Analysts expect record inflows into Bitcoin-ETFs in 2025. How will this affect the price of cryptocurrency?

In the first month of 2025, spot Bitcoin-ETFs cumulatively raised almost $5 billion. According to Matt Hogan of investment fund Bitwise, the data is encouraging and gives reason to expect inflows of more than $50 billion for the entire year. Such figures will emphasise the interest of large investors in the digital asset, and could be a reason for the bullrun to continue for a longer period of time.

Will Bitcoin grow in 2025?

Matt Hogan posted a brief report on the state of the digital asset market on Twitter. Here’s his commentary on it.

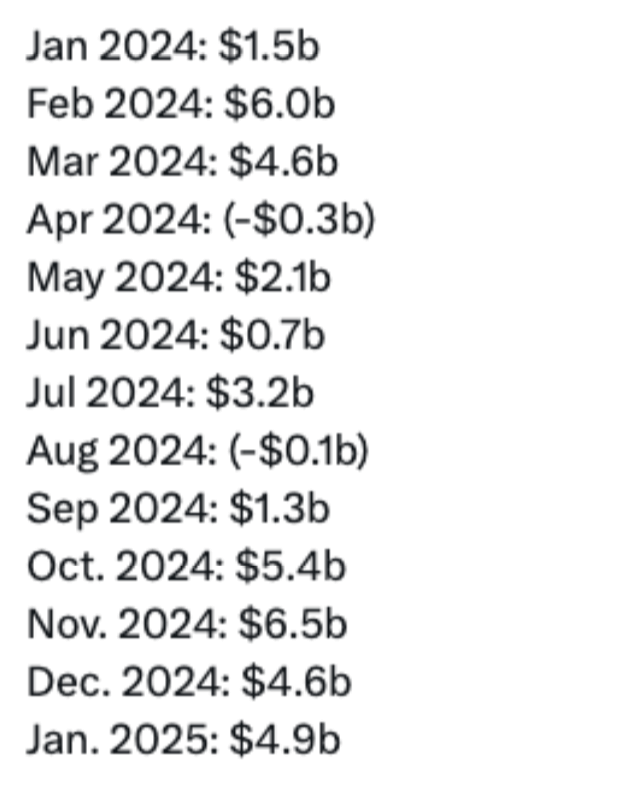

Things are going well so far: spot Bitcoin-ETFs raised $4.94 billion in January. If the pace stays the same, total inflows for the year should be around $59 billion. By comparison, Bitcoin-based exchange-traded funds raised $35.2 billion for the full year 2024.

