Spot Bitcoin-ETFs in the US are celebrating their first anniversary. How successful have they been?

Exactly one year ago, shares of spot Bitcoin-ETFs started trading on US exchanges. We are talking about the products of the leading market players like Fidelity, Bitwise, VanEck, WisdomTree and Grayscale. Most importantly, they included the largest investment company in the world called BlackRock. Although the instruments did not perform well at first, they ended up being a real hit in the stock market.

Bitcoin-ETF result for the year

According to CoinShares, it was spot US Bitcoin ETFs that were the main source of the $44.2 billion influx of total capital into cryptocurrency exchange traded funds over 2024.

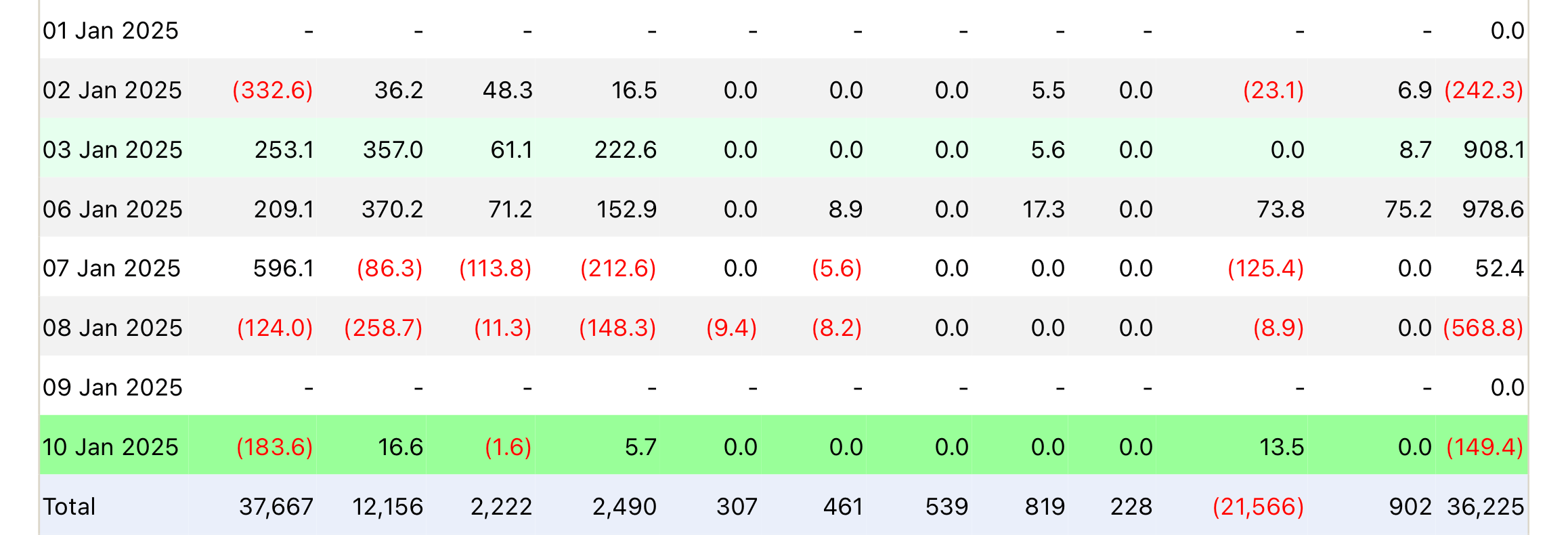

As of today, the instruments have recorded net inflows of the equivalent of $36.2 billion. The most popular product here was BlackRock’s iShares Bitcoin Trust (IBIT), which attracted 37.6 billion.

The performance of spot Bitcoin-ETFs in 2025, along with the overall result

So why is the total amount of fund flows from IBIT bolstered by the result of all of the world’s largest companies? The point is the outflow of capital, which only the GBTC instrument from Grayscale has recorded during this time. It turned out to be huge and amounted to $21.5 billion.

