Trump’s new meme token could get its own ETF. When to expect the launch of the investment instrument?

One of Donald Trump’s key promises on the crypto sphere during the election campaign was to create adequate working conditions for the industry. In other words, developers and entrepreneurs should receive clear rules, fulfilment of which will allow them to develop their own projects and not be afraid of unexpected lawsuits from the Securities Commission. It seems that the positivity of the sphere participants is increasing, which is confirmed by new applications for launching cryptocurrency ETFs.

Which ETFs to buy in 2025

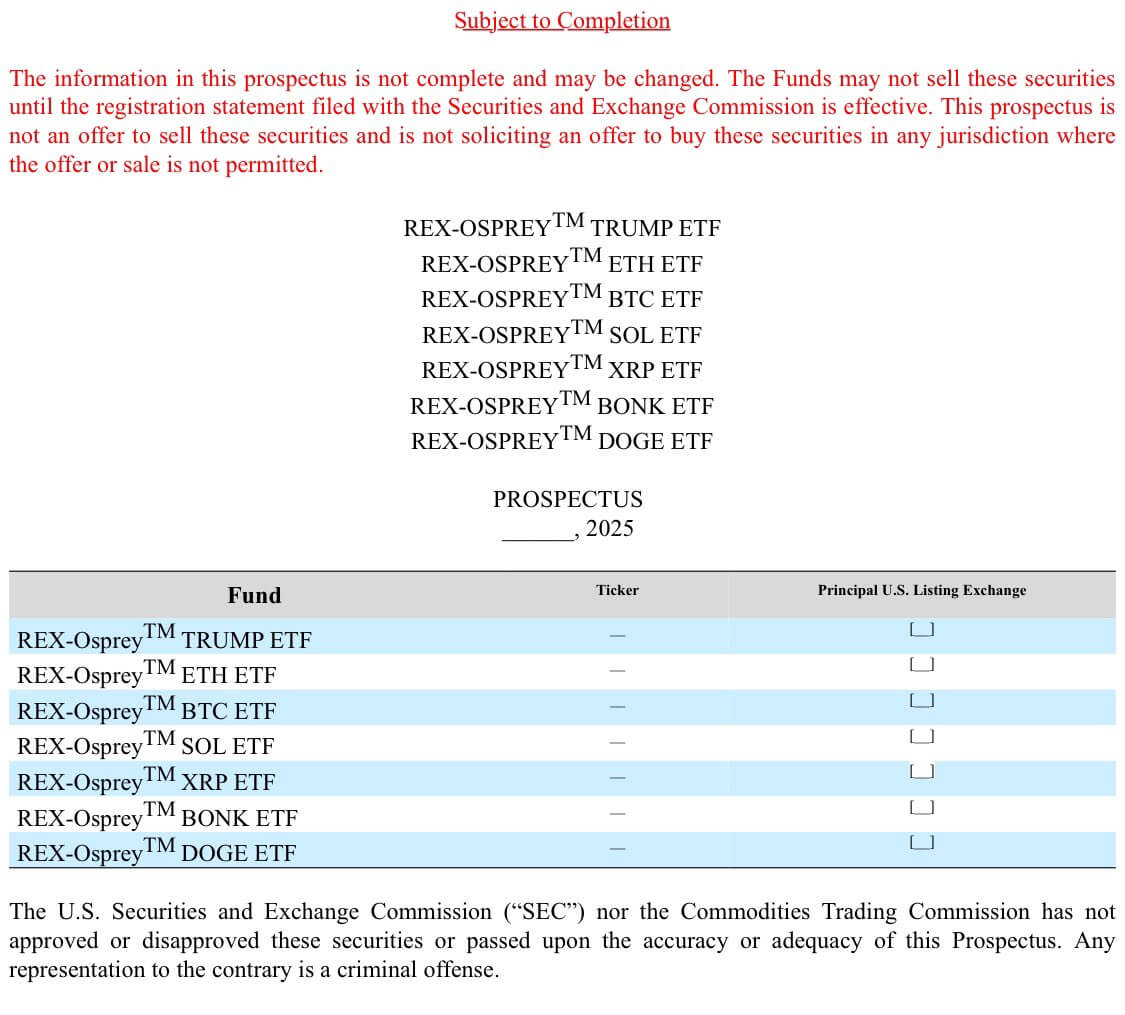

Osprey Funds and Rex Shares have filed seven applications with the Securities Commission to launch cryptocurrency ETFs. The main surprise among them were filings mentioning Donald Trump’s new meme token, Dogecoin, and the popular Solana network-based meme Bonk. Still, this asset category continues to be characterised by increased volatility and still hasn’t become a popular phenomenon among big investors.

The applications were created the day after Donald Trump’s inauguration. Moreover, they ended up at the Securities Commission a few hours before the news about the creation of a special working group on cryptocurrencies within the regulator.

REX-Osprey’s cryptocurrency ETF launch filings

Here’s a rejoinder from the filing that The Block cites.

The REX-OspreyTM TRUMP ETF (the “Fund”) seeks to provide investment results before fees and expenses that are consistent with Trump’s returns (the “TRUMP” or “Underlying Asset”).

Analysts confirm that the fact that applications for the launch of new cryptocurrency ETFs have been submitted speaks to expectations of a normalisation of digital assets amid the change of power in the US. Still, in early December, Trump chose Paul Atkins, who is considered friendly to cryptocurrencies, as chairman of the Securities Commission.

In addition, the SEC left Gary Gensler, who is remembered for fighting with the coin industry and litigation with representatives of the latter for several years. These changes, along with a renewed Congress, should be enough for the government to stop seeing crypto as a threat.

Former SEC head Gary Gensler

Applications to launch investment products have been filed under the Investment Company Act of 1940, similar to futures-based cryptocurrency ETFs. This was reported by Bloomberg analyst James Seyffarth. Here’s a comment on the matter.

