Trump’s cryptocurrency executive order could disrupt Bitcoin’s four-year cycles. Why.

Last week, new US President Donald Trump signed the first executive order on cryptocurrency. The document envisages the creation of a working group on digital assets, which should create norms to regulate crypto and assess the prospect of a national reserve of Bitcoin or other coins. The event turned out to be very loud for the market, and it may even affect its fundamental features.

What will happen to cryptocurrencies in the future

According to Matt Hogan of the Bitwise investment fund, the fresh initiatives of the US president are able to affect the traditional four-year cycles in the cryptocurrency market. We are talking about the period of time during which the market experiences a full-fledged bullrun and further decline to a local bottom.

For example, Bitcoin’s actual low during the past bear trend was $15,476 from November 2022. Approximately one year before that, the cryptocurrency set a rate high of $69,000.

Bitwise investment director Matt Hogan

In December 2018, BTC was down to $3156, which was the bottom of the bearish trend before last. Again, in December 2017, the cryptocurrency reached the $20,000 mark for the first time, which also confirms the relevance of the four-year cycle.

Weekly chart of the Bitcoin exchange rate on the Binance exchange

Now these time periods may shift or change in some other way, the expert believes. According to Hogan, crypto investors can at least expect shorter and not as deep market crashes compared to past ones.

The Bitwise investment director believes that Trump’s fresh executive order, along with recent changes at the Securities Commission, has brought financial markets to “full integration of cryptocurrencies.” Thanks to this, banks and large Wall Street companies can “actively enter the space” of coins, which means they have essentially received confirmation of the attractiveness of cryptocurrencies from the top of the country.

As a reminder, the SEC changed two things the day before. First, former Commission Chairman Gary Gensler resigned on 20 January 2025. He is remembered for blatantly fighting the coin niche through lawsuits and creating uncertainty in the industry.

Second, the regulator will soon have a separate working group on cryptocurrencies, headed by Commissioner Hester Pierce. By doing so, the SEC will help create an adequate framework for regulating the coin sphere.

Hogan believes that spot Bitcoin-ETFs in the US are large enough to attract billions of dollars from new investors, as well as the corresponding impact on the exchange rate of the asset at the core of the instrument. However, in reality, Trump’s executive order and the creation of a national stockpile of digital assets will end up inflating “trillions of dollars” into the sphere, the analyst believes.

Investment director of the Bitwise fund Matt Hogan

The expert’s remarks are quoted by Cointelegraph.

The crypto market has matured: there are now more diverse buyers and value-orientated investors than ever before. I expect volatility, but I’m not sure I’d bet against crypto in 2026.

If we focus on four-year cycles, this year should be the last year in the growth phase of the cryptocurrency market. However, Hogan notes that the development may continue next year, as the interest of large investors in coins against the background of the “legalisation” of coins in the United States will prove too strong.

The analyst added that the effect of Trump’s fresh decree will not be noticeable immediately, as work on the rules to regulate the sphere continues. Well, Wall Street players will need even more time to realise the potential of crypto.

Finally, Hogan confirmed that Bitwise’s prediction of Bitcoin growing to 200k by the end of 2025 remains valid.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

What’s going on with Trump’s meme token

The launch of Donald Trump’s meme token turned out to be a major hit in January. Initially, the crypto asset gave out massive gains for several days in a row, which was accompanied by liquidity outflows from the whole market. In other words, investors sold other coins from their wallets to invest in TRUMP. Against this backdrop, the novelty was getting more expensive, while many crypto assets were getting cheaper.

However, then the trend reversed, and TRUMP began to fall. This led to even more negativity in the industry and the fall of altcoins.

