Major investors commented on Trump’s meme token and the US president’s executive order on crypto. What do they think?

Last week, US President Donald Trump signed his first executive order on the cryptocurrency sphere. It is called “Strengthening American leadership in the field of digital financial technologies” and involves the creation of a working group on the sphere of coins, ban CBDC, as well as studying the prospects of creating a national reserve for America. Now the essence and effectiveness of the document has been commented on by representatives of the venture capital industry.

What will happen to crypto after Trump’s victory

The topic of a national Bitcoin reserve in the United States has raised many questions. Firstly, it may consist not of BTC, but of cryptocurrencies whose developers are located in the US. Secondly, in theory, the US government can do without buying digital assets and just keep the previously confiscated coins.

US President Donald Trump

In addition, some crypto enthusiasts speculated that Trump would directly sign an executive order to create a national BTC reserve, which has already not happened. Here’s Dragonfly general partner Rob Hedick’s rejoinder on the matter, as quoted by The Block.

In my opinion, this is the best we could have hoped for and a great sign for the industry that the administration is willing to consider such a possibility at all.

However, Hedick emphasises that the government could face citizen discontent in the case of direct purchases of cryptocurrencies. Either way, coins are still highly volatile and capable of losing tens of per cent of value in a short period of time – especially meme tokens. Therefore, the approval of digital assets by the authorities will surely end in losses for those who get in touch with coins for the first time.

Most traditional economic advisors will oppose it. My guess is that the eventual outcome will likely disappoint the market.

Buying cryptocurrencies by investors

At the same time, Framework Ventures partner Brandon Potts noted the importance of such a decision by the authorities for the whole world. Still, in the end, many countries will have to follow the U.S., which is the largest financial market, in order not to be left behind. Here is his comment.

If the government does start buying cryptocurrency on the open market, it could set off a domino effect, encouraging other countries to follow suit. Such a thing will happen even if they are not fully convinced about cryptocurrency, but simply out of a need to stay competitive.

Trump’s executive order states that the working group is to share recommendations for creating a regulatory framework for the coin sphere within six months. However, some investors concede that the actual timeframe for developments will be much shorter. For example, Tribe Capital managing director Boris Revsin thinks so. Here’s what he said.

If they wanted to, they could well develop the structure within a few weeks, inspired by the spirit of cryptocurrencies with a focus on getting things done quickly. We assume they will continue to build a reserve that will include buying crypto assets. It will all start with Bitcoin and will likely expand to other coins over time.

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

What’s next for Trump’s meme token

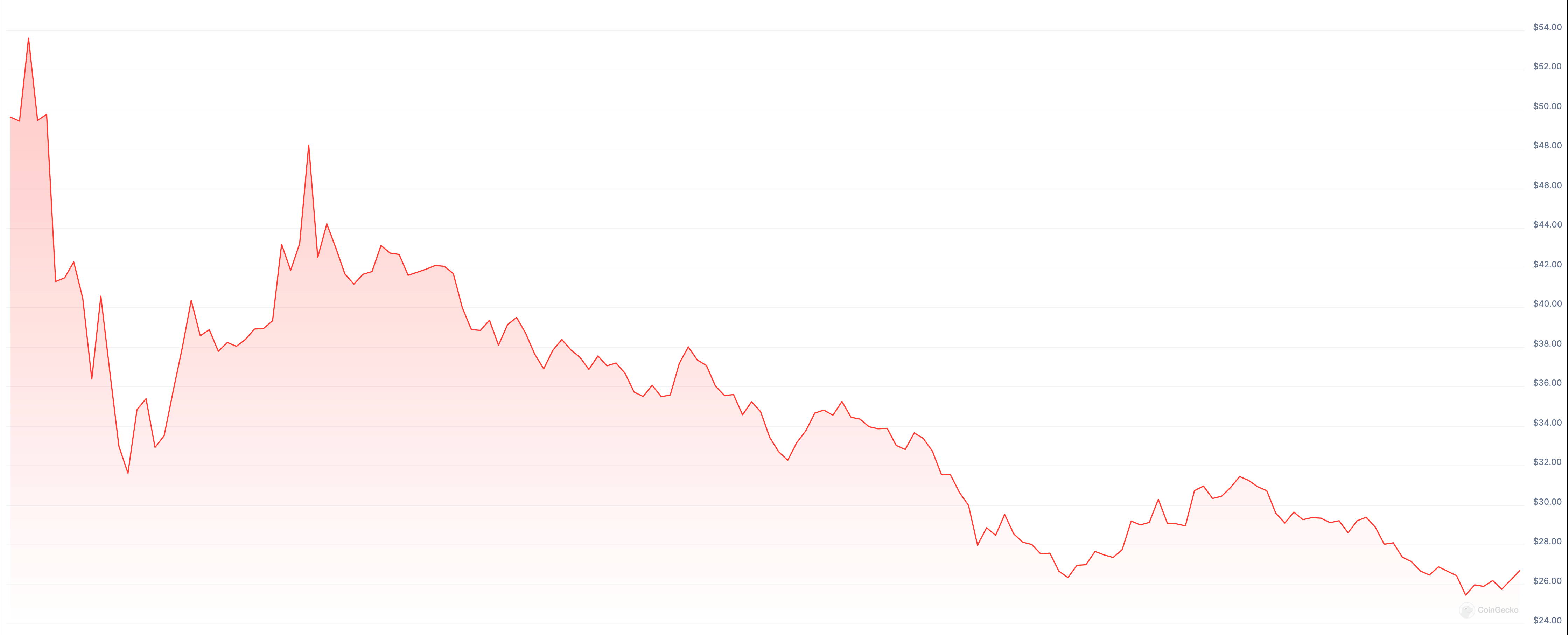

Over the past week, US President Donald Trump’s meme token called Official Trump has fallen in price by 50 per cent. Despite this, the asset continues to attract investors and remain in the trends of rate monitoring platforms like Coingecko.

A chart of the TRUMP meme token exchange rate over the past week

Experienced investors also did not leave this asset without attention. In particular, the already mentioned Dragonfly partner Rob Hedick expects that the Trump team will not start to get rid of the crypto asset.

Since its representatives collectively own 80 per cent of TRUMP’s maximum supply, and the asset itself has successfully sucked liquidity out of the coin market since its launch, this is unlikely to end well. Here’s the line.

If he or his organisations do sell a significant stake, almost no one in the industry or in Washington will support it – except those who stand to make money from it. Such a thing would only strengthen allegations of serious ethics violations and further exacerbate the cryptocurrency controversy. So I hope he doesn’t do it.

Tribe Capital spokesman Revsin doesn’t believe in such a prospect. Still, in such a case, Trump risks losing fans among coin enthusiasts, of which he has quite a few.

The potential reputational damage from being perceived as a ragpoll would far outweigh any financial gains.

Bullrun on the cryptocurrency market

Rob Hedick stressed that the launch of TRUMP showed the huge potential of the decentralised finance sphere. Still, the asset was launched precisely with the help of decentralised exchanges, which attracted traders and provided trading liquidity.

According to the expert, this initiative and similar actions of celebrities will surely attract a lot of investors in the future. Moreover, the latter will have to learn how to interact with the DeFi sphere, rather than using centralised solutions like Binance.

Everything points to the fact that experienced market players treat Trump's cryptocurrency initiatives predominantly positively. The president's meme token has attracted many players to the blockchain world who are sure to stick around thanks to the bullrun. Well, the next key task is to create a regulation of digital assets in the US that can turn the government into an ally of the crypto industry.

More news is available in our crypto chat room. We look forward to seeing you there today.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.