Utah approves bill for bitcoin hoarding by the state. When will cryptocurrency purchases begin?

In mid-January, a bill to purchase bitcoins was introduced in the new legislative session in Texas. It was made by state senator Charles Schwertner, who noted the importance of buying cryptocurrency for the sake of economic freedom and the growth of the local digital economy. Other US territorial units are not lagging behind on this issue and are gradually approving similar projects. In particular, Utah has already succeeded in this.

Which states buy bitcoins in the US

The Committee of the House of Representatives of Utah passed a bill that gives the state the opportunity to purchase cryptocurrencies. Now it must be approved by the majority of members of the House of Representatives and the Senate of Utah, after which the document will go to Governor Spencer Cox for signature.

As representatives of Cointelegraph note, the latter is a preliminary supporter of the digital asset industry, so there should be no problems with its approval.

Utah Governor Spencer Cox

The bill in question is HB 230, titled “Blockchain and Digital Innovation Amendments,” which the House Economic Development Committee approved with 8 votes in favour amid 1 against on 28 January.

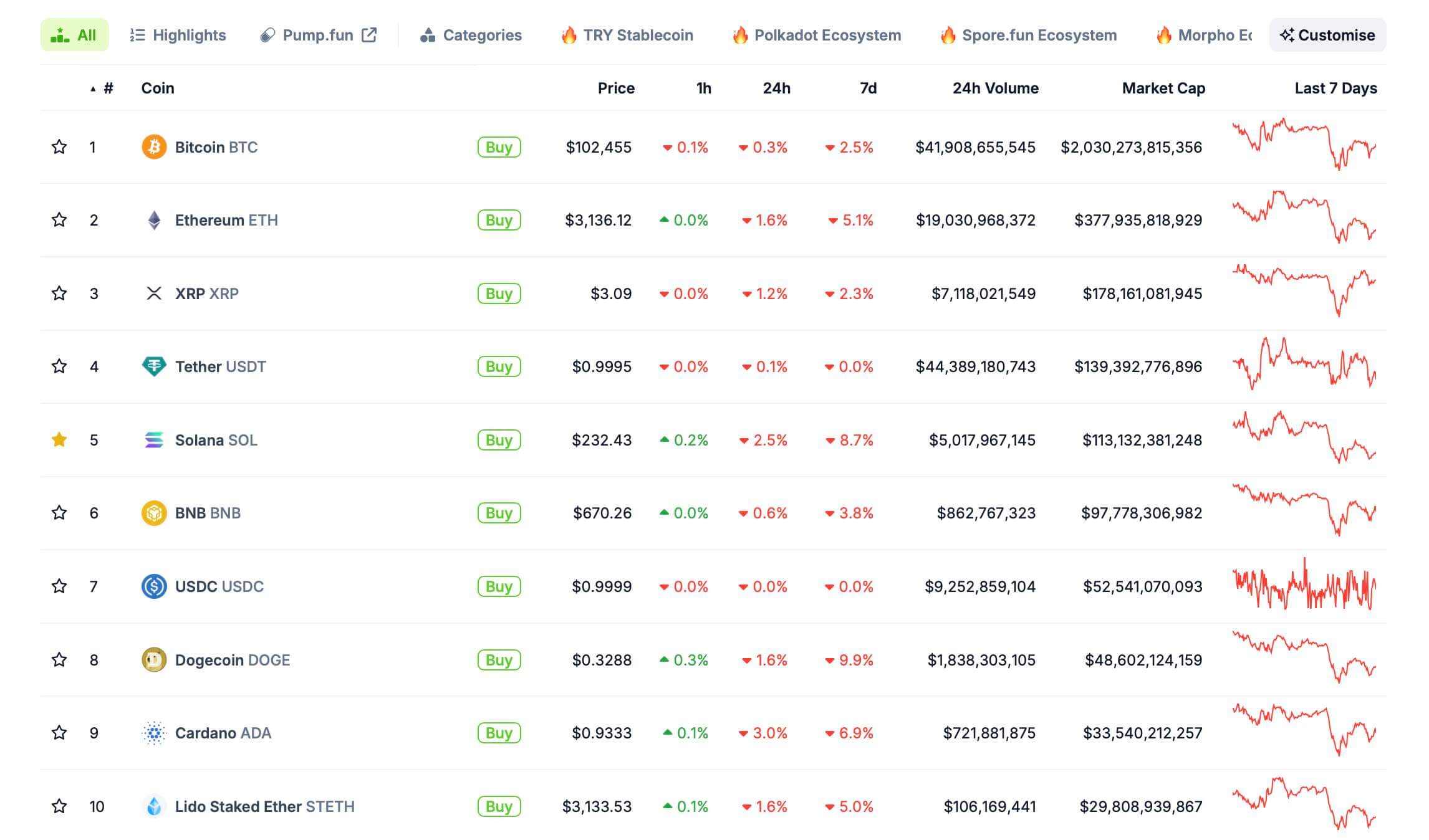

The document was presented by Utah Representative Jordan Teuscher last Tuesday, with the bill allowing the state treasurer to allocate up to 5 per cent in certain funds for the purchase of “qualified digital assets”. These are coins whose market capitalisation exceeds the $500 billion level and stablecoins.

Accordingly, the state will now be able to exclusively purchase bitcoins and tokens linked to the U.S. dollar exchange rate like USDT and USDC.

The largest cryptocurrencies by market capitalisation today

According to the Bitcoin Reserve Monitor platform, twelve US states have already introduced bills today that give local treasuries the right to allocate money to buy crypto. They also include Arizona, Wyoming, and Texas.

As noted by Dennis Porter, head of Satoshi Action Fund, Utah became the second state in which the relevant bill was approved at the committee level. He believes the state will be able to get ahead of Texas when it comes to direct investment in Bitcoin. Here’s the relevant rejoinder.

And although Utah has introduced a similar bill eleventh in line, we’ll be the first to pass it.

Utah’s document requires storage of purchased digital assets through secure custodial solutions, qualified custodians, or exchange-traded products (ETPs). In addition, the treasurer will be able to send some of the coins to staking or use them for cryptocurrency lending on special platforms from decentralised finance.

Buying cryptocurrencies by investors

