The state of Missouri is also working on launching a cryptocurrency reserve. How fast is Bitcoin adoption moving in the US?

In the Missouri House of Representatives, Bill 1217 has been introduced for consideration, which would create a local crypto fund to diversify the state’s investment portfolio. The initiative is primarily promoted by Representative Ben Keathley. He believes that local authorities should take a closer look at investing in Bitcoin, because in this way you can get a tool to hedge risks against inflation. If the bill passes, it would allow the state to “receive, invest and hold BTC in a wallet under certain circumstances.”

Is it worth buying Bitcoin right now?

According to Cointelegraph’s sources, Keathley’s filing recommended the creation of a strategic bitcoin reserve fund that would be overseen by the state treasurer. The fund would also be able to acquire BTC in the form of gifts and donations from government organisations and Missouri residents.

As part of the bill, all Missouri government agencies would be required to accept cryptocurrency in the form of fees – including taxes, fines and other legally acceptable payments. At the same time, the recipients of the payments will have to cover the transaction fees themselves.

Missouri cryptocurrency bill 1217

In the bill, Keathley proposed a long-term bitcoin storage strategy for the state. Here’s a relevant rejoinder to that.

The treasurer must store all BTC collected under subsection 2 of this section for a minimum of five years from the date the coins are received for storage.

That is, the bill gives the Missouri state treasurer the authority to invest, acquire, and store BTC with state funds.

