Oklahoma may allow people to get paid in bitcoins and use cryptocurrency to pay for purchases

Inflation has become a key problem in the global economy in recent years. And while the US Federal Reserve and other central banks have had some success in combating it, it may take longer to bring rates down to target levels. With that in mind, more and more policymakers are considering a state-level link to Bitcoin. Now Oklahoma is among them.

Where Bitcoins are being used and accepted

Senator Dusty Devers of the US Republican Party has introduced a bill called The Bitcoin Freedom Act (SB325). Its purpose is to allow employees of various companies, along with suppliers of goods and services, to conduct transactions in Bitcoin.

As the senator noted, the cryptocurrency could become an alternative for the “inflation-ridden” US dollar, which is going through bad times after the coronavirus pandemic in 2020. In doing so, residents of the state will have a choice of tools for trading transactions.

Bitcoin’s struggle with the dollar

Here’s a rejoinder on the matter cited by Decrypt.

At a time when inflation is eroding the purchasing power of hard-working Oklahoma residents, Bitcoin offers a unique opportunity to protect earned value and secure your own investments.

It's worth noting that Bitcoin is not immune to drops, and they can be massive. If at the peak of the previous bullrun in November 2021, BTC reached a mark of 69 thousand dollars, a year later its local minimum was 15,476 dollars.

And although after that the cryptocurrency still grew to a recent high above 108 thousand, not all investors are able to survive such swings in rates. And if a person doesn't have a financial safety cushion, a bearish trend can make him disappointed in crypto and lock in a loss.

.

However, Divers is not deterred by this. If his bill is approved, Bitcoin can be used in state government agencies, local private businesses and simply as part of individual transactions, provided that the relevant rules are followed.

The official himself is confident that popularising Bitcoin will promote innovation, increase financial transparency and strengthen economic growth. In addition, he mentioned the decentralised nature of the cryptocurrency along with its limited maximum supply. This, Dusty said, will protect ordinary people from “reckless spending and money printing” in Washington.

This small, but in theory revolutionary change has the potential to offset the damage due to inflation, as well as make Oklahoma a national leader going forward with the future of financial technology.

Devers attributed Bitcoin’s current rise in popularity to the cryptocurrency’s ability to act as a “promising alternative for wealth preservation.” Well that is highly relevant in the current political climate.

The power of Bitcoin and other cryptocurrencies

He continues.

President Trump has been actively promoting himself as a Bitcoin supporter and speaking at major cryptocurrency-themed events for a reason. BTC has already become an important part of our economy and has also proven to be a component of our financial future.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Bitcoin’s strategic reserve in the US

One of Donald Trump’s key campaign promises was the prospect of a national Bitcoin reserve. Senator Cynthia Lummis’ bill, for example, calls for the US government to purchase one million BTC over five years.

The cryptocurrency would have to be stored without movement for twenty years. The only exception here may be the sale of coins to repay the national debt of the country.

There is a possibility that the basis for the creation of Bitcoin reserve in the country will be the legislation in different states of the country. As we reported earlier, projects for the purchase of BTC were presented in Texas, Pennsylvania and Ohio. Moreover, their authors openly stated that in this way they want to protect local residents from further devaluation of the dollar.

