The cryptocurrency market has experienced one of the largest liquidations in history. What happened, and what does it have to do with Trump?

Donald Trump’s victory in the US presidential election in November led to a sharp growth of crypto. Still, the politician supported the coin industry during the election campaign and promised to approve adequate regulation of the sphere. After that, he managed to launch his own meme token TRUMP and even signed the first decree on cryptocurrencies. However, the political factor of Trump’s activity still led to a sharp collapse of Bitcoin, altcoins and all possible assets in general.

Why Bitcoin fell today

Bitcoin hit a local low of $91,231 on the Binance exchange tonight, after which the cryptocurrency recovered to 95,000.

15-minute chart of the Bitcoin BTC exchange rate

Efirium collapsed to the level of $2,125 on the same cryptocurrency platform. That is, the market drawdown turned out to be large-scale and painful.

15-minute chart of the ETH Etherium exchange rate

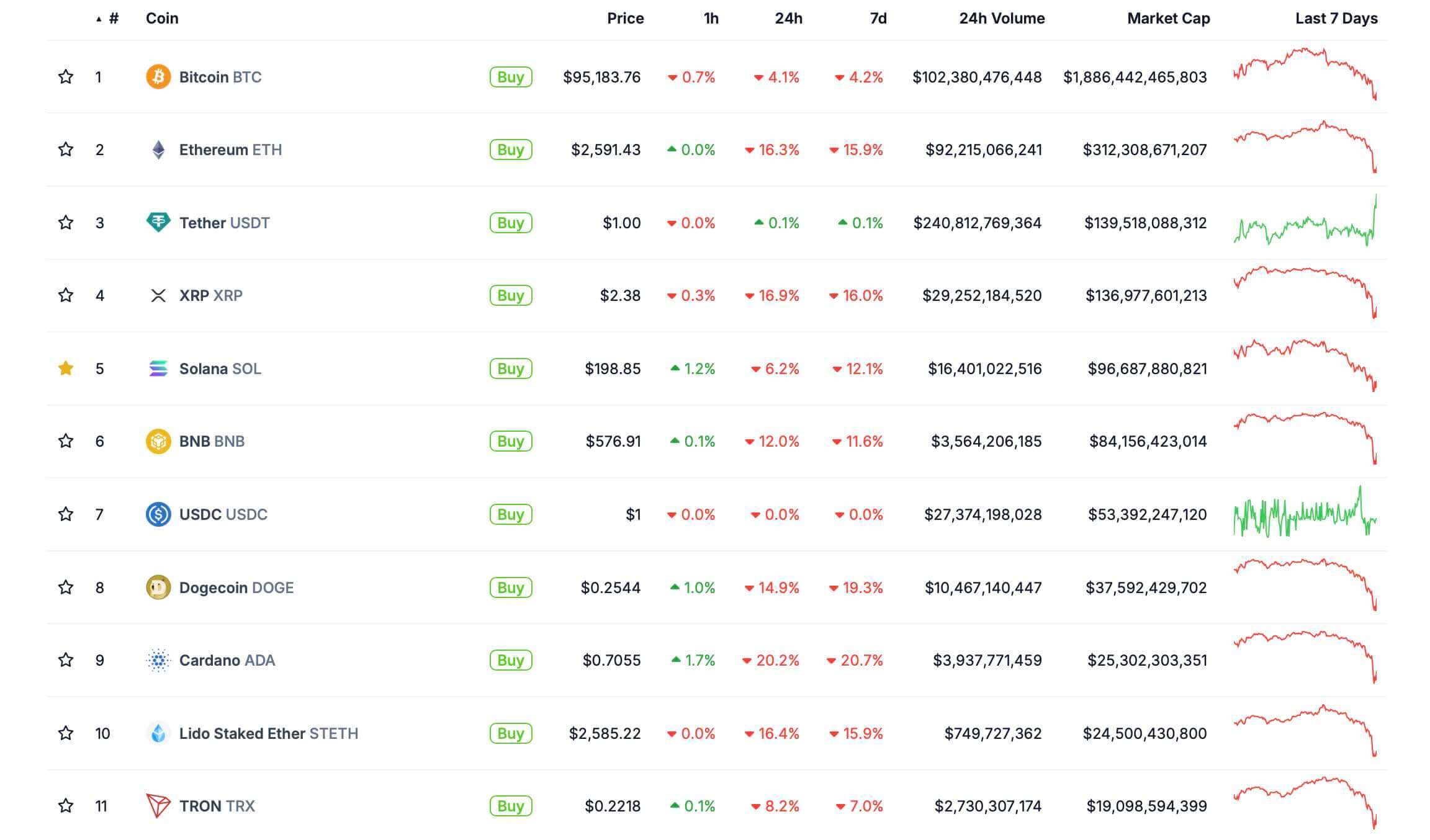

As a result, the total market capitalisation of the industry fell by 9.3 percent overnight. And the rating of the largest coins by capitalisation looks like this.

