The number of novice Bitcoin investors is near an all-time high. What does that mean?

In 2025, the US may create its own cryptocurrency reserve, which was mentioned in President Trump’s first executive order regarding digital assets. It may not turn out to be as it seemed before: still, instead of buying bitcoins, the authorities presumably plan to simply stop selling previously confiscated coins. However, even this prospect was enough to get investors interested in the coin market. They are now interacting with it more actively than ever before.

How many people hold bitcoins

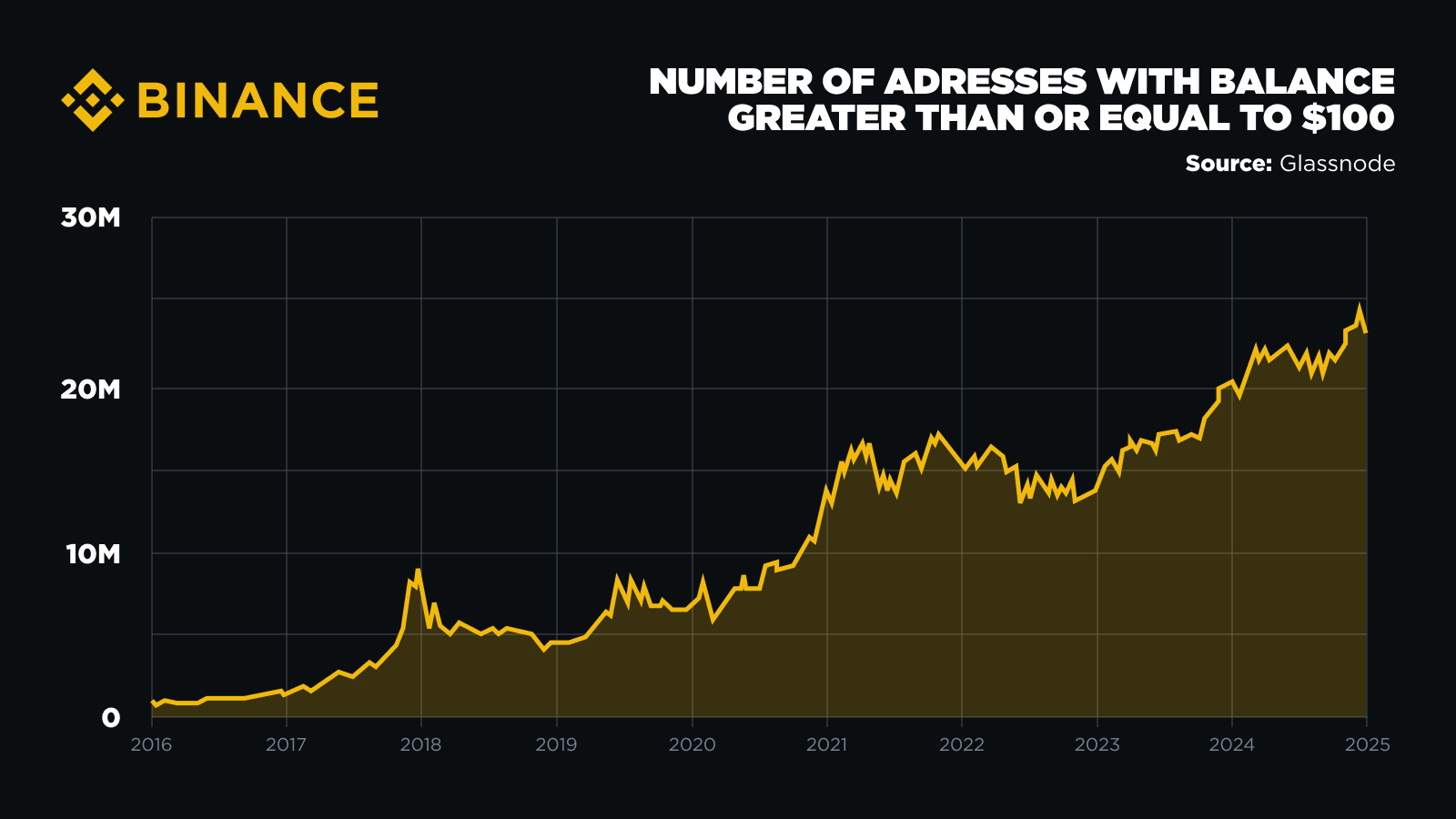

The number of addresses on the Bitcoin network that hold the equivalent of $100 has increased by 25 per cent over the past year. Their total number is now at 23.4 million units, which is very close to the historical high of the index.

