Activity on the Bitcoin network has fallen to almost a one-year low. What does this mean for the cryptocurrency market?

The number of transactions in the Bitcoin network in January 2025 has fallen to its lowest level in the last eleven months. As such, there has been a record recent decline in the number of transfers in the mempool: last week, for example, several blocks were nearly empty. In general, the decline in online activity is becoming a problem for large miners, whose income depends on blockchain user commissions. Now some mining companies have taken to looking for alternative sources of income along the lines of artificial intelligence computing.

What’s happening with Bitcoin?

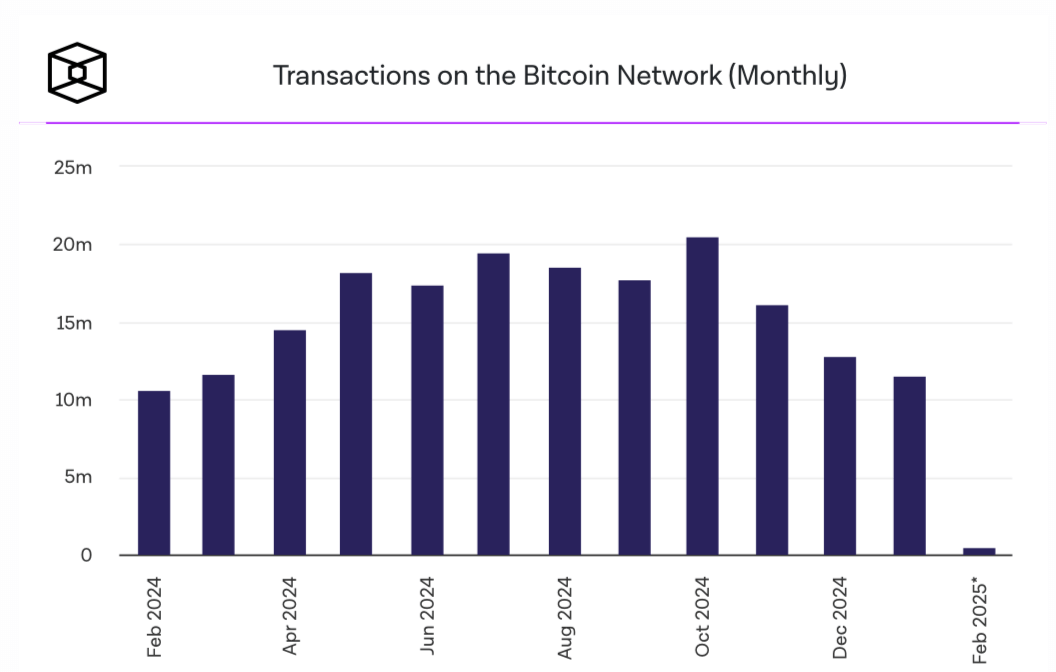

According to The Block’s sources, the number of processed transactions on the Bitcoin network has declined for the third month in a row. Since reaching an all-time high in October 2024, the figure has sagged by more than 43 per cent.

