A key US financial regulator will stop governing the crypto market through enforcement. What did investors have to say about this?

The current chair of the US Commodity Futures Trading Commission (CFTC), Caroline Pham, has announced the start of a restructuring within the regulator. As a result of the changes involved, the CFTC will no longer engage in regulation through enforcement. Pham’s statement this week mentioned that the Commission will split its enforcement division into two working groups. They will focus on tackling fraud at different levels, from deception to large organised schemes.

How are cryptocurrencies regulated in the US?

According to Cointelegraph’s sources, information about changes within the agency was published on the CFTC’s official website. This is a clear outcome of the change of political leadership in the US, as support for the crypto market was one of the priorities of the election campaign of the new president Donald Trump.

In December, the CFTC reported more than $17 billion in cash compensation for fiscal year 2024. Most of the funds came after the regulator’s enforcement action against the bankrupt FTX exchange. The commission also filed suits against Binance and its former CEO Changpeng Zhao, former Voyager CEO Stephen Ehrlich, and former CEO of lending platform Celsius Alex Mashinsky.

Current CFTC Chair Caroline Pham

The announcement notes that the regulator will not resort to enforcement through force “against bona fide citizens.” Here’s a related rejoinder on the matter.

The Commission will divide these responsibilities between two working groups. They will focus primarily on fraud against individuals, as well as Commodity Exchange Act violations and large-scale manipulation.

The situation with the CFTC is reminiscent of what is happening with the SEC. This week, Hester Pearce announced a shift in the regulator's approach to digital assets. The Commission is committed to providing clarity on which coins can be considered securities and which can't. This topic was previously used extensively by Gary Gensler, who labelled all cryptocurrencies except Bitcoin as unregistered securities, which was then used to file lawsuits in court.

Current head of enforcement Brian Young left a comment on the change.

The reorganisation into working groups will strengthen our active and vibrant enforcement programme, allowing our talented staff to focus their expertise on issues that deliver justice for victims and maintain public confidence in the integrity of our markets.

Former CFTC Chief Rostin Banham

The announced changes were the first item on the task list of Caroline Pham, who became acting CFTC chairman on 20 January – the day of Donald Trump’s inauguration. The former head of the regulator, Rostin Banham, stepped down. That said, Trump has yet to announce the name of a new chairman, although Banham’s tenure officially ends on 7 February.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Earlier, the Securities and Exchange Commission (SEC) began forming a working group on cryptocurrencies – the corresponding announcement was made back on 21 January. SEC Commissioner Mark Uyeda headed the agency as acting chairman until the U.S. Senate decides on the confirmation of Paul Atkins to replace former chairman Gary Gensler. In other words, the change in America’s approach to digital assets is more than being felt.

Who wants to buy cryptocurrencies?

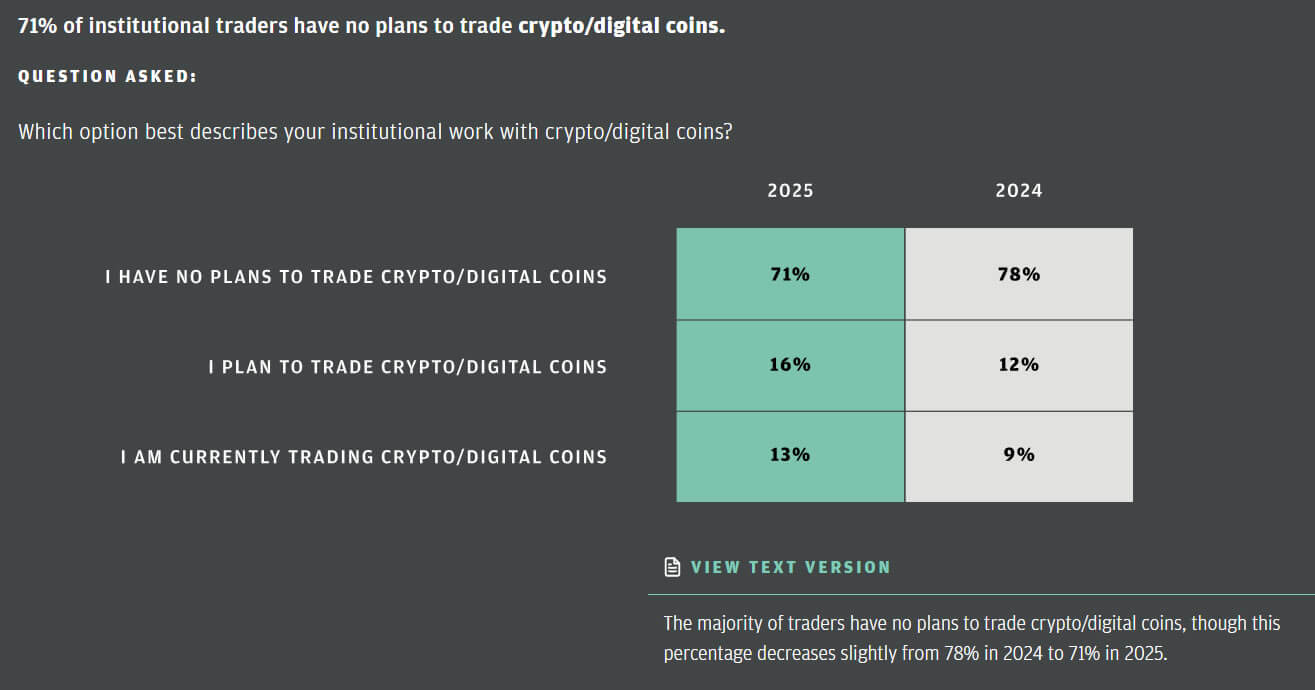

Although there have been a number of positive changes in crypto regulation recently, a lot of institutional traders are still doubtful about the prospects for returns on digital asset trades. This is evidenced by data from a JPMorgan survey. It was conducted among 4,200 large clients of the banking giant from 60 regions of the world in the period from 9 to 23 January.

As it turned out, 71 per cent of respondents do not plan to trade crypto this year. However, there is a slight positive here: in the 2024 version of this survey, this figure was at 78 per cent. That is, at least some part of the institutionalists managed to change their minds with the steady growth of Bitcoin and the crypto market as a whole.

JPMorgan survey data on cryptocurrencies among large investors

The survey also found that 16 per cent of participants plan to trade cryptocurrencies this year, and 13 per cent are already doing so. Both figures were higher than the 2024 figure.

However, all respondents in the annual trading survey said they plan to increase their online trading or e-commerce activity – especially with less liquid assets. Eddie Wen, head of digital markets at JPMorgan, commented on the analysts’ findings.

Recent headlines suggest the new presidential administration is supportive of the crypto industry, and fresh changes have lowered barriers to entry into the space for members of the traditional banking community.

Meanwhile, respondents said inflation and new tariffs will have the biggest impact on markets in 2025, followed by escalating geopolitical tensions. In addition, 41 per cent of respondents cited market volatility as the biggest challenge to trade – up from 28 per cent last year.

Judging by the news over the past few days, the U.S. government has indeed decided to become an ally of the crypto industry. Not only will this attract new developers and end up creating new projects, but it will also affect the reputation of coins. Still now they will become much more attractive in the eyes of big players like investment funds and banks.

More other interesting information about the digital asset industry can be found in our chat room. We look forward to seeing you there and hurry up, because important news appears at the most unexpected moment.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.