MicroStrategy’s bitcoin purchases have been called a “missed megatrend.” Next thing you know, other companies will be doing the same thing

MicroStrategy has been stepping up its bitcoin purchases lately. Its founder Michael Saylor published a chart of BTC purchases by the giant on Sunday for the tenth week in a row, followed by a major cryptocurrency acquisition reported by the company on Monday. According to a Bitwise spokesperson, “hundreds of large companies” will be conducting similar transactions in the near future.

Who will be buying bitcoins in 2025

Bitwise Investment Director Matt Hogan believes that companies buying bitcoins in huge volumes today is a “megatrend that is being overlooked.” Accordingly, the situation will become more pronounced in the future.

Bitwise investment director Matt Hogan

Here’s a rejoinder on the matter, as quoted by The Block.

This is a much larger trend than many people realise. In fact, I believe we’re talking about a full-blown megatrend. In the next 12-18 months, we will see hundreds of companies start buying Bitcoin for their own treasury reserves, and these purchases will significantly boost the entire BTC market.

MicroStrategy’s corporate Bitcoin buying model, which continues to be the largest holder of the first cryptocurrency among publicly traded companies, is already familiar to the media. However, it’s still not getting the attention it deserves from investors, Hogan said.

Still, most of the capital holders he spoke to continue to view what’s happening with Michael Saylor’s company as an exception to the rule.

