Goldman Sachs executive tells whether Bitcoin should be seen as a threat to the dollar

During the election campaign, the new US President Donald Trump supported the idea of creating a national Bitcoin reserve. According to him, the cryptocurrency could be used in the future to pay America’s national debt. Although the politician has not yet realised his promise to accumulate BTC, the perception of digital assets in the world is improving significantly. This was confirmed by Goldman Sachs executive David Solomon.

What will happen to Bitcoin in 2025

David Solomon shared his views on the crypto industry in Davos, where he spoke with journalist Andrew Ross Sorkin on CNBC. During the conversation, Sorkin asked whether the possible launch of a Bitcoin reserve for the US could affect the further interaction of US banks with crypto.

Recall that during the administration of the previous US President Joe Biden, the US government actively fought against the popularisation of crypto. All this was done within the framework of the so-called operation "Uvula 2.0", which involved the disconnection of cryptocurrency projects from the financial system. For this purpose, government officials pressurised US banks and demanded that they stop interacting with such companies and even individuals.

Goldman Sachs executive David Solomon

Here is Solomon’s commentary on the matter, as quoted by The Block.

Let me start by noting that we’ve discussed this sort of thing more than once. We pay a lot of attention to the technology at the core [we’re talking about blockchain – editor’s note]. It’s something we’re engaging with and testing, for the sake of reducing friction in the financial system. That kind of thing is extremely important.

However, from a regulatory perspective, Goldman Sachs still cannot store and use Bitcoin, or generally be associated with cryptocurrency in any way. Solomon therefore considers such conversations premature.

If the world were to change, we would be able to discuss what is happening.

Goldman Sachs bank logo

Journalists noted that the head of Goldman Sachs Bank previously responded about the prospects of interacting with crypto in a similar way. Here is his quote, voiced in December 2024.

If the regulatory structure changes, we will consider such a thing, but at the moment we are not allowed such a thing.

At this point, David commented on his own attitude towards Bitcoin.

At the end of the day I am a serious supporter of the US dollar. Bitcoin is a speculative asset – an interesting speculative asset. I don’t think there’s much to discuss here, to be honest.

I don’t see Bitcoin as a threat to the US dollar. Some may think otherwise, but I don’t see BTC as a threat to the national currency.

Earlier, a representative of Goldman Sachs repeatedly emphasised interest in blockchain technology at the heart of Bitcoin and other cryptocurrencies. According to him, this system can improve what is happening in the world of finance, which will get new opportunities for development due to the introduction of innovation. In particular, we are talking about faster transfers of value with the overall security of the system.

At the same time, Solomon emphasised that BTC belongs to the category of speculative assets and still has no useful use case – something that decentralisation enthusiasts will definitely argue with.

