Trump’s first executive order on cryptocurrencies received both approval and criticism at once. What are market participants dissatisfied with?

Donald Trump signed an executive order on cryptocurrencies in his first week as president. Overall, the document involves banning the issuance of central bank digital assets (CBDC), forming a coin market working group, and finding solutions to create a regulatory framework for crypto along with exploring the potential of the coin stockpile for the US. While the executive order overall seems like a huge step towards the blockchain industry, it has had its critics.

Pros of Trump’s cryptocurrency executive order

Trump’s executive order clearly hints at a new approach to the coin industry from the renewed government. Now the government wants to promote the development of the crypto sphere, create clear rules of operation for entrepreneurs and developers from the world of blockchain, as well as in theory to keep previously confiscated coins as a national reserve or even allocate money to form a crypto reserve.

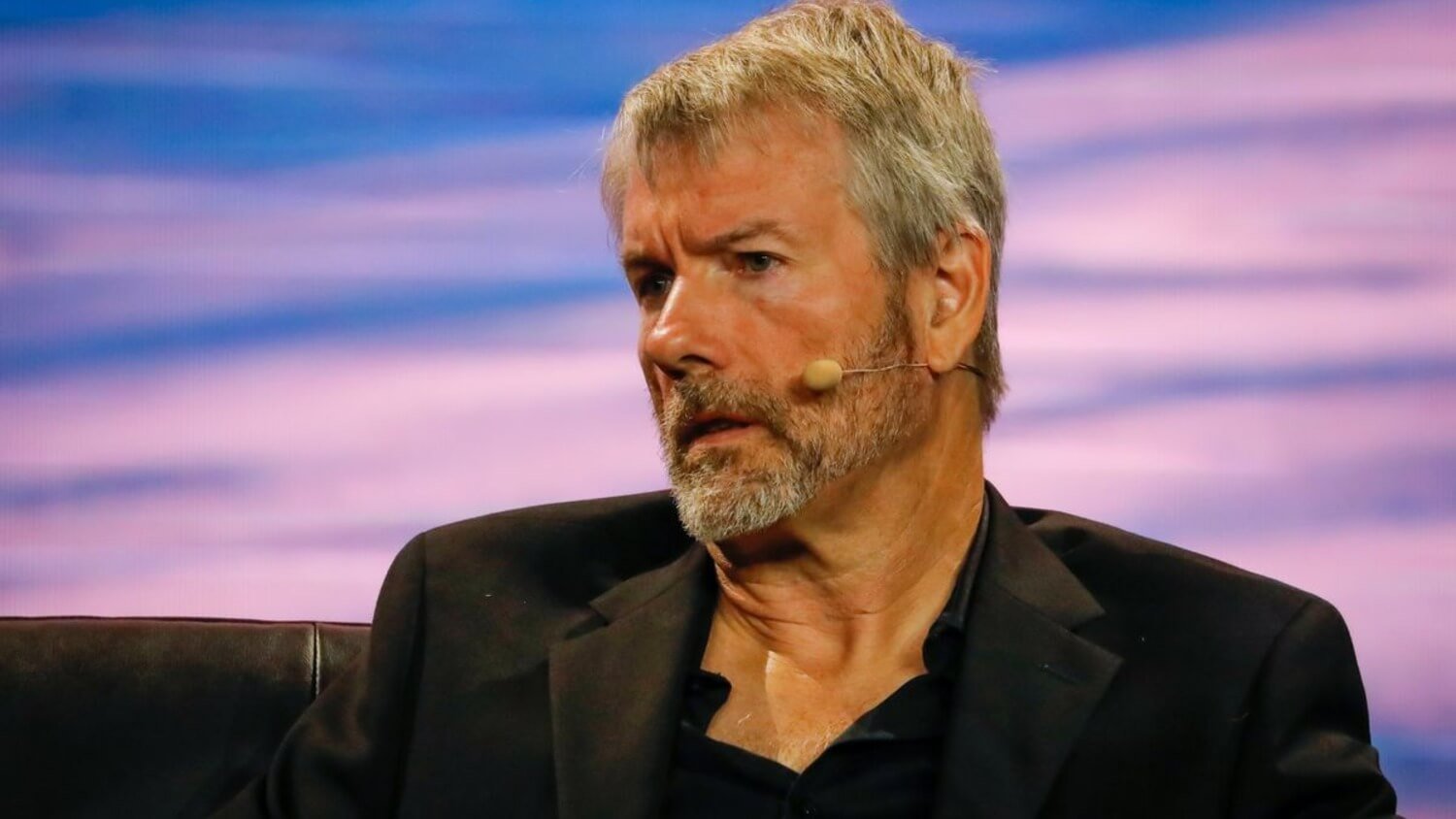

MicroStrategy founder Michael Saylor has reacted to what’s going on. Here’s his rejoinder, as quoted by The Block.

The cryptorenaissance has officially begun.

MicroStrategy executive chairman Michael Saylor

Thus the representative of the public company with the largest bitcoin reserves hinted at the improvement of the coin’s situation in the near future.

He was supported by analysts of the Benchmark platform. For example, Mark Palmer said that further crypto investors can expect even greater popularisation of this asset category. He said the following.

Cryptocurrency is an atypical asset class. Still, retail investors were the first to embrace it, while institutional players lagged behind, with most other assets doing just the opposite. Overall, Thursday’s moves should help legitimise Bitcoin and other cryptocurrencies within traditional finance.

Stock market structure analyst Dennis Dick sees the U.S. government’s actions as a reason for the digital asset industry to grow. Still, the president’s endorsement of crypto will attract more and more players to the market, whose purchase transactions will predictably affect rates.

This administration will support cryptocurrency. This news is good for those who are optimistic about coins. I hold Bitcoin long and believe it has a lot of upside potential over the next four years.

It's important to note that according to the standard duration of crypto's rise and fall cycles, 2025 should be the last for Bitcoin and other coins to grow. This means that the trader's version should be treated with caution, as the change of rate increases and collapses is relevant even for the stock market.

