New cryptocurrency ETFs on altcoins will raise billions of dollars: JPMorgan analysts’ view

At the beginning of next week, there will be a change of president in the United States. He will be Donald Trump, who repeatedly supported the crypto industry during the election campaign and promised to improve what is happening with it. Therefore, after the inauguration, coin owners are expecting not only the renewal of the Securities Commission with its new chairman Paul Atkins, but also the appearance of new spot ETFs on digital assets.

What ETFs for crypto will appear in 2025

Last year, only exchange traded funds based on Bitcoin and Etherium appeared on U.S. exchanges. And since the new U.S. government has a better attitude toward digital assets, analysts are waiting for ETFs on other coins to launch.

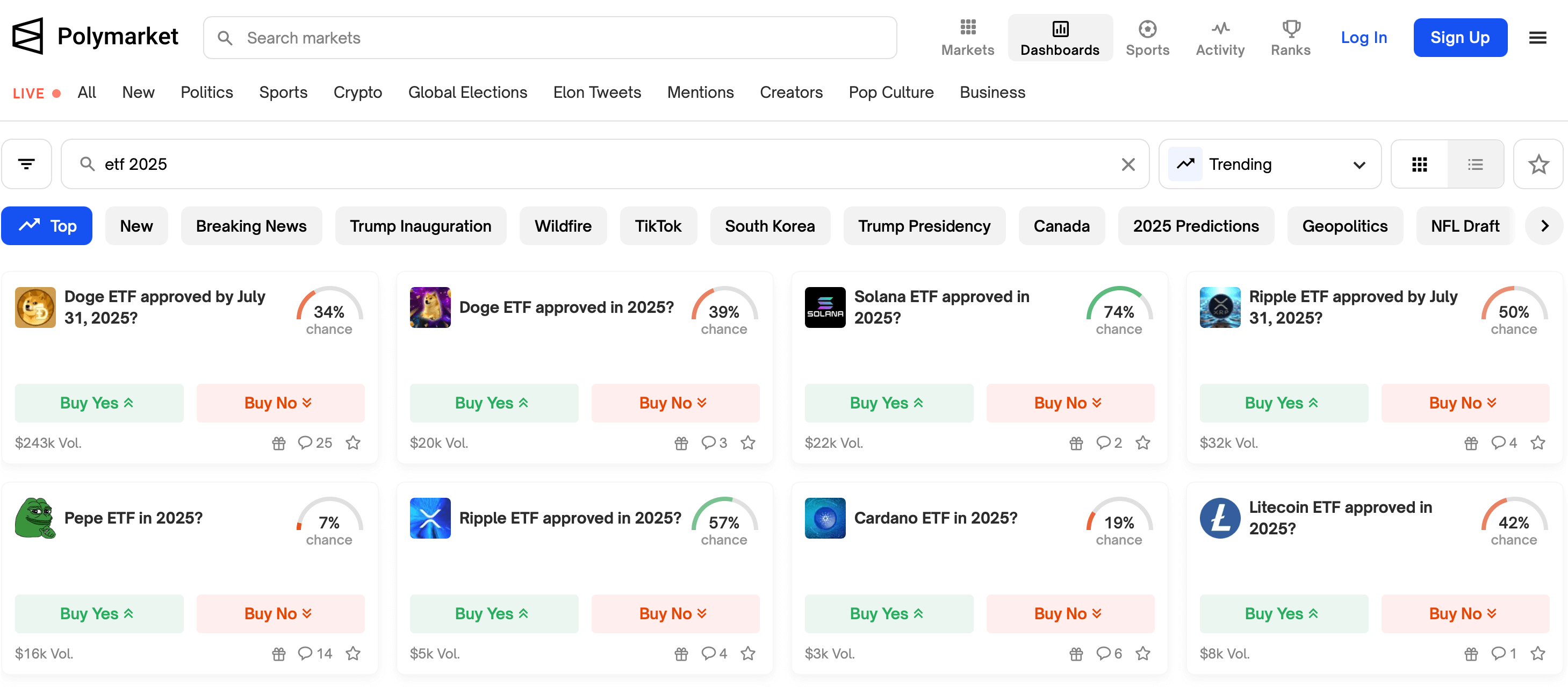

For example, users of the decentralised platform Polymarket are actively trying to guess which cryptocurrency ETFs will be launched in 2025. So far, Solana and XRP are in the lead, while the chances of Litecoin, Dogecoin and Cardano are noticeably lower.

