The supply of the USDT stablecoin has declined by a record amount in the last two years. Why.

The end of last week was accompanied by panic of cryptocurrency lovers. The fact is that on 30 December 2024 the implementation phase of the MiCA bill on the regulation of digital assets in Europe ended. With this in mind, coin holders feared the delisting of the largest steiblcoin USDT from Tether from the top exchanges and the subsequent collapse of the market. And although this did not happen, the situation with the token still worsened.

The reason for investors’ concern was the early delisting of USDT steiblcoin from Coinbase Europe, Coinbase Germany and Coinbase Custody in mid-December. At the time, company representatives said the Tether token was allegedly not MiCA compliant and got rid of it.

Instead, the giant's employees recommended interacting with USDC and EURC, with which there would definitely be no problems.

Coinbase crypto exchange chief Brian Armstrong

Of course, the crypto community did not appreciate the giant’s decision. Still, USDT is the largest and most popular stablecoin in the industry, on which the fate of the market depends without exaggeration. And any problems with the token will lead to a sharp decrease in liquidity in trading pairs, which in turn can lead to the most unpredictable consequences.

However, in the end, the digital asset continues to be available on the largest trading platforms in Europe. However, investors still decided to reinsure themselves, which can be seen in the USDT indicators.

Why is the supply of USDT falling?

