The chairman of the US Federal Reserve said that banks can cater to cryptocurrency investors. What does this mean?

Last night the FOMC meeting was held, during which the base interest rate in the US remained at the same level. Analysts were counting on just such a decision of bankers, so the situation was not a surprise. Instead, Fed Chairman Jerome Powell was able to surprise the audience. He made it clear that local banks are suitable for interaction with holders of cryptocurrencies, as long as they control the risks.

US Fed meeting and Bitcoin

According to US Federal Reserve Chairman Jerome Powell, US banks can serve cryptocurrency customers as long as they are able to manage the associated risks. He made this statement in response to claims that the digital asset industry is cut off from traditional financial institutions.

U.S. Federal Reserve Chairman Jerome Powell

Here is Powell’s comment on a reporter’s question about the risks associated with cryptocurrencies. The quote is cited by The Block.

The threshold for banks associated with cryptocurrency activity was a little higher. This is due to the novelty of this sphere.

In addition, the Fed chairman noted that the agency does not oppose financial innovation.

The disconnection of the cryptocurrency industry from the banking system is not a myth. This is a deliberate action of the U.S. government at the request of the administration of former President Joe Biden to create problems for the coin sphere. The complex of such decisions was called operation "Lure 2.0", and it implied closing of bank accounts not only for companies, but also for individual representatives of the coin sphere.

.

The government’s fight against crypto became especially apparent after the collapse of the FTX exchange in November 2022. The authorities are believed to have overlooked the activities of the platform’s founder Sam Bankman-Fried, who, among other things, communicated with senators and even former SEC chairman Gary Gensler. That is, the government decided to tighten its attitude towards the new industry to compensate for its own failure.

Former SEC Chairman Gary Gensler

After the US presidential, Senate and House of Representatives elections in November 2024, the topic of the government’s fight against the crypto industry has been at the centre of legislative attention. The reason for this is the attitude to digital assets of Donald Trump, who actively supported the sphere during the election campaign.

For example, in December, the chairman of the House Financial Services Committee, French Hill, said that he plans to investigate cases of so-called debunking and take a firm stance on the issue. Representatives of the U.S. House Oversight Committee also made a similar statement last week.

Here’s another of Powell’s remarks from the evening’s speech.

I think it would be helpful if there was a more developed regulatory system for cryptocurrencies. Congress has been pretty active on this.

Jerome Powell’s fresh comment came as a surprise to the crypto community, as the US Federal Reserve chairman is not considered an ally of the industry.

For example, during a press conference after the previous decision on the benchmark interest rate in mid-December 2024, he stated that the Fed should not own bitcoins, and bankers do not expect any major changes on this issue.

Investors reacted negatively to the statement, and as a result, the market experienced another correction.

Why did the rate of Bitcoin grow?

Now, however, the coins have issued a growth. For example, Bitcoin is above $105,000 this morning.