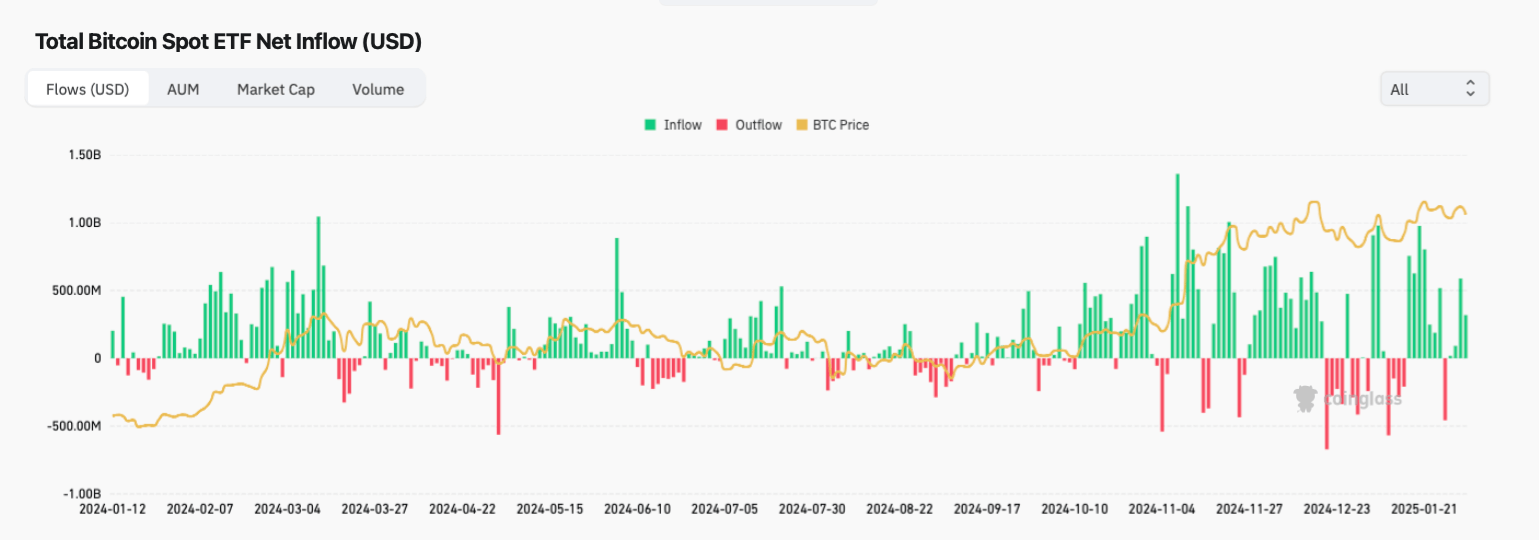

In another tweet, the expert noted that last year there was significant volatility in the statistics of fund inflows for ETFs, that is, noticeable changes. The relevant data can be seen in the screenshot below.

Bitcoin ETF inflows and outflows by month

Generally, Bitcoin-based spot ETFs were approved by the US Securities and Exchange Commission (SEC) on 10 January 2024. This decision was an important step for the crypto industry, as it opened up access for institutional and retail investors to invest in Bitcoin through regulated and understandable financial instruments. Among the first ETFs approved were products from giants like BlackRock, Fidelity and Grayscale.

According to Cointelegraph’s sources, the spot exchange traded funds from BlackRock under the ticker IBIT and Fidelity (FBTC) were the record-breakers in terms of capital inflows in January. They raised $3.2 billion and $1.3 billion, respectively.

Bitcoin-ETF inflow and outflow statistics

The fund from Bitwise (BITB) ranked fifth among all eleven ETFs as it managed to attract $125 million during the month of January. BITB was ahead of BTC, the Bitcoin Mini Trust fund from Grayscale. The latter received inflows of $398.5 million over the same timeframe.

The December report, which was compiled by Hogan along with Bitwise head of research Ryan Rasmussen, noted that more inflows into spot Bitcoin-ETFs are expected in 2025. The expectations are based on the assumption that institutional investors will want to invest in crypto “big time” this year. In this case, ETFs are the most convenient tool for them to enter the market.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Another important clarification in the report is the inflow statistics compared to other large ETFs. It turns out that the first year is traditionally the “slowest” for exchange traded funds. For example, gold-based spot ETFs once attracted $2.6 billion in 2004 after listing. The very next year, total inflows more than doubled to $5.5 billion.

The listing of the Bitcoin-ETF gave a strong boost to the value of the main cryptocurrency. Thanks to this, its price was able to set a new all-time high, and for the first time in history did so before the next halving in the BTC blockchain. Increased inflows into exchange-traded funds should similarly be positive news for the market.