Number of transactions on the Bitcoin network by month

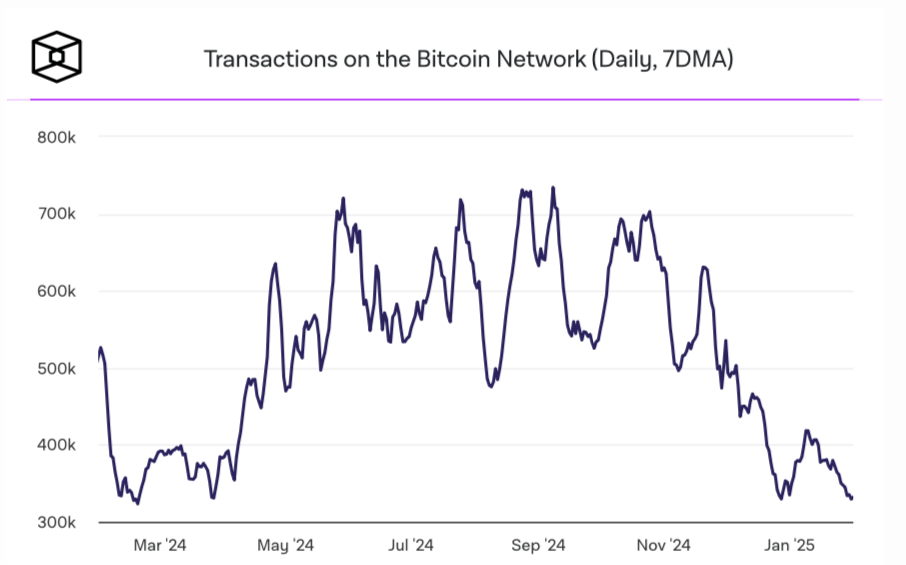

In recent weeks, a notable spike in activity on the network was seen on the day of US President Donald Trump’s inauguration on 20 January. In particular, on the chart of the average number of transactions per day, this event is marked by a local growth before continuing to fall.

Average daily number of transactions in the Bitcoin network

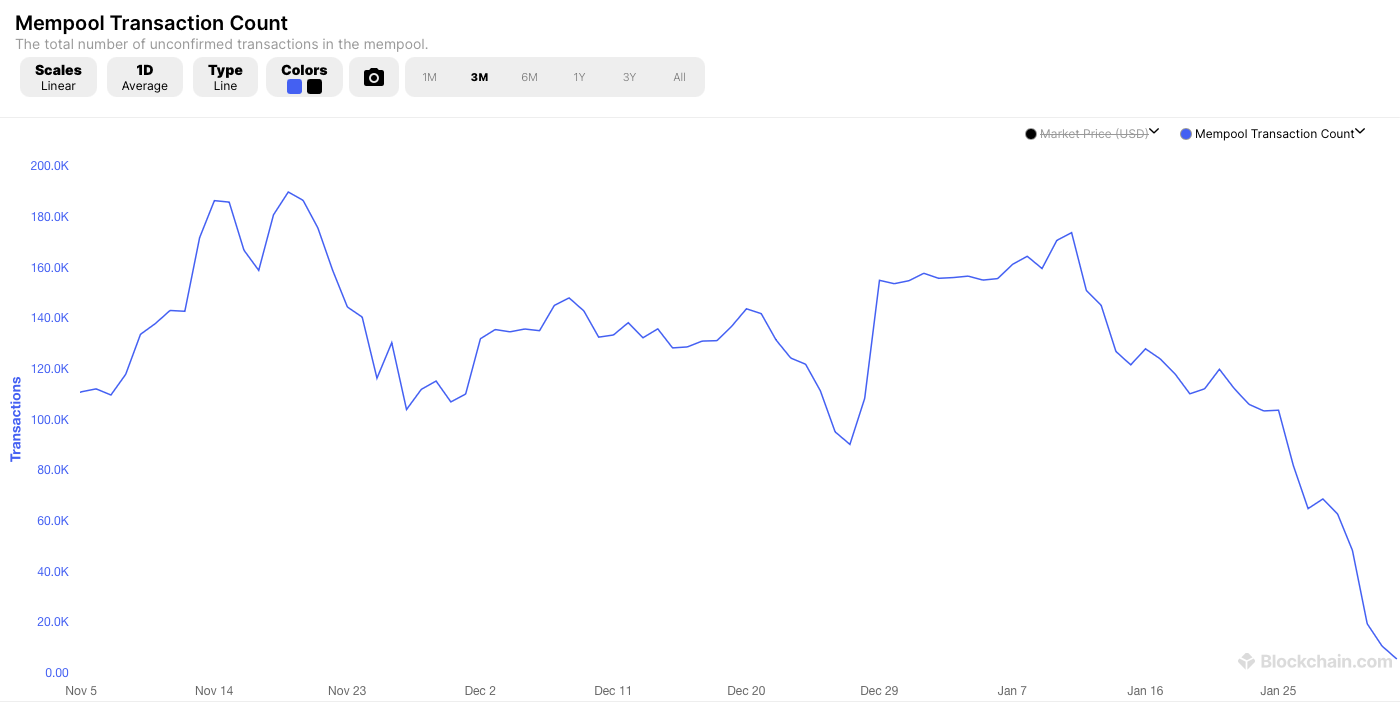

According to blockchain.com, the number of transactions in the mempool has decreased almost five times over the past three months.