15-minute chart of the Bitcoin BTC exchange rate

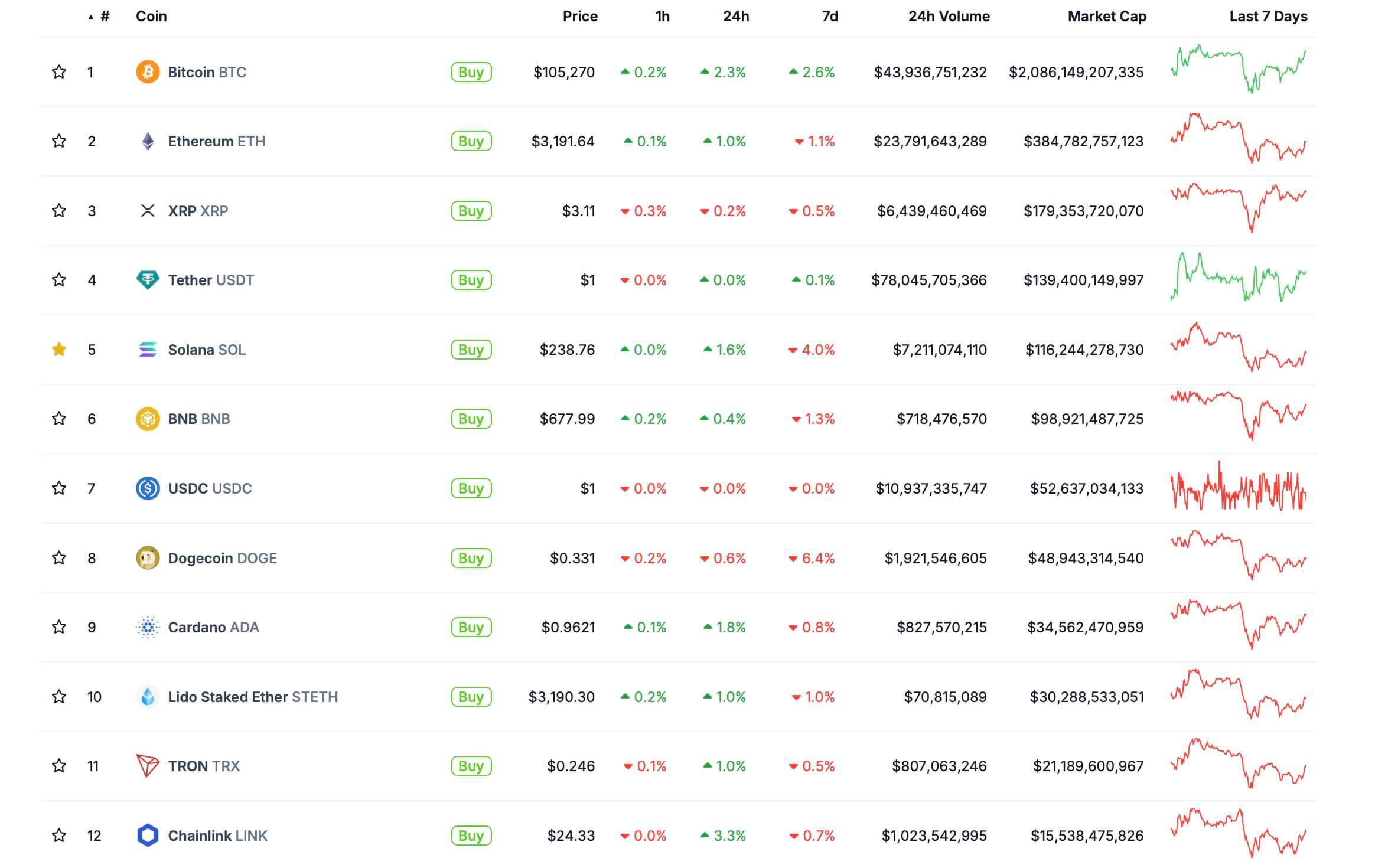

And this is what the ranking of the largest digital assets by market capitalisation looks like.

