How the creation of a national Bitcoin reserve in the US will help popularise the crypto: CoinShares version

One of the most anticipated events in 2025 for crypto will be the creation of a national Bitcoin reserve for the United States. Such an idea was voiced by newly elected President Donald Trump during his election campaign, after which its details were clarified by Senator Cynthia Lummis’ bill. And as more and more new states want to buy BTC, it’s a good time to discuss the possible impact of such reserves on the cryptocurrency industry.

The US Bitcoin Reserve and its impact on cryptocurrencies

According to representatives of the analytics platform CoinShares, the creation of a national bitcoin reserve for the United States will have an even greater impact on the crypto industry than the launch of spot ETFs on the first cryptocurrency a year ago.

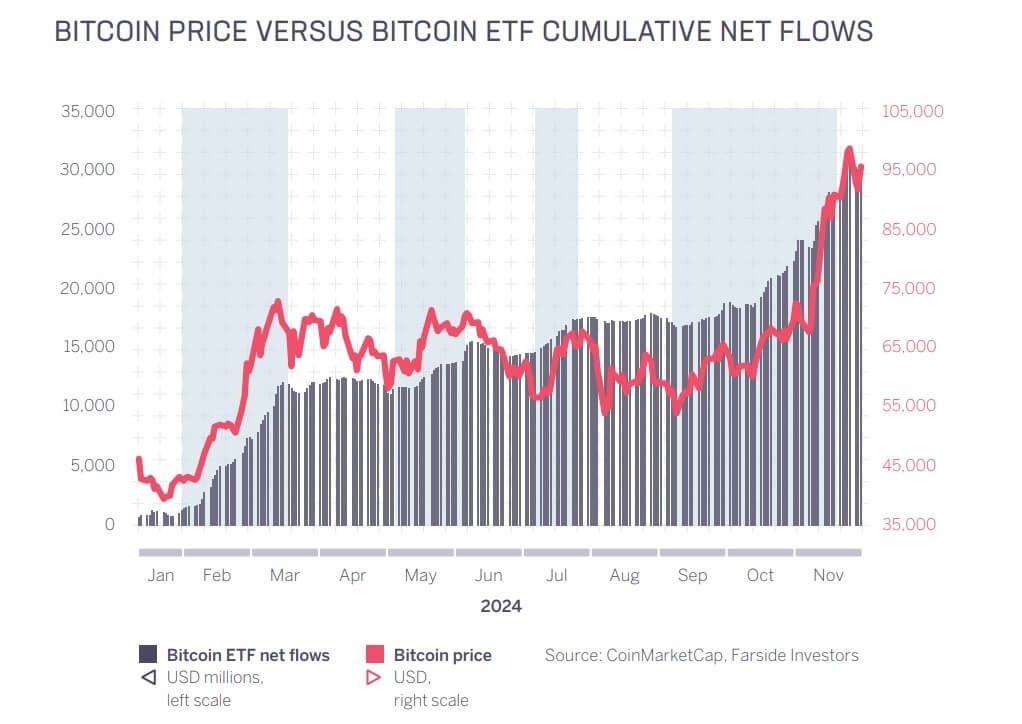

And that’s a loud statement, as net capital inflows into such instruments currently stand at $36.2 billion – and that’s despite the withdrawal of $21.5 billion from Grayscale’s GBTC exchange-traded fund.

Linking the Bitcoin exchange rate to capital inflows into spot cryptocurrency ETFs

Here is a rejoinder on the matter, as quoted by Cointelegraph.

We believe that the approval of the Bitcoin Bill (Bitcoin Act) in the US will have a deeper long-term impact on cryptocurrency than the approval of spot exchange traded funds on the first cryptocurrency.

Recall, Senator Cynthia Lummis presented the relevant bill in July 2024. According to it, the US government will recognise Bitcoin as a reserve asset and will allocate capital for the purchase of one million coins over five years – 200 thousand BTC each year.

The crypto is expected to lie unmoved for twenty years. And since it is expected to grow more actively compared to the U.S. government debt, Bitcoin will really help with the payment of the latter – at least this point of view was previously voiced by analysts of the VanEck investment fund.

US Senator Cynthia Lummis

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

According to the experts’ version, “multiple interactions with institutional-level clients” showed that they were slow to connect with BTC due to a lack of confidence in cryptocurrencies as a separate asset class. Well, purchases of digital assets by the U.S. government will be just the kind of necessary confirmation of the reliability of coins that one could wish for.

Analysts believe that the adoption of the bill on the purchase of bitcoins by the U.S. authorities will significantly reduce the problems of perception of coins by major investors. Still, in such a case, “Bitcoin will actually get the approval of the largest government in the world”.

The power of Bitcoin and other cryptocurrencies

When exactly will approve the idea of creating a national Bitcoin reserve in the United States – it is unknown. However, it is definitely worth waiting for the inauguration of Donald Trump, which will take place on 20 January 2025.

The renewed composition of Congress, let us recall, began work back on 3 January. It is called the most friendly to cryptocurrencies in the history of America – that’s why experts expect positive changes in the regulation of coins in the coming months and years.

Which companies want to buy bitcoins

Governments are not the only possible buyer of BTC in the near future, as it could also be the company Meta.

