The creator of Silk Road lost $12 million worth of meme tokens because of two simple mistakes. What did he do wrong?

Last week, new US President Donald Trump pardoned the creator of the Silk Road darknet platform. This allowed Ross Ulbricht to be free after being detained in 2013, although he was sentenced to a double life sentence and forty years on top. Ross has now predictably gone into cryptocurrencies, which he got involved with over a decade ago. However, the advancement of technology in that time has been too serious, causing the ex-con to start making mistakes.

How cryptocurrencies lose

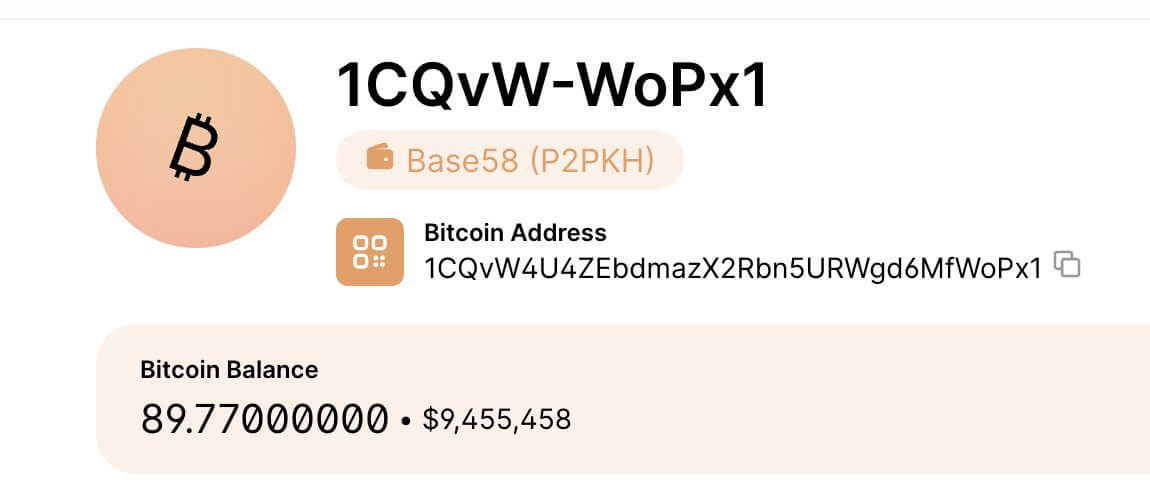

Even though Ross Ulbricht spent many years in prison, he was not left without funds. Firstly, the Silk Road creator’s old Bitcoin wallets contain 430 BTC, which are valued at tens of millions of dollars. Whether Ross kept the access keys to them is unknown, but the coins are in any case in place and have not been stolen by hackers.

One of the Bitcoin wallets of Silk Road creator Ross Ulbricht

Secondly, during all this time, Ulbricht’s family launched the Free Ross campaign for the convict’s early release, which included collecting cryptocurrency. One of them was the meme token ROSS, which became a kind of fan asset for Ulbricht’s fan. The coin’s developers sent 50 per cent of its maximum offering to a wallet associated with Ross. Despite the small capitalisation of the project, the amount was valued in the millions of dollars.

Ulbricht decided to use the assets he received as a gift, but made a few mistakes. Because of this, the coins were put up for sale at too low a price, and they were instantly bought out by bots. According to Arkham Intelligence analysts, Ross’s total minus was $12 million.

At first, Ulbricht tried to provide liquidity on the decentralised exchange Raydium, Cointelegraph reported. In this way, he wanted to make money on commissions from trades conducted by traders. However, it did not work out – here is a comment from Arkham experts.

Because he launched the liquidity pool at the wrong price, 5 per cent of the $1.5 million token offering was instantly bought out by the MEV bot and then sold to the existing pool.

