Bitcoin-ETF issuers bought almost 4 times as much BTC as they issued in December. What does this mean?

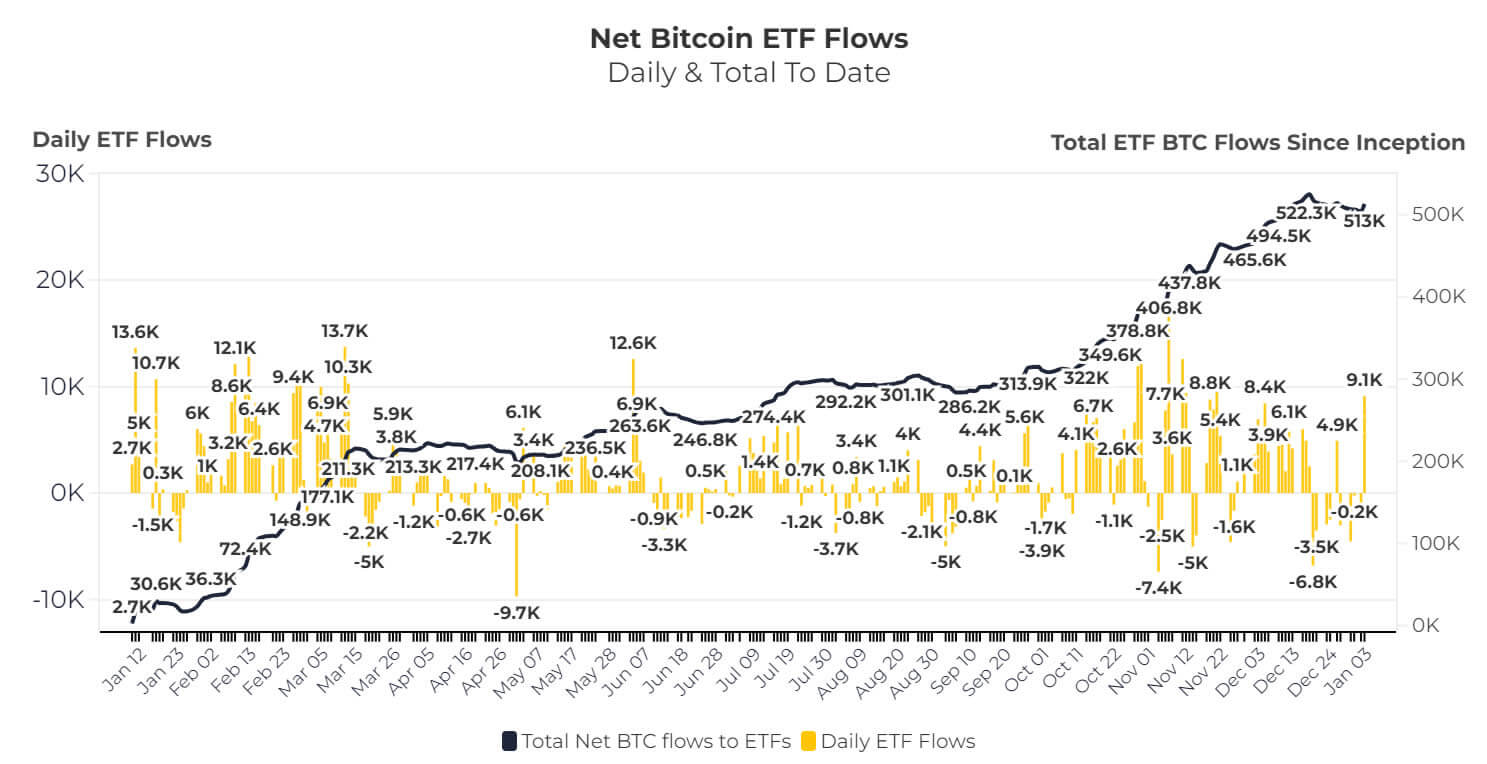

On 11 January 2024, spot Bitcoin ETFs started trading in the United States. The event was an important one, because thanks to such instruments a huge number of investors, financial institutions and even banks were able to get in touch with cryptocurrencies. Since then, net inflows into BTC exchange-traded funds totalled $36.89 billion – and that’s despite the withdrawal of $21.44 billion from Grayscale’s ETFs. Either way, crypto funds never cease to amaze.