At the end of the week, the company’s shareholders submitted a proposal for the giant to convert part of its $72 billion in cash and short-term cash equivalents reserves into Bitcoin. The corresponding proposal was submitted by Ethan Peck, and the reason for the initiative was the desire to protect the reserves from the possible depreciation of fiat currency.

Head of the company Meta Mark Zuckerberg

As noted in the proposal, Bitcoin is the most inflation-resistant instrument for saving value because of its fixed supply, which in addition can be easily verified.

According to Peck, Meta has lost 28 per cent of the value of its fiat savings over time due to inflation. Plus, he recalled that Bitcoin has outperformed bond yields by 1,262 per cent over the past five years, meaning it more than deserves extra attention.

Here’s his rejoinder to that.

Mark Zuckerberg named his goats “Bitcoin” and “Max.” Meta director Mark Andriessen has spoken well of Bitcoin and is also on the board of Coinbase. Don’t Meta’s shareholders deserve the same responsible approach to the company’s asset allocation that the directors and top executives are likely to take for themselves?

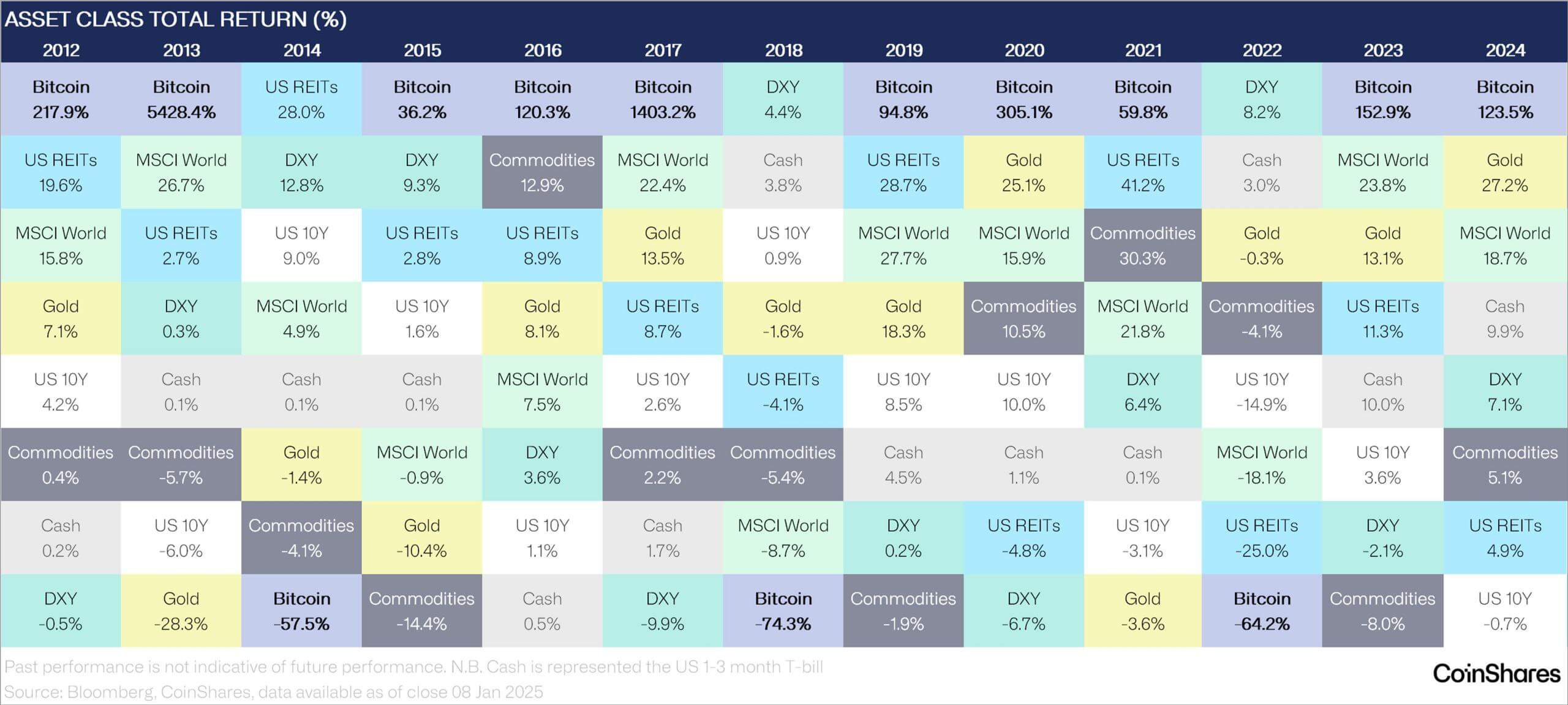

Bitcoin is indeed outperforming many market participants. As CoinShares analysts point out, the cryptocurrency’s 123 per cent return in 2024 has allowed it to outperform representatives of other categories of investment instruments. At the same time, the cryptocurrency repeated this trick in 10 cases out of the last 13 years.

Comparing Bitcoin’s returns in recent years with other investment assets

There is no doubt that the launch of a national Bitcoin reserve for the US will be one of the major events in the history of cryptocurrencies. When it will happen, on what scale and whether it will happen at all is still unknown. However, the active presentation of relevant legislation in different states of America allows us to assume that the chances of such a thing remain.

Look for more interesting stuff in our cryptocurrency chat room. Come in right this second.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.