The popularity of crypto queries and mentions of Bitcoin on social networks has reached a local peak. What does this mean?

Over the weekend, Donald and Melania Trump launched their own meme tokens – TRUMP and MELANIA. The first crypto asset came as a surprise to the crypto community, as its arrival from the US President essentially recognised the potential of coins on a planet-wide scale. The reaction to the first lady’s cryptocurrency was not so warm, as the market was going through a phase of collapse at the time. Be that as it may, the effect of both novelties is already being felt. Now cryptocurrencies are being talked about very actively.

The current interest in cryptocurrencies.

Bitcoin and Efirium are increasingly searched for using search platforms, in addition to cryptocurrencies being actively mentioned on social media. While this is not a guarantee that the market will grow, analysts see this as a “leading indicator of increased retail investor inflows”. In addition, in general, what is happening is in line with the situation in the coin industry during previous crypto bullruns.

Cryptocurrency investors

For example, during the second week of January 2025, Bitcoin was mentioned 247,000 times on the social network Twitter. The corresponding figure jumped to 495 thousand at the end of the third week, according to The Block.

Mentions of Efirium for the same period jumped from 73 to 293 thousand units, that is, the scale of the growth of interest in the second most capitalised cryptocurrency was even greater. Here’s a rejoinder on the subject.

The rise in social activity suggests an increase in retail audience participation. Still, many regular users and Influencers are actively discussing cryptocurrency.

A similar thing is relevant for “Bitcoin” and “Crypto” queries on Google search engine. On the day of Donald Trump’s inauguration, the popularity of such queries totalled 100 and 92 points. The maximum attention also recorded the query “how to buy cryptocurrency”.

On the topic: Why the launch of Donald Trump's meme token indicates a change of attitude to crypto in the United States: Bernstein's response

According to experts, the growing interest in crypto is not only due to the appearance of meme-tokens of Donald and Melania Trump. Firstly, yesterday Bitcoin set a new all-time high of $109,588, which is traditionally the best advertisement for the cryptocurrency industry.

Secondly, investors are waiting for dramatic changes in the situation with the regulation of digital assets in the United States amid the change of power, which will make coins a more popular category of investment instruments. And since the prospects for popularisation of cryptos seem significant, many are linking to them now in an attempt to get ahead of other market players.

