Bitcoin is in a position to hit a rate high in the first quarter of 2025. What will lead to this?

Friday 7 February saw the release of a fresh employment report on the US economy. Overall, over 143,000 jobs were added in the first month of 2025 – slightly less than earlier forecasts. These aren’t the best economic results, but they still won’t prevent Bitcoin’s value from rising in the first quarter. Zach Pandl, head of research at Grayscale, believes that BTC is capable of reaching a new record in price in the next couple of months.

How much will Bitcoin be worth in 2025?

According to Pandl, less optimistic reporting shouldn’t affect the crypto significantly. Here’s his quote on the matter.

Bitcoin is likely to take today’s jobs report calmly. The data may reinforce expectations that the Fed will keep the benchmark lending rate unchanged for a while longer, although all of this is unlikely to lead to significant price movements.

The strength of Bitcoin and other cryptocurrencies

According to Cointelegraph’s sources, the cryptosphere has its own tailwinds in the form of positive regulatory changes for the industry.

Still, after new President Donald Trump took office, the US government has become much more loyal to digital assets. Trump’s campaign promise to create a national cryptocurrency reserve played a big role in this, and major regulators like the SEC and CFTC have already officially announced a change of attitude towards the coin market.

For example, the SEC has created a special working group on cryptocurrencies. It will consult with industry representatives and develop recommendations on coin regulation for the SEC.

Cryptocurrency investors as the bullrun progresses

Therefore, Pandl expects the crypto market to remain under bullish control for at least the next few months. He continues.

As long as the stock market remains generally stable, Bitcoin is capable of hitting new highs later this quarter.

Prior to the release of the January jobs market report, experts mostly assumed that the labour market would add 169 thousand new jobs. As a result of the less optimistic data, traditional markets and crypto rose slightly. The reason is that the labour market proved to be less resilient to the US Federal Reserve’s tight financial policies.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

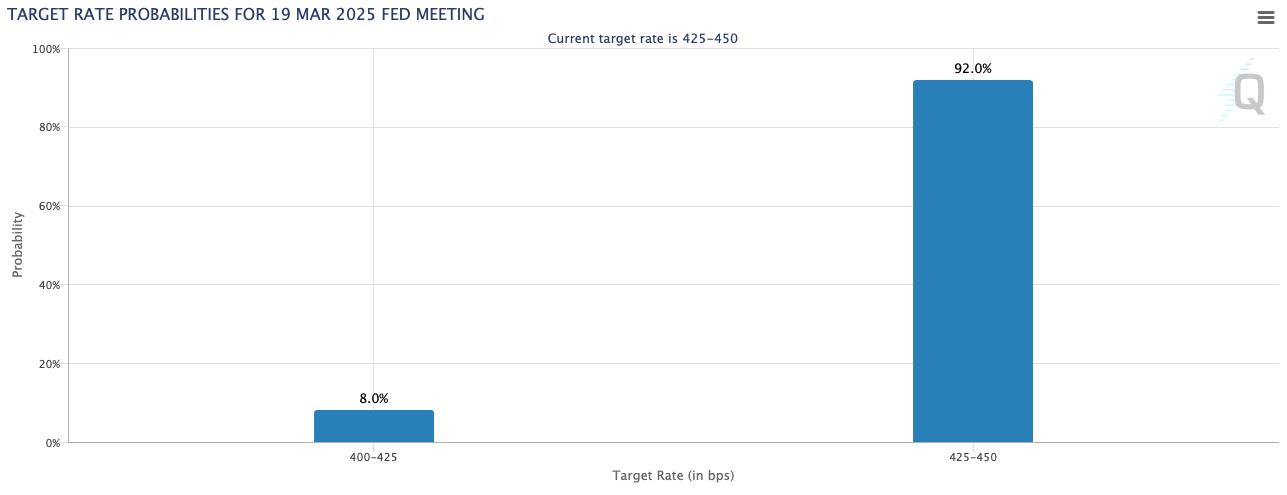

According to FedWatch, there is only an 8 per cent chance of a cut in the benchmark lending rate at the Fed’s next meeting in March. With a 92 per cent probability at this point, the Federal Reserve will leave things unchanged.

That means crypto will have a better chance to grow on the already known positive factors for the industry. However, no one is likely to count on a reduction in the pressure on the economy now.

Forecasts for changes in the base lending rate in the United States

Meanwhile, two US congressmen, French Hill and Brian Steil, on 7 February published a draft bill establishing a regulatory framework for dollar-based stablecoins. The bill calls for a two-year ban on issuing “endogenously backed stablecoins.”

This means issuers would be prohibited from creating coins backed by self-issued digital assets. In addition, the bill requires the U.S. Treasury Department to facilitate research on this asset category.

Who’s buying Bitcoin right now

Florida’s Republican Senator Joe Gruters has proposed that the state go even further. According to The Block, he has put a bill before his colegates that would allow local governments to invest directly in Bitcoin and other cryptocurrencies.

In the bill, the senator proposes allowing Florida’s chief financial officer to use state funds to “invest in Bitcoin and other digital assets for a specified purpose.” However, investments in Bitcoin cannot exceed 10 per cent of the total amount of funds in any account.

Florida’s chief financial officer Jimmy Patronis

Last October, Florida’s finance chief Jimmy Patronis said that the state holds about $800 million in investments “related to cryptocurrencies.” He also noted that the amount of the state’s crypto investments could grow if Donald Trump becomes president. Accordingly, this scenario is now getting more and more chances to materialise.

Some of the sources of state appropriation funds mentioned in the bill include the General Revenue Fund, Budget Stabilisation Fund, trust funds and all agency funds of the state as well as the judicial branch.

In addition, the bill proposes to authorise the trustees of the State Administrative Board to invest and reinvest existing trust fund assets in cryptocurrency, provided that the investment of public funds is exempt from certain security requirements.

The cryptocurrency market's reaction to the US jobs report was indeed subdued. However, in the short term, there are few reasons for positivity in the industry. Some experts even believe that the fate of the bullion in crypto will essentially be determined by the US Federal Reserve's decisions regarding the base interest rate.

Look for more other interesting information in our crypto chat.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.