The number of transactions in the mempool of the Bitcoin network

As a reminder, a mempool is a queue of unconfirmed transactions that are waiting to be added to the block. When a user submits a transaction, it goes into the mempool where it waits to be picked up by miners. Transactions in the mempool are sorted by priority, which depends on fees and transaction size.

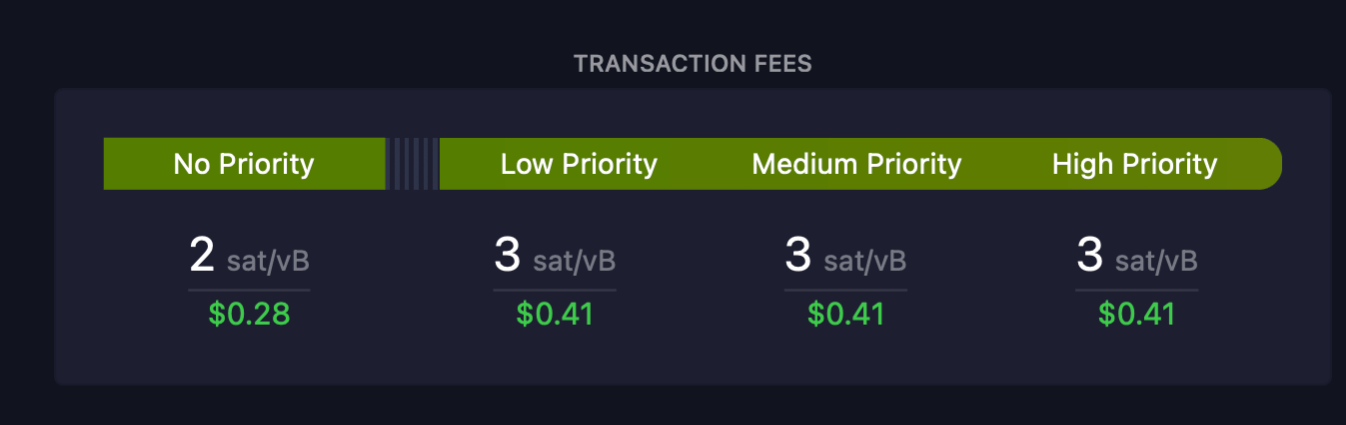

The low network load is good news for regular cryptocurrency users, because due to the lack of activity, BTC transfer fees are also low. According to the mempool.space portal, now for the average transaction size it is necessary to pay about $0.41.

