Financial advisors ready to invest in crypto after Trump’s victory: Bitwise survey results

Donald Trump’s victory in the US presidential election in November led to a sharp rise in cryptocurrencies. This is due to investors’ expectation of an improved situation with the regulation of the coin market, a change in the leadership of the Securities Commission and even the possible creation of a national Bitcoin reserve. However, as a fresh survey of Bitwise analysts shows, the coins themselves have also become more attractive to money managers.

What will happen to crypto in 2025

More than half of respondents in a fresh survey by investment fund Bitwise said they want to get involved with digital assets after Donald Trump’s victory. The relevant question was asked to 430 financial advisors between 14 November and 20 December 2024.

56 per cent of respondents reported that the likelihood of them investing in crypto in the new year has actually increased following the outcome of the presidential election, Cointelegraph reported.

Cryptocurrency investors

Among experts who are already allocating capital to buy digital assets, 99 percent of those surveyed plan to maintain their current position or increase it. Which means only a hundredth of coin holders want to give up on interacting with this asset category.

Also, 99 per cent of respondents confirmed that their clients have become interested in digital assets over the past year. And 71 per cent of respondents reported self-purchases of cryptocurrencies by their clients.

Bitwise’s Chief Investment Officer Matt Hogan commented on what’s happening and the survey results.

Financial advisors are more actively recognising the potential of cryptocurrencies than ever before and are allocating capital to them at the same pace. These alternative assets are a serious opportunity for advisers who want to help clients integrate digital assets into a broader wealth management plan.

At the same time, analysts note that access to crypto remains one of the key barriers to entry. Still, engaging in such investments in the U.S. isn’t easy – especially when it comes to committing serious capital. Although the launch of spot Bitcoin-ETFs in January 2024 has improved the situation markedly.

Here’s a rejoinder to that.

Only 35 per cent of financial advisers said they can purchase cryptocurrencies for their clients’ accounts.