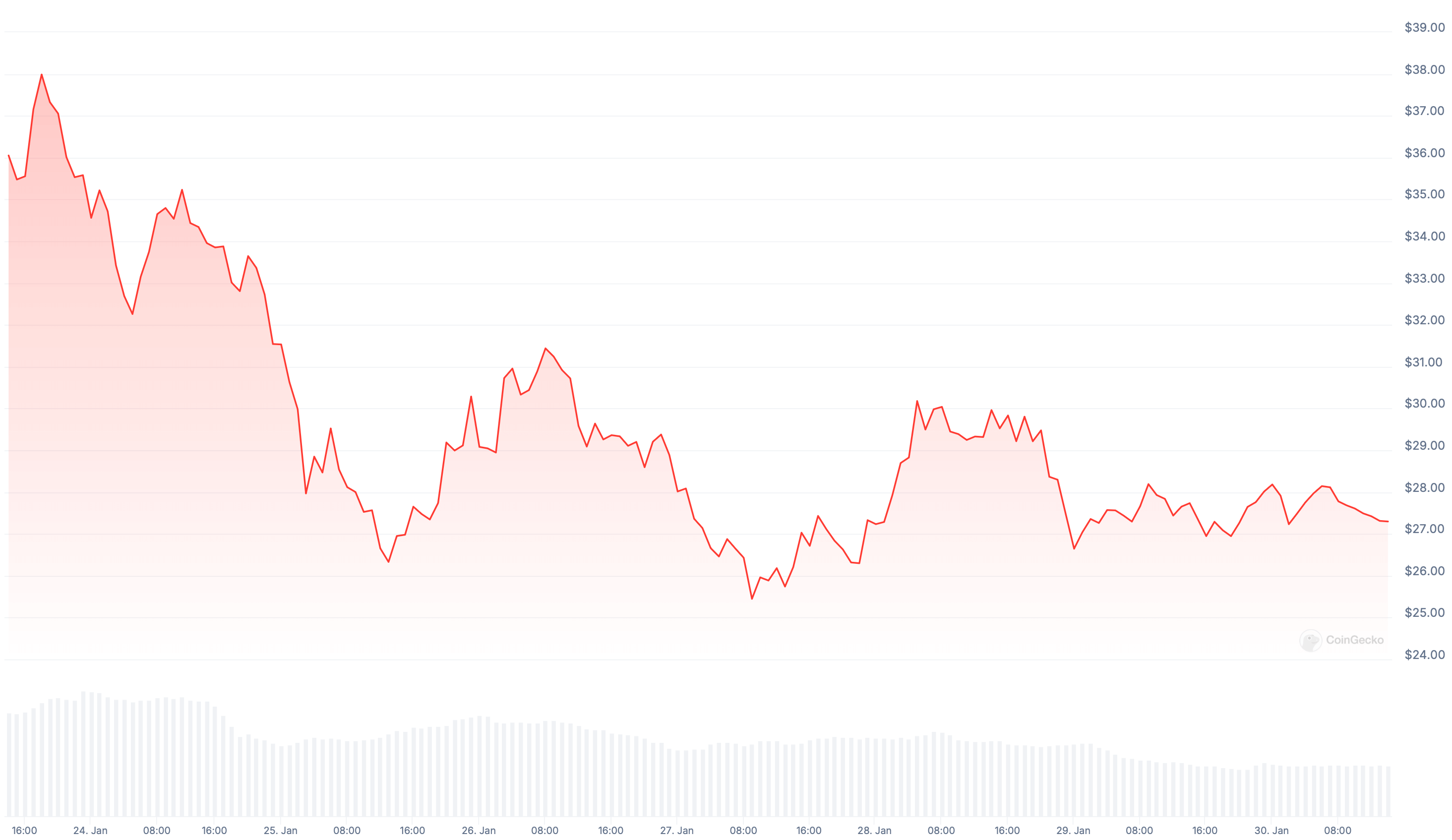

Recently, the value of the US President meme has stabilised. Still, for five days, the cryptocurrency is almost at the same price level, while TRUMP fell by only 1 per cent over the day.

