Tether will move its headquarters to El Salvador. What will it bring to the USDT stablecoin issuer?

Tether is one of the pillars of the cryptocurrency industry and the issuer of the largest stablecoin called USDT. Its market capitalisation exceeds the level of $137 billion, while the token accounts for more than 70 percent of all stables in the sphere. So any major change with the company is worth noting. And now the giant has announced a move to El Salvador.

Where is the headquarters of Tether

Tether is registered in the British Virgin Islands, but now its headquarters will be moved to El Salvador. It is a small country in Central America whose government recognised Bitcoin as the national currency back in September 2021.

Tether CEO Paolo Ardoino

The giant’s move is related to the company’s obtaining a licence as an issuer of stablecoins and a provider of services based on digital assets. As noted in an official statement, the giant’s management wants to connect with the country because of its “progressive policies, favourable regulatory environment and growing Bitcoin community”.

El Salvador thus proves to be “an ideal location for leading companies in the digital finance revolution.”

Such a statement does not seem entirely honest. El Salvador is characterised by a high crime rate and the existence of large gangs. Because of this, many investors are in no hurry to invest in this region.

.

Here is a commentary on what is happening by the head of Tether Paolo Ardoino. The replica is cited by The Block.

This decision is a natural step forward for Tether, because with it we can create a new home, strengthen co-operation and focus on emerging markets. El Salvador can be described as a beacon of innovation in digital assets. By moving there, we are not only joining forces with a country that shares our vision of financial freedom, innovation and sustainability, but also reaffirming our commitment to empowering people around the world with decentralised technology.

😈 MORE INTERESTING STUFF CAN BE FOUND ON OUR YANDEX.ZEN!

Salvadoran President Nayib Bukele

This news comes a week after connected platform Bitfinex Derivatives announced that it was moving its own operations to El Salvador. This followed the acquisition of the relevant licence.

As Tether representatives note, El Salvador’s Bitcoin-focussed economy fits perfectly with the company’s mission to empower individuals and businesses with digital assets. The choice in favour of this country was no coincidence, as the USDT issuer wants to continue scaling its operations. Well, the main tool in this direction will be the popularisation of Bitcoin and stablecoins in troubled regions.

Through the adoption of blockchain technology and digital currencies, El Salvador is creating an ecosystem that drives innovation and attracts investment in the financial and technology sectors. This strategic position is helping to shape the future of financial systems, making the country a key player in the global fintech market.

Tether not only supports El Salvador’s pursuit of financial freedom, but also strengthens its operational flexibility and ability to innovate. The move reflects the company’s commitment to providing reliable, affordable and transparent financial solutions to a global audience.

How many bitcoins El Salvador has in its possession

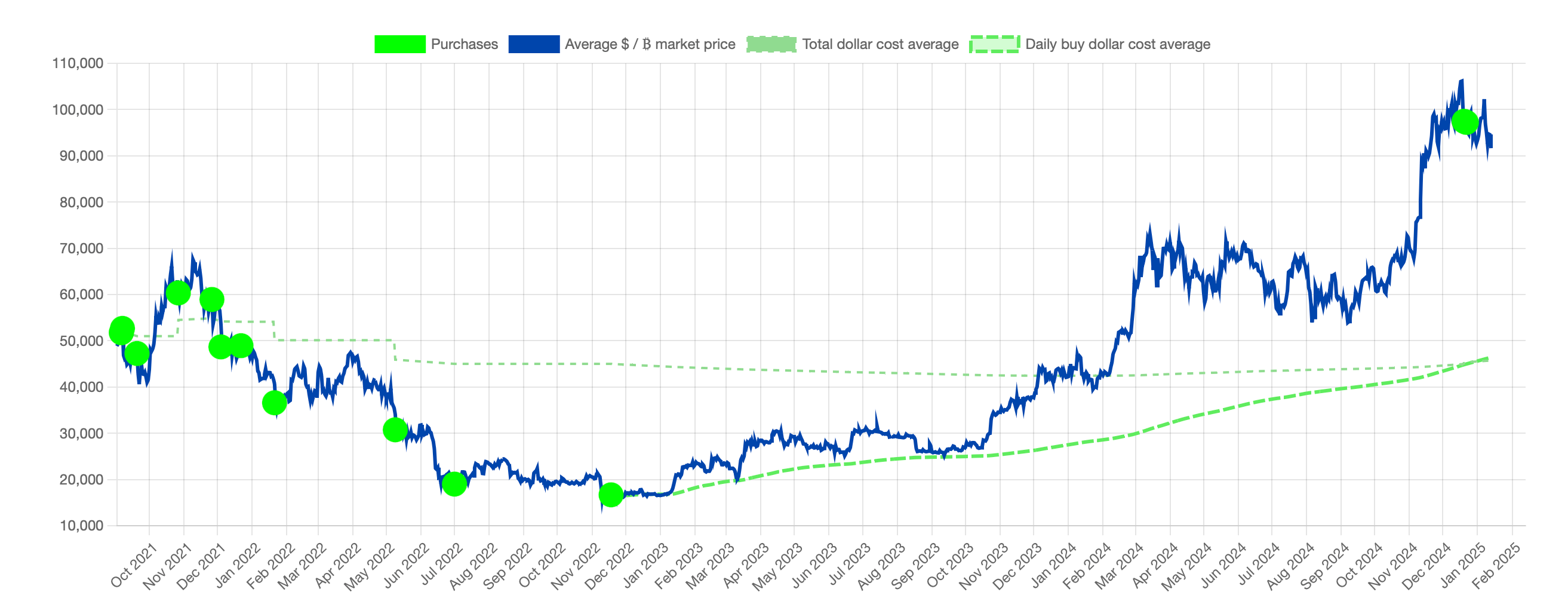

The state began accumulating the cryptocurrency for its own reserves in September 2021.

As of today, the country has acquired 6,026 BTC, with this investment generating an unrealised profit of $146 million, despite the current cryptocurrency market collapse.

Chart of bitcoin purchases by El Salvador

On 17 November 2022, the country’s president Nayib Bukele announced the purchase of 1 bitcoin every day. If the promise continues to be fulfilled, then the state has thus acquired 788 BTC, with this position coming in at 97 per cent plus.

Where bitcoins can be used

Bitcoins can be used not only in El Salvador, but also in other parts of the world. What’s more, some US states are now actively introducing new bills that would allow the local treasury to allocate funds for the purchase of BTC.

Last week, New Hampshire and North Dakota joined them. Although such ideas exist only in draft format for now, the overall trend here is still encouraging. Still, even three years ago it was almost impossible to imagine that the U.S. would openly discuss the prospect of buying BTC for its own reserves on a par with gold – albeit in smaller volumes.

Tether's decision clearly demonstrates the importance of adequate regulation of digital assets in different countries. The situation also emphasises the importance of expectations from the current composition of the US Congress and the new leadership of the Securities Commission. It is expected that these components will be enough to create clear rules of operation for cryptocurrency entrepreneurs and blockchain companies in general.

Look for more interesting things in our cryptocurrency chat room. We look forward to seeing you there already.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO KEEP UP TO DATE.