The largest cryptocurrencies by market capitalisation

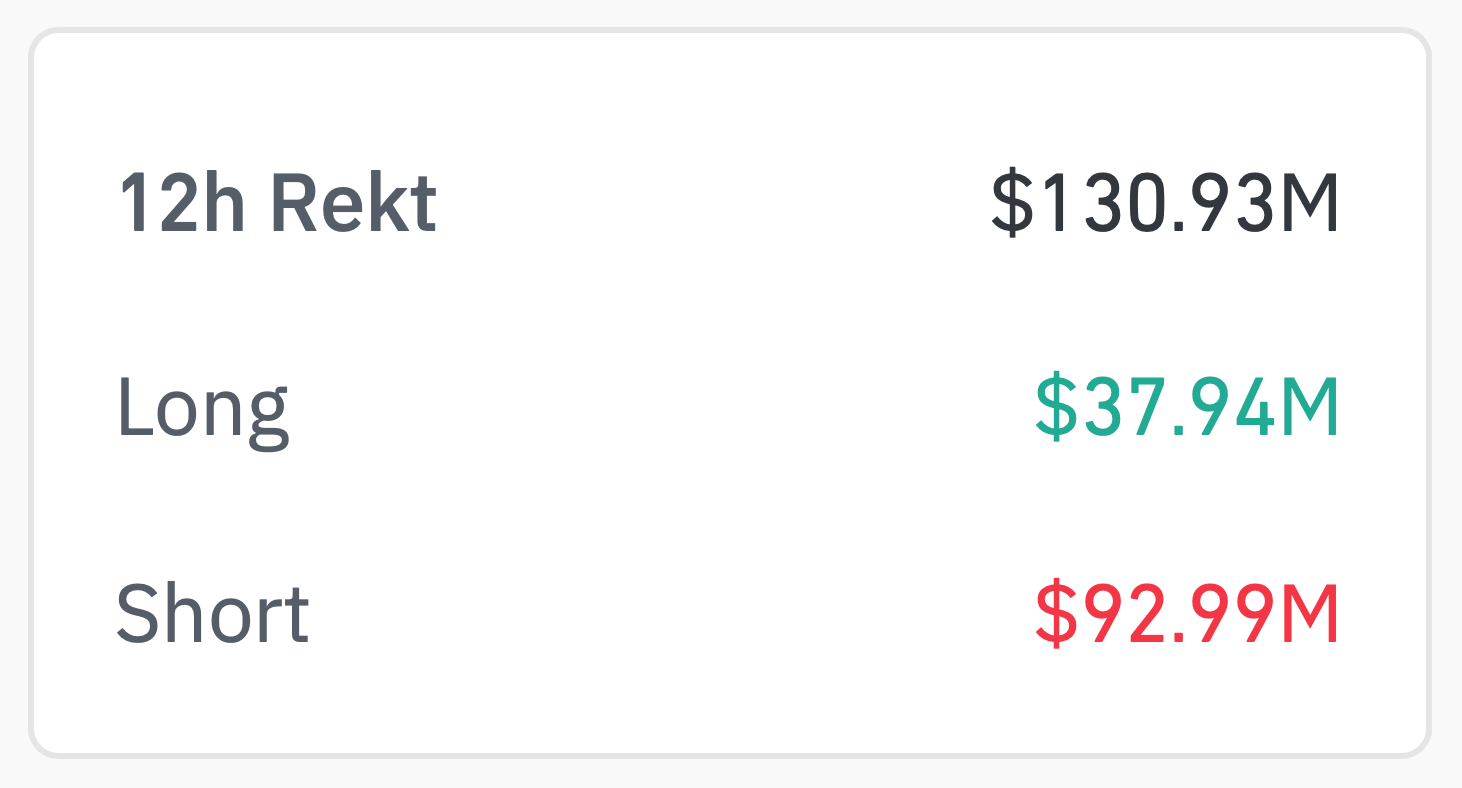

The sharp market jump led to the liquidation of short positions of traders who were counting on the industry collapse and used borrowed capital for trading. Thus, over the past 12 hours, shorts of almost $93 million and longs of almost $38 million were forcibly closed.

Volume of liquidations of trading positions for the last 12 hours

According to the experts’ version, the market growth was caused by the situation with the base interest rate in the USA. And although it was not reduced, investors’ fears of problems on the background of the Fed’s policy have become less pronounced.

Here is a comment from Bitget platform manager Gracie Chen, who is cautiously optimistic about what is happening. The replica is cited by Decrypt.

Instant growth, as in previous bullish cycles, may not follow, as a considerable amount of optimism around Trump’s position on cryptocurrencies is already embedded in the price against the background of recent bullish trends.

The expert also expects an improvement in the situation with the regulation of digital assets in the US. However, such a thing will not necessarily end with a several-fold increase in market capitalisation.

While some believe that the new administration will pay significant attention to the crypto market, it is important to maintain moderate price expectations.

Jerome Powell's fresh comments reflect a general shift in the US government's approach to the cryptocurrency industry. While the Republicans have not yet sorted out the regulation of the coin market, such work is already underway. The trend is also being felt at the Fed, whose leadership is talking about the possibility of banks interacting with crypto users. It would have been quite difficult to imagine such a thing a year ago.

More interesting stuff is in our crypto chat. Come in!

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.