The SEC chairman said the regulator has never labelled Bitcoin and Efirium as securities. Was he lying?

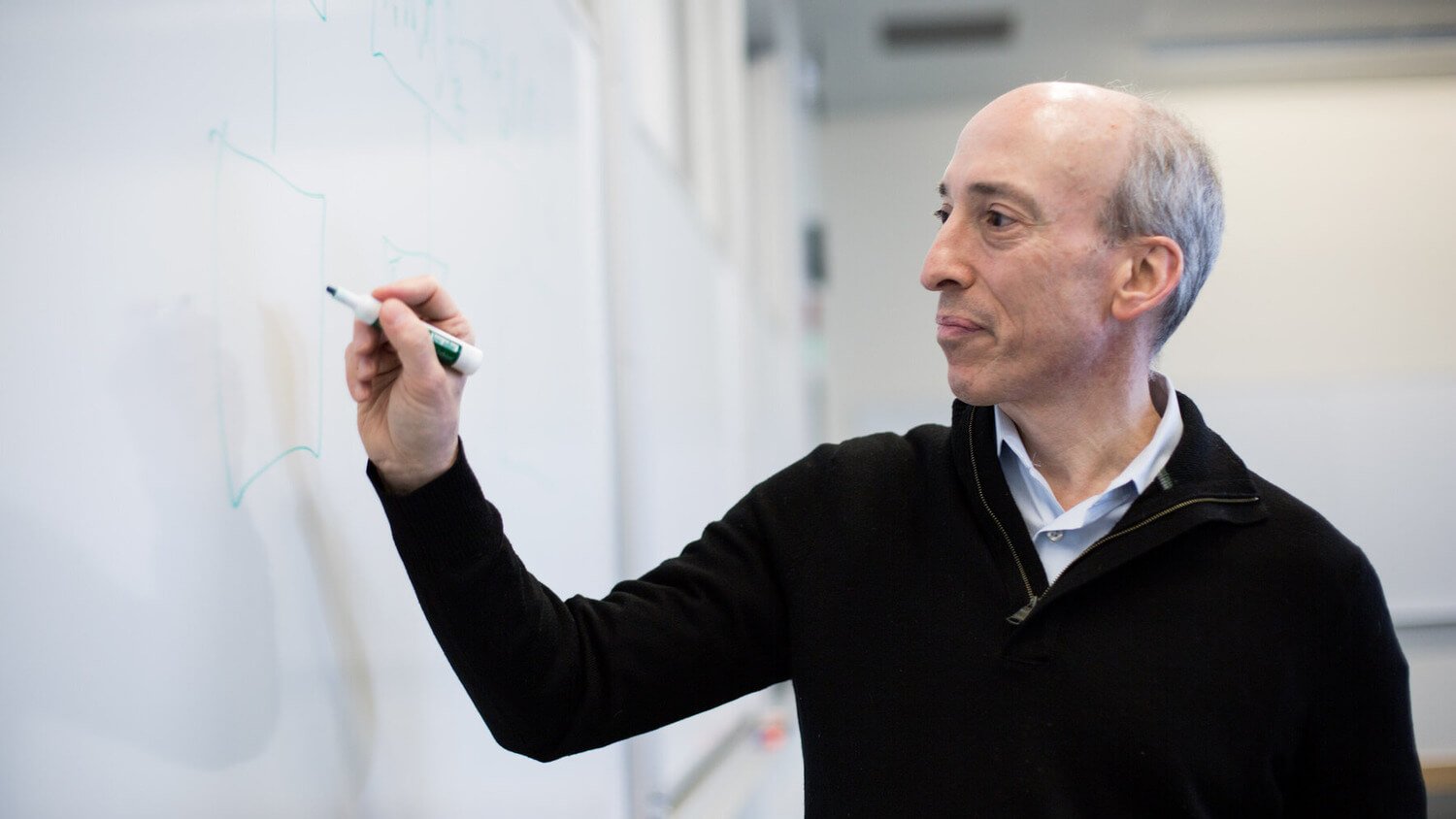

On 20 January, current SEC chairman Gary Gensler will leave his position. He will do so because of the election victory of US President Donald Trump, who promised to change the leadership of the SEC even during the election campaign. In general, Gensler was remembered for his tough fight with the coin industry and a huge number of lawsuits against blockchain companies. However, towards the end of his tenure, the official decided to voice controversial statements about crypto.