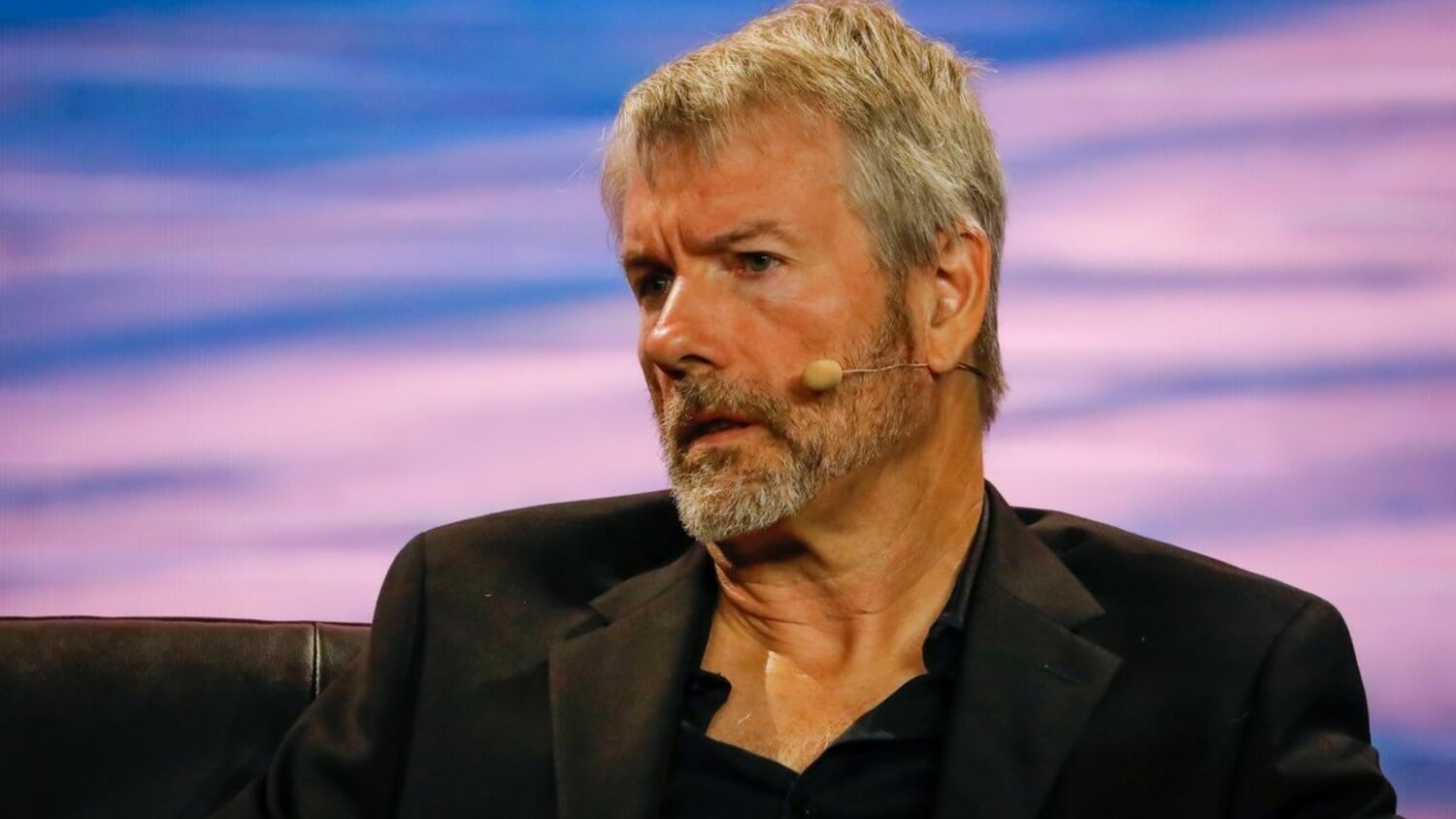

MicroStrategy Executive Chairman Michael Saylor

However, the reality is quite different, notes the Bitwise analyst. Although MicroStrategy today ranks 220th in the ranking of companies by market capitalisation, the giant has acquired 257,000 BTC through 2024. And this is tangibly more than the 218,829 coins issued by the Bitcoin network as rewards for miners over the course of a full year.

The company of scale Chipotle acquired the most new supply of the first cryptocurrency over 2024.

Here, Hogan brought up the so-called 21/21 plan, which involves MicroStrategy raising $42 billion. The analyst notes that this amount could now be used to purchase bitcoins, which would be equivalent to the issuance of a new cryptocurrency offering within 2.6 years. That is, the scale of these transactions in the context of an entire network is enormous.

However, MicroStrategy won’t be the only serious player committing millions and billions of dollars to rounds of BTC purchases. Still, there are now 70 public companies adopting the corporate bitcoin vault model, doing so for the same reasons as regular retail investors.

Michael Sailor at MicroStrategy’s company presentation

For example, some players are counting on the cryptocurrency’s long-term appreciation. Others are worried about further depreciation of the dollar amid inflation and want to be part of the “Bitcoin tribe,” Hogan notes.

Overall, the reasons may vary, but the general vector of thought is the same: BTC is evolving into a tool for preserving value globally. Here’s Hogan’s commentary on the matter.

What happens if the really big companies start taking MicroStrategy as an example? Meta, which is now considering a shareholder proposal to add BTC for its own reserves, is twenty times the size of MicroStrategy.

If 70 companies were willing to add BTC to their own accounts, even though from an accounting perspective its value could only go down, imagine how many companies will do it now. Two hundred? Five hundred? A thousand?

MicroStrategy accounts for less than 50 per cent of the corporate Bitcoin market. I think this share will become quite insignificant in the future.

That is, the expert is sure that purchases of other companies will gain momentum.

