US court approves sale of $6.5 billion worth of bitcoins seized from Silk Road. When will there be a crypto flush?

Silk Road was one of the first and largest marketplaces that focused on illegal goods, substances and illegal services. It was characterised by its darknet operation using the Tor network and the use of bitcoins to keep users anonymous. The arrest of founder Ross Ulbricht led to the forced closure of the site and the confiscation of a huge amount of BTC. Apparently, these coins will soon be on the open market.

Silk Road Bitcoin Sale

This morning it was revealed that on 30 December 2024, the Federal District Court for the Northern District of California approved the liquidation of bitcoins, which became the largest case of cryptocurrency confiscation by a federal agency. Thus a complex legal battle lasting four years came to an end.

Chief U.S. District Judge Richard Seeborg denied a motion for a temporary restraining order against 69,370 BTC, now valued at $6.48 billion. Accordingly, the Department of Justice has been granted permission to get rid of the huge amount of coins.

The interface of the Silk Road darknet platform

Why the document surfaced on the internet just now is unknown. Suspicious is the fact that it happened after the sharp collapse of the coin market, which has been observed over the past few days. Still, earlier the US government repeatedly shared negative news after the crypto's drawdown, which created additional uncertainty and pressure from sellers.

The source of the news was the DB News account, which received confirmation of the relevant information from sources. Representatives of the project emphasised the importance of timing for such a decision.

In a week and a half, the United States will have a new President Donald Trump, whose administration has repeatedly reported reluctance to get rid of confiscated cryptocurrencies. Here’s a rejoinder to that.

A long-running dispute over ownership of seized bitcoins ended after Battle Born Investments was barred from attempting to delay the sale. The group had been asserting its rights through the estate in a related bankruptcy case, and had just the day before failed in a Freedom of Information Act (USA) request case used in an attempt to reveal the identity of “Individual X” who originally transferred the bitcoins.

As a reminder, representatives of Battle Born Investments claimed to be entitled to the said amount of bitcoins, which they received during the bankruptcy case of the person believed to be the original owner of the coins.

Meanwhile, "Individual X" is referred to as the anonymous person who handed over BTC to authorities in 2020. Court documents confirm that the coins are related to the Silk Road platform, which was shut down by law enforcement in 2013.

Silk Road’s closed darknet marketplace page

Battle Born Investments’ lawyers have already called the decision “yet another egregious example of the Justice Department’s abuse of the civil asset forfeiture process.” In their version, the government “relied on procedural tricks to silence certain important facts.”

It was previously thought that the seized cryptocurrency could be the basis for a national Bitcoin reserve, the creation of which Donald Trump has previously talked about. If Cynthia Lummis’ bill is agreed and signed into law, then the US government will acquire one million bitcoins over the next five years.

Although the current development suggests that the crypto could be leaked even before Donald Trump’s inauguration.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Will Bitcoin fall in the near future

The possible sale of the said amount of coins could be one of the largest liquidations of cryptocurrencies by the government. However, the court decision does not mean an immediate sale of coins.

As Decrypt representatives note, such a procedure requires several administrative actions and even includes time periods for appealing such a decision.

Previously, the Department of Justice has already got rid of cryptocurrencies. Specifically, on 3 December 2024, the US government transferred the equivalent of $2 billion worth of BTC associated with the Silk Road platform to the Coinbase exchange.

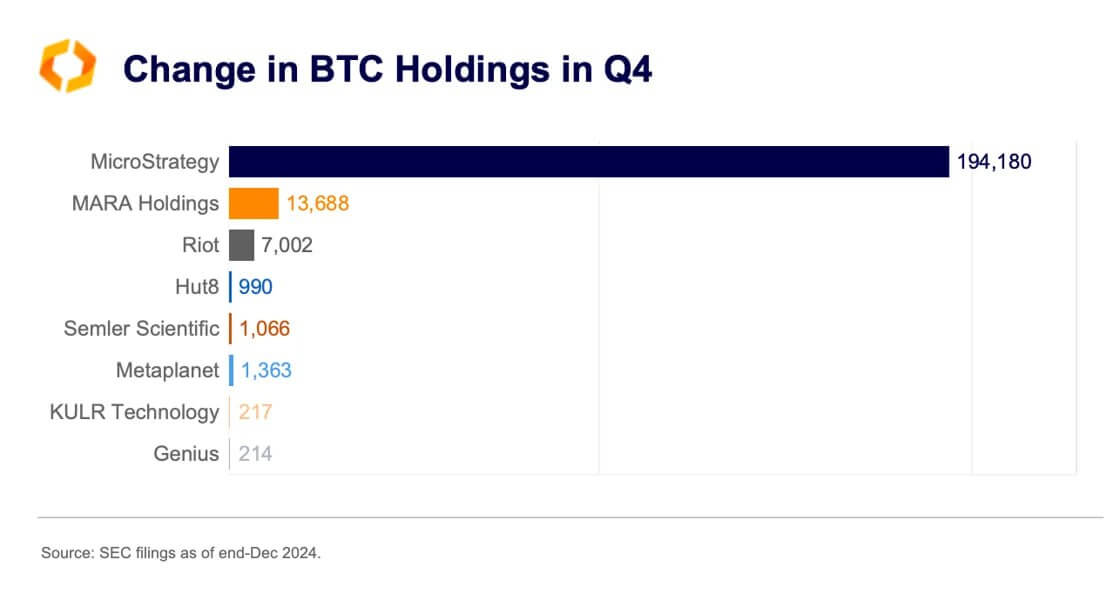

And while 69,370 BTC is a huge amount of money, its sale certainly won’t spell the end for the cryptocurrency industry. Besides, some companies are buying much larger volumes of coins.

