent respectively.

As a result, the industry’s total market capitalisation fell 7.6 percent overnight to $3.48 trillion.

Actual cryptocurrency rates today

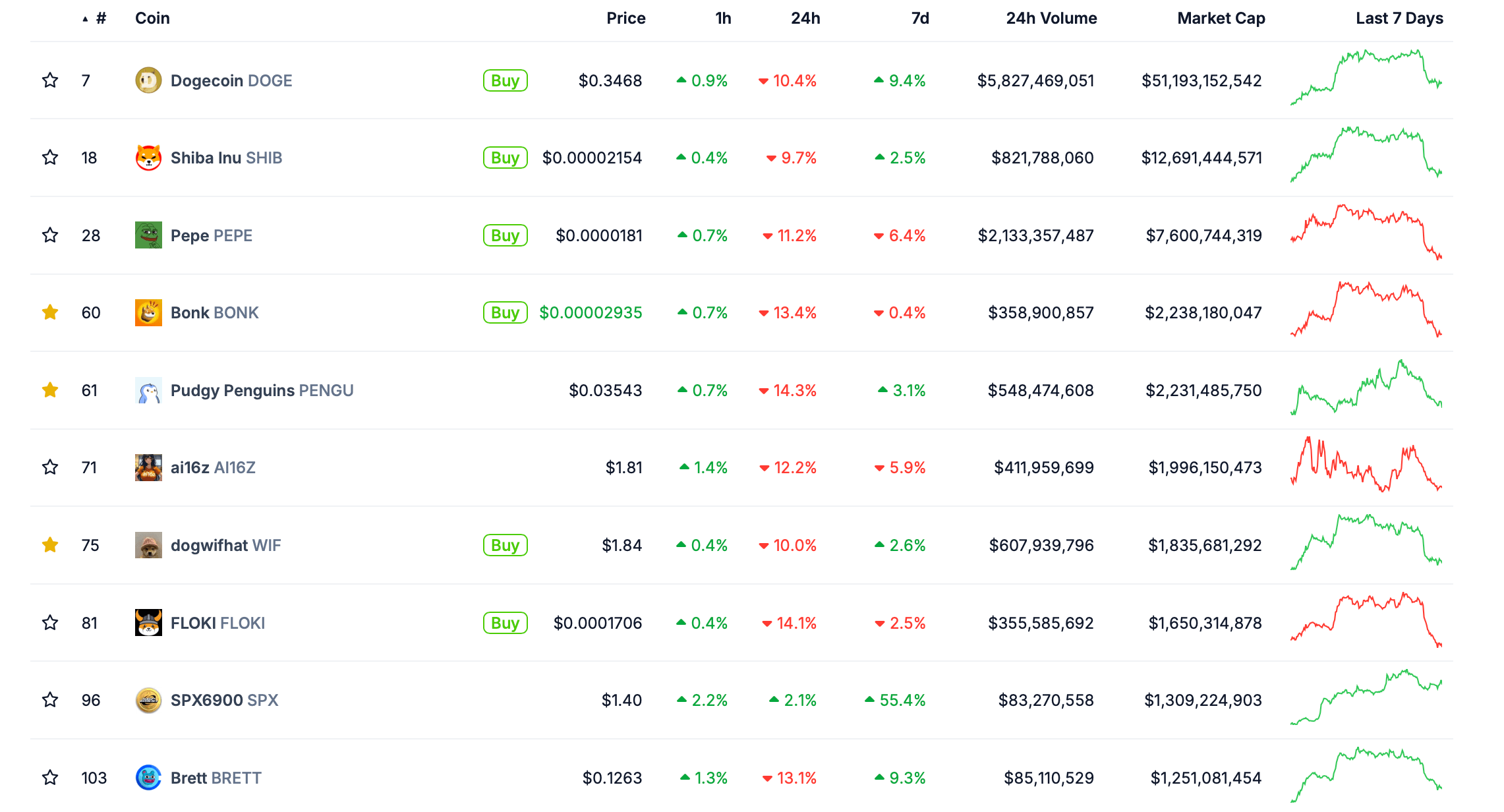

Although most of the largest coins still recorded slight gains on a week-on-week basis, the market crash today was truly painful – especially for meme token holders.