Transaction fees on the Bitcoin network

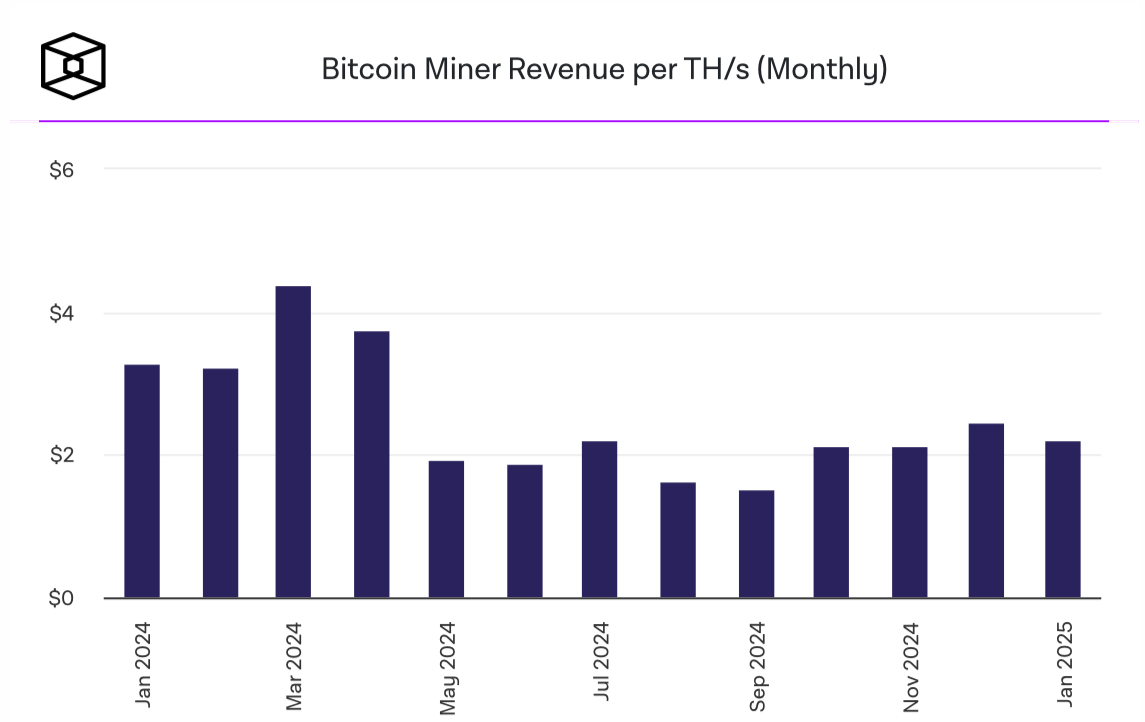

The decline in activity threatens to make mining less profitable – especially after the April 2024 halving, when the reward per block dropped from 6.25 to 3.125 BTC.

That’s why several large miners are exploring diversifying their businesses. The companies are planning to switch to providing their computing power for artificial intelligence and other high-performance tasks.

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

The business situation is not favoured by the weather in the US – the country is experiencing a drop in average daily temperature. Against the backdrop of increased energy consumption, the cost of electricity is rising, analysts at mining firm Luxor revealed. They added that the increase in the cost of mining led to the first negative recalculation of network complexity since September 2024, which took place at the end of January.

Bitcoin's mining complexity is adjusted every 2016 blocks or approximately two weeks, depending on the performance of miners, to keep the time interval between mining blocks at ten minutes. The complexity of mining decreases when there are fewer active miners on the network, making it easier for those remaining to tackle the task of finding new blocks.

Over the past six months, mining complexity has increased at every two-week interval except for two instances. It fell on 25 September 2024 after reaching an all-time high earlier that month and fell again on 27 January 2025.

Average Bitcoin miners’ revenue per terahash of computing power by month

Luxor experts estimate that the US accounts for 36 per cent of the global device capacity of all Bitcoin miners – with Texas alone providing around 17 per cent. The various fluctuations in the performance of U.S. mining companies greatly affect the ecosystem as a whole.

And this influence is only expected to expand in the foreseeable future. The reason is the more favourable attitude of the new administration of US President Donald Trump towards the crypto market.

Who is buying Bitcoin?

A few days after his inauguration, Trump signed the first executive order on cryptocurrencies. It calls for the creation of a digital asset working group to study the prospects of creating a national crypto reserve.

The government of El Salvador, a small country in Latin America, is already doing something similar – but on a smaller scale. Bitcoin became legal tender there in September 2021.