Polymarket platform users’ bets on new cryptocurrency ETFs in the US

Analysts at JPMorgan Bank support this version and believe that ETFs based on Solana and XRP, if approved, will attract serious amounts as investments.

The performance of exchange-traded funds on the listed coins, among other things, may surpass the results of trading for the first six months of exchange-traded funds on Etherium ETH. These, as a reminder, launched in the US in July 2024.

Here’s a commentary on the matter, cited by Cointelegraph.

When we apply the so-called “adoption rates” to SOL and XRP, we see that SOL attracts about $3 to $6 billion in net assets, while XRP could get capital inflows of $4 to $8 billion.

The fate of Solana-based ETFs will be decided soon enough: the deadline for a preliminary decision on them is at the end of January. Still, the respective applications were filed by VanEck and 21Shares investment funds at the end of June 2024. Then Grayscale, Bitwise and Canary Capital joined the list.

Solana’s ecosystem

It’s important to realise that experts base their forecasts for the SOL and XRP ETFs on the performance of the respective Bitcoin and Efirium investment vehicles. According to JPMorgan, the adoption rate of exchange-traded funds on BTC was 6 percent, because the new ETFs attracted about 6 percent of the market capitalisation of the first cryptocurrency. The rate of instruments on ETH first six months reached 3 per cent.

Bank analysts note less stable demand for altcoins compared to the largest cryptocurrencies on the market, which makes it more difficult to predict investor behaviour after the launch of new products.

At the same time, it is most likely not worth counting on the appearance of ETFs based on various HYIP projects. Here’s a commentary on the matter.

With the exception of a few major tokens such as BTC, ETH and SOL, the episodic nature of the crypto market is due to fickle investor sentiment and popular new coins that can attract additional attention only for a short period of time. We do not believe tokens with such limited potential can successfully act as the basis for investment products.

According to Alejo Pinto, founder of the Solana-based Lumio Tier 2 network, the approval of an ETF on SOL could have a serious impact on the cryptocurrency’s exchange rate. Here’s his rejoinder.

