Bitcoin collapsed to $90,000. Why aren’t big investors worried about the crypto market sagging?

On 17 December 2024, Bitcoin set a new historical high price, which exceeded $108 thousand dollars. Since then, the cryptocurrency has had several phases of declines and is currently in the $90 thousand dollar zone. Such things continue for more than one week, but experienced crypto investors do not consider what is happening as something unusual. Moreover, BTC drawdowns in January after halving are quite typical.

What will happen to Bitcoin in 2025

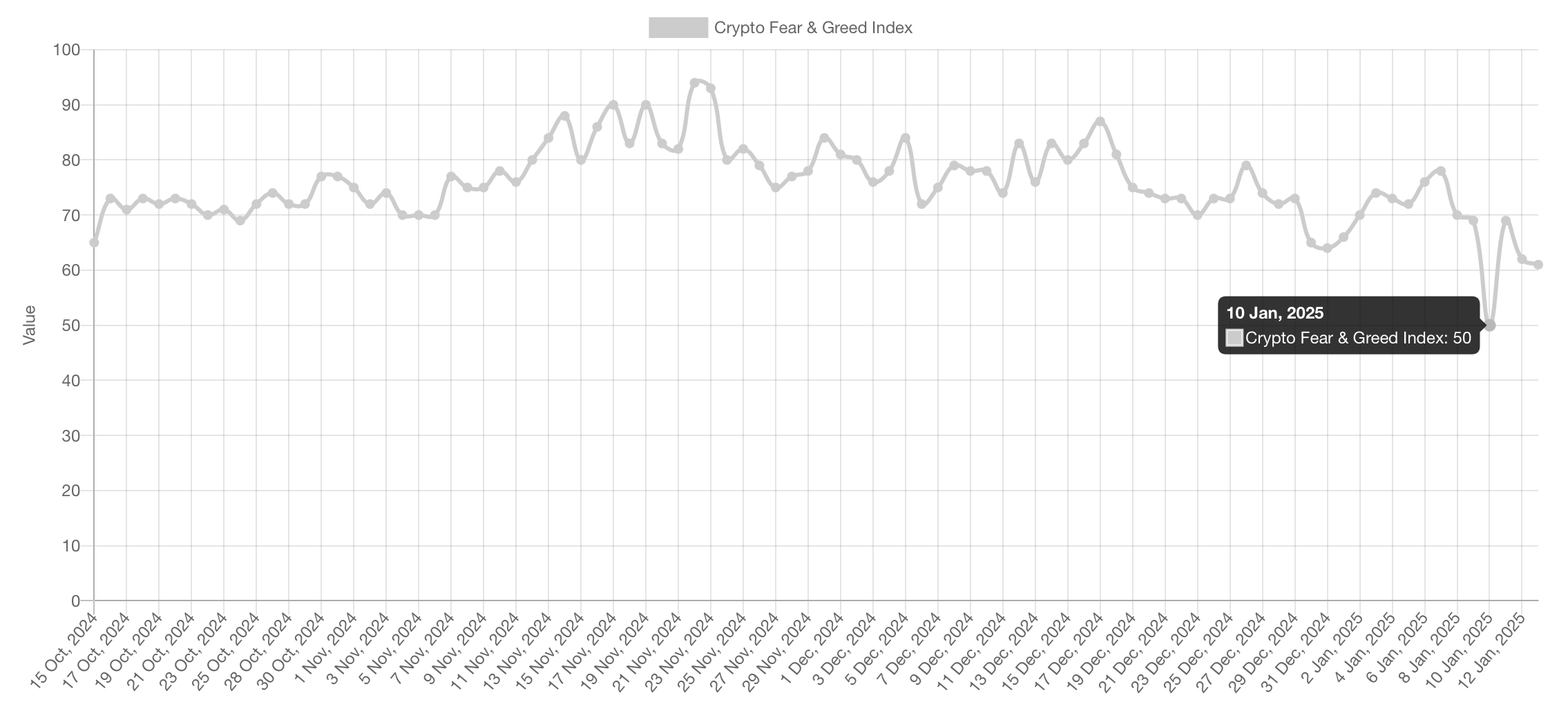

The current crypto market crash has seriously affected the sentiment of crypto investors. For example, on Friday 10 January, Bitcoin holders’ fear and greed index dropped to a score of 50 out of 100. This indicates their reluctance to get involved with the cryptocurrency and is also the lowest since mid-October.