Actual rates of the largest cryptocurrencies on the market

The reason for the negative market reaction is the decision of US President Donald Trump to impose additional customs duties on products from Canada, Mexico and China, as well as in the future EU countries. The first two countries received an additional tariff of 25 per cent, while a 10 per cent duty was imposed on Chinese goods.

In turn, Canada imposed retaliatory duties of 25 per cent on the equivalent of $155 billion worth of goods from the US. Mexico is promising similar action, while China is about to sue the World Trade Organisation. As a result, all this is gradually developing into a full-fledged trade war, which adds uncertainty to the markets and creates problems in the medium term.

Experts believe that what is happening will end up with inflation growth in the U.S. and other countries. However, most likely, the end consumer will have to pay for the increase in duties. And if American products cannot replace this or that product - that is, if they cost more - then people will be forced to spend more money on products or give them up altogether.

Cryptocurrency market collapse

Most importantly, the US Federal Reserve will not be able to lower the base interest rate further, which means that the fight against inflation will continue. Well, the economy will be under pressure for a longer period of time, which does not favour investor activism and puts into question the prospect of asset growth.

The situation with duties was commented on by US President Donald Trump in the social network Truth Social. His remarks are quoted by Decrypt.

Will we have to experience certain pain? Yes, probably. Or maybe not!

Experts confirm that the market reaction was a response to what is happening in the political sector. Here is a comment from Presto Research analyst Ming Jung.

The market sell-off began after the White House announced on Saturday that it would impose duties on Mexico, Canada and China.

US President Donald Trump

According to Hank Huang, head of Kronos Research, investors are wary of a worsening economy. In addition, the US Federal Reserve will be forced to keep the benchmark interest rate high for longer than expected.

This has reignited concerns about inflation, as additional duties can increase price pressure. Thus they have a negative impact on risky assets, including cryptocurrency.

BTC Markets crypto analyst Rachel Lucas noted the fact of large-scale liquidation of trading positions, which indicates the use of too high leverage by traders. And now this trend has quite predictably tapered off.

Here’s the commentary.

The prolonged lack of stimulus from the Fed and high interest rates have hit altcoins particularly hard, causing them to fall further behind.