Bullrun on the cryptocurrency market

Bitwise CEO Hunter Horsley reacted to the news. According to him, what is happening shows the maturity of crypto, which is becoming an increasingly recognised asset in the world. And since the number of BTC holders will grow, “the famous 60 per cent collapses of the first cryptocurrency may be a thing of the past.”

Here’s his cue.

Counterparties that used to be a source of inconvenience are maturing into traditional institutions. The owner base is becoming more diverse: it’s no longer just individuals using apps, but wealth managers, institutional investors, family offices and hedge funds – each with their own views and time horizons. Cryptocurrency is increasingly recognised as a valuable asset.

Why was Trump’s crypto executive order criticised?

However, the document has its critics – among them are the experts of TD Cowen, led by Jareth Seiberg. According to their version, nothing serious has happened so far.

Every president creates commissions and working groups on key issues. This has a symbolic value, as it shows how much attention Trump’s team is paying to cryptocurrency, but this is not the same as changes in regulations.

In other words, the company’s analysts first want to see the results of such initiatives. Until they do, they will be cautious about what is happening.

Buying cryptocurrency by investors

The founder of the decentralised protocol Derive.xyz Nick Forster also does not believe in rapid changes in the coin market.

Traders have been expecting concrete action, not vague promises, and the market is making it clear that hype alone is not enough to make a lasting impact. Without real steps like the creation of a national reserve, the market will not be interested. Until the government demonstrates a tangible commitment to the sphere, market scepticism will persist.

To be fair, for a possible cryptocurrency reserve, the government will need an up-to-date coin regulatory framework. The working group has been given 180 days to propose one – it will also study the prospects for a national coin reserve. Therefore, it is not worth criticising the government and Trump for now, because they have not yet had the opportunity to do something.

It is banally early to criticise the US President's initiative on cryptocurrencies, because he has not been in his new position for even a week yet. In addition, among the positive changes we have already learnt about the creation of a working group on digital assets within the Securities Commission. And that's worth a lot given Gary Gensler's policies.

Look for more interesting stuff in our cryptocurrency chat room. We look forward to seeing you there today.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.