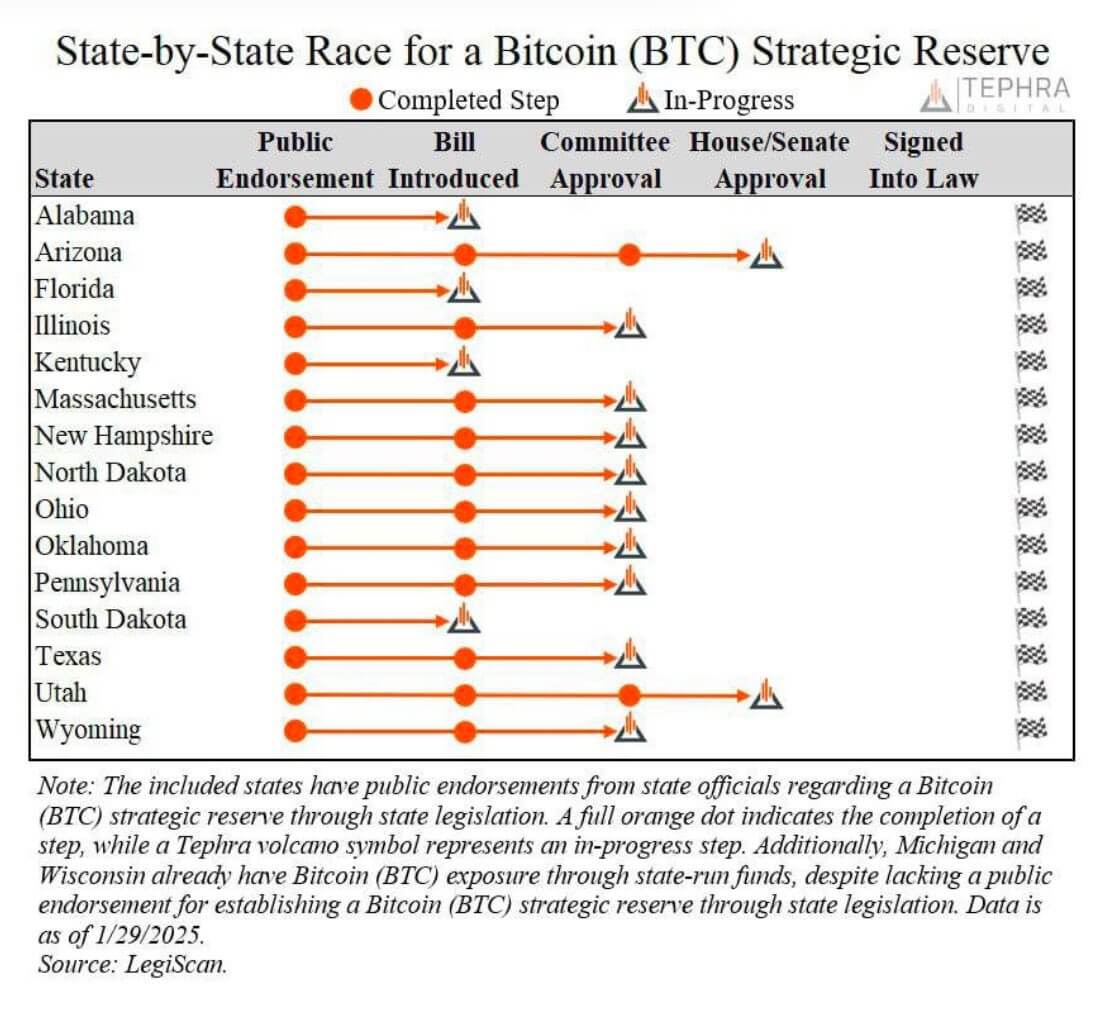

Which US states are buying Bitcoin?

An additional factor for accelerating the growth of BTC value is the adoption of the crypto at the level of individual states in the US. For example, Utah could become the first state to create its own crypto reserve. This was stated by Dennis Porter, CEO of Satoshi Action Fund, in an interview. According to him, the state authorities have 45 days to make a final decision on the recently voted bill.

On 28 January, the Utah House of Representatives Economic Development Committee voted to approve a bill that would allow the state to invest public funds in Bitcoin or other cryptocurrencies with a capitalisation of more than $500 billion. So far, such assets include only BTC.

US states’ “race” to approve cryptocurrency reserves

Porter added that over the past few years, every bill that has passed the Committee has eventually been signed into law.

Arizona is another state that has made it to this stage of the crypto reserve approval bill lifecycle. The states of Illinois, Ohio, Massachusetts, New Hampshire, North Dakota, Oklahoma, Pennsylvania, Texas, and Wyoming have introduced bills by today but have yet to vote. Representatives from the states of Alabama, Florida, Kentucky and South Dakota have so far only publicly supported the idea of creating a crypto reserve, which means that specifics are still out of the question.

The current crypto collapse has spoilt the mood of crypto investors and even made them doubt the continuation of the bullrun. However, in any case, the popularisation of digital assets and blockchains at their core will grow. This will happen at least because of the creation of a new regulatory framework for crypto in the U.S.

Want to keep up to date with other important news from the world of crypto? Join our chat room.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.