The growth in the number of Bitcoin wallets that have the equivalent of 100 dollars

As noted by Binance analysts, the number of holders of at least $100 in BTC in January 2024 was at the level of 20 million units. Since then, the figure has managed to grow by a quarter and fall slightly, Cointelegraph reports. Here’s a comment from experts on the matter.

This trend reflects the influx of new entrants to the market, indicating renewed interest and optimism in cryptocurrencies.

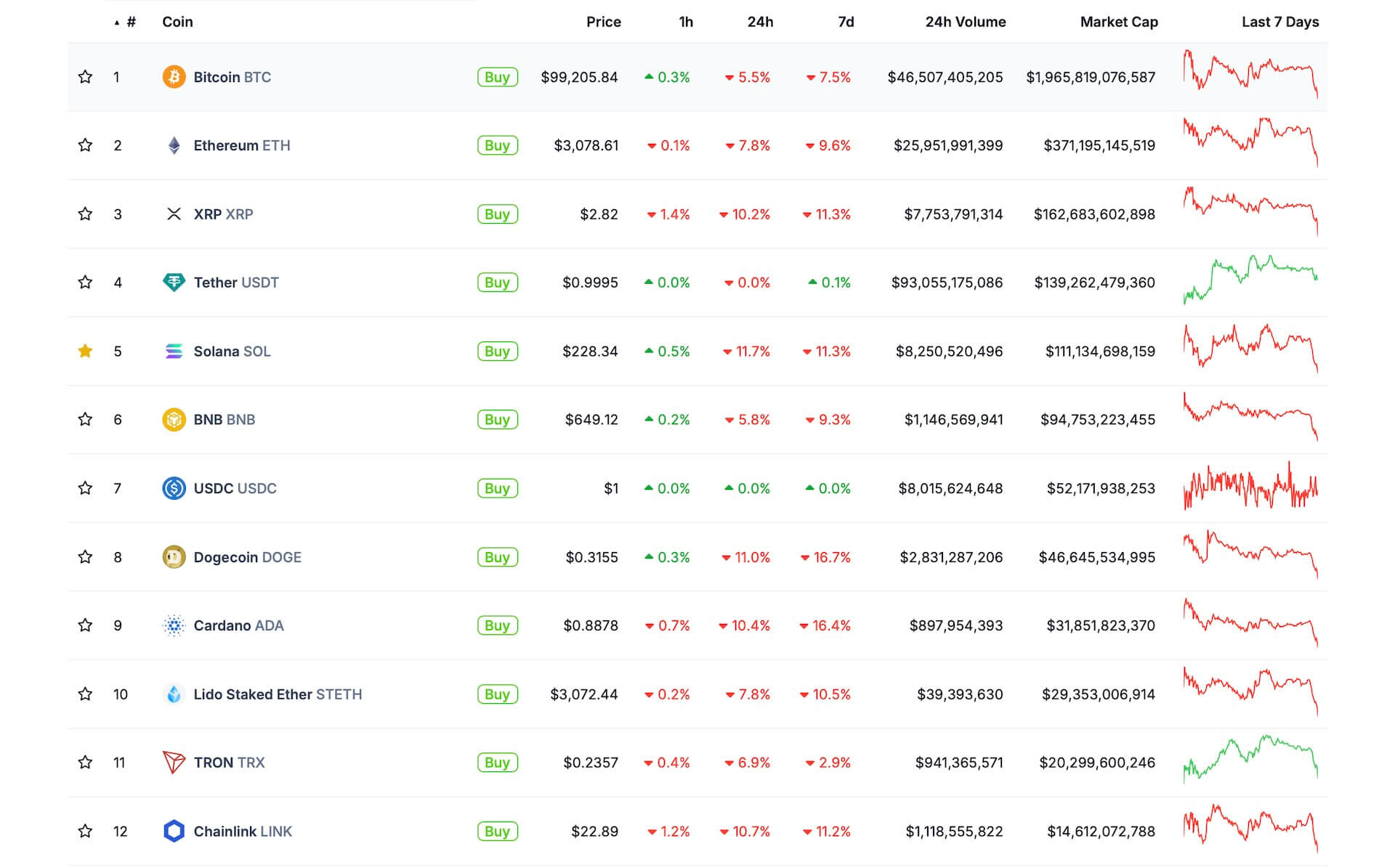

Note that the optimism of crypto-investors today has significantly diminished. Still Bitcoin at one point fell below $98,000 – and this traditionally pulled the market down. As a result, many of the largest coins by market capitalisation gave out more than 10 per cent of drawdown over the day.