Are Bitcoin and Efirium a security?

Gensler commented on the status of the two largest cryptocurrencies by market capitalisation in a fresh interview with Yahoo Finance. According to him, “The Commission has never called Bitcoin and Efirium securities.”

This is how Gary responded to the journalists’ question about whether ETH falls under the jurisdiction of the Securities Commission amid numerous litigations and uncertainty with the regulation of the coin sphere in the US. The current SEC chairman said that neither he nor his predecessor Jay Clayton labelled Bitcoin as a security. The same is true for Etherium.

Former SEC Chairman Jay Clayton.

Here’s a rejoinder on the matter, as quoted by The Block.

We didn’t say that Efirium qualifies as a security. I think BTC and ETH investors – or the masses, as you said – still had access to listed assets even before the launch of the respective exchange-traded funds and products.

Note that this is not the case. First of all, Gary Gensler's activities as Commission Chairman have been limited to labelling popular cryptocurrencies as "unregistered securities" and thus creating problems for them by threatening trading platforms with lawsuits. For example, this is how the Robinhood platform delisted Solana, Polygon and Cardano coins in June 2023, even though the SEC did not actually require it.

Plus, in a February 2023 interview with New York Magazine, Gensler made it clear that the regulator considers any cryptocurrency other than Bitcoin to be securities. Here’s a line from the conversation.

All projects except Bitcoin have their own website, their own group of entrepreneurs who can register legal entities in tax offshore, set up funds, bring in lawyers to complicate legal nuances or circumvent jurisdictional restrictions. In other words, behind most cryptocurrencies are specific individuals who use complex and opaque legal mechanisms to promote their tokens and attract investors. Bitcoin, due to its unique creation history, is fundamentally different from other crypto projects in this regard.

US Securities and Exchange Commission website

And because certain people are behind popular cryptocurrency platforms, this supposedly allows the SEC to consider them securities.

At the time, Gensler’s statements drew criticism from experts. For example, Blockchain Association legal counsel Jake Czerwinski reminded that the SEC chairman’s opinion is not a law, and it is necessary to prove the alleged belonging of each individual cryptocurrency to the category of securities in court.

After Gensler’s answer, Yahoo Finance journalists asked him to directly clarify that BTC and ETH definitely do not belong to the category of securities. However, the official never did so – here’s his rejoinder.

I said that we at the SEC have never claimed that they are securities.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

Gensler also noted that he can’t explicitly state that the two tokens are not securities given the specifics of his job. Although earlier this did not prevent him from telling in various interviews about the belonging of popular cryptocurrencies to this category, thus hindering the development of the coin market.

Why Gary Gensler is not loved

During a hearing before the House Financial Services Committee in April 2023, politicians also failed to get a clear answer from Gensler on whether ETH could be considered a security.

Former House Financial Services Committee Chairman Patrick McHenry was particularly active here. Towards the end of his speech, he asked Gary to at least agree that coin regulation lacks clarity.

SEC Chairman Gary Gensler

In a fresh interview, the official also noted that the launch of spot ETFs on Bitcoin and Efirium provided investors with better protections, lower fees and appropriate disclosure by issuing companies. Here’s a quote to that effect.

More than 70 – if not 80 per cent – of the cryptocurrency market is tied to Bitcoin and Efirium. I did study the rest of the industry in the form of 10,000 to 15,000 other tokens that exist mainly because investors are putting money in and thus essentially betting on the project. They need proper disclosure. The law requires such disclosures, but they are not meeting that at the moment.

Gensler finished his story with a line about BTC.

Bitcoin is a highly speculative and volatile asset. However, there are seven billion people on the planet, and they all want to trade cryptocurrency just like we’ve been trading gold for 10,000 years. Today it’s BTC, but in the future it could be something else.

Bitcoin’s strength against fiat currencies

Obviously, Gary Gensler continues to push the theory that cryptocurrencies are too dangerous an asset category to connect. Fortunately, investors can decide for themselves where to put their money. Well into the future, the number of bitcoin buyers will be much larger.

Look for more interesting stuff in our cryptocurrency chat room. Come in right this second.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.