How exactly did US regulators manipulate the crypto market? A special congressional investigation has been launched

This week, the general counsel of the largest US crypto exchange Coinbase, Paul Grewal, will testify before the US Congress. The subject of his speech will be the so-called Operation Strike 2.0. This is supposedly a coordinated effort by federal regulators to cut off banking services for cryptocurrency companies. And now the events of the last few years with the coin industry will have to be dealt with properly.

The details of the “Lure 2.0” operation for crypto

“Udavka 2.0” was one of the features of the work of the administration of the previous US President Joe Biden. Many in the crypto industry have repeatedly hinted that the Federal Deposit Insurance Corporation (FDIC) unofficially launched a campaign to curb crypto development during Biden’s presidency. Moreover, in early December 2024, evidence for such a theory was published in court.

Former U.S. President Joe Biden

On 20 January, new President Donald Trump was inaugurated. One of the pillars of his election campaign was support for the crypto industry. Therefore, the congressional hearing on the operation is expected to have a notable impact on the further regulatory treatment of digital assets.

Grewal will testify alongside MARA Holdings CEO Fred Thiel, WSPN CEO Austin Campbell and Anchorage Digital CEO Nathan McCauley.

They will be heard by congressmen from the Financial Services Committee’s Oversight and Investigations subcommittee. Lawmakers will also hear from financial and legal experts, including Stephen Gannon of Davis Wright Tremaine LLP and Mike Ring of Old Glory Bank. The list of witnesses may be expanded, Decrypt reported.

The issue of restrictions against crypto has gained even more attention since the November edition of Joe Rogan’s podcast. Back then, venture capitalist and billionaire Mark Andriessen became an on-air guest. He stated that under the previous president’s administration, the bank accounts of over 30 prominent personalities in the cryptosphere were suddenly closed.

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

The name “Boost 2.0” is a direct reference to a similar operation of the administration of former US President Barack Obama. Only then, the restrictive measures were directed against high-risk industries like legal arms trafficking or short-term loans.

In January, House Oversight Committee Chairman James Comer launched a formal investigation into alleged financial blacklists. He then released an open letter to industry leaders that includes the following quote.

The Committee is investigating the improper delisting of individuals and entities based on political views or involvement in certain industries, such as cryptocurrencies and blockchain.

Coinbase general counsel Paul Grewal

Coinbase representatives were able to gain access to a number of documents that confirm FDIC officials have issued guidance to banks regarding restrictions on partnerships with crypto firms. These actions show an abuse of authority – obviously, Grewal and others invited to Congress will mention this fact in their testimony.

Congressional hearings are scheduled for 6 February 2025. They will be held separately by the Banking Committee and the House Financial Services Committee.

Are banks buying cryptocurrencies?

According to The Block, the new U.S. government’s focus on the crypto market may still not be a compelling argument for U.S. banks.

This was stated in a note by analysts at investment bank TD Cowen. Here’s a comment on it.

We believe greater regulatory clarity around cryptocurrencies is in a position to encourage banks to act as custodial platforms for cryptocurrencies. But banks still need legal clarity given the serious liability they face if they fail to prevent money laundering, terrorist financing or sanctions evasion.

