The volume of stablecoins has hardly changed over the month. But experts still have no doubts about Bitcoin’s new records

Stablecoins are one of the pillars of the cryptocurrency world and almost the main way to use them. These instruments traditionally serve as a bridge between fiat currencies and crypto, because it is through them that capital comes into the sphere of digital assets. Over the past month, the total supply of staples has remained virtually unchanged, which is an alarming fact. However, analysts still count on the continuation of the bullrun in crypto and new records for the rates of popular assets.

What kind of stablecoins exist today

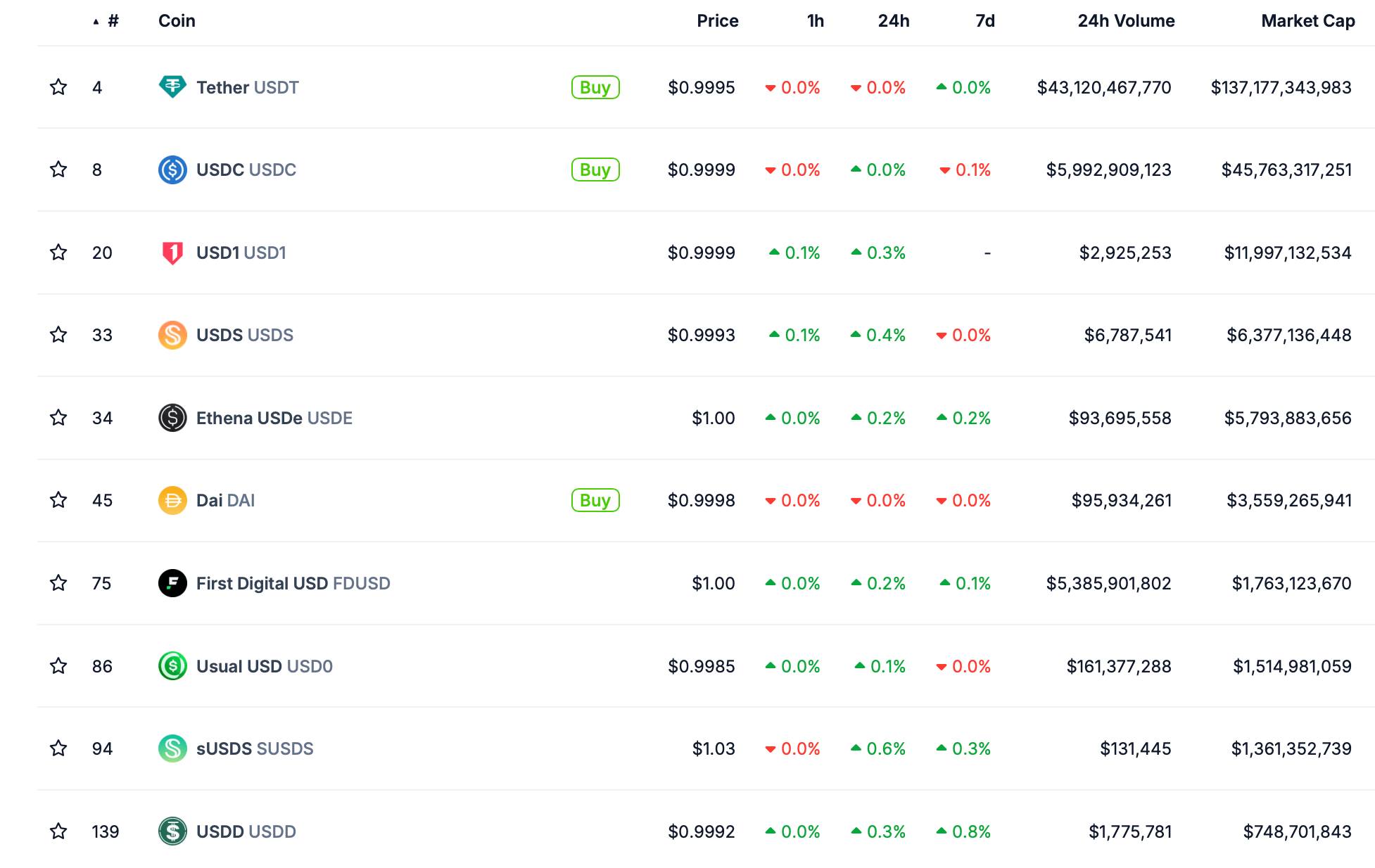

Today, the market capitalisation of stablecoins is $224 billion, of which USDT from market leader Tether accounts for $137 billion. Second place with a value of 45 billion is USDC from Circle. Here is a table of the industry leaders.