Actual rates of cryptocurrencies today

According to experts, the growth in the number of cryptocurrency addresses with a balance of at least $100 usually occurs during bullruns in the market, that is, stages of its growth. Previously, the indicator increased in 2021 and 2017. In addition, a similar thing happened at the end of 2024, when BTC jumped above $100,000 for the first time.

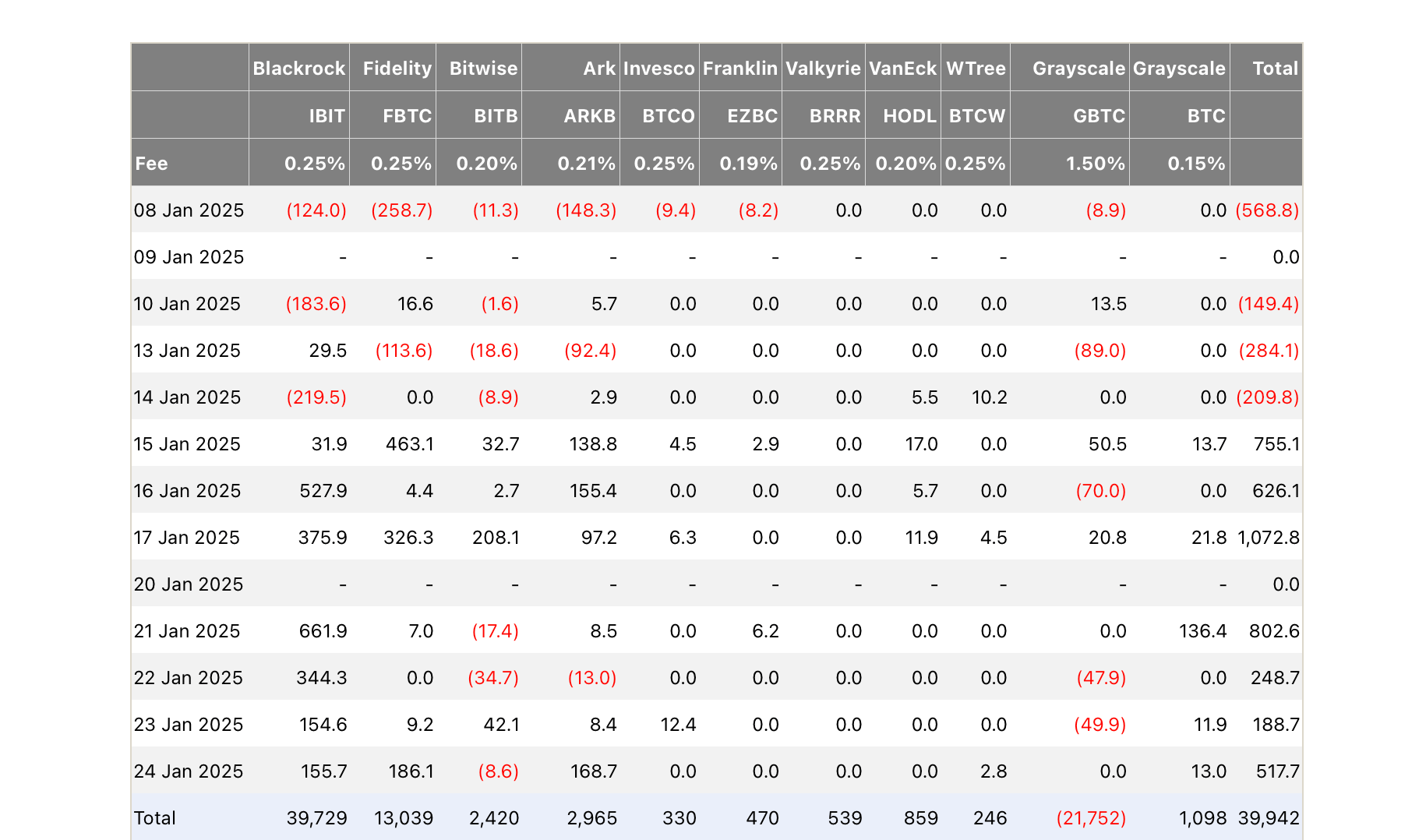

Binance analysts emphasise that the growth in popularity of digital assets in this cycle is primarily due to the launch of spot Bitcoin-ETFs in the US. Trading in such instruments began on 11 January 2024 – since then, exchange-traded funds have recorded a net capital inflow of $39.9 billion.