The largest meme tokens lost at least 10 per cent of their price overnight

At the beginning of the week, traders were actively betting on Bitcoin’s growth to the level of 110-120 thousand on the background of the approaching inauguration of Donald Trump on 20 January. However, now the attitude to the immediate prospects of the market has become the opposite.

A similar situation is observed in other areas. Presto Research analyst Min Jung shared a quote on the matter in a conversation with The Block. Here is his quote.

It wasn’t just cryptocurrencies that fell yesterday – the NASDAQ and S&P 500 also fell by more than 1 per cent amid concerns about inflation. Fresh ISM index data showed the US economy growing faster than expected, fuelling fears of sustained inflation. This led to a jump in bond yields, with the yield on 10-year Treasury securities reaching their highest level since April.

That is, market participants are beginning to think that the current problems in the global economy may be sustainable. And that's cause for concern, as the U.S. Federal Reserve has been trying to fight inflation for the past several years, culminating in a major rate cut in September 2024.

According to BTC Markets crypto analyst Rachel Lucas, fresh data on the U.S. economy clearly hints that the Federal Reserve may be forced to keep interest rates high for a longer period. Well, they traditionally lead to a decrease in the activity of economic agents, so this prospect is perceived negatively by the markets.

Lucas commented on what is happening as follows.

The market was already in tension after the December statements of Fed Chairman Jerome Powell, which indicated a tight stance in monetary policy and also weakened hopes for additional rate cuts, at the same time increasing volatility.

US Fed Chairman Jerome Powell

In December, Jerome Powell made it clear that the fight against inflation is still ongoing, which may cause bankers to pause in lowering the interest rate.