Who owns bitcoins now

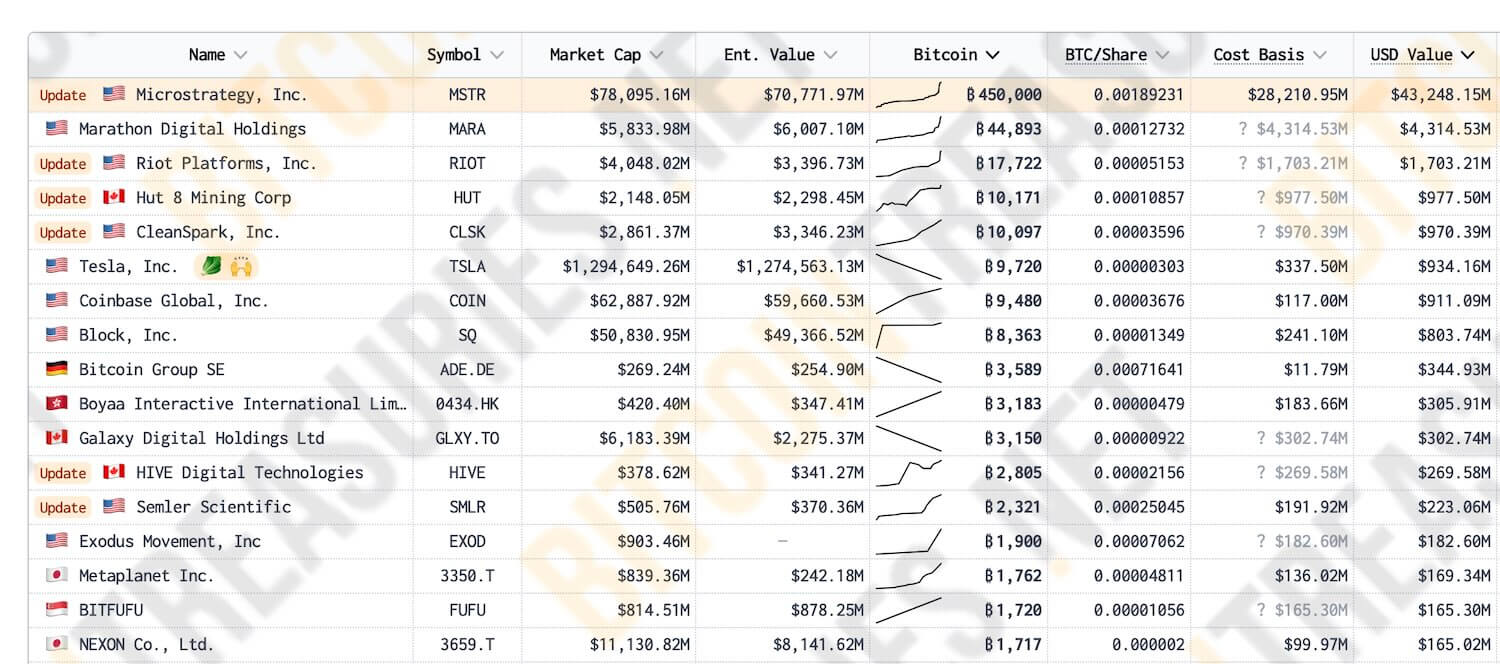

Today bitcoins are owned by public companies-giants like Coinbase, MARA, Block, Tesla, Semlar Scientific and Mercado Libre, which have accumulated a total of 141 thousand coins.

Private companies like SpaceX and Block.one store at least 368 thousand BTC. The Bitwise investment fund, which is represented by Matt Hogan and manages the Bitcoin exchange-traded fund under the ticker BITB, has also invested in coins.

As of today, MicroStrategy has accumulated 450 thousand BTC with $28.2 billion invested. Accordingly, the average purchase of each individual coin is $62,691.

The largest holders of bitcoins among publicly traded companies are as follows

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Now Italy’s largest bank called Intesa Sanpaolo has allegedly joined the list of bitcoin holders. This information was shared by Reuters sources, and it is not confirmed.

Intesa Sanpaolo bank logo

Intesa is believed to have bought 11 bitcoins worth €1 million. Moreover, the head of the bank Carlo Messina allegedly called the operation “an experiment and a test”.

According to him, such an investment is insignificant compared to the bank’s portfolio of securities in the equivalent of 100 billion dollars.

The situation shows that digital assets can be given some attention, but with very limited investment amounts.

Messina himself clarified that he has not personally invested in cryptocurrencies.

The Bitwise analyst's comments seem logical. Still, politicians, bankers and financiers have been scaring people about Bitcoin's alleged shortcomings for years, but now that hasn't stopped the world's biggest companies from committing money to buying BTC. Obviously, this trend will only gain momentum in the future, because ordinary people will still have good reasons to be interested in crypto. It can be both adequate regulation of coins in the U.S., and the fear of depreciation of fiat currency of their own country.

.

Look for more interesting things in our crypto chat room. We look forward to seeing you!

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.