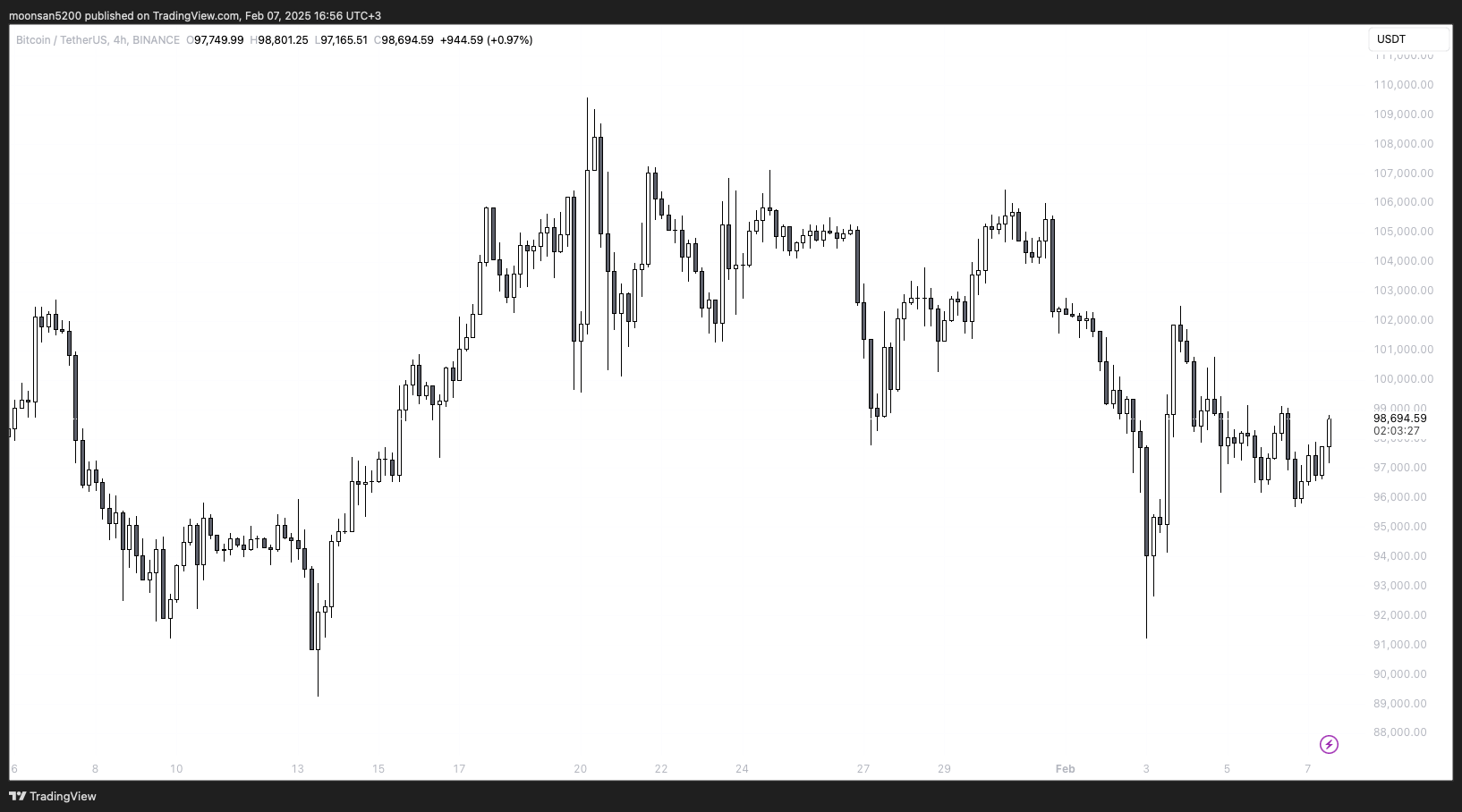

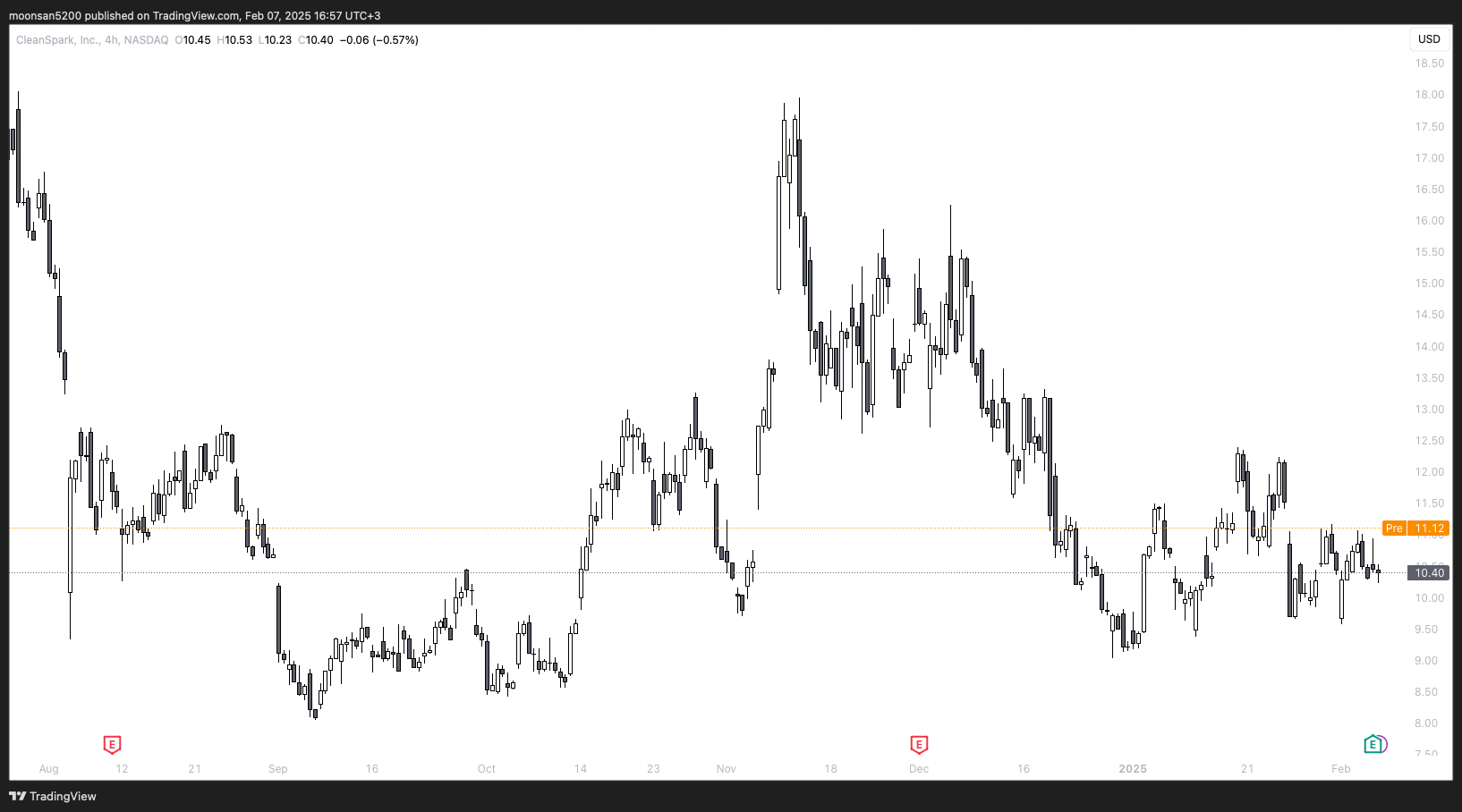

A four-hour chart of the Bitcoin exchange rate

The estimated effective date of Bill 1217, if approved, is set for 28 August – this is subject to change depending on further deliberations. A second hearing on the bill has not yet been scheduled at the time of writing.

