The crypto market has collapsed. Why do Standard Chartered analysts still recommend buying Bitcoin?

The new week started for the cryptocurrency market not in the best way. Still, the coins experienced a sharp decline, against which BTC fell to a local minimum of $97,777. In such conditions, experienced players prefer not to hurry and wait for the collapse to weaken before opening new positions. However, representatives of Standard Chartered are already calling what is happening a successful moment for crypto accumulation – and here’s why.

Is cryptocurrency worth buying?

Standard Chartered analyst Jeffrey Kendrick sees the current market collapse as an opportunity to buy coins at more favourable rates until it stabilises further.

The strength of Bitcoin and other cryptocurrencies

According to him, Bitcoin is now suffering due to its growing correlation with the Nasdaq index, which makes the cryptocurrency vulnerable amid a massive sell-off in tech stocks. Here’s a commentary on the matter cited by The Block.

Bitcoin is still linked to the Nasdaq, and noticeably more strongly than gold.

As Kendrick noted, the reason for the crypto's collapse was a 3 per cent drawdown in Nasdaq 100 futures linked to news about DeepSeek. This is about a Chinese startup whose artificial intelligence models turned out to be much more efficient and advanced compared to ChatGPT. The flagship solution called R1 is primarily in mind.

The DeepSeek app is now number one in the App Store in Australia, Canada, China, Singapore, the US and the UK. Well, the very success of the product and its advantages made market participants doubt the potential of American products, which caused a collapse in the stock exchange.

The expert continues.

There is now a risk that if the sell-off on Nasdaq continues during the US session, we will approach other key levels for Bitcoin. In particular, the average level of BTC buying by spot ETF issuers since the US election today is $96,400.

That’s likely given the release of reports this week – Microsoft, Meta, and Tesla will report on Wednesday. Plus, we’re supposedly in for a disappointing FOMC meeting on Wednesday.

