The first meme-token-based cryptocurrency ETF may appear in the US. What will it be like?

Yesterday it became known that Donald Trump may create a national cryptocurrency reserve not from Bitcoin, but from coins created in America. First of all, we are talking about Solana, XRP and USDC steiblcoin from the company Circle. The news became a reason for speculation about the possible launch of spot ETFs based on popular altcoins. According to representatives of trading firm Wintermute, the matter may even come to exchange-traded funds for meme tokens.

What ETFs will appear in 2025

Earlier, the topic of new cryptocurrency exchange-traded funds in the United States was commented on by analysts of the bank JPMorgan. They believe that the most likely candidates for the launch of ETFs are Solana and XRP, and instruments with these coins in the basis can attract billions of dollars of capital.

However, representatives of the Wintermute platform made a bolder assumption in today’s crypto market report. Here’s a rejoinder on the matter, as cited by Decrypt.

A key asset manager will launch a meme-based ETF in 2025. We’re betting on DOGE.

Tesla CEO Elon Musk and Dogecoin

In the past year, members of the traditional finance sector have shown significant interest in trading meme tokens. For example, memes’ share of the Wintermute OTC trading market grew from 0.3 per cent in 2023 to 5.1 per cent by the end of 2024. This was primarily due to HYIP tokens in the form of Dogwifhat (WIF), BONK and PONKE, experts clarify.

Despite this, no fund has yet applied to launch such an ETF. Wintermute OTC trader Jake Ostrovskis supported such a prediction, although he noted that it was intentionally a bit jokey. Here’s the comment.

Trading volume eventually generates interest, which in turn leads to additions to indices. If the meme-token sector develops further, we can easily imagine where this will lead. And the most liquid asset in this category remains DOGE, one way or another.

