The panic around DeepSeek has dissipated. Why did Bitcoin and other cryptocurrencies recover yesterday’s losses?

Yesterday, the cryptocurrency market experienced a tangible collapse, against which BTC plunged to a local low of $97,777. What happened was attributed to the general collapse of stock markets, which was especially noticeable in the US. It was provoked by the success of the Chinese application DeepSeek, which made people question the effectiveness of artificial intelligence models of American companies. However, a day later, the situation stabilised, and the coins are again showing growth.

What is DeepSeek

DeepSeek is an application of a Chinese startup that was launched just a week ago. In that time, the app has found itself on the first place of Apple’s App Store in many countries around the world, pushing ChatGPT to the third position.

DeepSeek’s artificial intelligence model turned out to be more efficient compared to solutions from OpenAI and other American companies. Most importantly, it requires much less computing power to develop – in the case of DeepSeek-V3 training we are talking about Nvidia H800 chips for less than 6 million dollars.

Cryptocurrency miners with an Nvidia graphics card

Thus, analysts questioned the fair valuation of American companies and the need to inject billions of dollars to develop the sector. And investors took to selling shares of the relevant manufacturers, expecting a correction in their value.

Analysts at Standard Chartered said that Bitcoin is tangibly linked to Nasdaq. Therefore, the collapse of traditional investment instruments also affected the cryptocurrency category, which explains why the coin market collapsed yesterday.

How DeepSeek affected cryptocurrencies and financial markets

As noted by analysts at The Kobeissi Letter, the US tech sector lost a trillion dollars in a single day amid market panic. Initially, ARM, Nvidia and Broadcom lost the most value – their securities fell in price by 5.5, 5.3 and 4.9 per cent respectively.