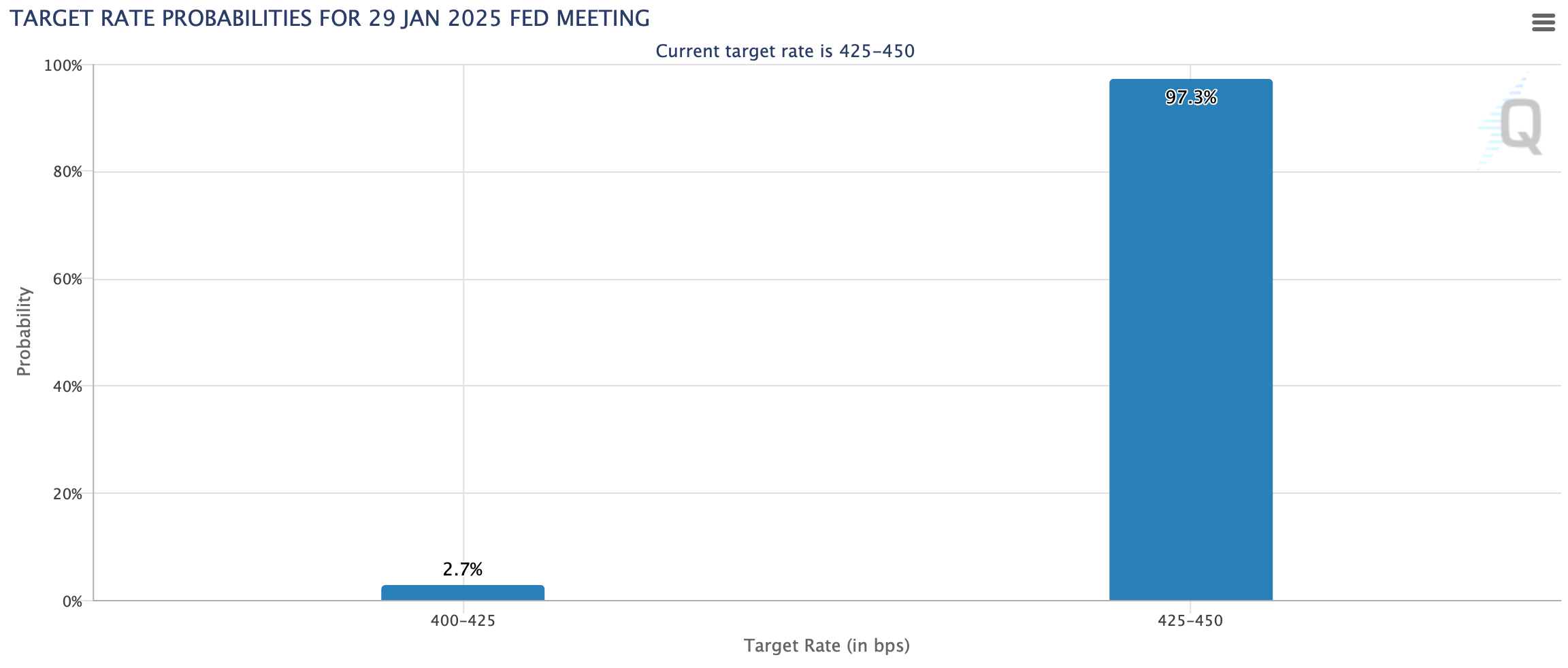

It is believed that at the next FOMC meeting the US Federal Reserve representatives will leave the base interest rate at the same level. Accordingly, we should not expect any easing of the pressure on the economy now – moreover, this will be the first meeting after the inauguration of US President Donald Trump last Monday.

At the next FOMC meeting, the US Fed leadership will leave the rate at the same level

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

How much is Bitcoin worth today

The main phase of the cryptocurrency market collapse occurred tonight. As a result, yesterday’s local high for Bitcoin at $105,500 was replaced by a local low of $97,777.

15-minute chart of the Bitcoin exchange rate on the Binance exchange

After that, the cryptocurrency got out above 102,000 and continued to balance there.

