Which regular bitcoin buyer will become the first company in the S&P 500 index: the VanEck version

One of Donald Trump’s most high-profile campaign promises was the prospect of a national Bitcoin reserve for the US. It supposedly involves buying a million BTC over five years, which would then be held for at least twenty years. Although it hasn’t come to that yet, many market participants are purchasing the cryptocurrency themselves. Well, some of them are also claiming to be listed in the S&P500 index on top of that.

Requirements for listing in the S&P 500 index

Financial services and digital payments company Block – formerly known as Square – could be the first company with an obvious strategy to acquire bitcoins in the S&P 500 index. The corresponding forecast was voiced by Matthew Siegel, head of digital asset research at the VanEck investment fund.

The purchase of cryptocurrency by investors

The expert shared the rationale behind the version on Twitter. According to him, six key criteria must be met in order to get on the list of the 500 largest US companies by market capitalisation, Cointelegraph reported.

These are a market capitalisation above the $18 billion mark, at least 10 per cent of shares in free float, and positive earnings for the last quarter. In addition, earnings for the previous four quarters must be positive in accordance with generally accepted accounting principles (GAAP).

The final points are that the company is highly liquid, at least one year since its IPO or going public, and has a domicile in the US.

According to Siegel, Block has achieved earnings compliance beyond the first quarter of 2024. However, there are no guarantees, as “inclusion in the S&P500 is not formulaic and is approved by the members of the relevant index committee.”

As historical data shows, the inclusion in this index of companies that met all of the above criteria took from 3 to 21 months. Which means the chances of Block being added in the near future are quite high.

After the publication, Siegel was asked why he didn’t bring up Tesla, which is already in the S&P500 index and owns bitcoins on its balance sheet. A VanEck spokesperson noted that “Tesla does hold BTC.”

The option to pay in BTC on Tesla’s website, available in spring 2021

However, the expert considers the company a regular holder of cryptocurrency. Still, the car manufacturer led by Ilon Musk does not have a clear strategy for acquiring bitcoins unlike Block. And this is a very important difference.

Recall, Tesla announced the purchase of BTC for $1.5 billion in February 2021. This is where the acquisitions ended, because further the giant only conducted rounds of sales of the digital asset.

At the same time, Block is allocating 10 per cent of its monthly gross profits from its first cryptocurrency transactions to the purchase of Bitcoin, acting in a “predetermined and recurring pattern.”

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

Cryptocurrency exchange Coinbase can also claim to be included in the index in terms of performance. However, analyst VanEck considers this option more risky for the committee, since the activities of this platform are focused exclusively on digital assets.

In general, representatives of the Index Committee are really interested in diversifying the sectors of the companies represented in the S&P 500. Right now, financial companies account for about 14 per cent of the index’s participants, so an expansion of this area seems likely.

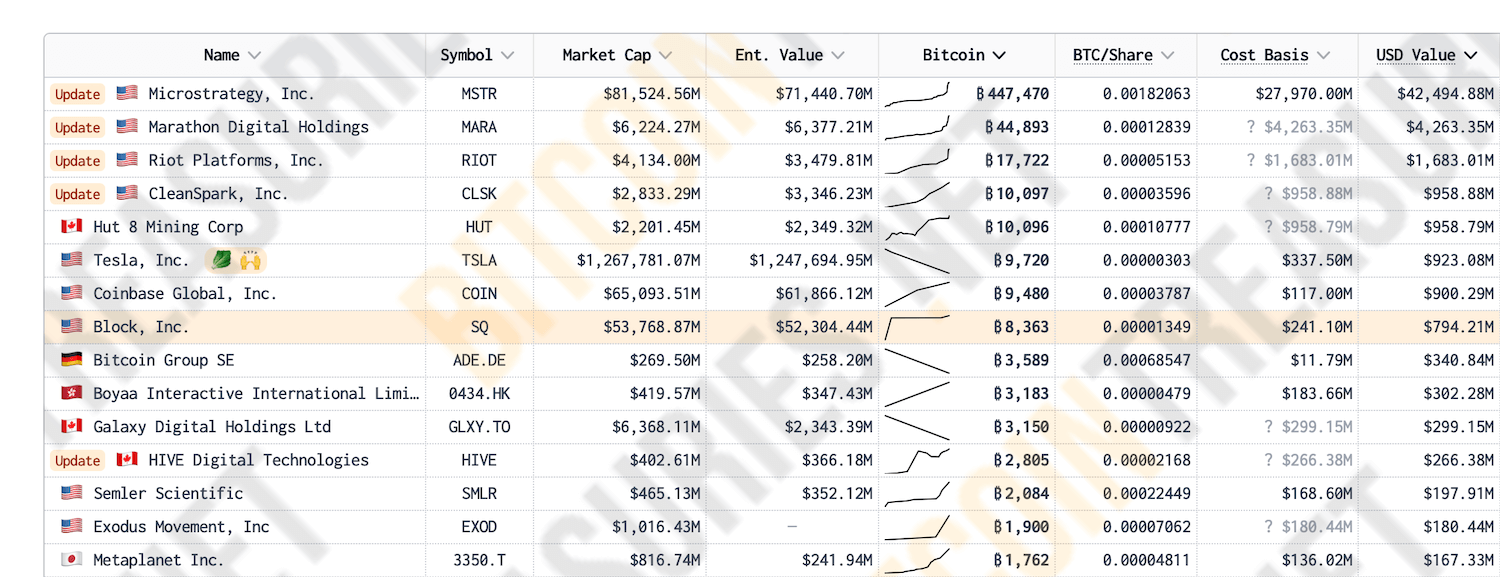

As of today, Block has accumulated 8,363 bitcoins, which are valued at $794 million at the current exchange rate. That puts it at number eight in the ranking of the largest holders of BTC among publicly traded companies.

Largest Bitcoin holders among public companies

In December 2024, shares of the largest BTC custodian called MicroStrategy were added to the Nasdaq 100 index. The giant is expected to be able to attract even more capital for bitcoin purchases, as its securities will be bought passively through the world’s largest ETFs, similar to Invesco’s QQQQ, where MSTR will also be added.

Who’s buying Bitcoin now

Although the prospects of creating a national Bitcoin reserve in the U.S. remain uncertain, many companies are actively accumulating the cryptocurrency. The day before, representatives of the publicly traded miner CleanSpark reported having more than 10 thousand BTC.

ASIC-miner for Bitcoin mining

The company now holds 10,097 coins worth the equivalent of $957 million, with this figure increasing by 236 per cent in a year.

As a result, CleanSpark became the fourth public miner to surpass this mark. Previously, Marathon Digital, Riot Platforms and Hut 8 did so.

Also in the week about the prospects of creating a reserve of the first cryptocurrency spoke in the national bank of the Czech Republic. A senator in Oklahoma suggested using Bitcoin to pay salaries and pay for products or services.

The forecast of VanEck experts demonstrates the change of trend in the world of finance. Now more and more big players are not shy to get involved with cryptocurrencies and thus set an example for others. And since the possible purchase of bitcoins by the U.S. government is looming on the horizon, the prospect of more giants accumulating coins is becoming much more likely.

.

Look for more interesting stuff in our cryptocurrency chat room. We look forward to seeing you there right now.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.