Analysts expect even better results from Bitcoin exchange-traded funds in the new year. For example, Bernstein experts published ten forecasts for the crypto market for 2025, and one of them touched on the topic of cryptocurrency ETFs.

According to the staff, BTC-based spot exchange traded funds will attract $70 billion in net capital inflows over the next twelve months. That’s roughly double the total for 2024.

Until that happens, the situation with investment instruments already suggests serious demand for Bitcoin.

The latest news about Bitcoin-ETFs

According to Apollo and BiTBO platforms, issuers of spot BTC ETFs purchased 51,500 coins in December. That’s 3.7 times the number of bitcoins the network has released in that time frame as rewards for miners. Accordingly, the new supply of cryptocurrency does not cover investors’ demand for exchange-traded fund shares.

Bitcoin purchases by issuers of cryptocurrency ETFs in the United States

It is important to understand that Bitcoin ETF issuers like BlackRock and Fidelity do not purchase coins for their own holdings. Since exchange-traded funds are spot funds, they are based on common BTC. So when investors want to purchase such stocks, companies are forced to back them up by buying more and more new cryptocurrency.

And when market participants dump their shares, the giants also get rid of coins, which obviously affects the rate of the asset.

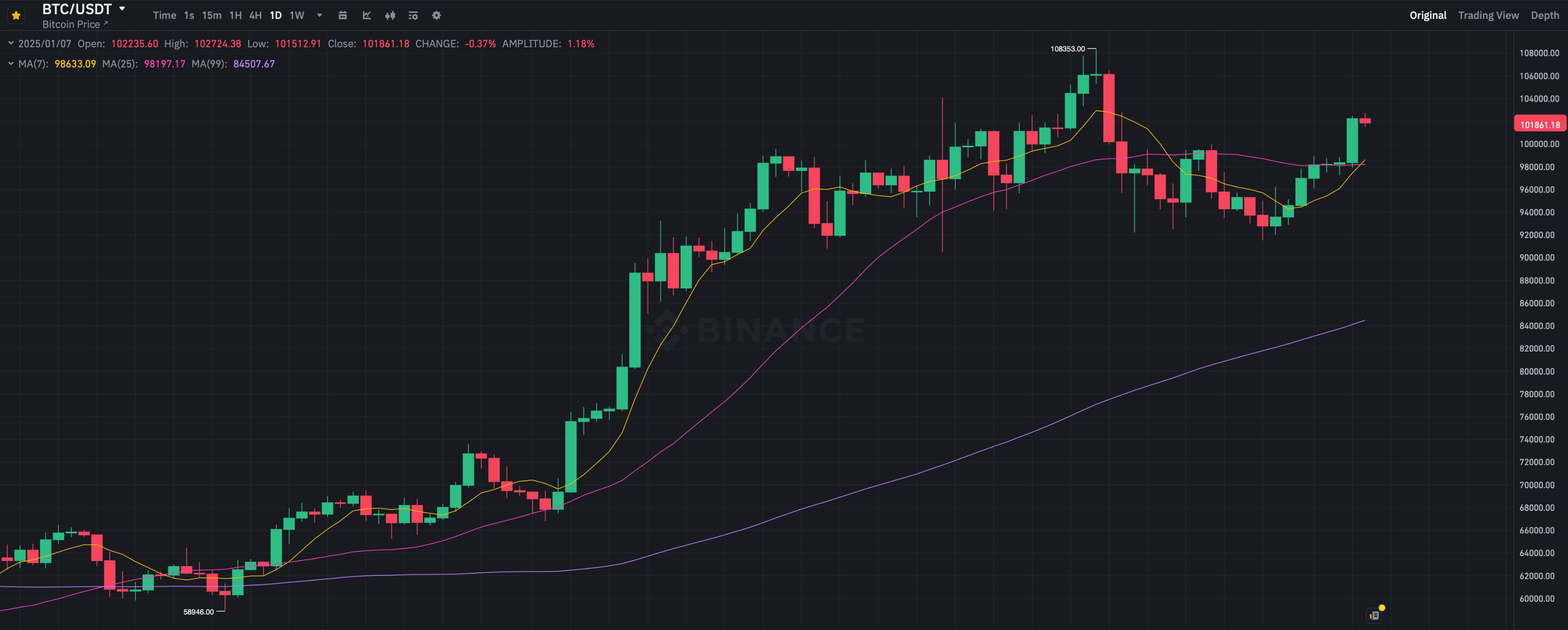

Crypto purchases have fuelled BTC’s rise to new highs. The current exchange rate record of the coin is $108,353 from 17 December 2024.