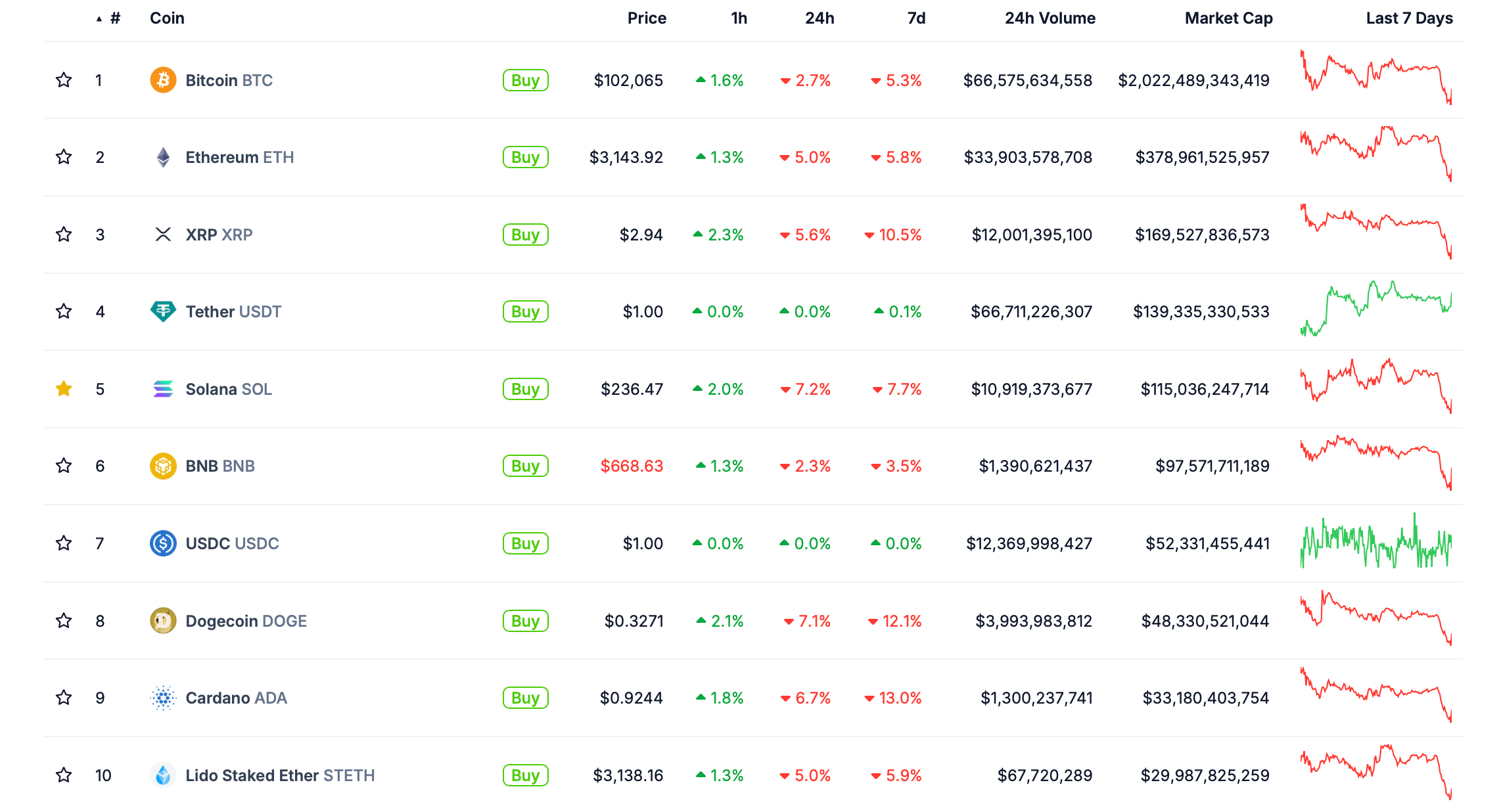

And this is how the overall ranking of the largest coins by market capitalisation looks like.