MicroStrategy, along with the famous Michael Saylor, bought 194,180 BTC during the fourth quarter of 2024. The chart also shows the pace of crypto acquisitions by MARA Holdings, Riot, Hut8 and other giants.

The scale of bitcoin accumulation by different companies in the fourth quarter of 2024

Which means there will surely be plenty of people willing to absorb such a volume of bitcoins.

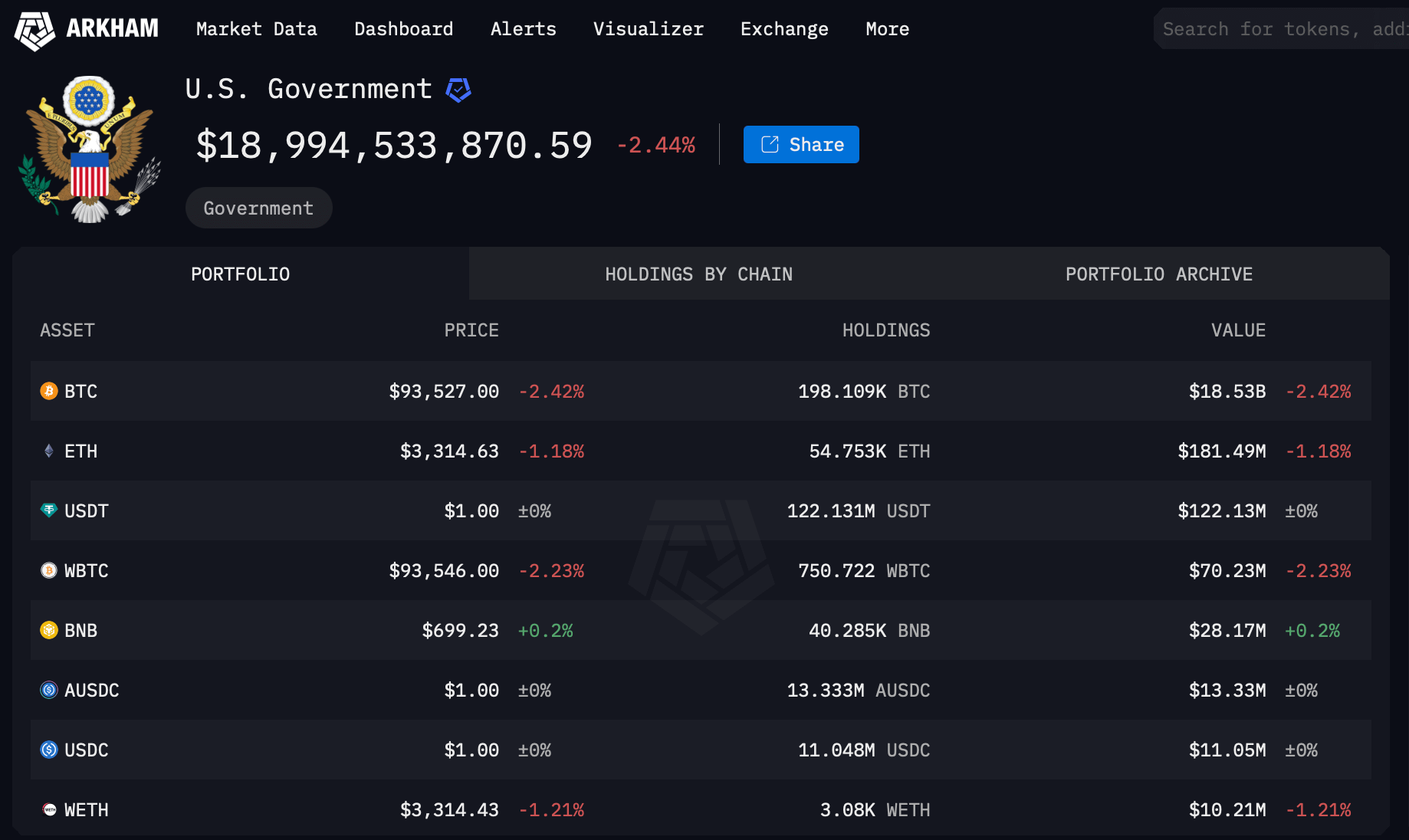

How many bitcoins does the US government have?

Today, the US authorities control the equivalent of $18.99 billion in cryptocurrency. As the Arkham platform shows, BTC accounts for the majority of the $18.53 billion portfolio.

US government cryptocurrency holdings

Second place with 181 million is held by Efirium, and in third place is the USDT stablecoin with the equivalent of $122 million.

News about the possible sale of cryptocurrencies by the authorities constantly leads to excessive volatility in the market and collapses in rates. It is possible that insiders learnt about what was happening earlier, whose activity became another reason for the current industry sag.

However, eventually the sales will end, and Bitcoin will get conditions for growth. Still, in the summer, the German government dumped 50,000 coins at $57,000 each, which ultimately didn't stop BTC from making almost two X's since then.

Look for more interesting stuff in our crypto chat. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.