They will hold a combination of derivatives, assets and a subsidiary in the Caymans that will own the assets. This is similar to the scheme that issuers use in the commodity ETF world to avoid Form K-1, but I’m not sure.

In my opinion, something like this can be perceived as the beginning of ETF issuers trying to push the boundaries of what is permissible with the new SEC administration. This way they are trying to see what they will be able to spend.

According to the expert, the new filings can be perceived as a kind of test for the SEC without Gary Gensler. They will show how open the regulator will be to the coin industry today.

James continues.

These funds are also structured in a unique and novel way to meet the requirements of the 1940 Act. It will be interesting to see how the SEC handles this structure and some of the more controversial memcoin-type assets. Still, $TRUMP has only been around for a few days.

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

When will Trump’s meme token ETF launch?

Bloomberg analyst Eric Balchunas believes that the fate of new applications to launch cryptocurrency ETFs will be decided noticeably faster than it usually happens. According to him, we’re talking about early April 2025.

Here’s the commentary Decrypt cites.

These are applications under the 1940 Act. Theoretically, if they are not rejected, they could hit the market as early as early April.

If approved, the new ETFs will be a bridge between the Internet memes and the world of traditional finance. Well, ordinary brokerage account holders will be able to interact with the former, which will definitely speak volumes about the development of the markets.

US President Donald Trump buys burgers for bitcoins

Saravanan Pandian, the head of the KoinBX platform, Saravanan Pandian noted the importance of the situation.

The crypto market holds on to the principles of innovation and cultural relevance. Dogecoin with its growing acceptance and the emergence of meme-based financial instruments reflect a shift in how a new generation interacts with investments.

What is happening with applications to launch cryptocurrency ETFs illustrates the dramatic change in the coin market due to the shift in power in the US. Obviously, investors will still get to experience new digital asset-based instruments this year. And something like this will definitely benefit the current bullpen.

Look for more interesting stuff in our crypto chat. We look forward to seeing you there right now.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.