Ranking of the largest stablecoins by market capitalisation

Alas, over the last month, the total capitalisation of the four largest staples has increased by only 0.56 percent, which indicates low investor interest in what is happening in the crypto and a decrease in the inflow of new liquidity.

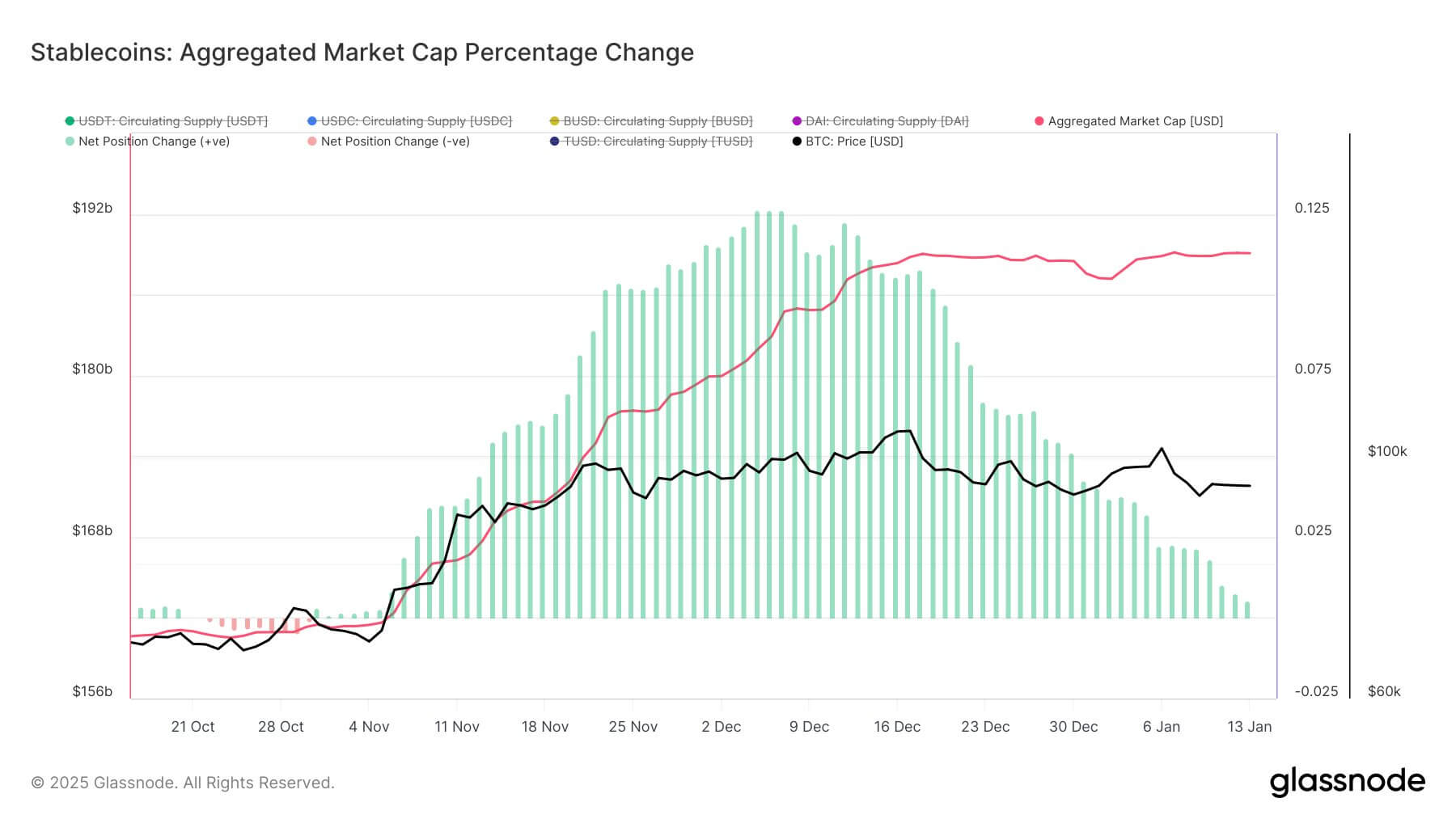

The situation itself differs significantly from the growth of the index, which was observed during the period of active increase in coin rates in November-December.

