Two more US states have introduced a bill to launch a strategic Bitcoin reserve. What are they?

At the end of December, there were three states in America, in which officials presented new bills for the connection with Bitcoin. These turned out to be Texas, Pennsylvania and Ohio, with the main justification being the strong inflation and dollar problems in recent years. Fortunately, the number of such states is increasing. They now also include New Hampshire and North Dakota.

What’s going on with the US Bitcoin Reserve

Legislation on the importance of linking to BTC was introduced in New Hampshire and North Dakota. In this way, the authorities once again emphasised the prospects of Bitcoin and blockchain-based digital assets in general for diversifying investment portfolios and treasuries of different countries, according to Cointelegraph.

Investors buying cryptocurrencies

As Satoshi Action Fund manager Dennis Porter notes, the bill in New Hampshire was introduced by Representative Keith Ammon, a Republican from the 40th District. The relevant document does not mention Bitcoin directly and instead uses the term “digital assets.”

According to Porter, this way state representatives get a better chance to approve similar bills, while at the same time not causing too much debate and activism among coin sphere averse citizens. Here’s his commentary on the matter.

The goal here is Bitcoin, however sometimes that is not possible depending on the state chosen.

Keith Ammon also commented on the event in a conversation with Decrypt reporters.

New Hampshire’s motto is “Live Free or Die,” which is basically “leave me alone and don’t burden me with unnecessary regulations.” We are pegged to the U.S. dollar, like it or not, but that would allow the state to invest a small portion of its funds in this uncorrelated new asset class.

Buying cryptocurrencies

As noted in the bill, the state treasurer would be given the ability to allocate state funds to precious metals like gold and platinum, as well as “any digital asset with a market capitalisation averaging $500 billion over the previous calendar year”.