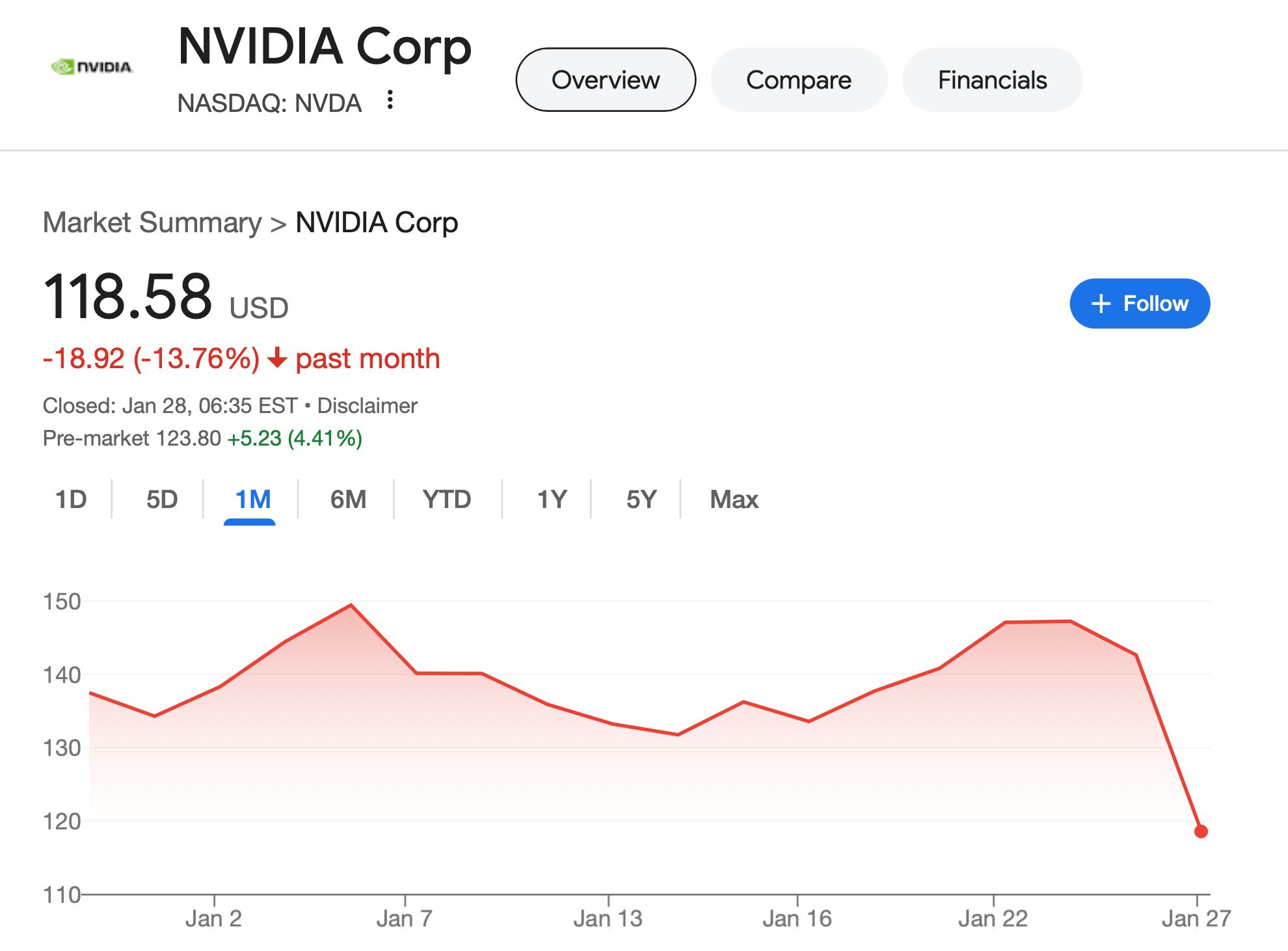

For the world of crypto, such drawdowns seem insignificant, but the stock market is not used to this. In addition, the collapse of Nvidia’s stock ended with a $600 billion drop in the company’s market capitalisation, the largest decline of the day.

In addition, the current NVDA collapse is also visible on the monthly chart of the share price.

Nvidia share price chart for the month

However, in general, the sharp reaction of investors can be explained – the market conditions became the reason for it. Here is a commentary on the matter by Bitget’s Chief Operating Officer Alvin Kahn, as quoted by Cointelegraph.

The excitement around DeepSeek and general volatility in the US AI market has spooked investors, forcing them to look for safer investment options. Ahead of the next Federal Reserve meeting and expectations of no rate cuts, the market is laying a firmer tone, which reinforces the sentiment of caution.

As a reminder, the next FOMC meeting will be held on Wednesday. It is believed that the US Fed leadership will leave the base interest rate at the same level, i.e. without its reduction. Thus, the economy will not get pressure easing.