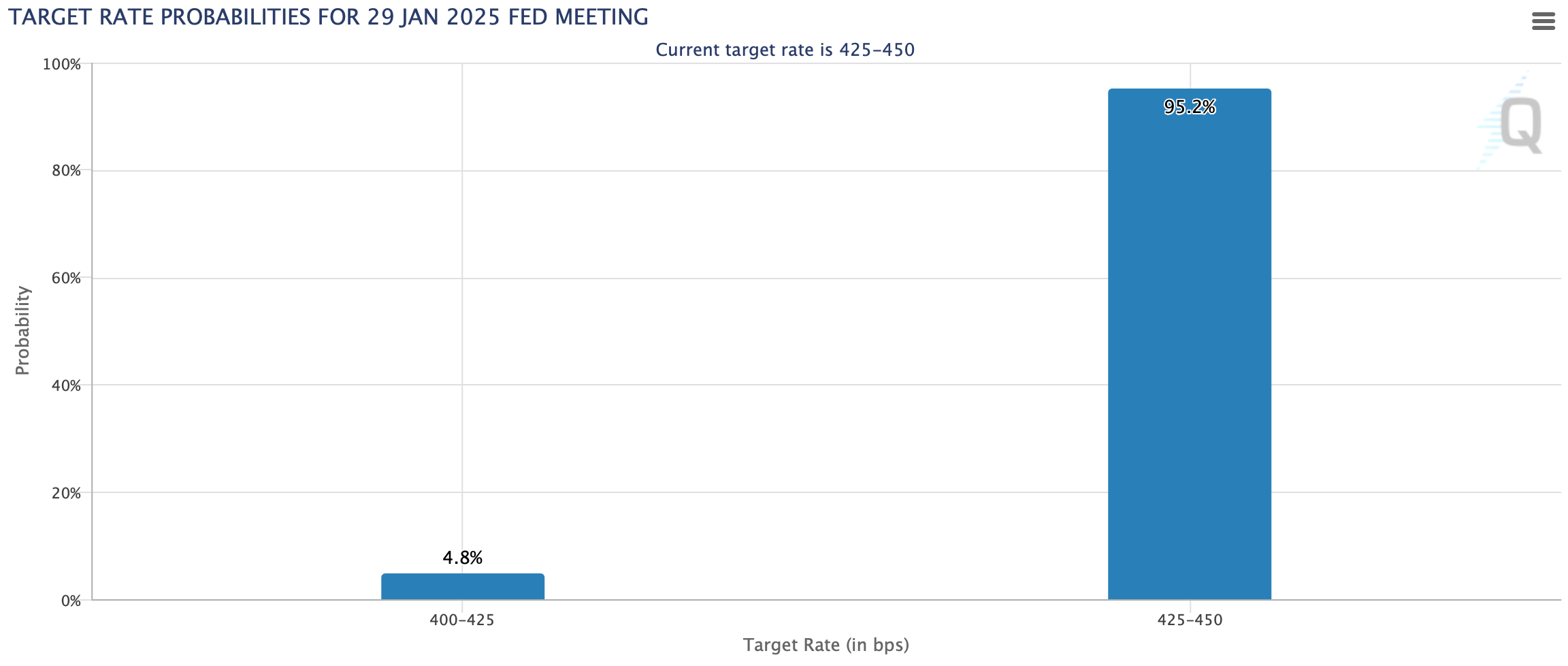

As of today, traders believe that the Fed will leave the benchmark interest rate at the same level during the next FOMC meeting on 29 January 2025. The probability of such a thing happening is estimated at 95 per cent.

The prospect of a change in the US benchmark interest rate at the next FOMC meeting

In such an environment, Trump’s upcoming inauguration on 20 January will only add to market uncertainty and lead to additional rate volatility, says Lucas. She continues.

A majority of Congressional representatives support the cryptocurrency industry. Well, key appointments like Scott Bessent as Treasury Secretary and Ilon Musk as an advisor clearly indicate a sharp turn by the new presidential administration towards the crypto sphere.

Which countries are buying cryptocurrencies

And while the market is falling, authorities in some countries and regions are choosing cryptocurrency for their own reserves. Today, the government of the Special Administrative Region of Bhutan called Gelephu announced the creation of a cryptocurrency reserve.

It deserves special attention that not only bitcoins, but also ETH along with BNB will be used for accumulation.

Buying cryptocurrency by investors

The addition of cryptocurrency assets for the reserve should increase the economic sustainability of the district and also create new opportunities for Bitcoin mining, which Bhutan is officially engaged in.

Here’s a quote from today’s announcement as quoted by Cointelegraph.

Gelephu intends to recognise digital assets with large market capitalisation and deep liquidity. This will guarantee the ability to easily sell and buy with minimal impact on the price of the asset.

The new plan will involve the city administration discussing a related cryptocurrency savings initiative with senior Bhutanese government officials and global industry leaders. This will take place in March 2025.

The news was commented on by former Binance crypto exchange chief Changpeng Zhao on Twitter.

A few observations about the creation of a cryptocurrency Strategic Reserve for Gelephu in Bhutan:

1. This is not just a Bitcoin reserve, but a cryptocurrency reserve that also includes ETH and BNB. This may be the first of its kind, but clearly won’t be the last. The situation shows that Bhutan is open not only to BTC but also to other digital assets. Overall, this is a smart move by the country to attract cryptocurrency companies, investment and innovation.

Incidentally, the Kingdom of Bhutan has been known for mining bitcoins using surplus hydroelectricity for years. In fact, they already have a reserve of BTC.

2. For BNB, this is a recognition. The move also opens the door for BNB and other cryptocurrencies to be included in other countries’ National Strategic Reserves.

According to the Arkham platform, the Bhutanese government today holds the equivalent of $1.1 billion in crypto. Bitcoin accounts for the majority of this amount.

Bhutan’s actual cryptocurrency accumulations

The collapse of Bitcoin and the cryptocurrency market dovetails perfectly with the news of a city-wide coin reserve. All of this hints that digital assets are indeed gaining more and more recognition as an asset to store value. And so far, such a trend is only gaining momentum.

Look for more interesting stuff in our crypto chat. We look forward to seeing you there now.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.