Recall that until 11 January 2024 GBTC existed in the form of a trust. Its conversion allowed investors to instantly access their funds and not wait for the lockup period, relevant earlier. This is what many players ended up taking advantage of, which ended in failure for the exchange-traded fund.

The interim results of the launch of exchange-traded funds based on the first cryptocurrency were commented on by James Butterfill, head of research at CoinShares. His commentary is quoted by Cointelegraph.

Our estimates were much more modest – $14 billion for the year. Obviously, the result far exceeded our expectations and was well above almost all other forecasts.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Butterfill also noted that BlackRock’s Bitcoin ETF reached $61 billion in assets under management faster than a year. At the same time, the company’s gold exchange-traded fund got to the 33 billion mark in a full twenty years, illustrating the current investor interest and activity.

Here’s a rejoinder from cryptocurrency research strategist at 21Shares Matt Men.

I was extremely optimistic about spot Bitcoin-ETFs in the US, as the cryptocurrency community has been discussing them for over a decade. I was expecting a net inflow of $15 billion, but the final results completely exceeded my expectations.

Cryptocurrency market growth

Roxanne Islam, Head of Industry and Sector Research at VettaFi, also shared a rejoinder. Her colleagues didn’t expect anything like this from the new product either.

We expected a successful launch of a spot Bitcoin-ETF, but after a year, its impact has been much bigger than imagined.

According to Meng, one of the main reasons for the hype around BTC-based exchange-traded funds was the long wait for the launch of such products and the corresponding demand from institutional players. The latter got the opportunity to get in touch with cryptocurrency in a rather easy way, while not worrying about the difficulties of self-storage of digital assets.

On top of that, the popularity of investment instruments was fuelled by the long-awaited cuts in the US benchmark interest rate, which began in September 2024, and expectations of notable changes in coin regulation on the back of Donald Trump’s victory in the presidential election in November.

The transformation of Bitcoin-ETF into the most successful instrument on the market was helped by the growth in the value of the first cryptocurrency and long-term demand for such funds. This is the viewpoint shared by Bitwise Investment Director Matt Hogan.

Bitcoin is the asset with the best price performance in history.

According to the representative of a large investment fund, the record performance of the Bitcoin ETF in the US was also led by the halving of the network on 20 April 2024, which reduced the reward for new blocks from 6.25 to 3.125 BTC. We can also recall the fears of market participants due to the prospect of a sharp rise in US government debt, reminding us of the drawbacks of using assets with unlimited supply.