The largest cryptocurrencies by market capitalisation today

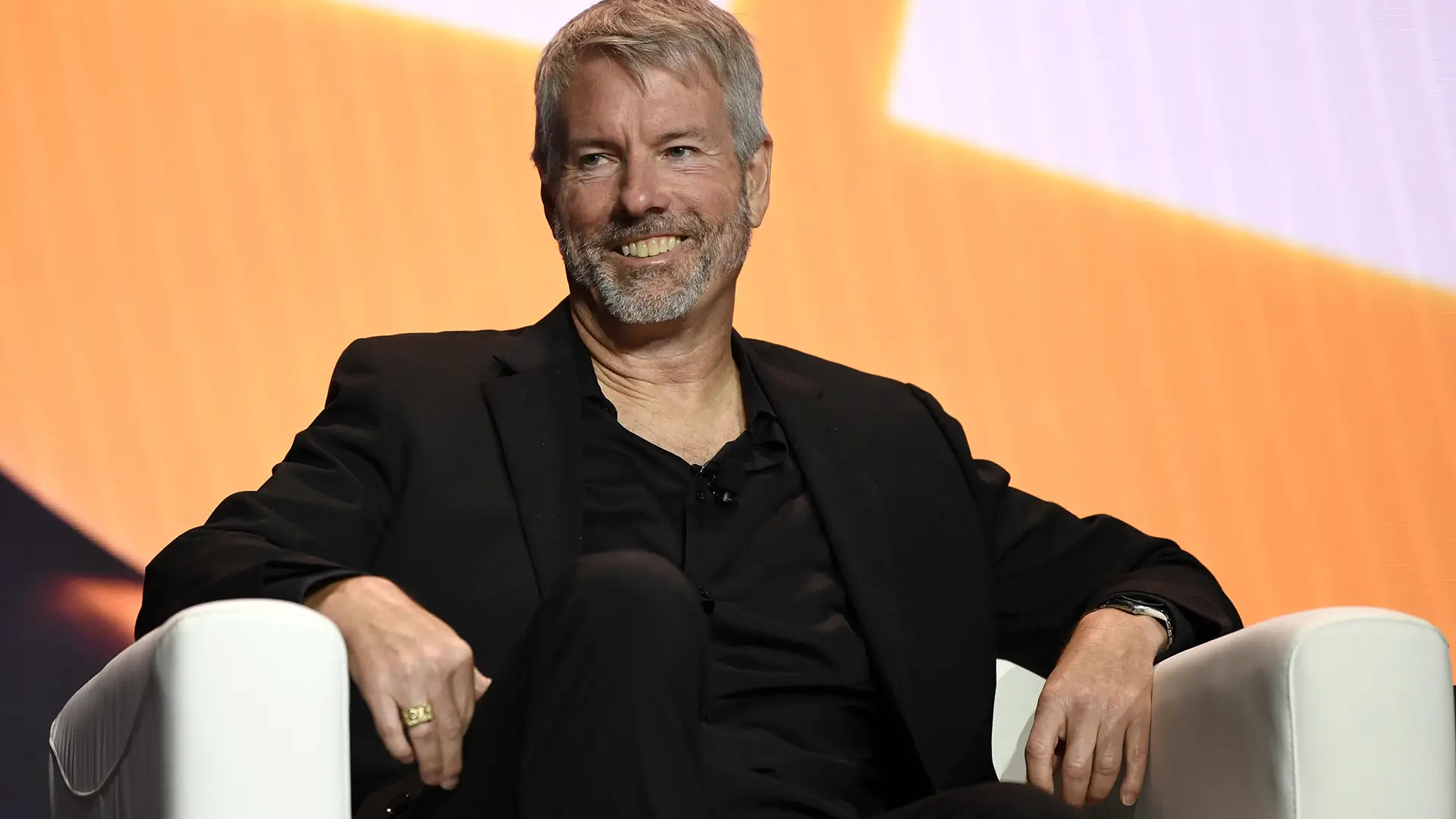

The rebound of BTC was also favoured by the positivity due to the MicroStrategy company. Still, the giant conducted another large-scale round of digital asset purchases, acquiring 10,107 bitcoins for $1.1 billion. As a result, the company’s total accumulated coins reached 471,107 BTC.

MicroStrategy’s executive chairman Michael Saylor

30.4 billion has been invested in them, making the average value of each coin $64,511.

What will happen to Bitcoin because of Trump’s executive order

Kendrick from Standard Chartered also commented on Donald Trump’s debut executive order on cryptocurrencies. According to the expert, he found himself disappointed by what was happening – and on two fronts at once.

Disappointment for me was twofold. Firstly, “reserves” instead of “reserve” sounds more like confiscated assets rather than acquired assets. Second, the executive order has already been signed, and now further clarity or action will require congressional approval, which will take some time.

As we found out over the weekend, the crypto community has indeed questioned the executive order on digital assets. Still, the wording in the document suggests that the US government may abandon the idea of buying bitcoins or other coins, and instead keep previously confiscated cryptocurrencies like BTC, which were seized after the closure of the Silk Road darknet marketplace.

Cryptocurrency market growth

In addition, President Trump’s administration has now moved into action, causing the hope and expectation phase for investors to end and Bitcoin’s risks to diminish. The next phase is “buying cryptocurrencies after the collapses”, Kendrick believes.

The expert’s colleagues from Standard Chartered continue to count on the final stage of the bullrun in 2025. Their target for Bitcoin is at the $200,000 mark, while Etherium should get to $10,000. Although these predictions don’t have to come true, they form certain expectations of investors and influence their actions.

We can assume that the current collapse of crypto is really connected with the negativity in the financial markets. When the latter will dissipate is unknown. However, the prospect of adequate coin regulation in the U.S. and at least a stockpile of digital assets by the U.S. government definitely hints at a continuation of the bullrun.

Come on over to our crypto chat room. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.