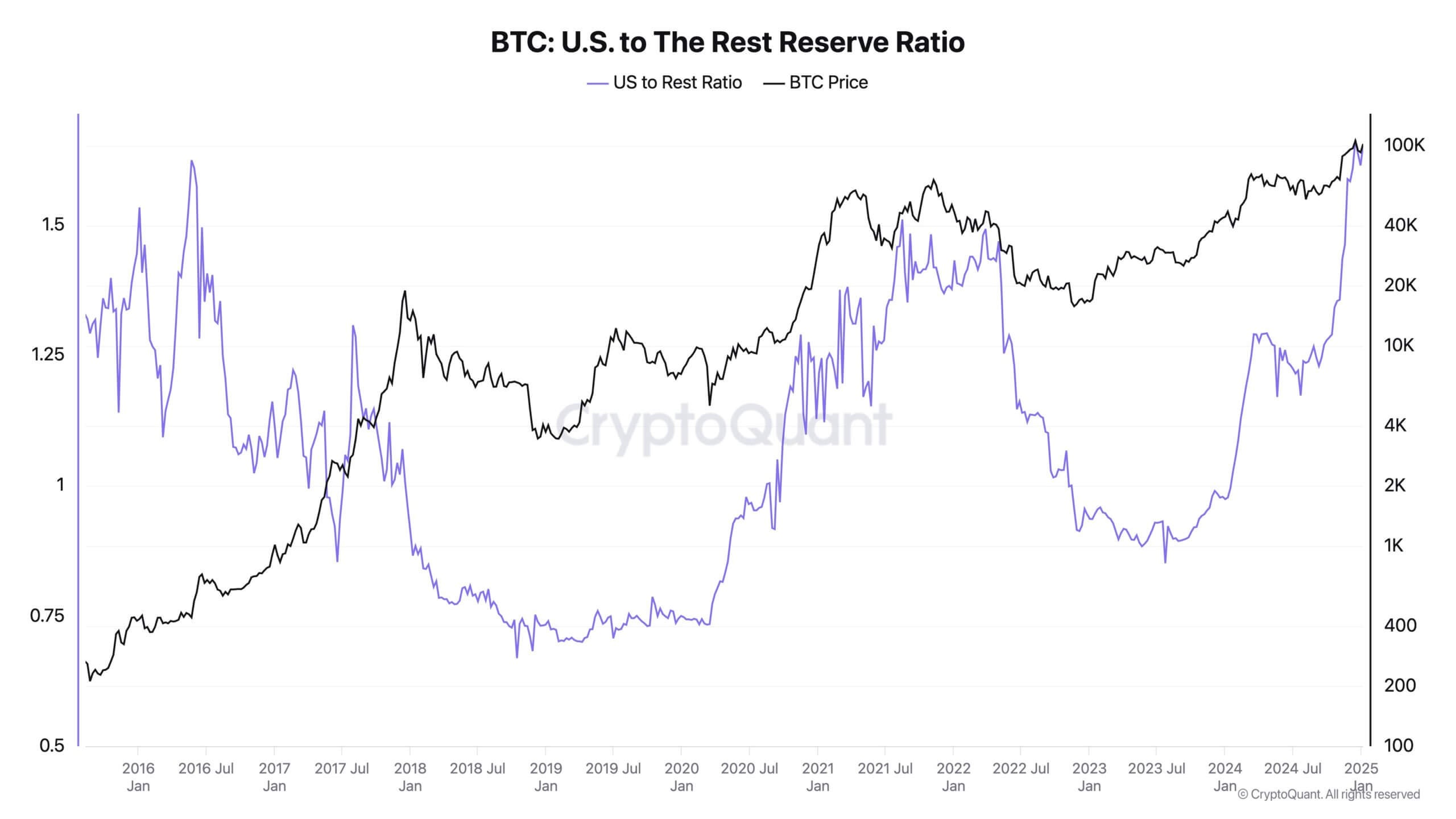

Despite this, US organisations hold far more BTC than companies in other parts of the world. According to CryptoQuant platform head Ki Young Ju, the share of bitcoins held by US institutions has set an all-time high: their stockpile of the crypto is 65 per cent ahead of the rest of the market.

We are talking about well-known miners, MicroStrategy, ETFs, exchanges, governments and other such organisations.

The ratio of BTC held by U.S. entities to offshore entities was 1.24 in September 2024. The ratio is now at 1.65.

The ratio of the number of bitcoins in the possession of American companies to the indicator of offshore organisations

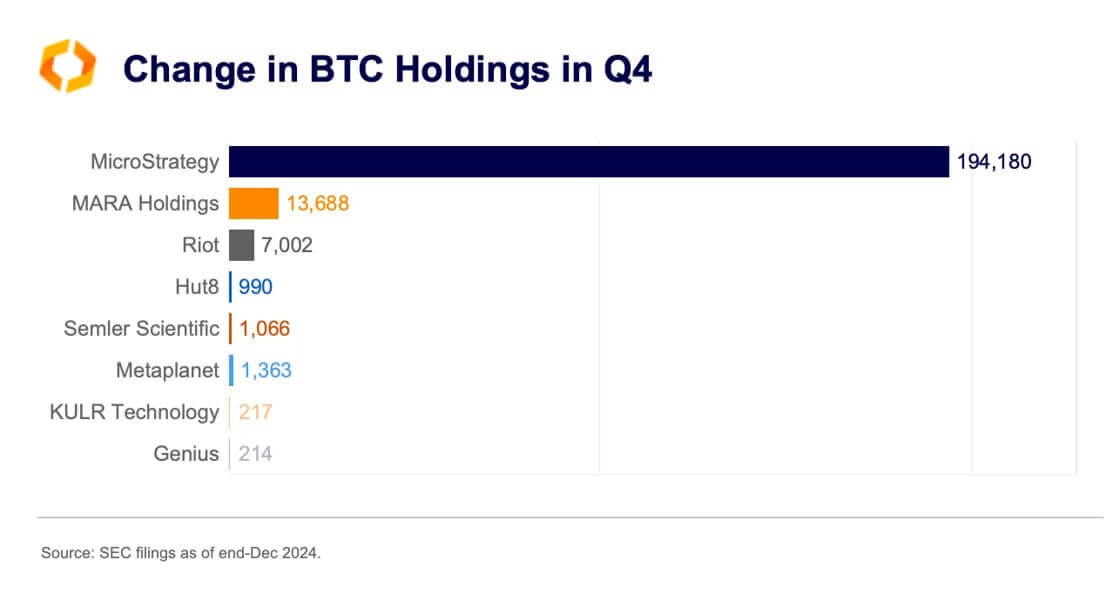

The growth of the latter is actively promoted by bitcoin purchases by MicroStrategy. However, as we have already found out earlier, the giant has accumulated 194,180 BTC in the fourth quarter of 2024. This is much more than the owner of the second line in the person of MARA Holdings, which acquired 13,688 coins.

Scale of bitcoin accumulation by different companies in the fourth quarter of 2024

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

Cryptocurrency forecast for the new year

Earlier, Bitwise experts shared a detailed forecast on the situation on the coin market in the new year. They agree with the version that 2025 will be the final one in this bullrun of the coin industry.

Experts expect Bitcoin to reach a mark of approximately $200,000 at its peak. But if the U.S. government approves the idea of accumulating BTC for the national reserve, then the benchmark may well jump to the level of $500 thousand.

Analysts also said that there is an opportunity for growth in the popularity of Efirium, which was not the best investment last year, even compared to Bitcoin.

Bitcoin’s strength

Among the positive factors for the crypto’s further growth, experts included a slowdown in the rate of new bitcoin issuance due to the April 2024 halving, the acquisition of BTC by governments and large companies, a definite improvement in the economy, and an increase in the target level of crypto investments for an organisation from 1 to 3 percent of total capital.