Graph of the Bitcoin Investor Fear and Greed Index over the past three months

The same is true for altcoin holders, many of which have lost at least 50 per cent of their price over the past month. All of this has made crypto enthusiasts question the continuation of the current bullrun and start thinking that BTC at 108k in mid-December was the peak at this stage of growth.

But according to Wave Digital Assets CEO David Simmer, the difference in how traders and large professional investors view the coin market’s outlook has never been more serious. Still, large financial organisations around the world are preparing to offer new crypto products to their clients, while governments of different countries and state authorities are going to buy BTC for their own reserves. That’s why experienced players are confident that the bullrun hasn’t even essentially started in full force yet.

Here is an analyst’s rejoinder on the matter, as quoted by Coindesk.

In fourteen years of owning Bitcoin, I have never seen such a dichotomy. Traders are all excited, nervous, hedging risk, and taking a completely neutral or even negative stance. At the same time, long-term investors are full of optimism.

Wave Digital Assets manages the assets of funds and major cryptocurrency market participants. For example, one of its clients is Charles Hoskinson, co-founder of Etherium and creator of Cardano.

Cardano creator Charles Hoskinson

Simer also believes that the crypto’s current growth phase will continue in the coming months. He continues.

There’s a very high probability that Bitcoin will hit the $200,000 per coin mark this year. Do I think I will see a million quid for BTC in my lifetime? Sure. However, definitely not soon, that is, not next year.

The smart and influential people I know are also bullish. A lot more will happen in the next six months than most expect.

According to Wave Digital Assets, a major sign of the crypto world is that many governments are looking at the prospect of improving local legislation and other actions to benefit the coin industry. These include the US, the Russian Federation, Singapore, the UAE, South Korea, Japan, the Philippines and some European nations.

As effective as such changes would be, they would definitely have a good effect on the reputation of cryptos and the number of their buyers, Simer is confident. Here’s his rejoinder.

Japan or Singapore are societies where people really trust and rely on their governments. If their government says something is OK, then it really is. It’s not at all like in the US where we see our officials as idiots.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

The popularity of crypto in 2024 has grown thanks to the launch of spot Bitcoin-ETFs in the US. According to David Simer, the incredible performance of exchange-traded fund activity on BTC makes companies around the world think about possible ways to compete.

Accordingly, in the near future we can expect to see the emergence of non-standard products like multi-token yield funds. They will try to get back the liquidity that the iShares Bitcoin Trust ETF from the world’s largest company BlackRock attracted over the last year.

The expert continues.

ETFs originated in the US and literally destroyed all Bitcoin-ETPs around the world. Such products had terrible terms with commissions of 1.5 per cent. All of them ended up getting crushed. That said, regulators on their part will surely support the market. For example, the European Union may offer a friendlier version of cryptoasset regulation (MiCA).

The chances of new strategic bitcoin reserves are also high. Even if the US doesn’t create such a reserve, several other countries clearly will.

