Who is investing in crypto: results of a fresh CryptoQuant survey

December 2024 turned out to be a record month for trading volumes on centralised exchanges. The total value of spot and derivatives transactions rose by 7.5 per cent to $11.3 trillion. The largest number of spot trades were made on the Binance platform, accounting for transactions worth $946 billion. But who are the people who invest in crypto? A fresh survey by analysts at the CryptoQuant platform provided the answer.

Who is buying cryptocurrency

As the survey results show, the digital asset market is dominated by young, educated and experienced investors. At the same time, they most often use the Binance trading platform, which remains the most popular exchange among players.

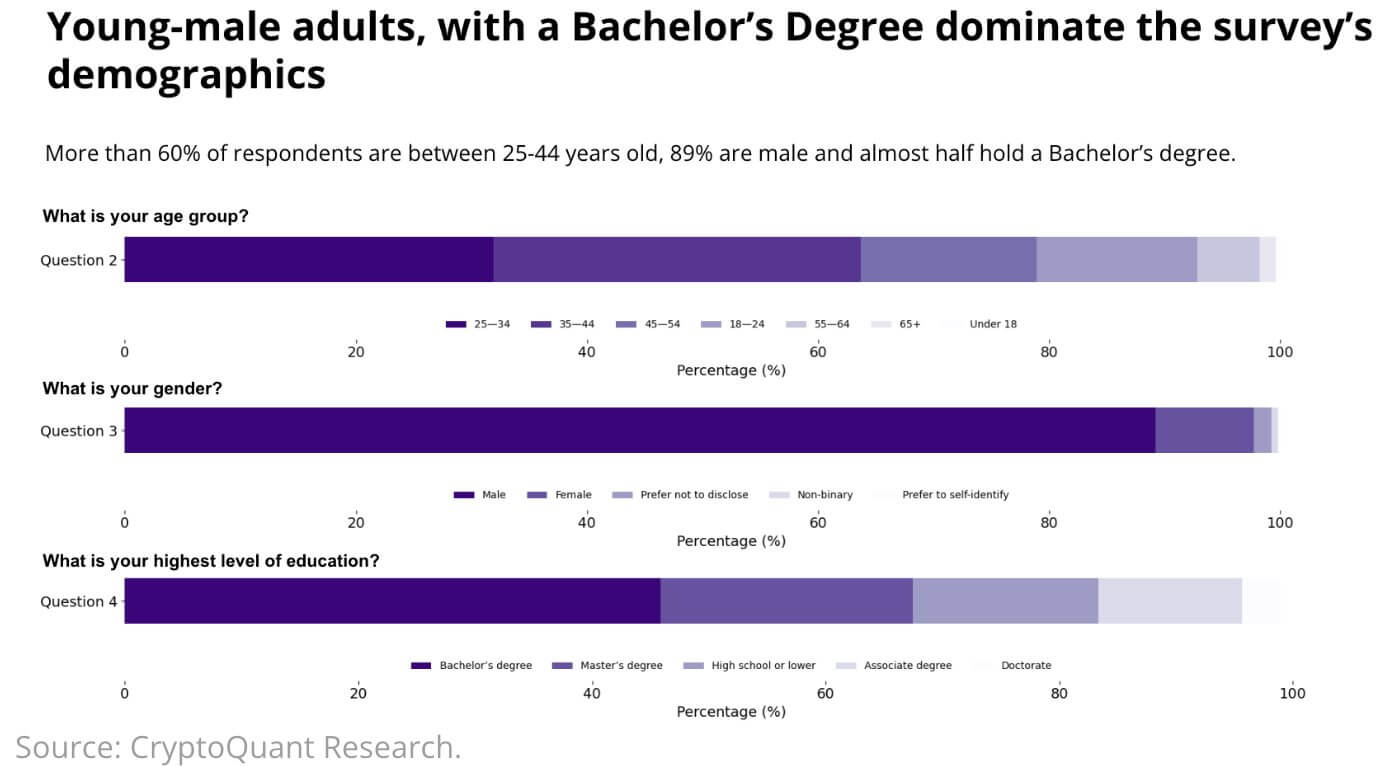

About 60 per cent of crypto investors are between the ages of 25 and 44, meaning they are relatively young participants in the financial markets. According to the study titled “Cryptocurrency Survey 2024: Exchange Use and Investor Behaviour”, among all categories, the age of 35 percent of coin users is between 25 and 34 years old, while 26 percent are between 35 and 44 years old.