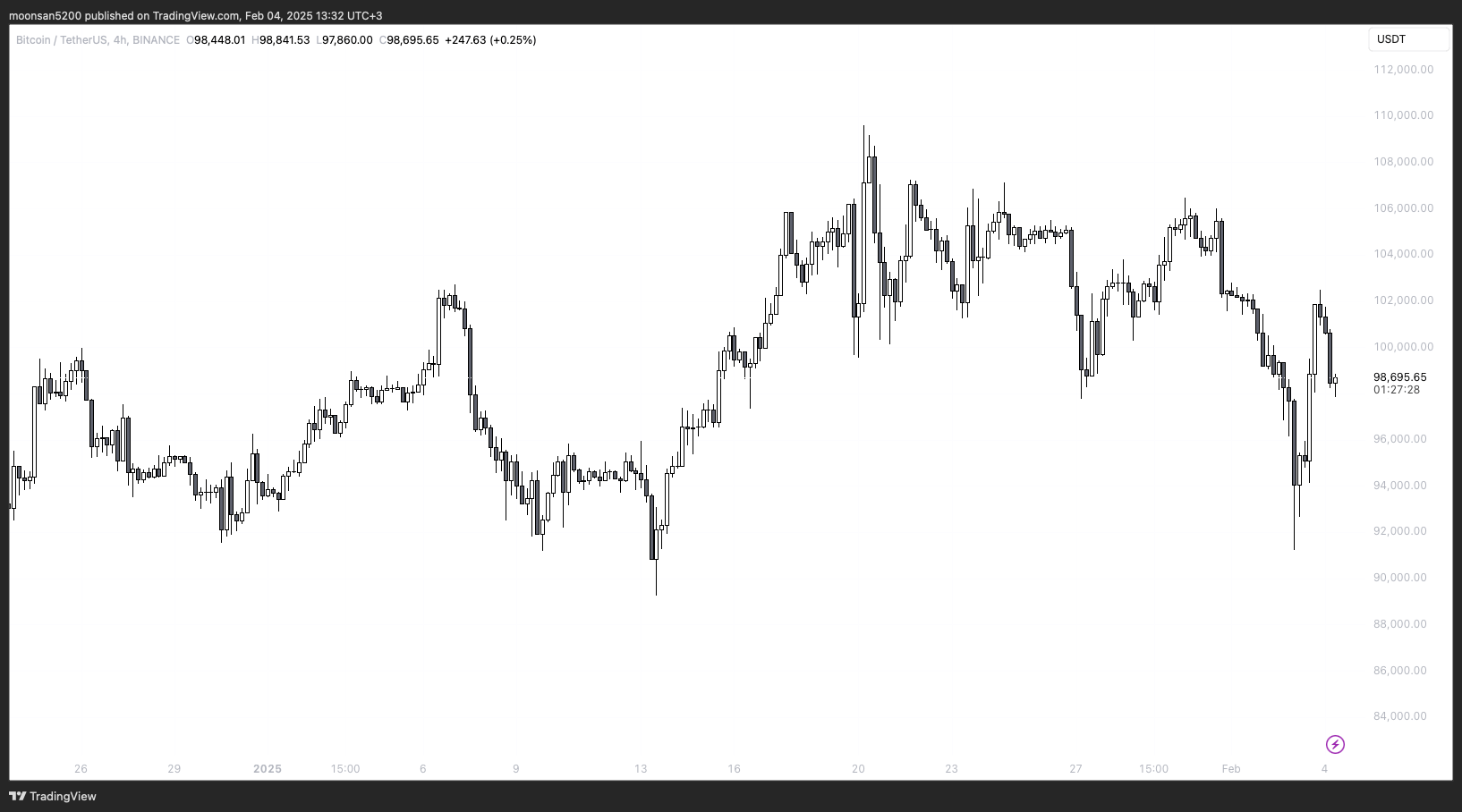

A four-hour chart of the Bitcoin exchange rate

Following the collapse of a number of crypto firms in late 2022 – including major exchange FTX – the US Office of the Comptroller of the Currency (OCC) and the Federal Reserve (Fed) have issued warnings about the high risk of dealing with the cryptosphere. TD Cowen believes that these restrictions may be reviewed in the future.

We believe this is a mistake. Banks will restrict cooperation with the cryptosphere as long as there is risk associated with the Bank Secrecy Act and money laundering. The penalties for violations of these regulations are too high for banks to serve the crypto sector on a large scale without greater regulatory clarity.

Well-known personalities from the traditional finance sector have also recently started to mention the issue of ties to the crypto industry more actively. For example, JPMorgan CEO Jamie Dimon said in a recent interview that his bank works with several crypto firms but risks paying millions of dollars in fines if something goes wrong.

That said, Fed Chairman Jerome Powell noted last week that banks are able to serve crypto-firm customers if they know how to manage risk. And that’s a good enough basis to start building a new paradigm for regulating digital assets in the country that could fuel investor interest.

The upcoming hearings have the potential to unlock the mystery of what's been happening to banks during Biden's presidency. If the guilt of the representatives of these or those agencies will be proved, such a thing may well end up with fines and real terms. Well, the coin industry will surely experience the next stage of prosperity, because now it will not be threatened by such things in the U.S.

.

Want to keep up with other interesting news? Subscribe to our crypto chat.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.