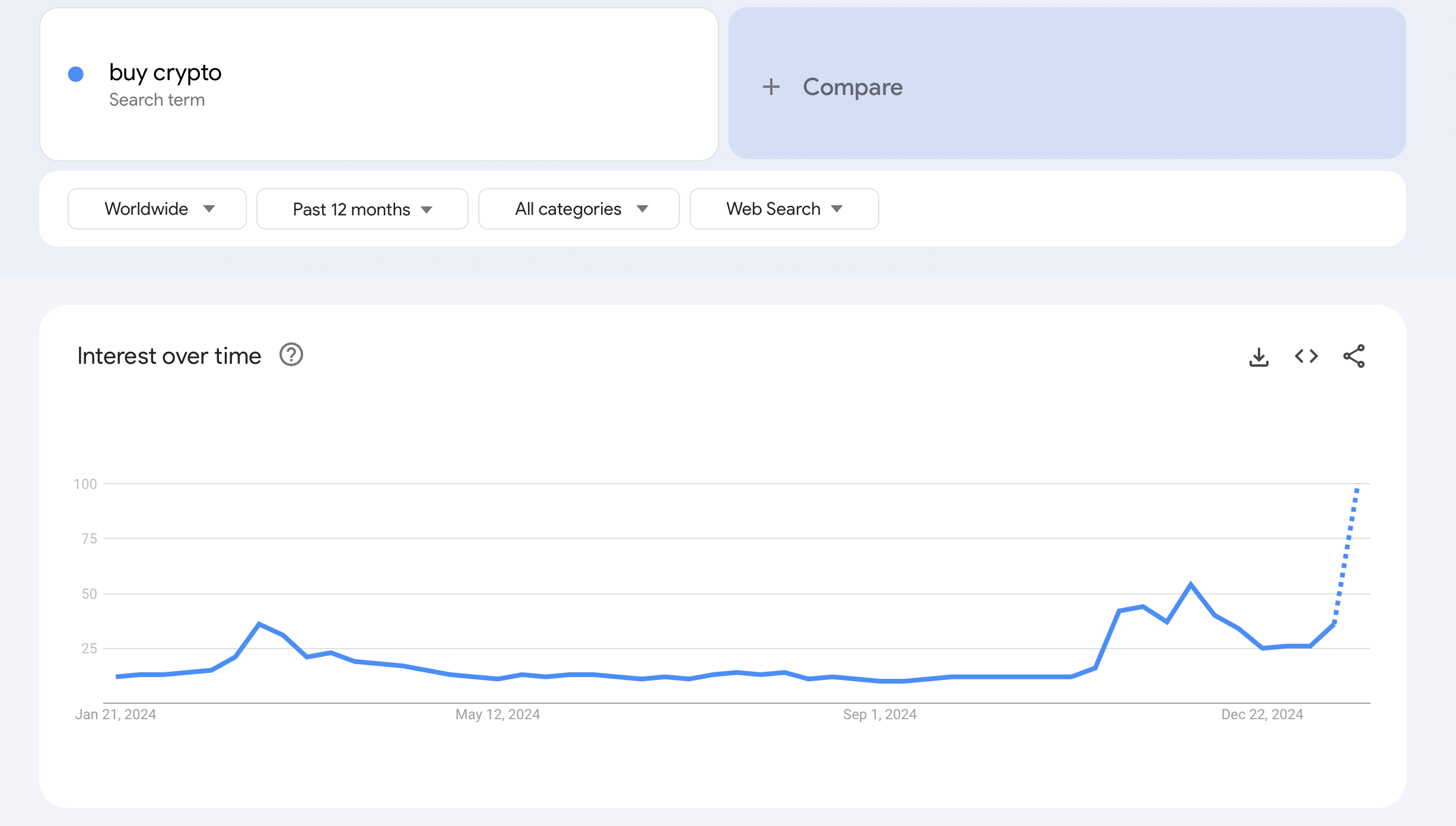

This is what a graph of the popularity of a Google query about cryptocurrencies looks like worldwide over the past twelve months. That is, this topic is now more actively interested in it than ever before.

Popularity of the query about cryptocurrencies in Google worldwide

And here is a similar graph for the query “buy cryptocurrency”. The situation is the same.

Popularity of the query about buying cryptocurrencies in Google worldwide

Who continues to buy bitcoins

El Salvador has been stocking up on its own cryptocurrency in recent days. The country’s national Bitcoin office reported the purchase of 11 BTC on the 19th of January and another 1 coin on the 20th.

Thus the total stock of crypto state reached 6044 bitcoins, whose value exceeds the equivalent of 600 million dollars, reports Cointelegraph.

El Salvador’s President Nayib Bukele

In September 2021, El Salvador became the first country to recognise Bitcoin as an official currency. This move by President Nayib Bukele was aimed at attracting investment, making international transfers cheaper and strengthening financial independence.

To support the initiative, the country's authorities launched the national cryptocurrency wallet Chivo, which allowed simple transfers of digital assets for Salvadorans abroad. However, due to technical problems and the volatility of Bitcoin, part of the population met the innovation with distrust.

Despite criticism from international organisations, El Salvador still caught the attention of coin enthusiasts and tourists interested in digital assets. However, as the events of recent years show, recognising BTC as an official means of payment was definitely not a magic wand to instantly improve the situation in the state.