Changes in the value of meme token TRUMP over the past week

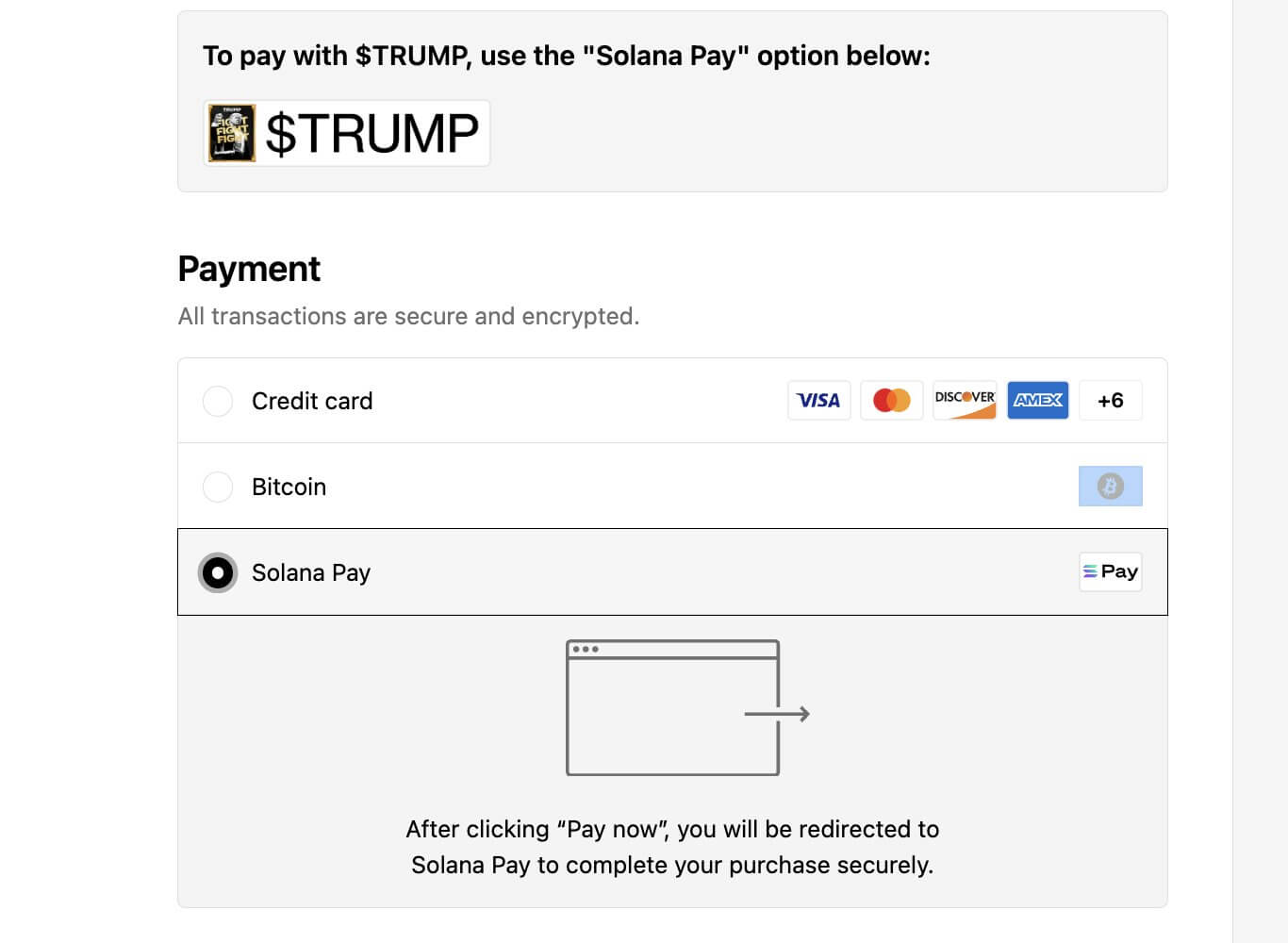

For now, we can assume that the crypto asset will not be forgotten by investors, as it has a new use case. We are talking about the possibility of using TRUMP to pay for Trump’s official merch – it appeared today.

The possibility of paying for Trump merch with the TRUMP meme token

The crypto can be used to pay for the US president’s perfume, wristwatches and trainers on websites. So investors got an additional opportunity to use their savings, which are now likely to be in the negative. Still, the TRUMP rate is off 63 per cent from its all-time high.

During each bullrun, a trend appears in crypto, which supposedly should change the standard cycles in the market and lead to almost eternal growth of coins. For example, in 2021, blockchain enthusiasts counted on the arrival of large institutional investors in the cryptocurrency sphere, while in 2017 ICOs became such a hit. However, all this time, the coins were still moving to a bearish trend, so Matt Hogan's version should be treated with caution.

More interesting stuff is in our crypto chat. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.