Donald Trump is suspected of foreign funding. All because of the US President’s TRUMP meme token

American non-profit organisation Public Citizen is calling for a federal investigation into the circumstances surrounding the launch of the OFFICIAL TRUMP meme token (TRUMP), i.e. the official meme token of the US President. The coin delighted investors with a quick ups and x’s, but within days the TRUMP exchange rate collapsed with the same speed. Public Citizen representatives insist that Donald Trump’s advertising of the crypto asset gives cause for concern about hidden foreign funding.

President Trump’s troubles over the meme token TRUMP

On Wednesday, the organisation filed a formal complaint with the Department of Justice and the Office of Government Ethics. Public Citizen’s lawyers cited Trump’s social media posts. They said they were used to promote his OFFICIAL TRUMP (TRUMP) token once he takes office as president on 20 January 2025.

US President Donald Trump

Representatives Bartlett Naylor and Craig Holman explained the nature of the claim. Their rejoinder is cited by Decrypt.

It seems that Trump is begging for money in exchange for nothing – that is, he is asking for a gift that will bring him personal benefit.

Earlier, David Sachs, the person in charge of crypto policy, called NFT and meme tokens collectibles. That is, after the introduction of appropriate regulation of coins in the US, the attitude to the launch of such projects is likely to improve.

The president’s promotion of his own meme-token allegedly violates a number of federal laws, as well as ethics and the Constitution. In particular, it is a violation of the Emoluments Clause. Experts continue.

Because of the nature of digital asset transactions, it is difficult to know whether foreign government actors are making a gift to the president by purchasing his meme token.

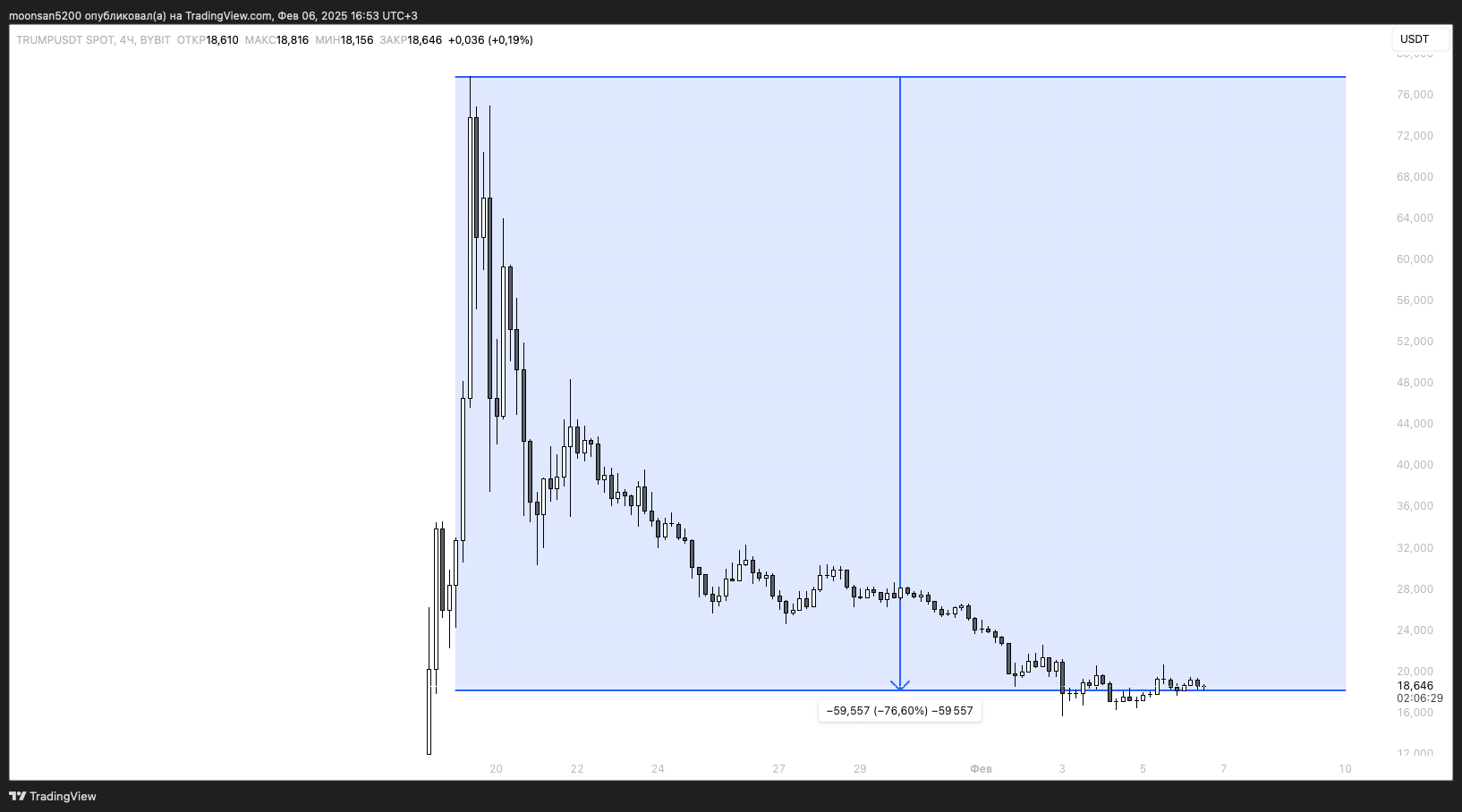

The TRUMP meme-token collapse is on the chart

The Emoluments Clause is a provision in the U.S. Constitution that prohibits public officials from receiving gifts, payments, or other benefits from foreign governments, which is intended to prevent corruption and ensure the independence of government decisions.