The total market capitalisation of the four largest staeblecoinv

According to analysts, this factor casts doubt on the sustainability of market jumps in December and hints at further industry drawdown. Still, the decline in capital inflows directly hints at a reduction in the number of new buyers of digital assets.

Here’s a comment from Glassnode representatives on the matter, as quoted by Coindesk.

The fact that the late 2024 rally required nearly double the amount of capital inflows for less price appreciation underscores the speculative demand and liquidity-focused momentum that has since weakened significantly.

As a reminder, stablecoins fulfil several important functions within the cryptocurrency industry and beyond. First of all, such tokens allow people from emerging economies to protect their own money by transferring it into dollar-pegged assets. In this way, they get an opportunity to insure themselves against inflation, which is relevant in their countries.

Cryptocurrency traders use staples to preserve value in times of market uncertainty. In theory, tokens allow you to buy them before a market crash, save the dollar value of your savings and then use the latter to buy crypto at discounted prices.

What the Bitcoin exchange rate will be and 2025

And although the situation with stables hints at a weakening presence of crypto investors in the industry, experts from the Hong Kong-based HashKey Group are betting on the growth of coins in 2025. The day before they published several predictions for the new year, where, among other things, they talked about the prospects for growth of coins.

On the topic: "Bernstein experts published 10 predictions for the crypto market for 2025. One of them is the growth of BTC to 200 thousand"

According to analysts, during the current bullrun Bitcoin will reach the level of 300 thousand dollars, Efirium will rise in price to 8 thousand, and the total capitalisation of the crypto industry will take a maximum of 10 trillion dollars. It’s funny that such a prediction implies a larger growth of BTC rather than ETH.

Cryptocurrency investors

That is, experts are allowing Bitcoin to grow more significantly despite the asset's much larger market capitalisation. This is an important clarification, because the larger the capitalisation of a particular coin, the more difficult it is to influence its value.

The second prediction affects decentralised exchanges. As reported by The Block, DEX platforms will leverage the power of AI agents and popular meme tokens to increase their market share. At the same time, centralised exchanges will leverage various DeFi strategies to raise capital from users through high-yield investment products.

Artificial intelligence-based applications will become more popular, which is also relevant for second-tier networks. And the latter will be clearly divided into application chains and general-purpose networks.

😈 MORE INTERESTING THINGS CAN BE FOUND IN OUR YANDEX.ZEN!

According to HashKey experts, the new administration of US President Donald Trump will launch the Bitcoin Reserve and approve the FIT21 bill. The latter will give more powers to the US Commodity Futures Trading Commission (CFTC) in overseeing spot cryptocurrency markets and “digital commodities”. Accordingly, the role of the Securities Exchange Commission (SEC) in this area will be significantly reduced.

Analysts are also counting on the approval of spot ETFs based on Solana and XRP, the emergence of cryptocurrency stock analogues that will appear on the Nasdaq exchange, as well as the growing hype around the securities of publicly traded Bitcoin mining companies.

Here’s a quote on the matter from HashKey Group CEO Xiao Feng.

The year 2025 opens the door to the so-called Golden Decade of the Web3 world. With regulation coming to the forefront, an influx of traditional capital and growing technological breakthroughs, the cryptocurrency market is on the cusp of incredible growth.

Cryptocurrency investor during the bullrun

Analysts concede that the current stablecoin situation will not affect the course of the current bullrun. That is, it reflects only a pause in investor interest in what is happening in the market, which is explained by the collapse of rates the day before. Well, in the medium term, it should not hinder the coin sphere.

Look for more interesting things in our crypto chat. Visit us.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.