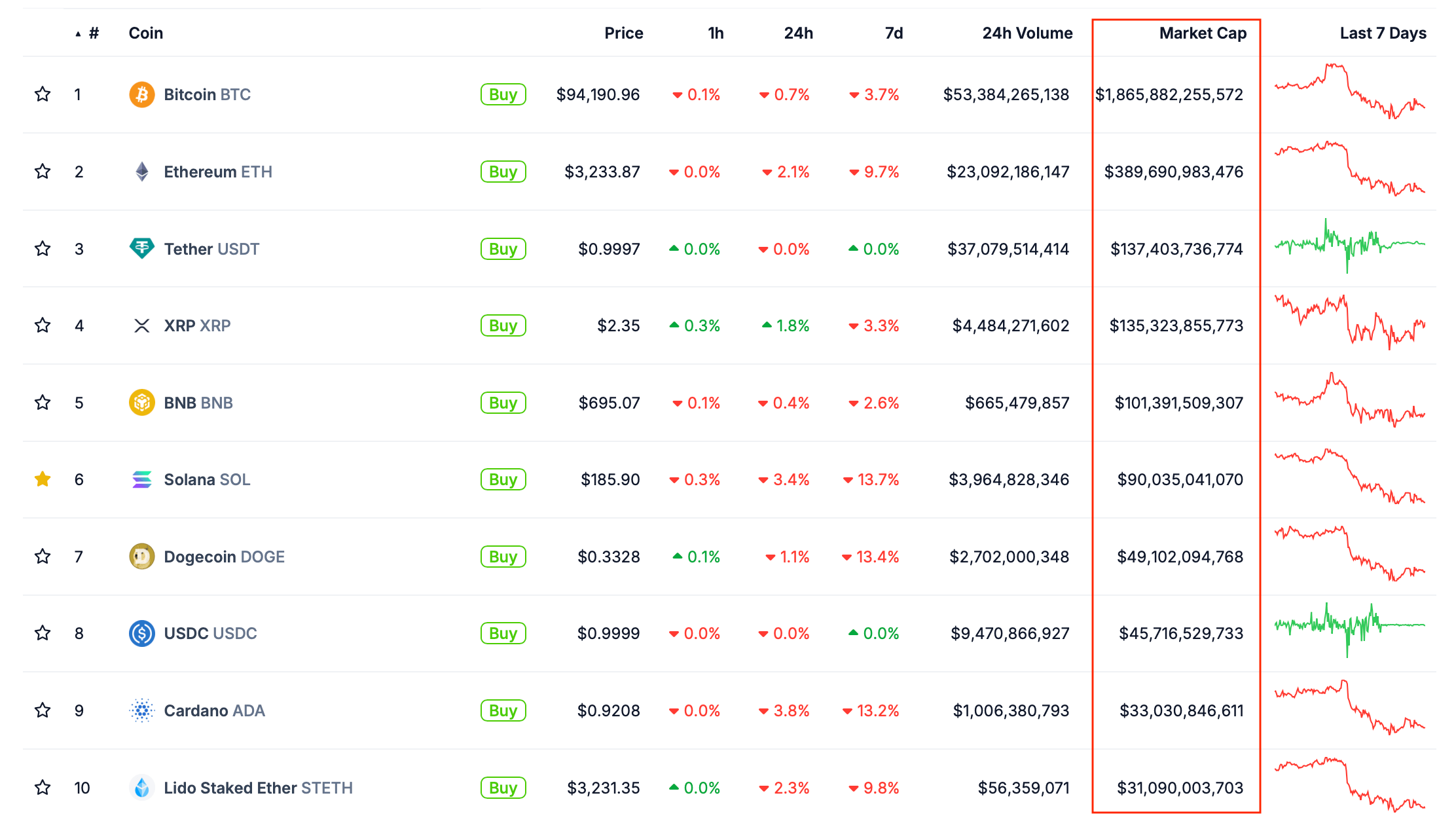

With this in mind, only Bitcoin investments will be possible, as the market capitalisation of the second largest cryptocurrency, Etherium ETH, is currently at 389 billion. However, as the current bullrun in the crypto develops, the number of supported coins will surely grow.

Actual market capitalisation of the largest cryptocurrencies in the industry

Since 1920, New Hampshire has held its first presidential primary, thus allowing residents to evaluate candidates from different parties before anyone else. With that in mind, there’s no reason why the state shouldn’t also be the first among bitcoin holders, Ammon noted. Being among the leaders here is critical, he said.

The state that is the last to set up a Bitcoin reserve will lose out. They need to act as quickly as possible, and that requires a certain amount of education from state officials.

Buying cryptocurrencies and unique tokens

Following a similar document on a strategic Bitcoin reserve was presented in North Dakota. The bill was supported by state representatives Nathan Thoman, Josh Christie, and Jeff Barta.

Then, in a separate tweet, Porter noted that the related document received eleven cosponsors. Which means early support for the project has been pretty substantial.

Which states want to buy bitcoins

As we have already noted, earlier legislation for the use of bitcoins was presented in Texas, Pennsylvania and Ohio. As local officials believe, the cryptocurrency is able to protect local residents from the depreciation of the dollar.

The week also saw news from Oklahoma, where Senator Dusty Devers of the US Republican Party introduced a Bitcoin bill. If approved, the latter would allow locals to receive their salaries in the first cryptocurrency, as well as use BTC to pay for goods and services provided.

😈 MORE INTERESTING CAN BE FOUND AT US IN YANDEX.ZEN!

Such initiatives began to appear after the newly elected US President Donald Trump promised to create a national cryptocurrency reserve in his election campaign. Then Senator Cynthia Lummis introduced a bill that would involve the American government buying one million BTC over five years.

Newly elected US President Donald Trump at the Bitcoin 2024 cryptocurrency conference

Cryptocurrency must be held for twenty years without being moved, and exceptions can only be made if coins are sold for the sake of paying off part of the government’s national debt.

It is believed that it is the new documents at the state level that will eventually become the basis for a similar bill on a nationwide scale. Accordingly, the US Federal Reserve will be able to allocate funds for the purchase of bitcoins.

So far, everything goes to the fact that the states of America will be the first to buy Bitcoin and, in the future, other cryptocurrencies. And when such operations will become commonplace, it will surely be possible to do the same at the state level. Under such conditions, the hype around the coin market will increase significantly.

Look for more interesting things in our cryptocurrency chat room. Visit us.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.