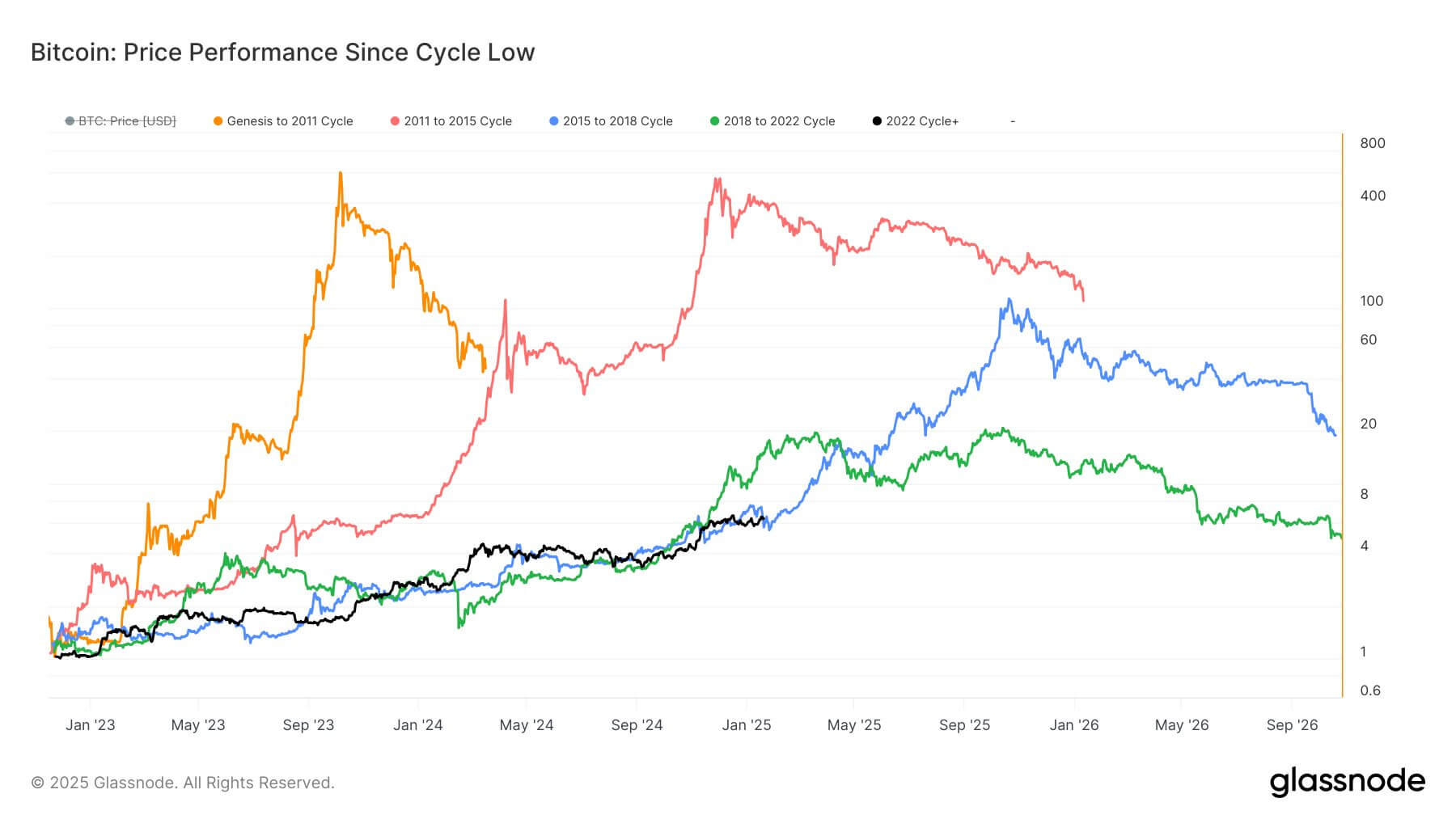

In the meantime, Bitcoin continues to behave similarly to its growth cycle from 2015 to 2018. The current growth phase is labelled on the Glassnode analysts’ chart in black, and it is indeed similar to the bullrun before last, labelled in blue.

Comparing the magnitude of Bitcoin’s growth during bullruns

While BTC is now up 630 per cent from its low in December 2022, it was showing 562 per cent growth at the same point in 2016.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Which cryptocurrencies to buy

At the same time, the necessity in connection with Bitcoin is insisted on by the head of the investment fund ARK Invest, Katie Wood. According to her, the entrepreneur’s focus remains on BTC, Efirium and Solana.

Thus she commented on the topic of a new meme token from Donald Trump in a conversation with Bloomberg.

Trump’s coin will not acquire any utility. Rumour has it that you will get a chance to meet US President Donald Trump as one of the benefits of owning these coins. I don’t know if this is true, however, so far we don’t have much information about the utility of TRUMP. Except for the fact that it’s a meme of President Trump himself.

As a reminder, previous NFT collections of the President of the United States did allow you to meet him. And while the opportunity was only available to a few unique token holders, it was still there.

Ark Invest executive Katie Wood

Wood also compared the current hype around meme tokens to what is happening around ICO projects in 2017. As a reminder, we’re talking about the mechanism of funding new projects in their early stages of existence in the bullrun before last through token purchases. Here is the quote that Cointelegraph cites.

I think it’s true that the topic of ICOs in 2017 attracted many people new to the world of blockchain, or at least sparked interest in the new technology. And while some members of the cryptosphere expect to mess with such coins, calling the situation by the word “cringe”, it has really opened many people’s eyes to what’s going on.

Changes in the approach to crypto regulation in the US will definitely affect the reputation of digital assets. Bitcoin and other large coins will surely be perceived as a reliable instrument for preserving value. And the more people agree with this, the more real this version will be.

Look for more interesting stuff in our cryptocurrency chat room. We look forward to hearing from you.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.