Despite all the positivity, investing in coins should be done with the utmost caution. This week, a user on the Solana network lost a huge amount of coins in an attempt to make money on a new token.

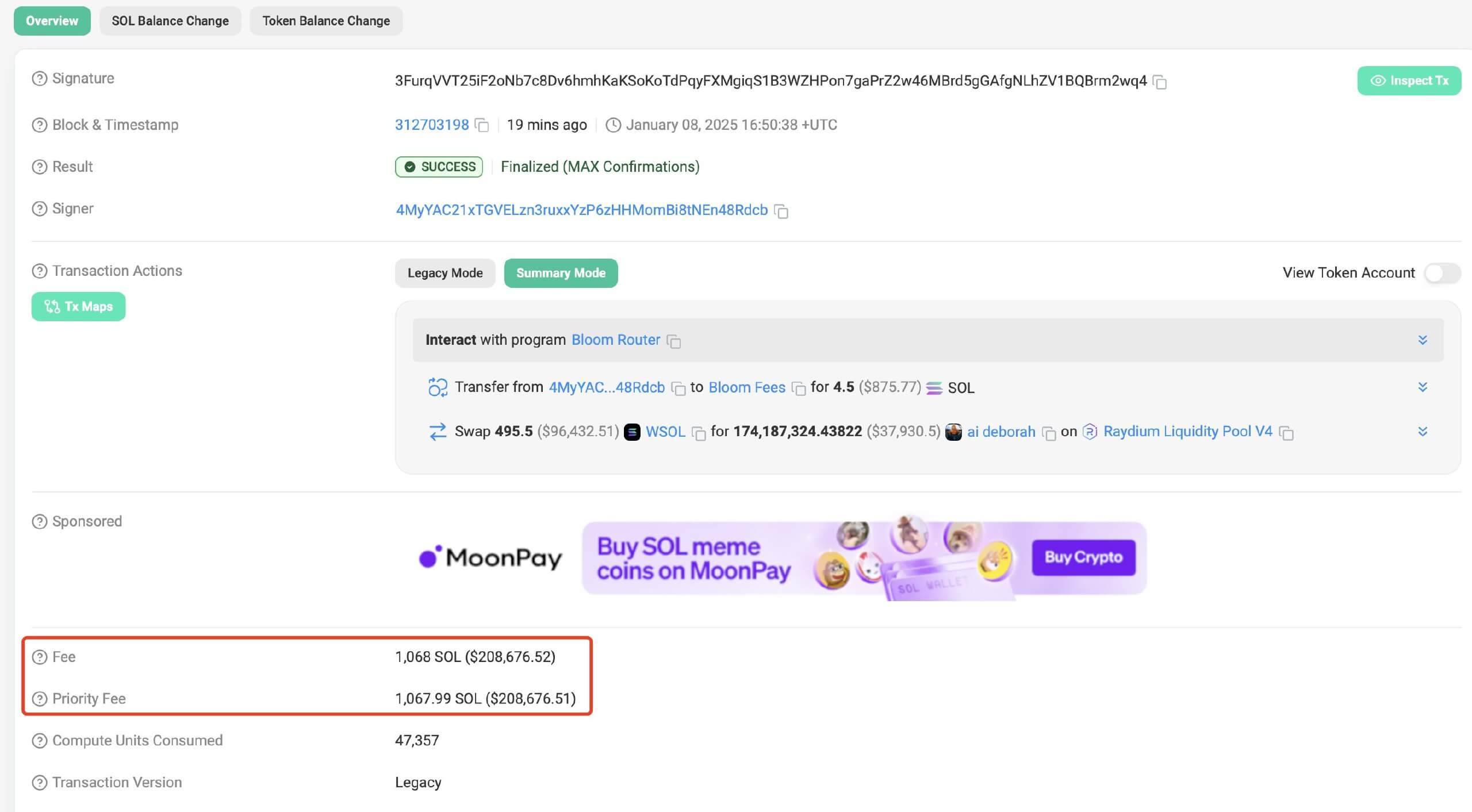

First of all, he paid 1,068 SOL or $208,000 transaction fees to be among the first buyers of the artificial intelligence-related crypto asset “ai deborah”. For the novelty, he flushed 500 SOL or $97 thousand dollars, resulting in 174 million tokens.

Buying a token on the Solana network, which cost the investor more than 200 thousand dollars

However, the crypto did not give out the expected growth. As a result, after only three minutes, the trader drained the purchased coins, receiving 40 SOL or only $7.7 thousand dollars. Accordingly, the almost instant loss amounted to 1528 SOL or 298 thousand quid.

Almost instant token sale on the Solana network with a huge loss

It can be argued that Trump's victory in the US presidential election has changed the perception of cryptocurrencies by ordinary people. Fewer investors will now treat the coin market solely as an attempt to lose their money. Either way Bitcoin has more than earned its title as a capital protection and long-term investment tool.

Look for more interesting information in our cryptocurrency chat room. Go there now.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.