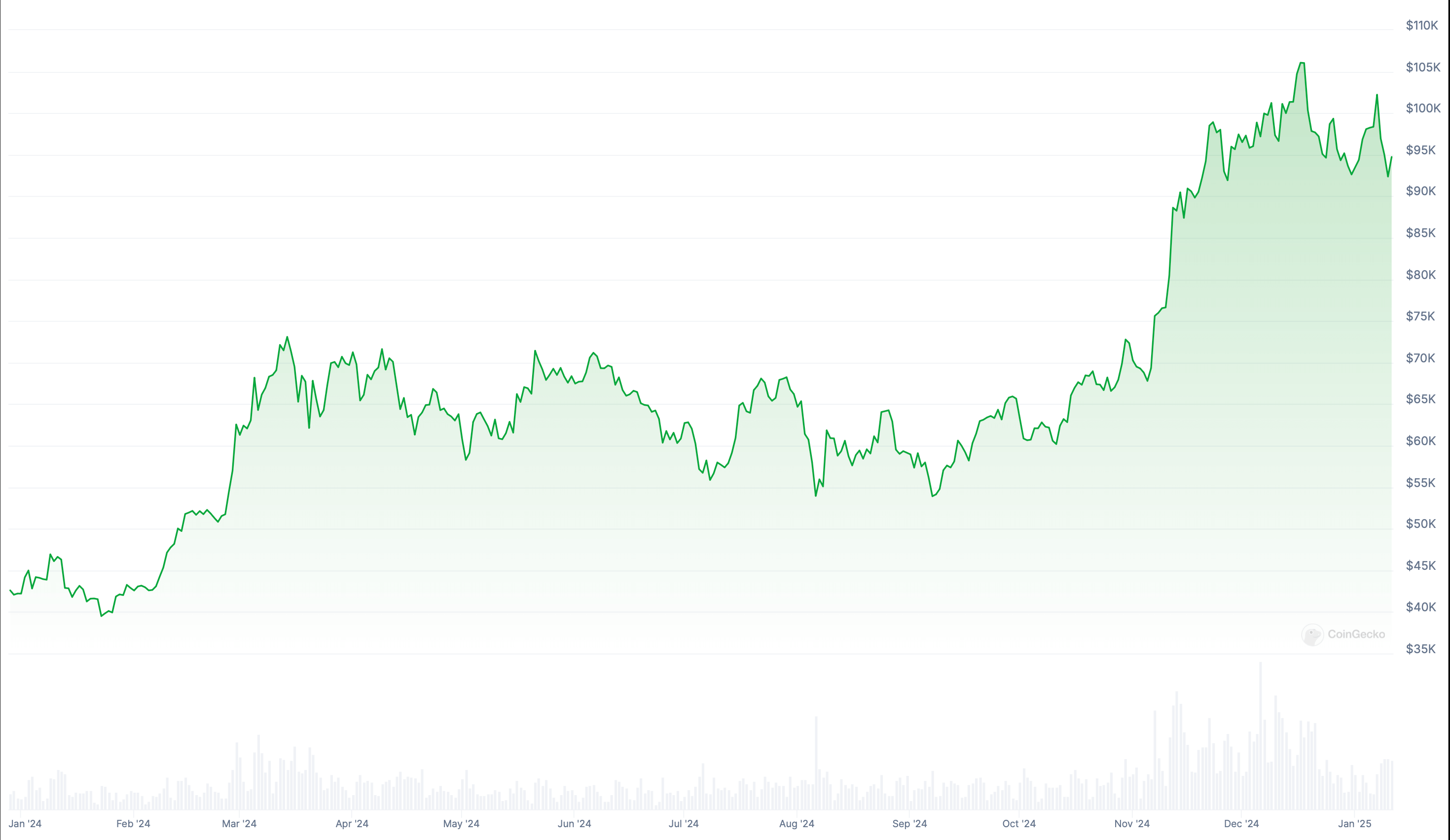

The already mentioned James Butterfill admits that the time of launching the instruments helped exchange-traded funds to achieve such results. Still, on the day of the start of trading in new products in January 2024 for 1 BTC gave 46 thousand dollars. Already by mid-March, the cryptocurrency for the first time jumped above the level of 70 thousand.

Bitcoin rate chart from the beginning of 2024

Investors were also attracted by the very fact that Bitcoin-based instruments were approved by the Securities Commission. Still, it made it clear that the regulator will not fight the popularity of cryptocurrencies and try to ban them in the future in some way.

What will happen to Bitcoin ETFs in the U.S. in 2025

Industry analysts are confident that 2025 will prove to be even more successful for Bitcoin ETFs. Matt Hogan of Bitwise calls exchange-traded funds a “perennial story,” as capital inflows into such new products in their second year almost always outpace the results of the debut year. Here’s his rejoinder.

The reality is that most professional investors still can’t access Bitcoin ETFs. That will change in the new year, and I expect significantly higher capital inflows into such instruments compared to 2024.

Previous attempts to get spot Bitcoin ETFs approved

While BlackRock’s IBIT is the largest Bitcoin-based exchange-traded fund, it is unlikely to displace the rest of the market. A Bitwise spokesperson recommends exploring other areas of the market where assets are spread across multiple funds with similar exposure.

Some ETFs are larger, some are smaller, and there are often one or two really big funds. But there is no market where a single ETF gathers 100 per cent of all assets. In segments that attract tens of billions of dollars, there are invariably a few very successful funds.

In the end, 2024 ended in unambiguous success for Bitcoin exchange-traded funds, which recorded $36.2 billion in net inflows. Experts have no doubt that the new year will be even more successful. Well, this cannot but affect the BTC rate and the general mood of cryptoinvestors.

Look for more interesting things in our crypto chat room. We are waiting for you there right now.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.