The sentiment of regular crypto investors has fallen to a low. Why do experienced players still believe in Bitcoin?

The beginning of 2025 is proving to be a terrible start for crypto investors so far. Although Bitcoin continues to hold above 90k and sometimes goes over the 100k mark, altcoins have been falling for months now. Because of this, the mood of ordinary market participants has deteriorated significantly, and faith in the continuation of the current bullrun has all but dried up. Be that as it may, large investors are still confident in the industry’s prospects and are betting on the further growth of coins.

What is happening to the cryptocurrency market

The situation in the industry of digital assets was commented on by Bitwise investment director Matt Hogan. According to him, experienced investors are more optimistic than ever about the prospects of the coin market. At the same time, the sentiment of ordinary retail players has dropped to the lowest level that has not been felt in the digital asset industry for many years.

Bitwise platform investment director Matt Hogan

Here’s an expert’s comment on the matter, as quoted by Cointelegraph.

There is a huge gap between the sentiment of retail and professional investors in crypto right now. Regular players are feeling worse than at any time in the past few years, while professionals are extremely optimistic. It’s like living in two completely different worlds.

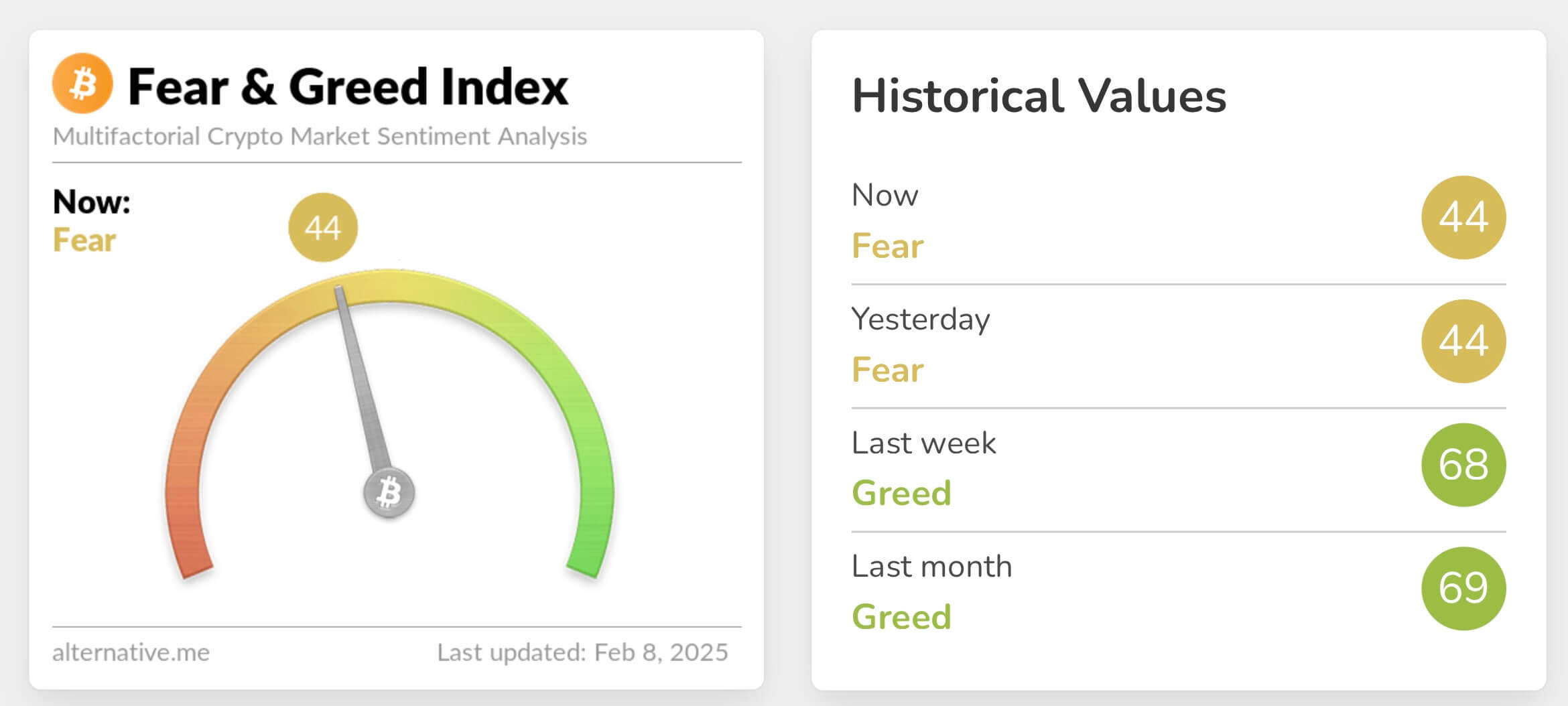

Today, the so-called Bitcoin Investors Fear and Greed Index is at a score of 44 out of 100. This means that capital holders are afraid of a continued market drawdown and are in no hurry to open new positions in the crypto. Here is the corresponding chart.

Today’s Bitcoin Investors Fear and Greed Index score

The index is down 25 points from the greed level that was recorded last month. That is, sentiment in crypto has deteriorated very sharply, which has only increased the negativity of industry participants.

A version of what is happening was shared by Bloomberg analyst James Seyffarth. According to him, the positivity of retail investors evaporated due to the fact that they keep quite a few altcoins and meme tokens. Well, those coins have “really fallen hard.”

