What categories of cryptocurrencies will the biggest investors bet on in 2025?

The new year should be a good one for the crypto industry. Still, the US will soon have a president who supports the niche of digital assets. In addition, Donald Trump has already made several appointments suitable for the world of coins – the next head of the SEC Paul Atkins is an example of such an appointment. Now let’s find out what venture capitalists expect from cryptocurrencies in 2025.

Before we evaluate the popular types of crypto assets in the new year, we need to deal with the old one. According to Coingecko analysts, tokens related to the world of artificial intelligence turned out to be the most HYIP and profitable topic in 2024. For example, these could be assets managed by an AI bot or a so-called agent.

The average yield of such tokens was 2,940 per cent, and the main growth wave was observed at the end of the year.

The most popular categories of cryptoassets in 2024 and their average yields

The second place was occupied by meme tokens, which attracted a mass of investors in the first months of 2024. Their average yield was 2185 per cent.

To assess what is happening on the market, Coingecko analysts took the ten largest representatives of a certain niche by market capitalisation and calculated the changes in their value throughout 2024. The total figure was then divided by the number of participants.

.

In third place were the so-called RWA tokens, i.e. coins from the real world. Their return result was 820 per cent.

In which cryptocurrencies to invest in 2025

Reflections on the prospects of 2025 representatives of the world of venture capital shared with journalists Cointelegraph. The first opinion was voiced by the head of the company-managing assets of institutional level HashKey Capital Dan Chao.

According to him, cryptocurrency projects will attract much more money from venture capitalists in 2025. Such players will be interested in stablecoin-based products, real-world asset tokenisation (RWA) and tokens using artificial intelligence and infrastructure systems.