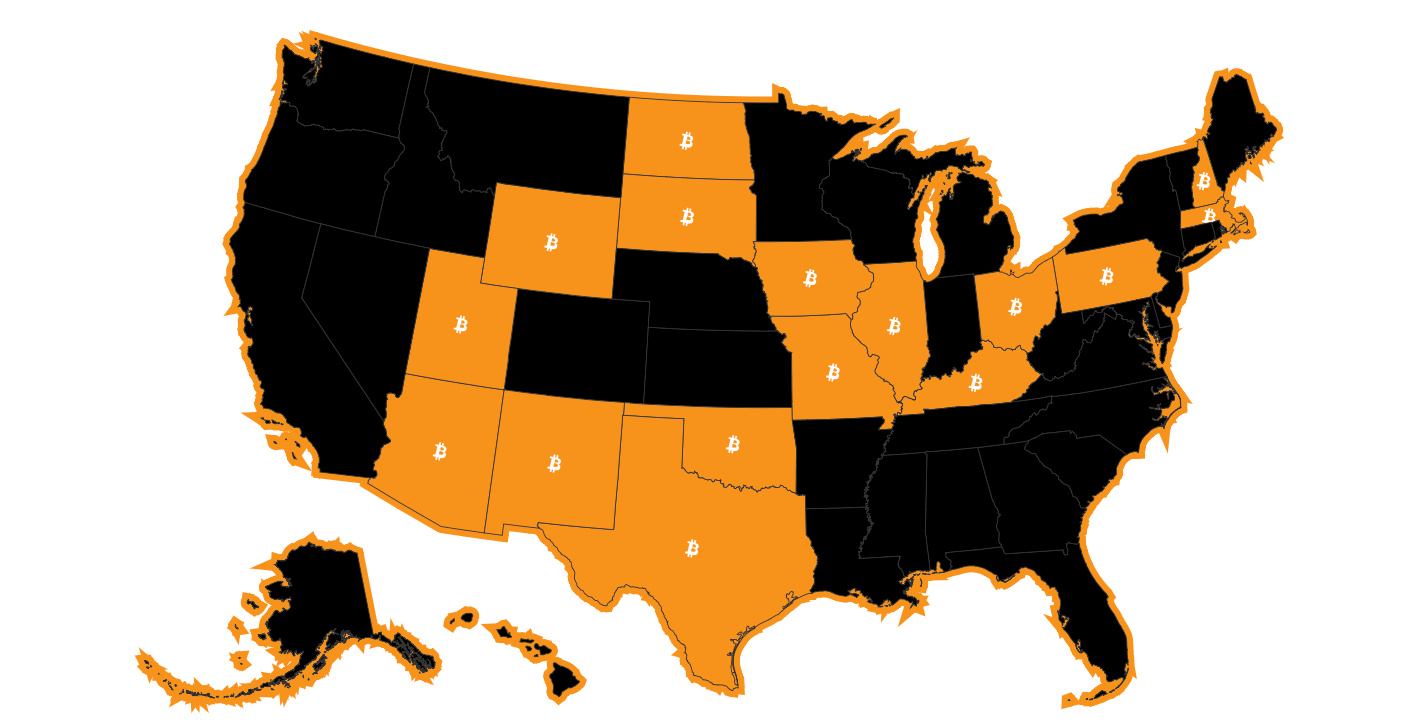

Earlier, a similar initiative appeared in the state of Utah: on 6 February, the Utah House of Representatives passed Bill 230, which is now headed to the Senate. According to bitcoinlaws.io, as of 7 February, 16 of the 50 US states have started discussing the creation of a strategic crypto reserve.

Map of crypto bill passage in the US

Utah officials have made the most progress – the state is just two steps away from introducing a bill. Other states considering similar legislation include Arizona, Kentucky, New Hampshire, North Dakota, Wyoming and South Dakota.