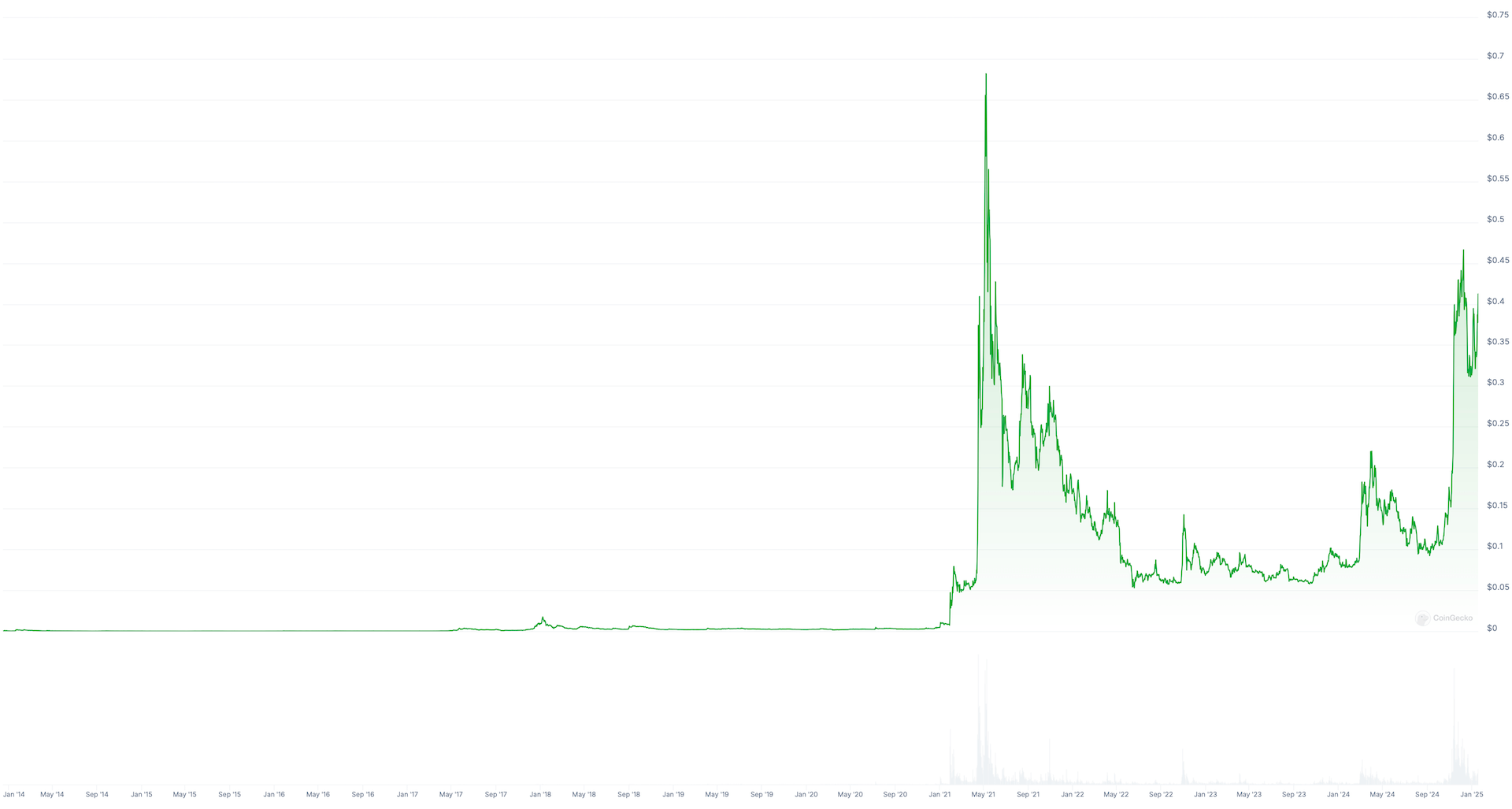

Dogecoin was created in 2013 as an attempt to mess around with the proliferation of coins without any useful application. Despite this, the token has become the original meme token and the most popular member of the category.

During the 2021 bullrun, DOGE was actively promoted by billionaire Ilon Musk, using relevant memes in his tweets. This and other factors led to a hundred-fold increase in the token’s price in a few months at the beginning of the year. In addition, developers then intercepted this trend and created a huge number of their own meme tokens.

Nate Geraci, head of The ETF Store, also spoke about the need for a Dogecoin-based spot ETF. Here’s his comment from Twitter.

It’s shocking to me that no issuer has yet applied to launch a spot Dogecoin-ETF. It is the seventh largest cryptocurrency by market capitalisation.

At worst, it will be a marketing expense for the company. At best, we’ll be treated to an extremely lenient Securities Commission approving the instrument, as well as Elon Musk praising what’s going on.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Dogecoin cryptocurrency graph over time

At the same time, Ostrovskis also reported possible problems with the popularisation of this sector of cryptoassets is fragmentation. Still, we are talking about multiple memes that exist within different blockchains. Such a feature is able to cause uncertainty and confusion for investors, especially if they have not interacted with crypto before.

The expert notes that Wintermute’s clients favour Dogwifhat and Pepecoin (PEPE) among meme tokens. However, the crypto sphere is characterised by a sharp change of narratives, i.e. the main trends. If in March 2024 meme-tokens caused the greatest hype, then by the end of the year their place was taken by assets related to artificial intelligence.

The trend attracted a lot of attention while it remained hot. However, it has now cooled off a bit.