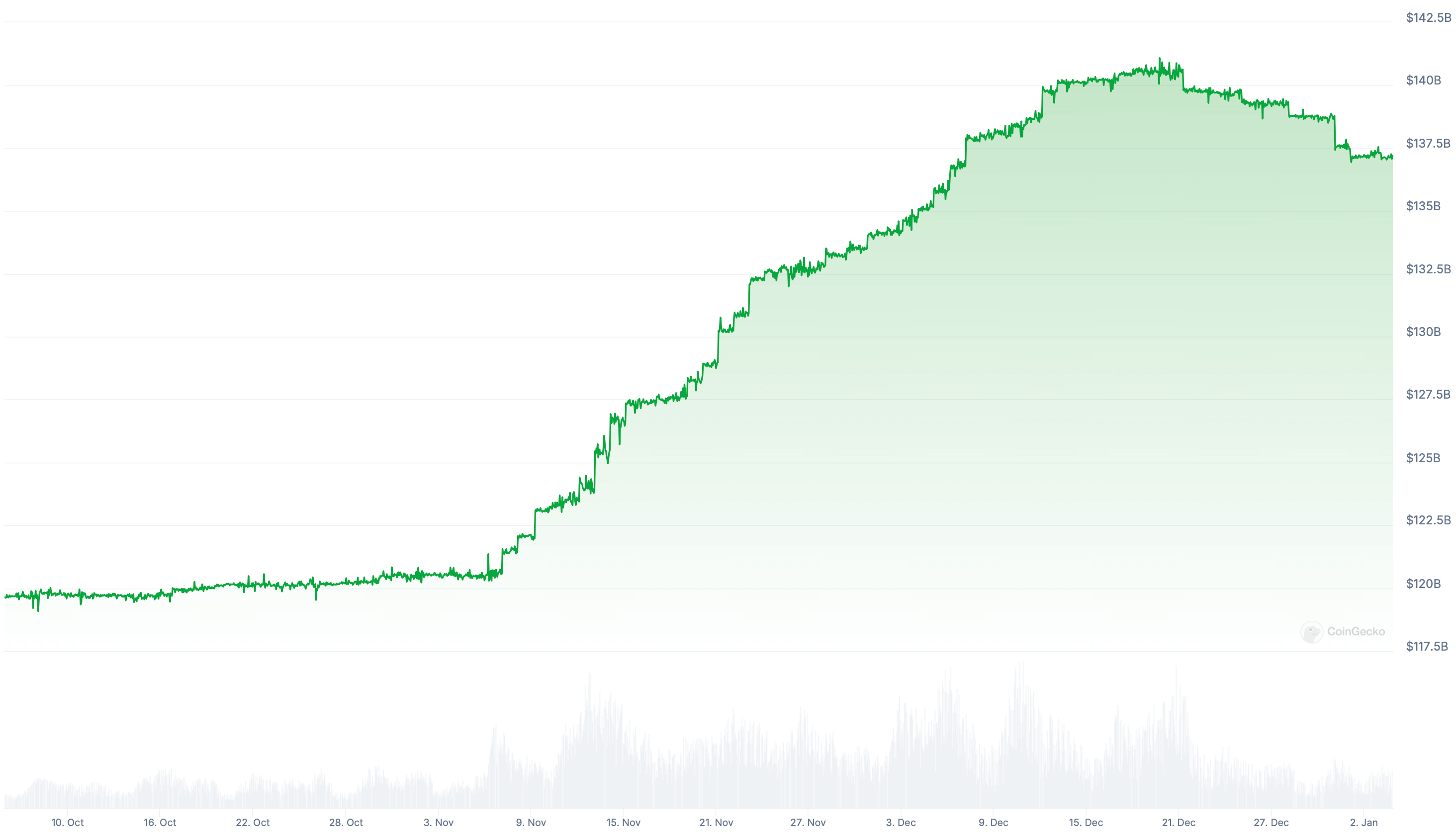

Over the last week, the number of USDT tokens in circulation decreased by 1.2 percent, which reduced the market capitalisation of the project from $138.8 billion to $137 billion. As noted by analysts at The Block, this is the largest collapse in the figure in a week since 10-17 November 2022.

Tether CEO Paolo Ardoino

Back then, the industry was experiencing the collapse of major cryptocurrency exchange FTX by Sam Bankman-Fried, against which the USDT capitalisation collapsed by 5.7 percent. That is, the scale of the token's current problems is quite serious.

According to analysts, the latest drawdown of USDT is directly related to the full-fledged launch of MiCA. Still, the event caused a wave of speculation, which many investors wanted to hedge against.

They got rid of Tether’s stablecoin by exchanging it for other crypto-assets or stablecoins, as well as directly withdrawing USDT into dollars. The latter is done through the issuer and just leads to a reduction in the supply of the asset.

Changes in the supply of USDT steiblcoin from Tether over the past three months

As a reminder, MiCA is changing the approach to the regulation of digital assets in EU countries. First of all, the relevant authorisation for a cryptocurrency company’s activity in one of the states of the union allows it to operate in all other members. However, the requirements for stablecoin eminentes are becoming much stricter – they touch on the topic of company reserves and liquidity.

Here’s a rejoinder to the situation from Agne Linge, head of growth at decentralised lending platform WeFi. She believes that complying with the new regulations may be trivially uneconomical for giants like Tether.

A new EU law now requires issuers of smaller stablecoins to hold 30 per cent of their reserves in a low-risk commercial bank inside the EU, while big players like Tether are required to keep 60 per cent or more in banks. Given the large capitalisation of USDT and its global reach, meeting this requirement is not economically feasible without disrupting the entire cryptocurrency ecosystem.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

Lynge suggests that the sheer scale of Tether’s operations reduces the likelihood of immediate financial repercussions amid a possible exit from the EU market.

Tether’s operations remain largely immune to potential regional disruptions. The company is also highly profitable and is heading towards ending the year with a $10 billion profit.

Tether executive Paolo Ardoino is the head of the company

According to the expert, Tether’s huge financial reserves allow the company to further diversify its products. Thus the giant is able to reduce the risks associated with the overall capitalisation of the stablecoin.

Lynge also noted that many EU countries offer transition periods of 6 to 18 months, which must be utilised for compliance or possible exit from the market. This essentially avoids the prospect of an abrupt delisting, as happened with Coinbase.

What's happening with USDT shows how much news influences the behaviour of cryptocurrency investors. In essence, nothing happened to the stablecoin, but speculations were the reason for worries. However, they were enough to disappear almost two billion dollars.

.

Look for more interesting stuff in our cryptocurrency chat room. Come in right this second.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.