CryptoQuant’s survey results on crypto investors

Coin holders are also often highly educated. For example, about 50 per cent of respondents are bachelor’s degree holders, while 28 per cent of respondents have earned an additional degree.

When it comes to gender, men are much more common than women in crypto: the ratio is 89 per cent and 11 per cent respectively.

Most marketers invest less than $10,000 a year in crypto, indicating the dominance of conventional retail players in the sphere. The largest number of respondents live in Asia with a score of 40 per cent. Europe and North America followed in the ranking with scores of 29 per cent and 10 per cent respectively, Cointelegraph reported.

Next, the analysts looked at what players are guided by when investing in a particular project’s crypto asset. 22 per cent of respondents conduct their own research on the coin, taking an interest in its creators, tokenomics and the so-called roadmap. 16 per cent of respondents rely on the recommendations of celebrities on social networks like Twitter, well, and a minority of players listen to the advice of friends and the media.

76 per cent of market participants prefer to conduct transactions on spot, i.e. without the use of debt capital from exchanges. Accordingly, the rest use derivatives, futures and other popular instruments, which imply much greater risk, including full liquidation of the trading position.

The last point in the description of investor behaviour was their desire to receive additional returns on their own savings. It turned out that only 28 per cent of respondents send coins to staking or other platforms to increase the stock of digital assets.

Which crypto exchanges are the most popular

Binance remains the industry leader and the most popular centralised exchange among investors. As noted in the CryptoQuant report, 53 per cent of those surveyed cite it as their primary transaction platform. Here’s a rejoinder to that.

Binance leads globally as the preferred exchange with the exception of North America, where Coinbase dominates. A total of 53 per cent of respondents use Binance as their primary exchange. 48 per cent store the majority of their assets on Binance, and half of respondents say their biggest profits have been made on this platform.

Binance crypto exchange chief executive Richard Teng

Bybit, Binance, OKX and Bitget are the choice of professional traders who engage in coin trading as a full-time occupation – we’re talking about more than 30 per cent of the figure. Regular players who don’t deal all day favour Coinbase, Crypto.com and Kraken. These three platforms were chosen by 80 per cent of those surveyed.

It turned out that 83 per cent of crypto owners try to avoid platforms that have faced regulatory pressure. Again, a majority of respondents at 32 per cent named Binance as the exchange that complies with regulatory guidance from governments more thoroughly than the others.

Which crypto ETFs will emerge in 2025

New spot cryptocurrency ETFs could be waiting for us in 2025, according to The Block. According to Bloomberg analyst Eric Balchunas, Litecoin (LTC) based exchange traded funds are likely to be such next approved instrument.

Here’s a rejoinder on the matter.

Rumours have reached us that the Form S-1 for Litecoin ETFs has received comments from the SEC. This confirms our assumption that it is LTC that should be the next coin to receive SEC approval.

Litecoin LTC creator Charlie Lee

Note that JPMorgan analysts do not agree with this version. Earlier they said that they expect the approval of ETFs on cryptocurrencies Solana and XRP. The former are able to raise $3-6 billion, while the latter are able to raise $4-8 billion.

CryptoQuant's research hints that cryptocurrencies are a preferred asset among younger people. Accordingly, they are certain to remain connected to the digital asset market in the future and maintain a good attitude towards decentralised platforms. Well, this creates conditions for the growing number of crypto investors.

Look for more interesting things in our crypto chat room. We are waiting for you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.