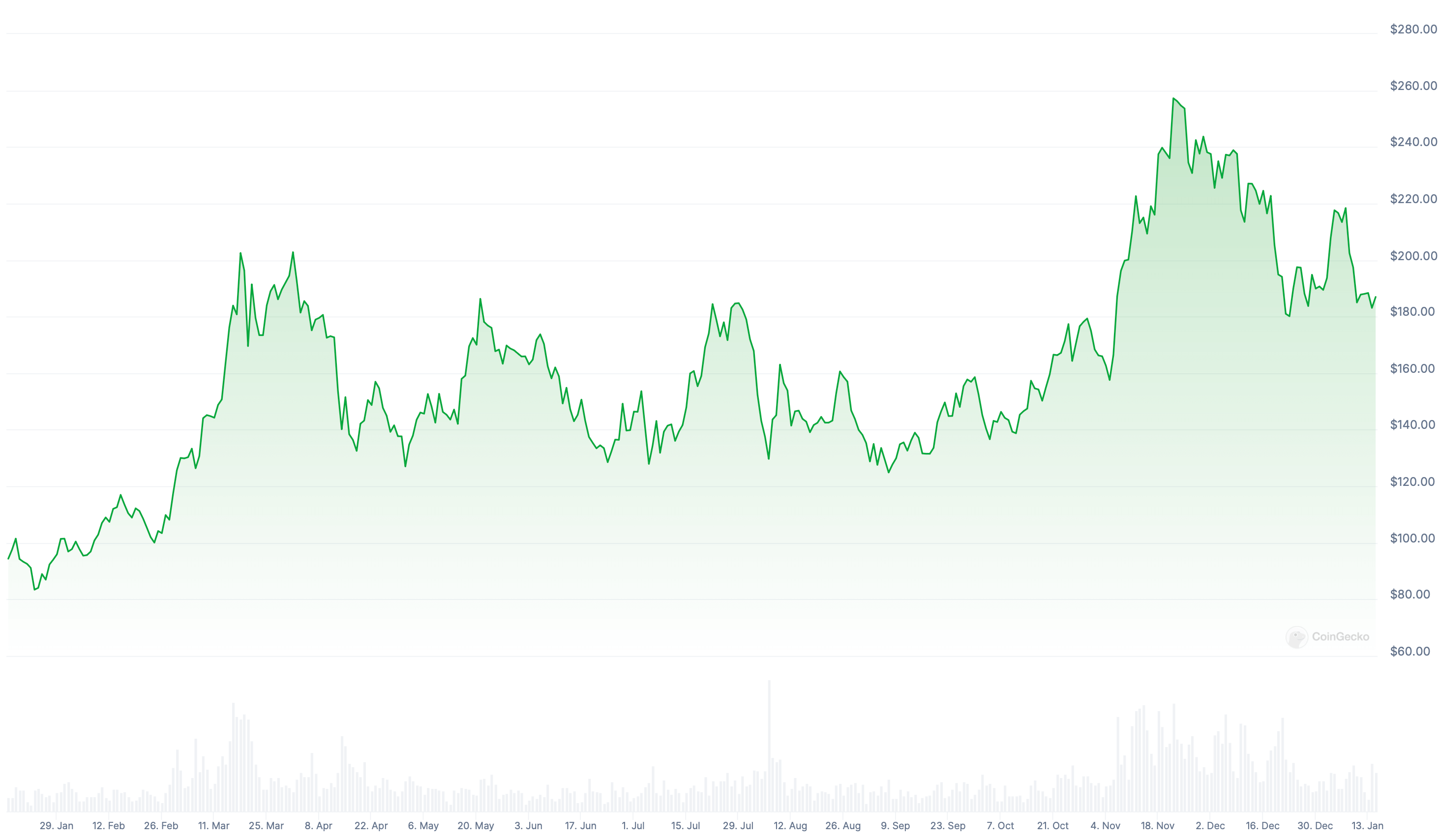

As the situation remains highly uncertain, the approval of the ETF in the US will have a positive impact on the price of SOL. Still, the probability of this event is low, and it has not yet been factored into the current rate.

Chart of Solana cryptocurrency rate for the last year

To understand the expectations of growth of SOL and XRP on the background of the possible launch of ETFs is quite easy. The first Bitcoin spot funds in the US were launched in January 2024, and their trading results for the first year brought net inflows of over $35 billion. And since the spot exchange-traded funds are based on common cryptocurrencies, this money is being used to make matching purchases of digital assets.

As of 15 February 2024 – a month after the launch pitch – Bitcoin ETFs were bringing 75 per cent of new investments into the cryptocurrency. So investors’ focus on traditional instruments does have the potential to influence rates.

What will happen to the regulation of cryptocurrencies after Trump’s victory

And while some investors are waiting for the situation with crypto to improve after Donald Trump’s inauguration, Senator Elizabeth Warren demanded that the newly elected president’s appointees treat coins more strictly. The day before, she published an open letter to Scott Bessent, who will be the new US Treasury Secretary.

Here’s a comment from it.

Anti-money laundering (AML/CFT) programmes and sanctions measures should include risk-based provisions that are reasonably designed to prevent money laundering or terrorist financing using digital assets. Attackers are increasingly turning to cryptocurrencies to launder money, circumvent sanctions, and fund serious national security threats such as Russia’s invasion of Ukraine, North Korea’s nuclear programme, China’s sale of weapons components to sanctioned countries, and ransomware attacks.

US Senator Elizabeth Warren

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

The politician continues.

The Treasury Department has recognised the growing threat from cryptocurrencies and in November 2023 released a document outlining tools and five legislative initiatives to combat illicit financial transactions involving digital assets. Among the proposals is amending the Bank Secrecy Act (BSA) to add a new category of “financial institutions” linked to cryptocurrency. It would cover cryptocurrency exchanges, non-custodial wallets, decentralised finance (DeFi) and validators on the blockchain.

There seems to be no way Warren can accept that the newly elected government in the US will no longer make crypto the culprit for all ills. Either way, the problem is people who use coins to break the law.

This is also relevant for the dollar, but for some reason the senator is not talking about any bans on the national currency.

Expectations of changes by crypto investors from the new Trump administration clearly show how bad the situation with the coin market was under Biden and Gensler. If the U.S. government does indeed promote the digital asset industry, then the current bullrun will definitely have a good reason to continue.

Look for more interesting stuff in our crypto chat room. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.