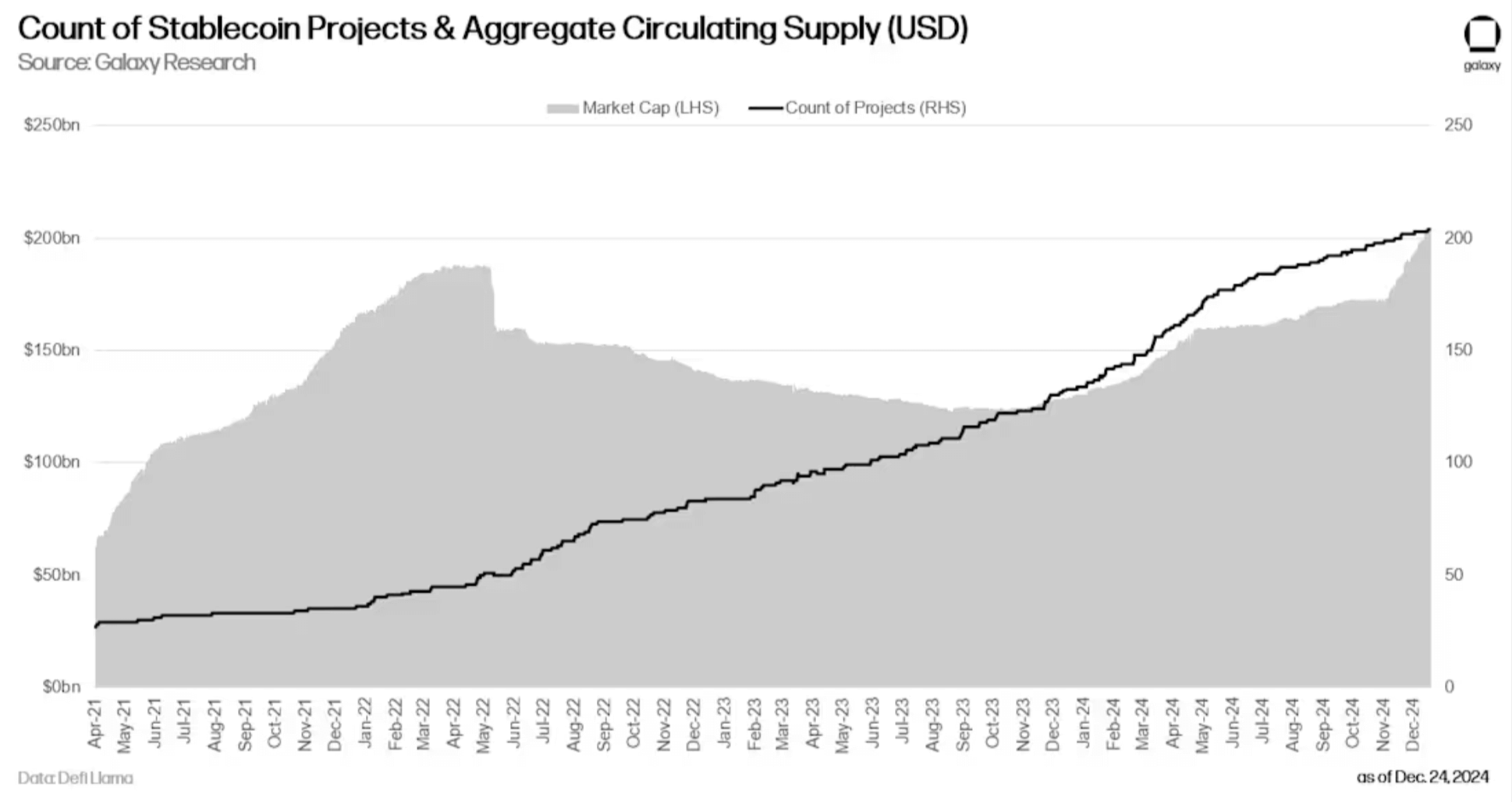

The growth in the overall capitalisation of stablecoins

The reason for this is the sharp growth of the crypto market in 2024 and investor positivity on the back of Donald Trump’s victory in the US presidential election. Still this event could lead to better regulation of digital assets in this country and will definitely end with a change in the leadership of the Securities Commission.

Here is a quote on the matter.

Given the favourable macroeconomic environment on the back of the US stimulus policy and the formalisation of the regulatory framework for cryptocurrencies, such macroeconomic factors set the stage for increased venture capital investment in 2025.

However, there are also market risk factors to consider. We are talking about possible geopolitical frictions in the world and increasing deficit spending. In such conditions, the coin market may face increased exchange rate volatility and uncertainty.

Newly elected U.S. President Donald Trump at a Pubkey bar

According to Chao, stablecoins have proven to be the most justified way to use digital assets in 2024, with large investors appreciating the opportunities for such tokens in emerging economies. Still, residents of such countries often suffer from the depreciation of local fiat currencies, and with that in mind, they want to connect with a more stable dollar.

What is especially important, you don’t need a bank account to use staples. In addition, transactions with such assets on the basis of modern blockchains like Solana are carried out almost instantly, and commissions are hundredths of a cent.

According to analysts of the World Bank, today about 1.4 billion dollars remain without access to banking services, which is mainly due to the lack of appropriate infrastructure. And just the latter is able to replace smartphones with internet connection and cryptocurrency wallet.

How much money will invest in cryptocurrencies in 2025?

