The head of the Czech central bank wants to buy billions of euros worth of bitcoins. How does he explain it?

In early January, the head of the Czech Central Bank, Aleš Michl, spoke about the prospect of buying bitcoins at the expense of the financial institution’s reserves. He positioned the cryptocurrency as a diversification tool, but serious investments were out of the question. Since then, the manager’s appetite has grown, in connection with which Alÿs started talking about the acquisition of BTC for billions of euros.

Which banks buy cryptocurrencies

Ales Michl told reporters at the Financial Times that he is ready to present a plan to invest in Bitcoin to the board. This will happen on Thursday, that is, as early as tomorrow.

If the board approves the initiative, the Czech Central Bank will be able to allocate up to 5 per cent of its €140 billion reserves for the purchase of cryptocurrency, which means we are talking about no more than €7 billion. In addition, the Czech Republic will then become the first country in Western Europe whose national bank will directly hold cryptocurrencies.

Czech Central Bank Governor Aleš Michl

Michl recalled Donald Trump’s debut executive order on cryptocurrencies published last week. The publication of the document signals a shift in the US government’s attitude towards the coin industry, as well as the increasing influence of blockchain executives on the presidential administration.

Here’s a comment on the matter.

Bitcoin looks good for diversifying our assets. The guys from Trump’s entourage may now create a bubble around Bitcoin, but the growth trend is likely to continue without them, as it is becoming an alternative investment tool for many.

Recall that in December 2024, US Federal Reserve Chairman Jerome Powell said that the agency does not store bitcoins due to the absence of the cryptocurrency in the list of assets that Congress has authorised the Fed to acquire. In addition, Powell did not expect any changes in this direction in the near future.

The head of the Czech Central Bank said that he does not share this attitude towards BTC. He continues.

Of course, if you compare my position with other bankers, I’m kind of heading into the jungle – a kind of pioneer. I used to manage an investment fund, so overall I’m a typical investment banker. I like the returns.

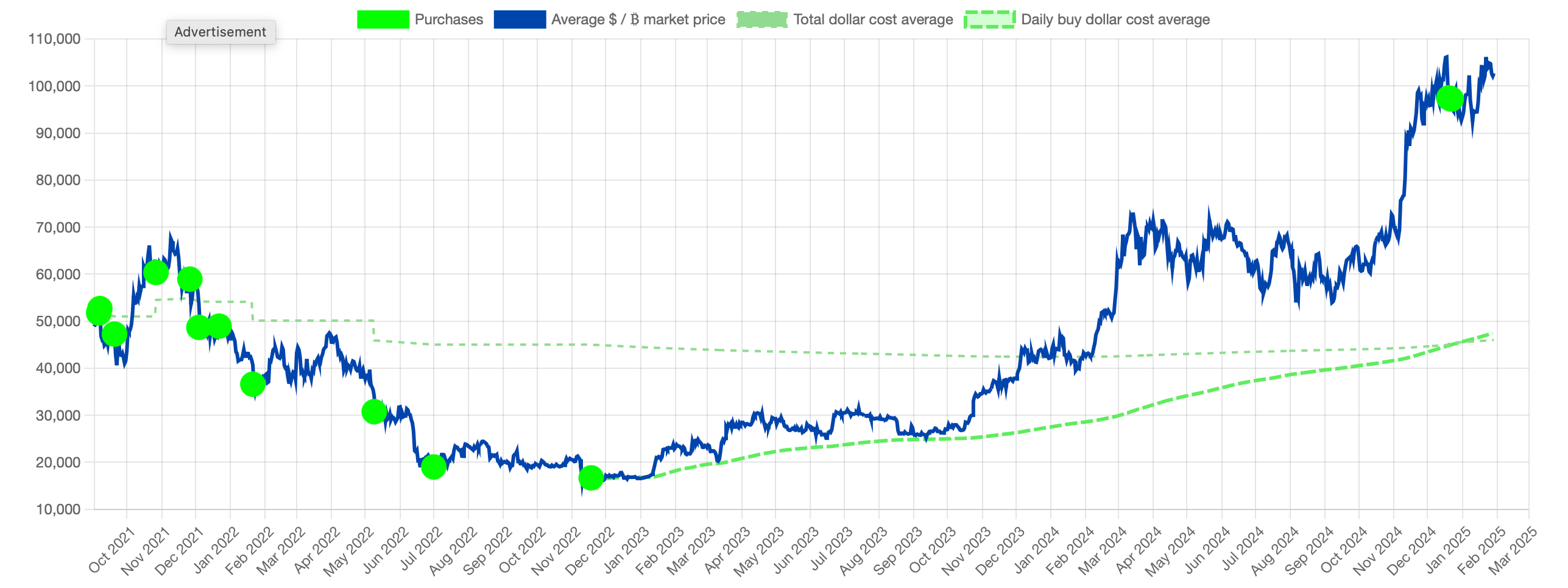

Note that some countries have been acquiring bitcoins on an ongoing basis for a long time. The real pioneer here was El Salvador, which recognised BTC as a national currency back in September 2021 and started accumulating the coins.

As of today, the state has bought 6,049 bitcoins. As noted by the President of El Salvador Nayib Bukele, the country has been acquiring 1 BTC every day since 18 November 2022.

Chart of El Salvador’s bitcoin purchases

Michl believes that other central banks could follow the Czech Republic’s lead in the next five years. Still, in recent months, some funds and commercial banks have officially changed their attitude towards digital assets, adding them to their own investment portfolios. The same goes for certain pension funds.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

That said, Alesh also admits that such an initiative could fail. Here’s what he had to say about it.