Daily chart of the Bitcoin BTC exchange rate on the Binance exchange

According to the Blockchain-com platform, 13,850 new coins were created in the Bitcoin network during December. That means demand from ETFs alone exceeded new supply by 272 per cent, Cointelegraph reports.

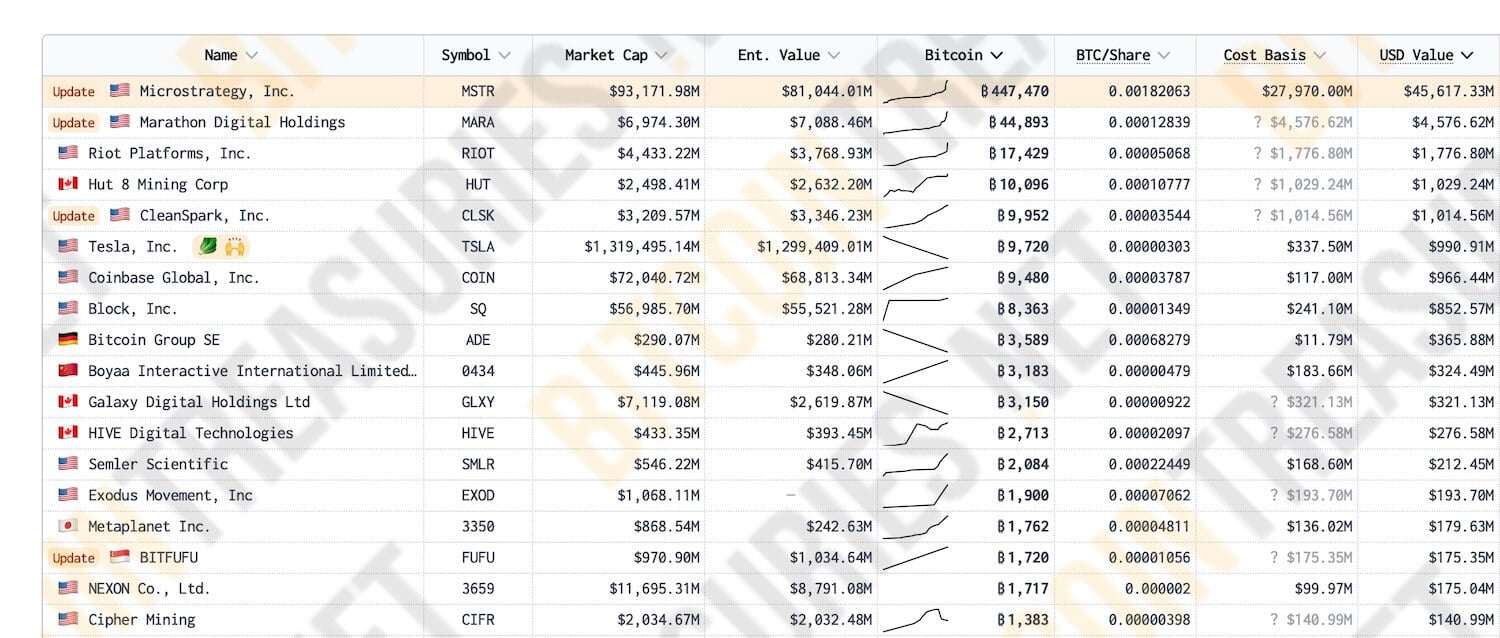

At the same time, MicroStrategy, which remains the largest holder of bitcoins among publicly traded companies, has been actively buying up coins throughout December. As of today, the giant has accumulated 447,470 BTC, which are currently valued at $45.6 billion.

Public companies with the largest bitcoin holdings

😈 MORE INTERESTING STUFF CAN BE FOUND AT