How much money Bitcoin-ETFs have attracted

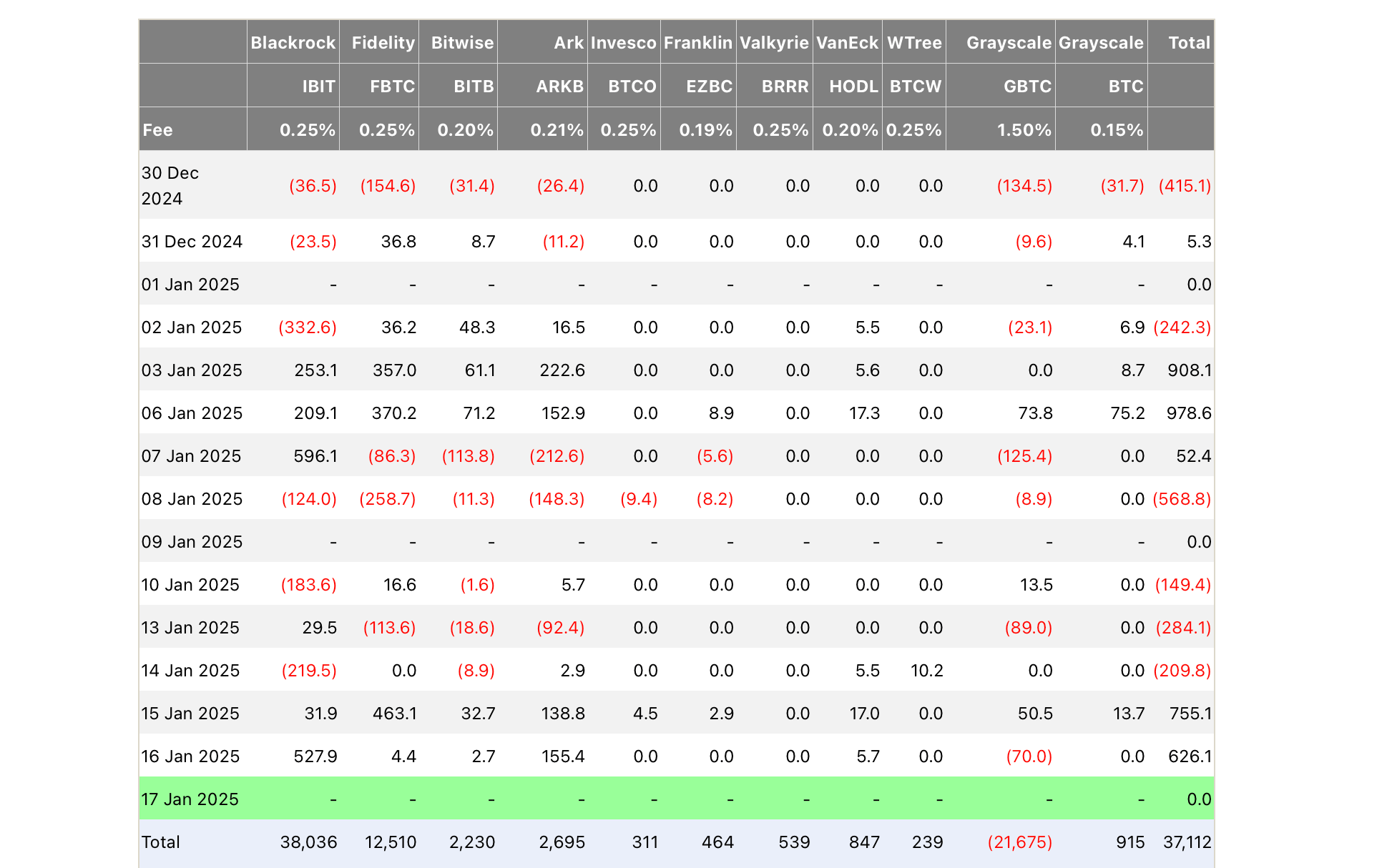

Bitcoin spot ETFs were the first to launch on US exchanges, which happened on 11 January 2024. The instruments proved to be a hit in the market, set several records and closed the debut year of trading with net capital inflows of $35 billion.

Since then, the figure has risen to 37.1 billion. And this was not hampered by a massive withdrawal of $21.6 billion from Grayscale’s GBTC tool. Here is the corresponding table of capital flows in these instruments.