Another important point in the bill is the prohibition of state and local authorities to restrict the conduct of cryptocurrency payments for goods or services by local residents. Accordingly, the opportunity to use digital assets in real life will become much greater. If adopted, the document will come into force on 7 May 2025.

Utah Governor Spencer Cox tentatively supports the popularisation of digital assets. Still in 2022, he signed a bill to create a working group on blockchain and digital innovation – something similar was approved by US President Donald Trump last week.

Against this backdrop, South Dakota Representative Logan Manhart has endorsed the idea of creating Bitcoin reserves for the US. Here’s his comment.

I am proud to announce that I will introduce a bill in the South Dakota House of Representatives to create a strategic bitcoin reserve.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

What cryptocurrencies are criticised for

The development of digital assets is traditionally opposed by US Senator Elizabeth Warren, who shaped her last election campaign on the theme of “armies against cryptocurrencies”. Now she has criticised Trump’s nominee for US Commerce Secretary, Howard Lutnick, Cointelegraph reports.

The reason for this is the manager’s connection and interest in the USDT Tether steiblcoin issuer. Still a year ago, the head of Cantor Fitzgerald LP publicly confirmed the existence of reserves in the giant.

Warren said there were serious concerns because of Tether’s “deep involvement in and support for Tether, a known facilitator of criminal activity whose USDT token has previously been described as the favourite cryptocurrency of criminals.” Here’s a rejoinder on the topic.

And while you agreed to give up your stake in Cantor Fitzgerald, which owns 5 per cent of Tether and acts as its asset manager, the move does not remove questions about your close personal ties to the company and its affiliates.

In general, Democrats continue to push their line that cryptocurrencies are allegedly the tool of criminals. For example, the day before, they wanted to investigate what was going on with Donald Trump’s meme token. However, in reality, the fight against digital assets also influenced their defeat in November, as many people are banally fed up with this approach.

US Senator Elizabeth Warren

And since Warren promotes this narrative even in her rejoinder, her criticism has no merit. Still, the dollar is far more likely to be used to break the law than cryptocurrencies, yet politicians are silent about it.

Everything now points to the fact that purchases of bitcoins and other cryptocurrencies by the U.S. government is a matter of time. One way or another, representatives from many states have prepared the infrastructure to allocate capital to Bitcoin and stablecoins. And some such bills are clearly going to pass.

Come on over to our crypto chat room. We look forward to seeing you there.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.