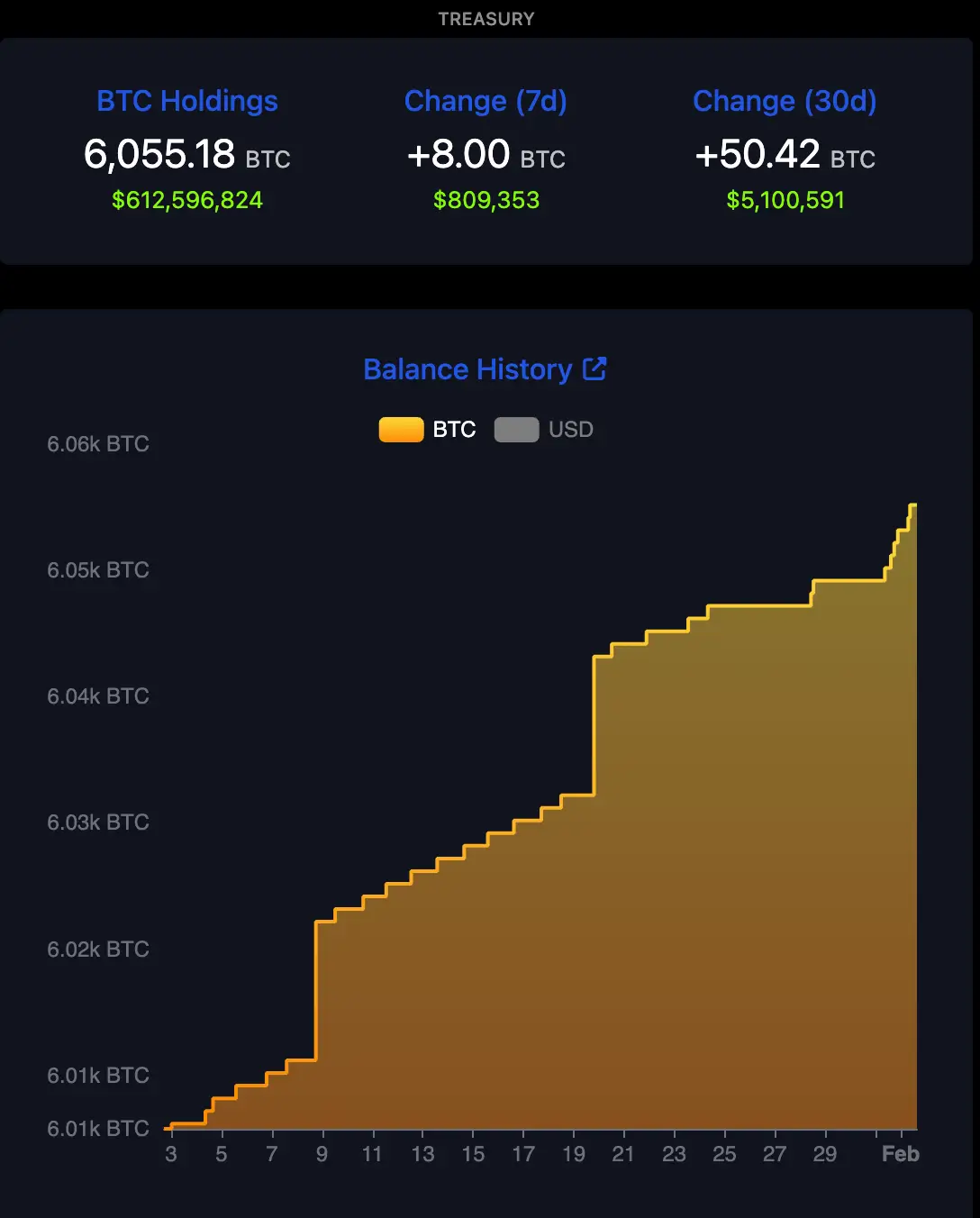

The growth of BTC in El Salvador’s wallets

Since then, the government of El Salvador has acquired 6,055 BTC with a total value of $575 million so far. The most recent transaction was on 1 February, a purchase of 2 BTC. In total, the government has purchased 50 BTC in the last 30 days, according to Cointelegraph.

The adoption of Bitcoin is considered extremely risky from the point of view of the International Monetary Fund experts. That’s why the conditions to a new $1.4 billion loan for El Salvador from the IMF say the country should make payments in the crypto voluntary, as well as generally reduce the rate of adoption of digital assets.

The decline in activity on the Bitcoin network is a typical phenomenon in the cryptocurrency industry. It is now also fuelled by declining coin rates, which traditionally scare away investors. However, since the bullrun should still have room for development, the situation may also change in the perspective of the coming weeks.

Want to keep up with other important news? Check out our crypto chat.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.