Situation with spot ETFs on Bitcoin BTC

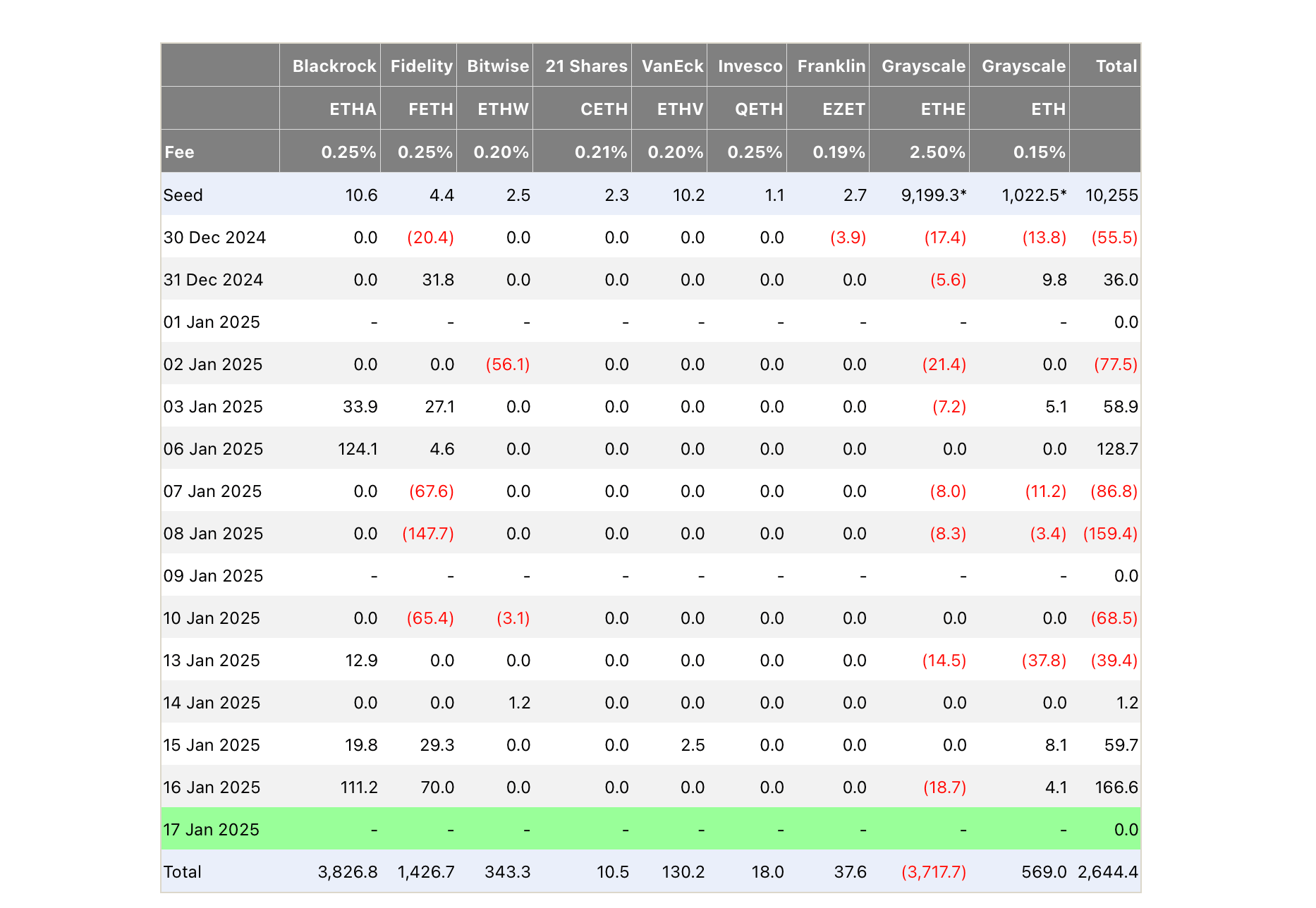

Exchange traded funds on Efirium started trading at the end of July 2024. Since then, these ETFs have raised only $2.6 billion, with only withdrawals recorded in the first few months after they started trading.

Situation with spot ETFs on ETH Efirium

Analysts remind that ETFs usually perform best in the second year of trading. Thus, exchange-traded funds may turn out to be one of the main factors in the popularisation of crypto in 2025.

Wintermute's forecast can be perceived as ironic, because it is still quite difficult to imagine the world's largest financial companies investing in ETFs based on memes. However, they are definitely not wrong in that trading volumes and general investor interest in the instrument dictate their conditions. So things could change significantly over the course of the year.

Look for more interesting things in our crypto chat. We look forward to seeing you there and soon.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.