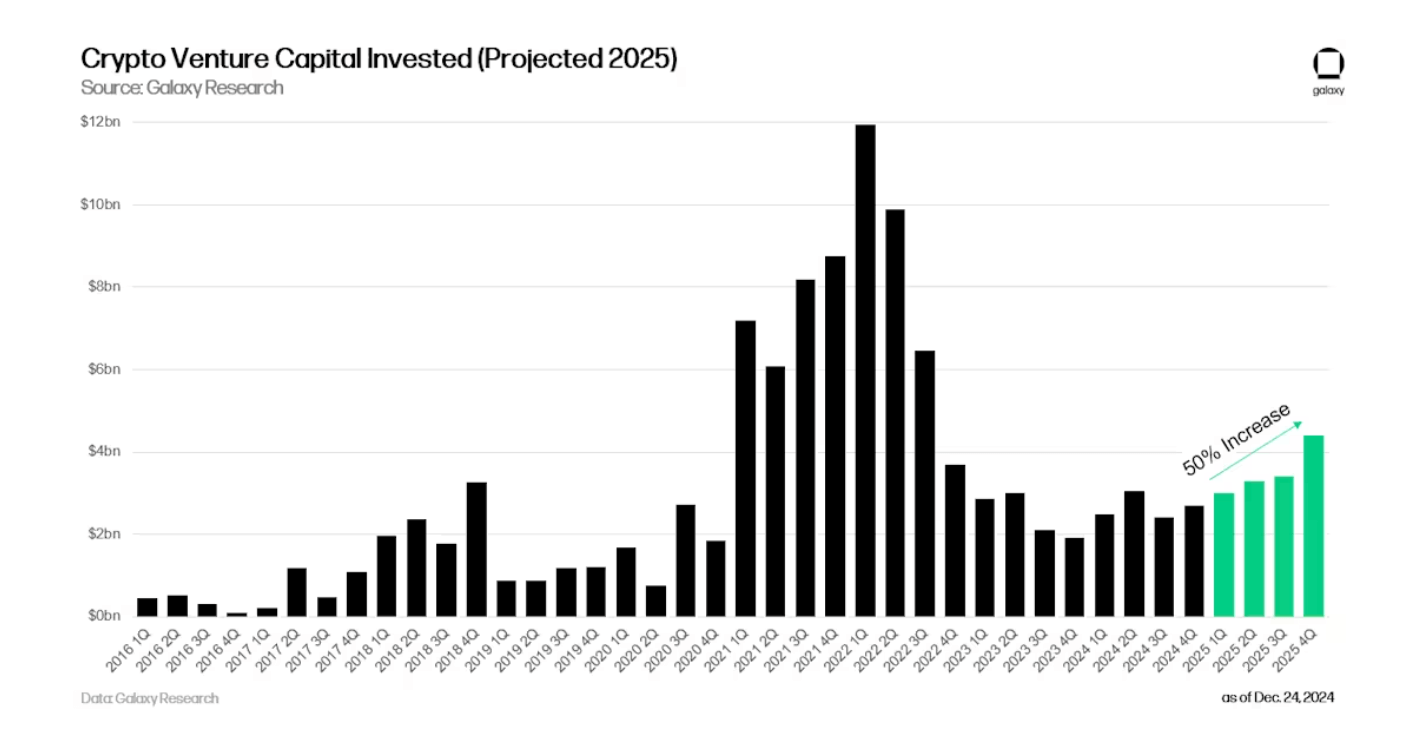

As noted by an analyst under the pseudonym Infinity Hedge, the volume of venture capital investments in cryptocurrency projects in 2025 will exceed last year’s result. However, they are unlikely to surpass the record set during the previous bullrun in 2021.

Blockchain companies raised about $13.6 billion in 2024, which is well ahead of the $10.1 billion figure for 2023. Experts at the PitchBook platform are betting on a 50 per cent jump in the figure in the new year, that is, to the 18 billion mark.

Possible investments from venture capital in the cryptocurrency industry

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

So far, we can assume that 2025 will be a much better year for the cryptocurrency industry. Still in the United States for the first time there will be a president who supports the niche of digital assets, well, and the Securities Commission will presumably stop suing many projects.

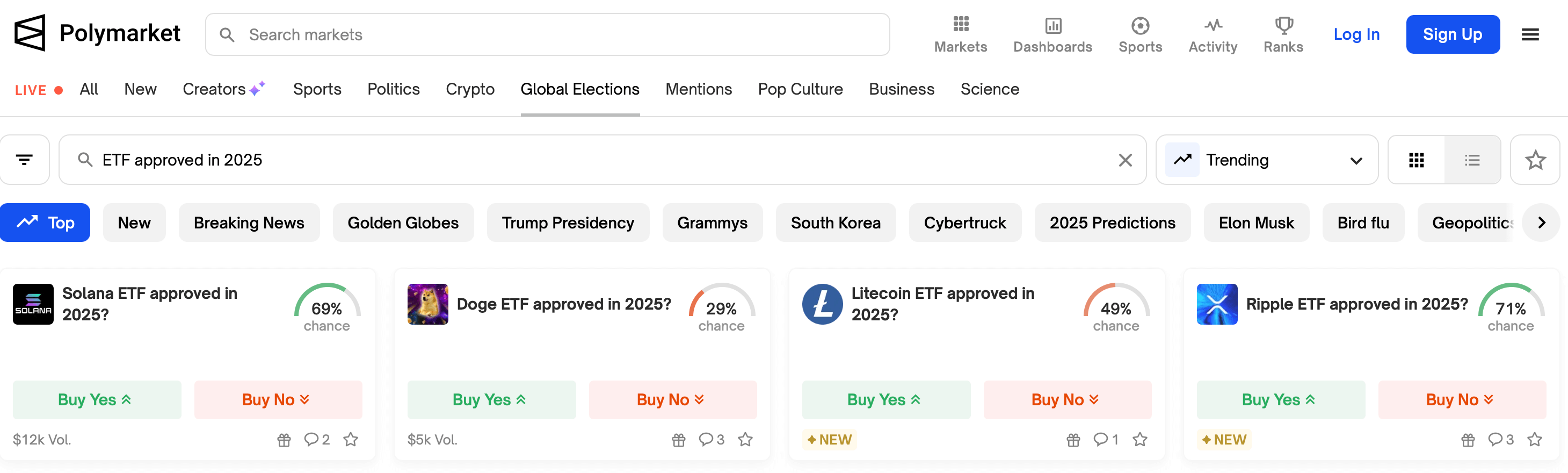

Under such conditions, we should expect that new spot ETFs based on altcoins will be launched on US exchanges. According to users of the decentralised betting platform Polymarket, we are likely to see the launch of exchange-traded funds on Solana and XRP in 2025. At the same time, the respective chances of Litecoin and Dogecoin are much lower.

The prospect of approval of ETFs for different cryptocurrencies in 2025

The change of power in the US and adequate regulation of cryptocurrencies in this country will make the coins attractive not only for ordinary users. Large investors will also pay attention to this category of assets. This means that we can expect more and more new projects in the sphere.

.

Look for more interesting things in our crypto chat. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.