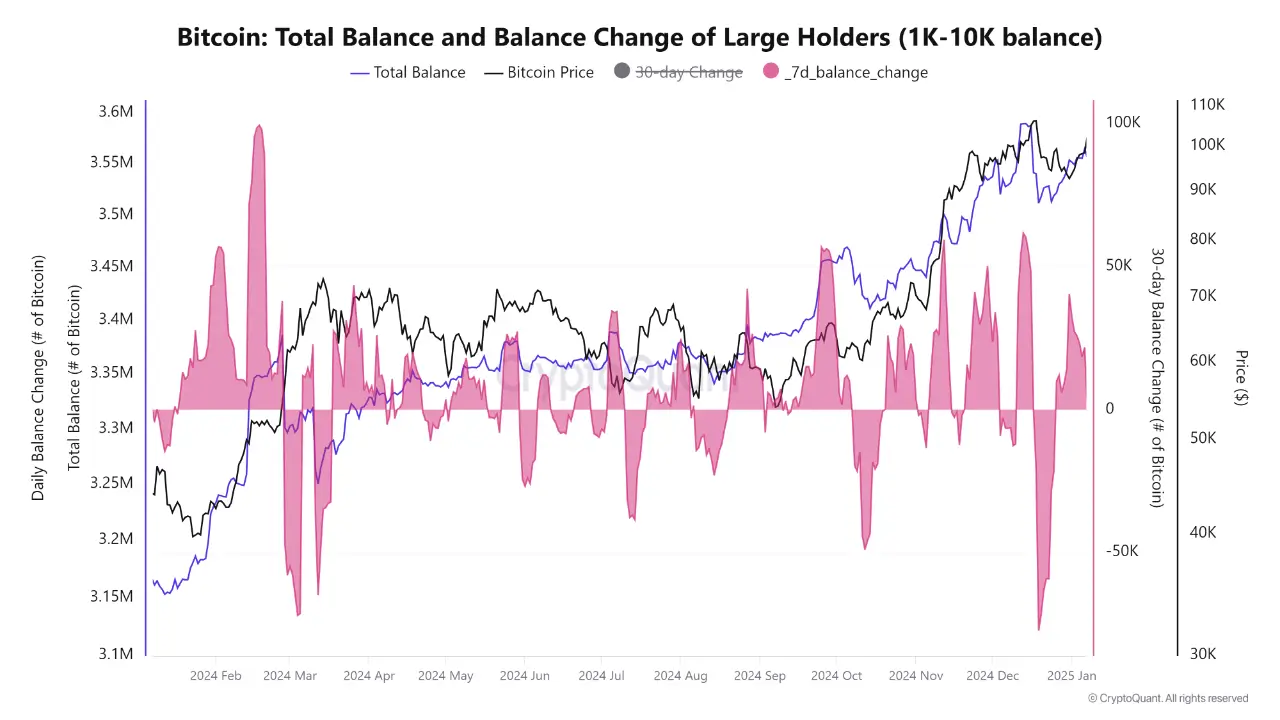

The prospect of accumulating US bitcoins forces other investors to act proactively, buying crypto already now. As Cointelegraph representatives note, since the market collapse in December, the largest investors have accumulated 34 thousand BTC. At today’s exchange rate, this amount is estimated at $3.15 billion.

Changes in the balance of the largest holders of Bitcoin BTC

Here is a rejoinder from Kaue Oliveira, head of research at Blocktrends, on the situation.

More than 34 thousand BTC with a total value of about 3.2 billion were accumulated by institutional investors the day before. This is creating buying pressure and fuelling Bitcoin’s current recovery.

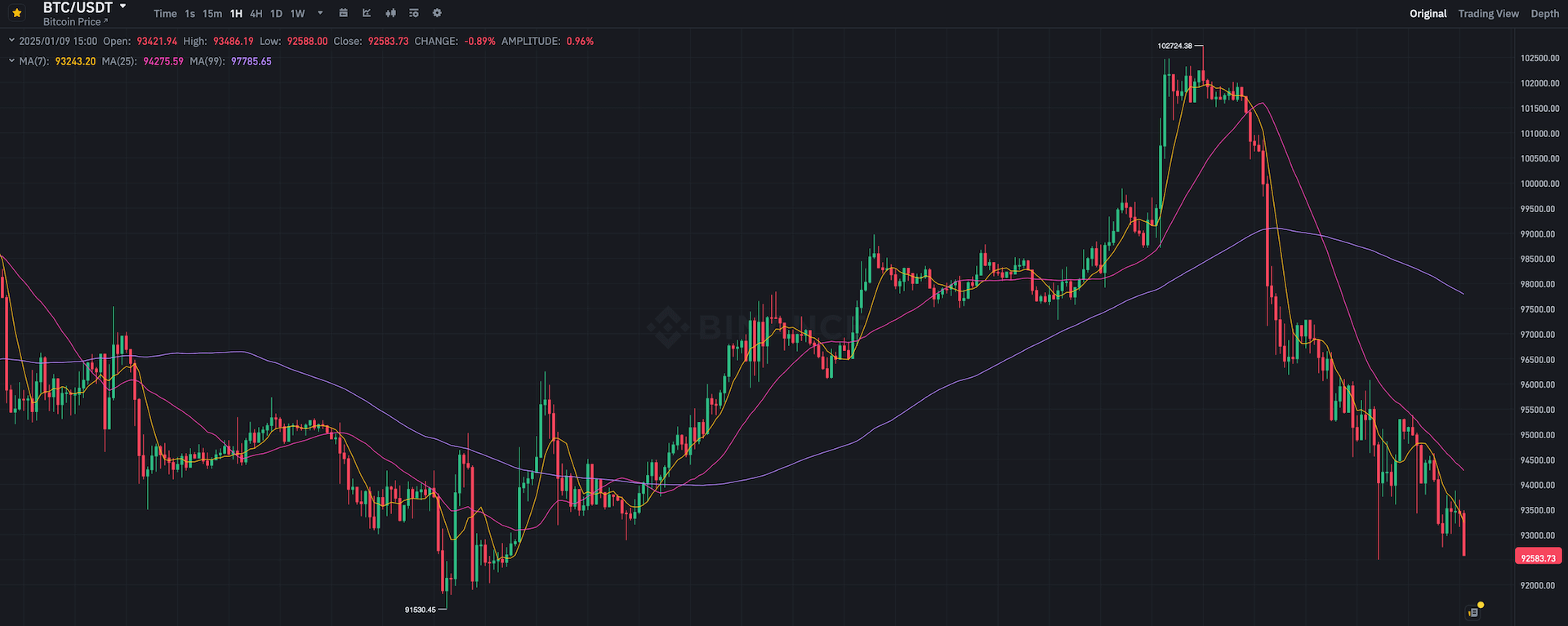

Hourly chart of the Bitcoin BTC exchange rate

Oliveira notes that buying of the crypto resumed after large investors sold 79,000 bitcoins during the week of 21 December. The dump occurred shortly after BTC set an actual high above 108 thousand in the middle of the month.

The expert notes that “big players took advantage of the actual consolidation.”

The positive trend is confirmed by the situation with the movement of coins on centralised crypto exchanges. According to analysts IntoTheBlock, trading platforms continue to record the outflow of bitcoins.

Bitcoin deposits and withdrawals from cryptocurrency exchanges

Which means players continue to accumulate digital assets. This kind of thing is usually done for long-term storage of coins.

The presented bill allows us to argue that Bitcoin and other cryptocurrencies are not just an object of hype in the current bullrun of the market. Coins are now becoming an instrument of value preservation, and an internationally recognised one at that. With this in mind, the prospect of creating national reserves of different countries in BTC seems quite likely.

Look for more interesting things in our crypto chat room. Go there, we are waiting for you.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.