There are many options: Bitcoin could either depreciate to zero or reach a fantastic value. But we’ve already had stocks like Enron or the payment company Wirecard in our history, so we already have experience with failed investments. Yes, I am prepared for a possible BTC crash.

So in the end the high volatility of cryptocurrencies doesn’t stop Michl, in addition he allows for the possibility of a sharp rise in BTC if the cryptocurrency is recognised as a reserve asset for various countries and banks. Here’s his closing line on the matter.

What I’m saying is that the goal is to diversify the portfolio, and if Bitcoin is a good fit for that, why not. Five per cent of our assets is a lot of money, even for the BTC market.

What will happen to cryptocurrency after Trump’s victory

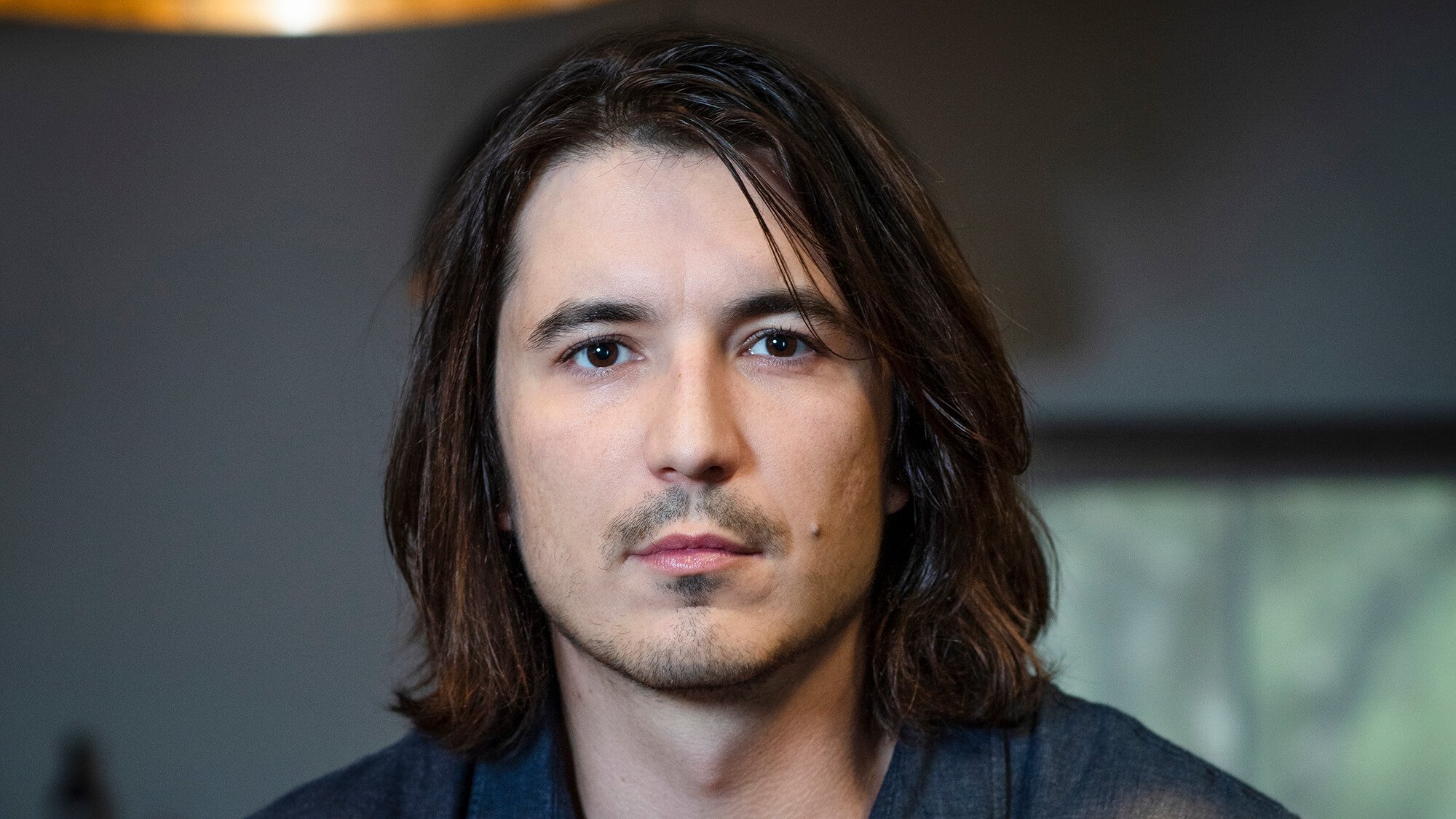

Vlad Tenev, head of the Robinhood trading platform Robinhood, has also drawn attention to the changes associated with the change of power in the US. He published a column in the Washington Post regarding the regulation of digital assets in America, The Block reported.

Head of Robinhood Vlad Tenev

According to the expert, the government needs to update the legislation, because then startups in the early stages of existence will be able to tokenise their own capital. Well, this will benefit the country’s economy.

Finally, the U.S. is catching up and starting to take cryptocurrencies seriously. So many promising steps ahead! It’s time to further expand our understanding of what’s possible.

As Tenev pointed out, the opportunities to invest in early-stage private companies in the U.S. are overly restricted, making the ability for such players to raise capital too narrow as well.

More specifically, “accredited investor” laws in the US restrict investment in the private market to those whose net worth does not exceed the $1 million mark and whose income does not exceed $200,000. Such a thing leads to a concentration of capital in a limited number of players and hinders innovation, the Robinhood executive notes.

As both cases show, Donald Trump's rise to power in the US makes cryptocurrencies a more attractive asset category. The development of a regulatory framework for digital assets and the creation of a national crypto reserve could confirm his serious intentions for the coins.

More interesting stuff is in our crypto chat. We look forward to hearing from you.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.