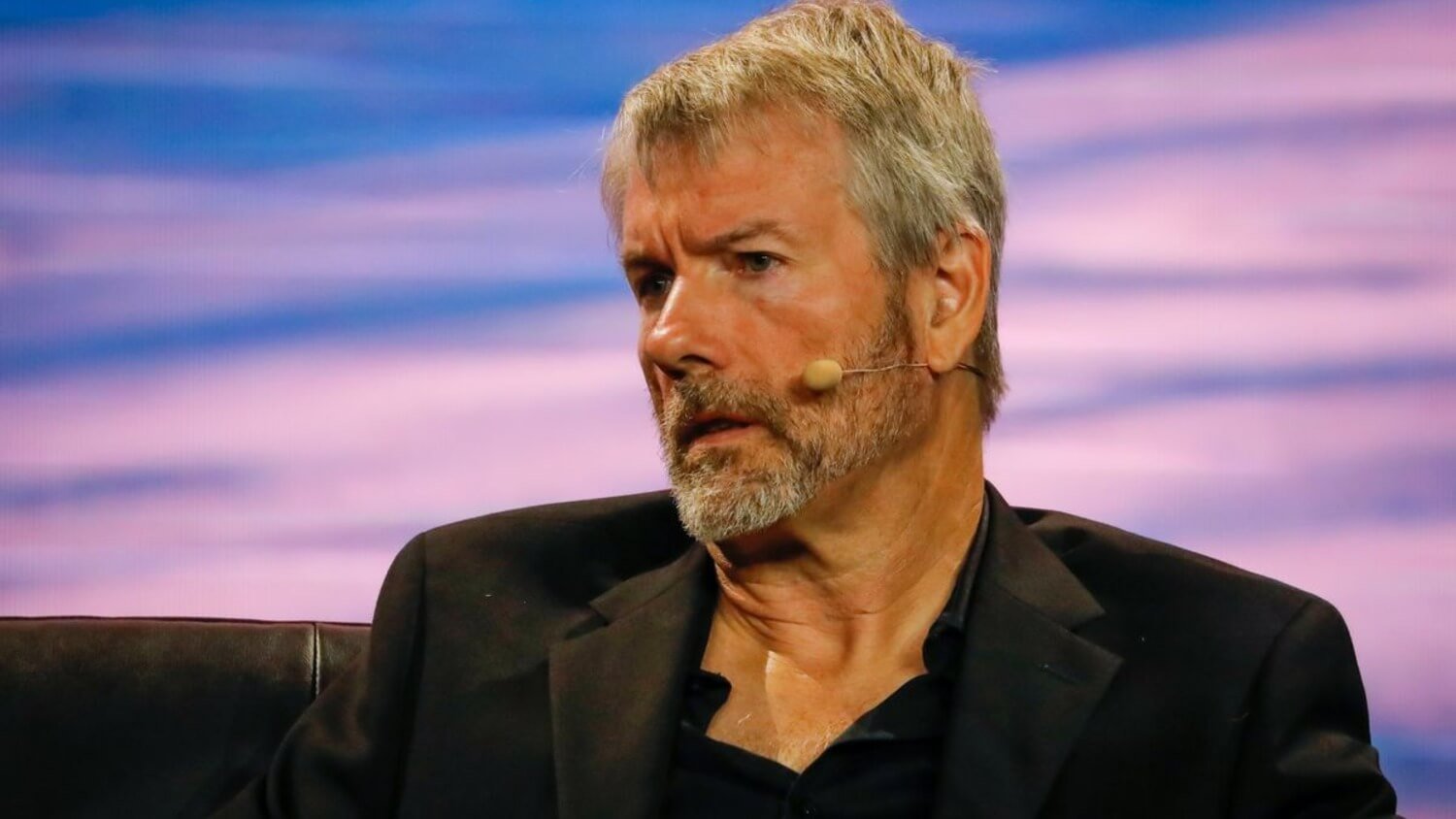

Larger-scale bitcoin purchases are traditionally carried out by MicroStrategy. Today the giant reported the purchase of 11 thousand coins worth $1.1 billion, bringing the total cryptocurrency savings of Michael Saylor’s company to 461 thousand BTC.

MicroStrategy executive chairman Michael Saylor

It took $29.3 billion to buy cryptocurrency. Accordingly, the average price of each bitcoin is $63.6 thousand.

So far, cryptocurrencies can safely claim to be the key trend of early 2025. And if it comes to the introduction of adequate regulation of the niche in the United States and even the creation of a national Bitcoin reserve in America, the situation will be even more interesting. And very quickly.

Look for more interesting things in our crypto chat room. We look forward to seeing you!

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.