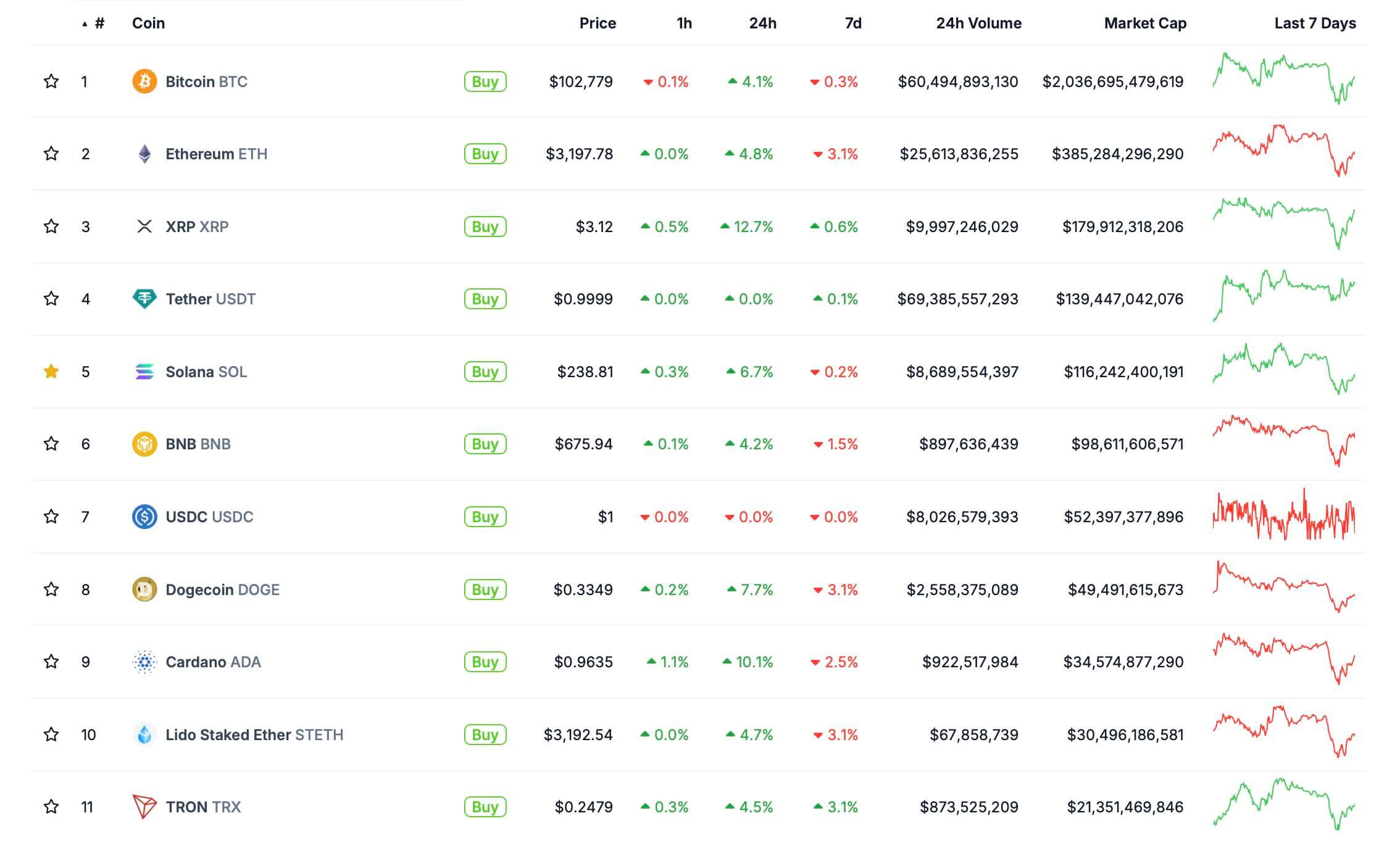

However, over the day investors came to their senses, and the negativity due to the events has dissipated. This is how the current rates of the largest cryptocurrencies by market capitalisation look like: the coins have grown by between 4 and 12 percent.

Actual rates of cryptocurrencies today

Kronos Research analyst Dominic John confirmed the positive trend. The corresponding quote is provided by Decrypt.

A “tangible recovery” can be seen, as investors are clearly reallocating funds into their favourite crypto assets. This trend provokes optimism about the long-term impact of the democratisation of artificial intelligence on the market.

That is, capital holders have tentatively reached a consensus that the success of DeepSeek will not kill the field of artificial intelligence in its current form. On the contrary: the technology will become cheaper to develop, which means that people will have better access to AI and will be more willing to use it in their normal lives.

Semiconductor analyst at Bernstein, Stacey Rasgon, called yesterday’s market reaction overreaction. Here’s the line.

Will DeepSeek be the end of an era of AI development? We don’t think so. Still, DeepSeek didn’t create OpenAI for $5 million.