The biggest liquidations in the cryptocurrency market

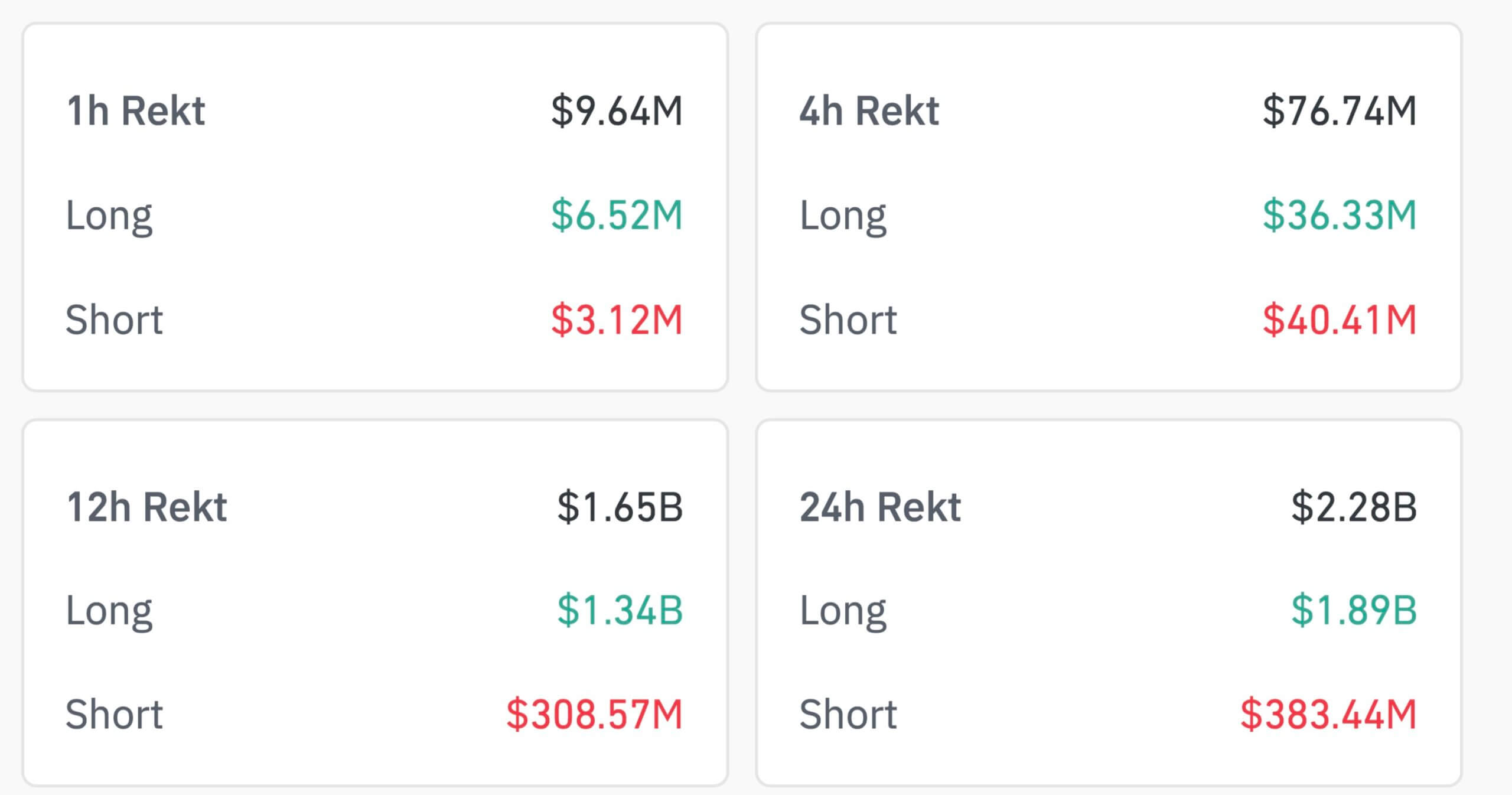

The market crash brought one of the largest liquidations in the history of digital assets. It is about the forced closure of trading positions of traders who use the exchange’s borrowed capital. This is how trading platforms protect their own funds.

The volume of liquidations for the last day amounted to $2.28 billion. 82 per cent of this indicator fell on long positions, the authors of which bet on the market growth.

The volume of liquidations of cryptocurrency positions per day

For comparison, it is worth remembering that the collapse of Terra LUNA in the spring of 2022 ended with the liquidation of positions for 1.6 billion. The collapse of the FTX exchange in November of the same year resulted in zero positions of the same scale.

The biggest in recent years was only the collapse of the industry in early 2020 due to the onset of a pandemic. Back then, liquidation reached $2.9 billion.

Since cryptocurrency markets operate around the clock, their collapse could be a precursor to the stock market crash in the US after it opens. However, whether it will actually turn out that way will be known in a few hours.

What’s next for Bitcoin?

Nick Forster, the developer of the decentralised Derive protocol, believes that the new duties on Trump’s decision will end with rising inflation. And the mood of crypto investors is unlikely to be positive given this prospect. His remarks are cited by The Block.

We’re already seeing signs of increased market volatility: the implied 30-day BTC volatility rose 4 per cent to 54 per cent on the back of the imposition of these duties and general economic uncertainty. Expect volatility to continue as more negative factors are certain to emerge in the coming weeks.

With inflationary pressures mounting, the Fed may maintain or even raise interest rates, which has historically created a less favourable environment for cryptoassets. This has the potential to squeeze the digital asset sector in the coming quarters.

Pav Hundal, a leading analyst at Australian crypto exchange Swyftx, admits that the US Fed will now take a pause in lowering the benchmark interest rate. Such a decision will be fuelled by inflationary pressures amid import costs and supply chain problems.

Cryptocurrency market collapse

Here’s his comment.

The fact is that we are just entering a period of unprecedented political support for cryptocurrencies. Plus, there remains high uncertainty about how the tariff war will unfold.

With US non-farm payrolls and unemployment data coming out this week, I expect the market to be extremely sensitive to any unexpected changes, either up or down. We will soon have more clarity on the likelihood of risks to rate cuts.

However, some experts believe that such market conditions will not last forever. Still, Trump is using the pressure on Canada, Mexico and China in the name of fighting illegal fentanyl on US streets. And if the problem is solved, the duties will also be cancelled.

This opinion and hope for the future was voiced by Peter Chang, head of research at Presto.

Trump has done his best to tie this round of duties to the fentanyl trade, which involves Canada, Mexico and China.

We’ll see how this plays out. I have a feeling that trade tensions may ease faster than many expect.

Cryptocurrency investors during the bullrun

So far, it's become clear that Trump's desire to ensure cryptocurrencies are properly regulated doesn't guarantee the coin market will grow. Still, here it is also worth considering the political component, which also knows how to hit the financial markets. Be that as it may, customs duties are a tool of pressure. And sooner or later they can say goodbye to it.

Look for more interesting stuff in our crypto chat. We look forward to seeing you.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.