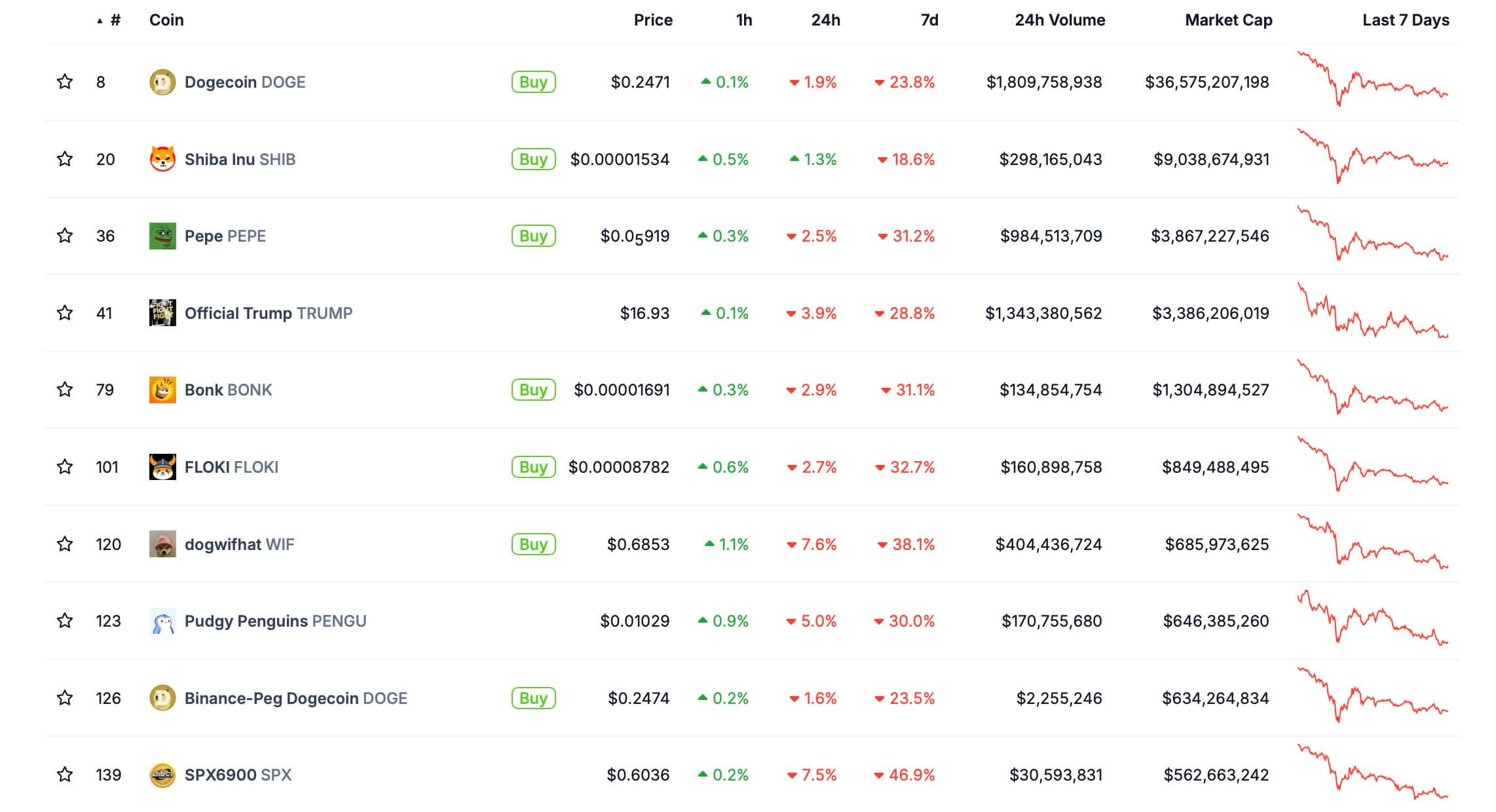

Alas, this is indeed the case. For clarity, here is a ranking of the largest meme-tokens by market capitalisation. On the scale of a week, most of them lost 20-30 per cent of their value, while for a month the rates dropped by 40-60 per cent. In other words, investors could lose at least half of their investments in just a couple of weeks.

Changes in the rates of the largest meme tokens by capitalisation

A replica of the situation was shared by an anonymous crypto trader under the pseudonym DFarmer. Here it is.

I don’t recall the carnage among altcoins ever being this brutal.

The trader noted an interesting feature of what is happening in the market. According to him, retail participants of the Solana ecosystem assess the prospects of this network “a little better than professionals”. Apparently, this is due to the relatively good behaviour of the SOL cryptocurrency exchange rate in recent weeks – also due to the launch of Donald Trump’s meme token.

You can’t say the same about Etherium. Here’s a quote.

Retail ETH investor sentiment is as bad as ever. I think professionals have slightly better expectations.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

What will happen to cryptocurrencies in 2025

One can understand the positivity among the big players regarding crypto too. Firstly, they do not use all the capital to invest in coins, which means that their loss is limited. Secondly, the change of power in the US is already leading to a change in the attitude of regulators to digital assets. For example, the CFTC leadership promised to stop regulating the digital asset industry by coercion.

However, that’s not all. Now representatives of the U.S. Commodity Futures Trading Commission are planning to hold a forum for leaders of the U.S. crypto industry. The event will be used to sound out information about the upcoming digital asset pilot programme.

Ripple CEO Brad Garlinghouse

The latter is designed to explore “tokenised non-cash collateral”, which is relevant to stablecoins and other similar products. Well, the event itself will be attended by executives from Circle, Ripple and Crypto-com.

Current CFTC Chair Caroline Pham noted that continued engagement with members of the coin industry will help realise Trump’s campaign promises on cryptocurrencies.

Clarity on crypto regulation isn't the only upside for the industry for 2025. Experts also expect to see an increase in capital inflows into Bitcoin spot ETFs, which is traditionally seen in the second year of such products. Perhaps this will indeed lead to BTC at $500,000, which is what analysts at Standard Chartered bank are counting on.

Come on over to our crypto chat room. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.