Morgan Stanley experts support this approach. According to them, the fresh success of DeepSeek has shown “an alternative path to effective model training.” That is, there is no question of a threat to the major players in the field of artificial intelligence.

The topic became so big that it was commented on by US President Donald Trump. He took what was happening as a signal of the need to strengthen the activity of American companies in this direction. Here’s what he said.

The release of the Chinese company’s DeepSeek artificial intelligence should be a signal to our industries: we need to focus on competition to win. That’s a good thing, because now we don’t have to spend as much money. I see this as an advantage in an asset role.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

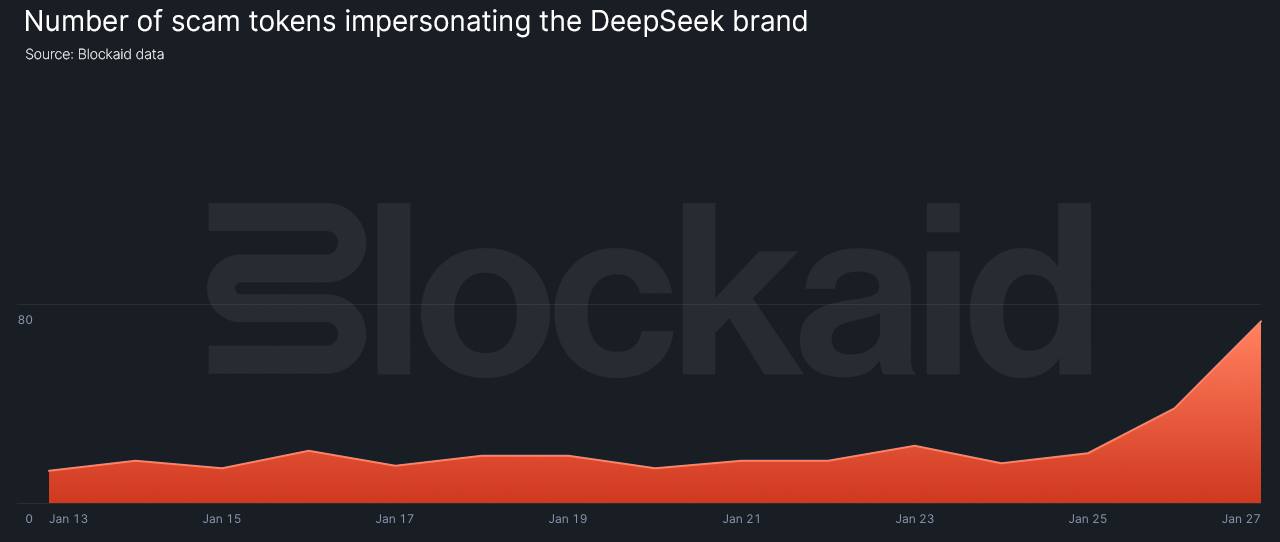

Cryptocurrency scam on the DeepSeek theme

The DeepSeek trend has also affected the activity of fraudulent cryptocurrency developers. According to the data protection company BlockAid, no less than 75 scam tokens were created on 27 January mentioning the name of a Chinese company. This is at least three times more than the previous day’s result.

Graph of the number of fraudulent tokens that are referred to DeepSeek

However, that’s not all. According to expert Oz Tamir, scammers have even created a decentralised application that mimics the DeepSeek website. It has a “Connect Wallet” button that grants the right permissions to scammers and allows them to empty the contents of the victim’s blockchain address.

Cryptocurrency scammers

Accordingly, crypto investors need to exercise caution and ignore new trending assets.

It seems that investors did agree that the success of the Chinese AI project will not lead to the collapse of popular American companies. However, the market crash was still noticeable and also affected the cryptocurrency industry. So, coin enthusiasts still need to keep a stockpile of stablecoins to be able to top up bitcoin and other cryptocurrencies' savings on collapses. Of course, with confidence in a future industry rebound.

Look for more interesting stuff in our crypto chat room. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.