The uncontrolled use of such proposals could lead to a normalisation of the use of public servants for selfish purposes, analysts believe.

If the president is allowed to enrich himself in this way, other politicians could follow suit.

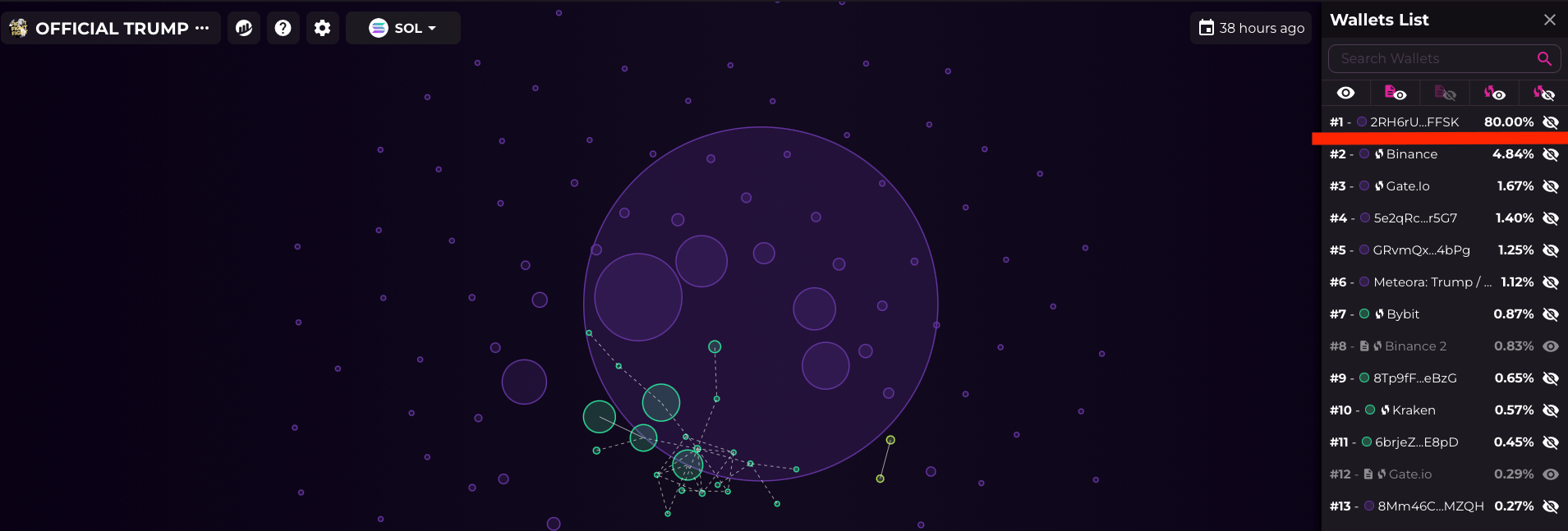

The meme token’s website itself states that 80 per cent of its maximum offering is owned by CIC Digital LLC, an affiliate of The Trump Organization controlled by Trump’s revocable trust, of which he himself is the sole beneficiary.

According to the Bubblemaps portal, about 80 per cent of the altcoin’s supply is indeed under the control of the aforementioned organisation. However, their unlocking and distribution will happen gradually.

Map of TRUMP token distribution by wallets

Since reaching an all-time high, the token’s value has fallen by more than 76 per cent due to the general collapse of the crypto market and increased volatility caused by Trump’s proposed additional customs duties against China, Canada and Mexico. While the president has since dropped tariffs against Canada and Mexico, a 10 per cent tax on all Chinese imports remains in place.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

The Chinese government has imposed retaliatory measures in the form of its duties. These include 15 per cent on US coal and LNG and 10 per cent on crude oil, farm equipment, trucks and large engine sedans imported from the US.

What’s happening with cryptocurrencies?

Despite the TRUMP crash, for investors, investing in major altcoins like Etherium may not be the best option either. JPMorgan experts believe that this coin will be in serious competition with other blockchains in the foreseeable future.

Still, ETH lags behind not only BTC, but also a number of popular altcoins like Solana. We discussed the reasons for this in a separate article “Why are investors so reluctant to buy Efirium?”.

Efirium’s share of total market capitalisation has fallen to a four-year low, The Block reports. Experts cite two reasons for this – growing competition from blockchains such as Solana and second-tier networks with lower fees and greater scalability, as well as the lack of compelling advantages of Etherium over Bitcoin in the current market conditions.

Changes in Etherium’s performance since the integration of the Dencun upgrade

Even after the Dencun upgrade introduced solutions to the altcoin ecosystem to reduce fees and improve scalability, activity here is increasingly shifting to other blockchains.

In particular, the most popular decentralised applications have started moving to their own blockchains to improve performance and reduce costs. Uniswap, dYdX and Hyperliquid have all made the move, with Uniswap’s upcoming move to Unichain being particularly significant. According to analysts, Uniswap’s departure as one of Efirium’s biggest gas consumers could reduce overall validator revenue and increase the risk of the coin becoming even more inflationary. Still, fewer transactions will mean lower fees and lower ETH burn rates, respectively.

Despite these problems, Efirium still leads in the areas of stablecoins, decentralised finance and tokenisation. However, even here, the project’s top position could be squeezed by competitors.

During the last weeks, the meme token TRUMP, Etherium and other coins show themselves not in the best way. Perhaps, the reason for a change in the mood of crypto investors will be the development of new rules to regulate the sphere of digital assets in the United States. In theory, this will significantly increase the number of those willing to get in touch with them.

Want to keep up to date with other crypto news? Join our chat room.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.