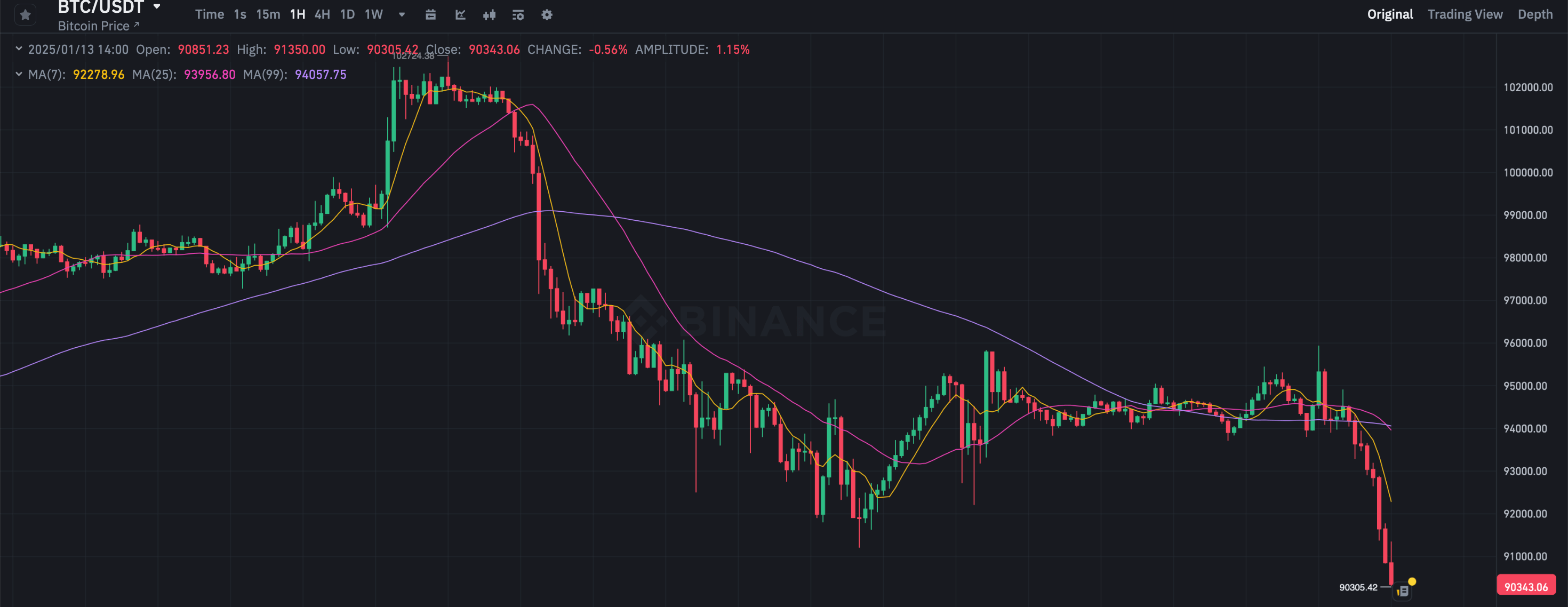

Why did Bitcoin BTC fall?

Bitcoin has collapsed to $90,000 today, thus lagging behind its all-time high by 16 per cent. Analysts consider the situation normal, as BTC always issues a significant drawdown in the first January after halving.

Hourly chart of Bitcoin (BTC) exchange rate

Halving is a procedure for reducing the reward for mining a block in the Bitcoin network and other similar cryptocurrencies. It was last held on 20 April 2024, when the rate of new coins was reduced from 6.25 to 3.125 BTC per block.

Here’s Axel Bitblaze’s comment from Twitter. The replica is cited by Cointelegraph.

Bitcoin’s collapse in January has historically been a common occurrence in the post-halving years. We all remember what happened after the 2017 and 2021 drawdowns.

Cryptocurrency market growth

In January 2021, BTC sagged more than 25 per cent from the $40,000 level. In November of the same year, the cryptocurrency set a price high of 69 thousand.

In January 2017, Bitcoin collapsed from $1,130 to $784. Further in the same year, the crypto gave away 2,400 per cent growth to a peak of $20,000.

It is important to realise that past financial market events do not guarantee that they will happen again in the future. However, investors generally behave in a similar way, so it makes sense to study the chart history of certain coins.

Cryptocurrency investors

In general, we can conclude that the situation with Bitcoin and other popular coins is the norm. At least the major players are counting on a continuation of the bullrun and a possible BTC jump to 200k in 2025. Whether this will happen - time will tell.

Look for more interesting stuff in our crypto chat room. Go there and hurry up 🤪

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.