And since ETFs are spot, it means that they are based on ordinary bitcoins, not futures and other instruments. Accordingly, the said amount was spent on buying BTC over twelve months.

Capital inflows and outflows from spot Bitcoin-ETFs in the U.S.

By the end of 2024, exchange-traded fund issuers had 1.25 million BTC at their disposal. Meanwhile, an ETF from BlackRock called iShares Bitcoin Trust (IBIT) surpassed the $50 billion level in assets under management.

Experts also note the recent records of Bitcoin network hash rate, which indicates the interest of miners in mining the cryptocurrency. In early January 2025, the rate surpassed the 1,000 hashes per second level for the first time, which is equivalent to about 50 per cent year-over-year growth.

Here’s a rejoinder from analysts on the matter.

Bitcoin’s hash rate recently hit an all-time high, surpassing the combined computing power of tech giants like Amazon AWS, Google Cloud and Microsoft Azure. They together provide less than 1 per cent of the total capacity of the BTC network.

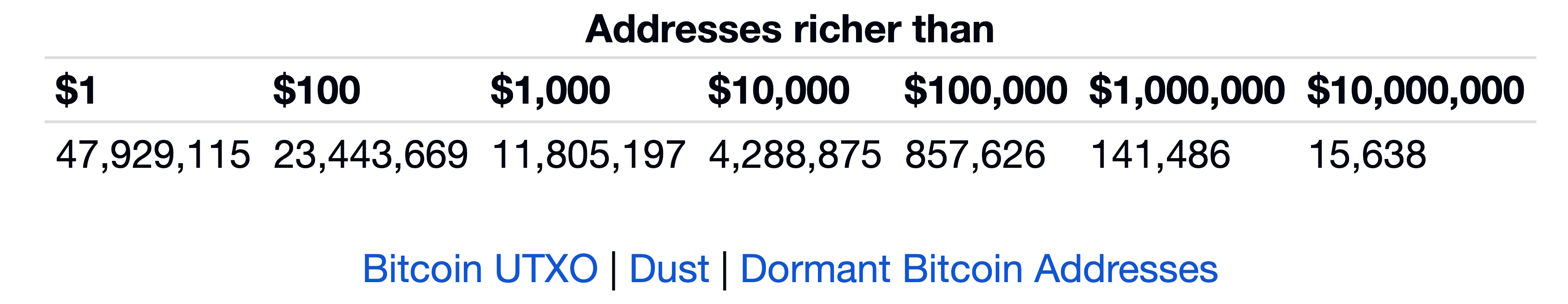

Below is a detailed distribution of Bitcoin addresses by the dollar value of the coins on them. As you can see, $100 in BTC is now available on 23.4 million addresses. One thousand dollars in coins is owned by 11.8 million addresses, 100 thousand is on 857.6 thousand, and more than $10 million is stored on just 15.6 thousand wallets.

Detailed distribution of Bitcoin addresses by accumulation volume

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

How many Bitcoin investors are on the upside

Bitcoin’s value has risen 134 per cent in the last year. With that in mind, it’s not surprising that 86 per cent of BTC holders are now on the plus side – meaning they bought coins at a lower rate compared to today.

As the head of the analytical platform CryptoQuant Ki Young Ju notes, the record was set by the number of accumulating addresses, the owners of which exclusively accumulate cryptocurrency. For the month, the figure reached 495,000 units.

Here’s Ju’s retort to the difference in investor behaviour.

Retail Bitcoin investors with less than 1 BTC are selling cryptocurrencies, while more experienced players with more than 1 coin are buying.

Cryptocurrency buying by investors

The expert believes that the coin market is now in the late stage of the bullrun. To be more precise, we are talking about the early distribution stage, when new investors are getting in touch with coins, while the interest of large institutional-level players remains tangible.

If market events are consistent with the previous growth stages, we will be waiting for the final stage of the so-called euphoria. It lasts for several weeks and is accompanied by large-scale jumps in assets from any category and with any market capitalisation.

Despite the current collapse, retail investors' interest in crypto is becoming tangible again. Apparently, this has been fuelled not only by the rise of coins in recent months, but also by the launch of Trump's meme token. Thanks to the event, digital assets no longer seem so dangerous to people outside the industry.

More interesting stuff is in our crypto chat. We look forward to seeing you.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.