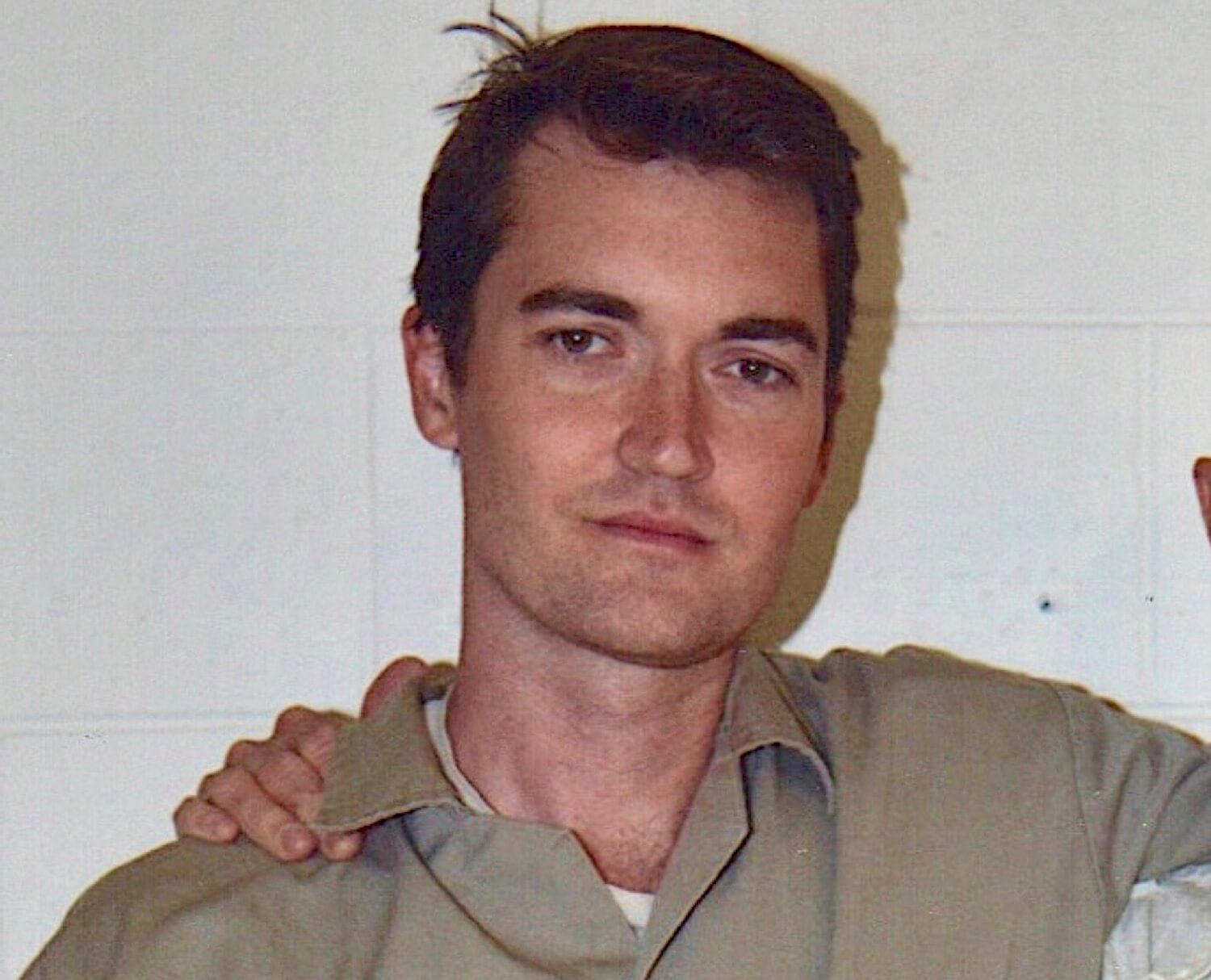

Silk Road creator Ross Ulbricht

We are talking about special programmes that look for opportunities to make money on digital assets and conduct the necessary transactions in automatic mode. The appearance of a popular coin on sale at a low price is one of the reasons for a bot trigger.

The same goes for transactions with expensive NFTs. Sometimes holders of the latter make a mistake and, for example, release tokens for sale not for 5 ETH, but for 5 USDC. In such cases, the bot will immediately buy the crypto asset.

Then the owner of the wallet in support of Ulbricht made the same mistake again – but this time it was about 35 per cent of the token offer or the equivalent of $10.5 million. Arkham analysts continue.

Ross was trying to add one-sided liquidity to gradually sell the coins, but mistakenly created a pool with Raydium CPMM, or constant product market maker, instead of CLMM, which is a concentrated liquidity market maker.

As noted by experts, the MEV bot sold more than $600,000 worth of tokens it bought. These low-price sales of the asset caused the market value of the asset to plummet – a collapse of approximately 90 per cent.

As a result, the ROSS token is trading at 1 cent. Although it still rose by 560 per cent in the last 24 hours.

A four-hour chart of the ROSS meme token

After losing a huge amount of tokens, Ulbricht still controls about 10 per cent of the total ROSS supply. This amount translates to approximately $200,000. However, if Ross had not made a mistake, he could have made a good profit on the digital asset that was gifted to him.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

New tools based on cryptocurrencies

The Ross story shows that even experienced users of digital assets in the past can easily lose huge sums in coins. Of course, non-crypto-related people are unlikely to be happy about this news, as the prospect of losing money with no way to get it back sounds really scary.

However, newcomers will be able to get in touch with crypto using other safe instruments – for example, ETFs. It was revealed tonight that the Securities Commission has approved an application to launch a hybrid exchange-traded fund from Bitwise based on Bitcoin and Etherium at the same time. BTC will make up 83 per cent of the instrument and ETH will make up 17 per cent, Decrypt reported.

Bitwise’s chief investment officer Matt Hogan

The fund will be listed on NYSE Arca, where trading will take place. The approval of the new product came very quickly, hinting at the regulator’s new approach to the coin sphere given the change in the US president. Here is Bloomberg analyst Eric Balchunas’ commentary on the matter.

I’d like to take this as a sign that the renewed SEC will work faster, although we can’t really say for sure here yet.

Overall, Bitwise continues to actively expand its own cryptocurrency portfolio. The fund launched spot ETFs on Bitcoin and Efirium in 2024, followed by an XRP fund in October and a Solana-ETF in November. The latest initiative from last week was an exchange-traded fund based on the Dogecoin meme.

The situation with Ross Ulbricht shows the pace of development of the crypto sphere. Still in 2011-2013, the Silk Road creator was one of the pioneers of the Bitcoin movement, which somehow made people perceive the digital asset as money. However, he has now lost millions of dollars where he didn't necessarily have to. One would like to believe that on other assets, he will still be able to lock in profits.

Look for more interesting stuff in our crypto chat. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.