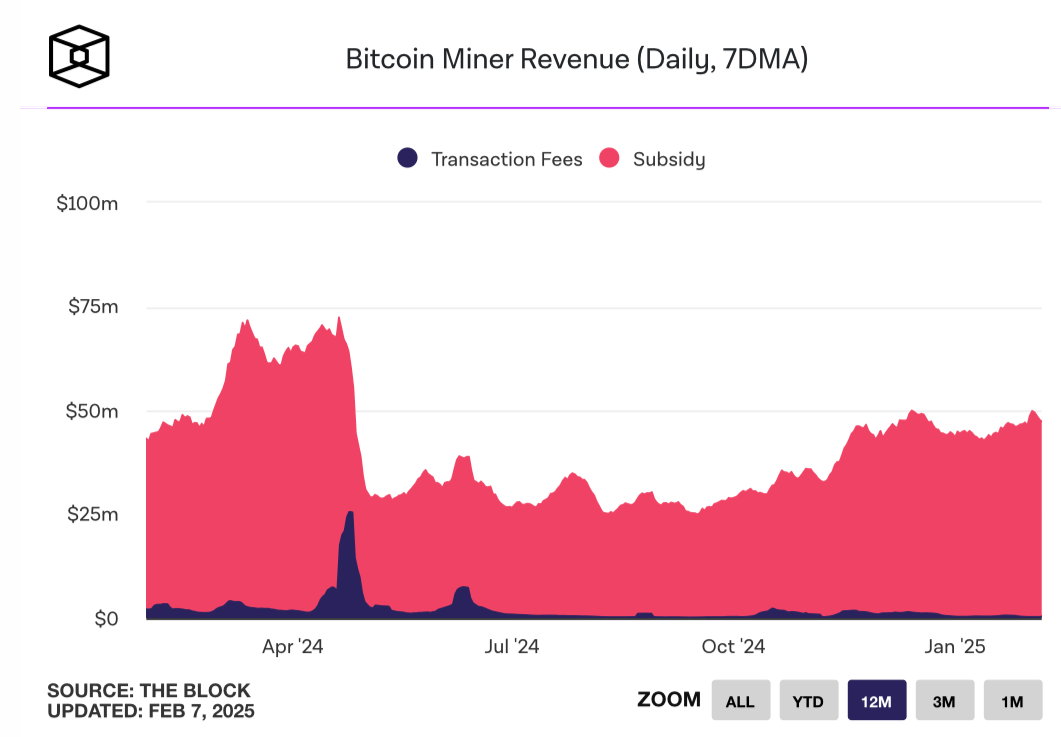

Profitability of Bitcoin mining

While the government is thinking about acquiring bitcoins, mining companies are focusing more on mining coins specifically, rather than buying the main cryptocurrency. This is especially evident in the financial statements of mining giant CleanSpark, The Block reports.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

CleanSpark previously reported revenue of $162.3 million for the fourth quarter of 2024. That’s a 120 per cent increase from last year, at a mining cost of around $34,000 per coin.

Bitcoin miner profitability

The company’s net income in the fourth quarter was $246.8 million, or 85 cents per basic share. For the same period in 2023, the numbers are much lower at $25.9 million or 14 cents per basic share. Adjusted earnings before interest, taxes, depreciation and amortisation rose to $321.6 million from $69.1 million in the same period a year earlier.

As of 31 December 2024, CleanSpark had total assets of $2.8 billion, with $929.1 million of that in bitcoin. The company does not yet plan to increase the volume of BTC on its wallets through their direct acquisition. CleanSpark CFO Gary Vecchiarelli commented on this information.

We continue to invest in ourselves. Why buy Bitcoin at current prices if we can mine it at $34,000 per coin?

Change in CleanSpark’s stock price

The company’s remarkable revenue growth is particularly notable against the backdrop of Bitcoin’s halving, which saw the reward to miners per BTC block mined in April 2024 drop from 6.25 BTC to 3.125 BTC. Here’s what Vecchiarelli stated on the matter.

We have overcome almost all of the effects of halving while increasing our current balance to over 10,500 BTC. 100 per cent of these coins were mined by CleanSpark independently and exclusively in the United States.

CleanSpark plans to reach the level of computing power in the region of 50 exashells per second in the first half of 2025 by expanding its presence in Wyoming, Tennessee and Georgia.

As a reminder, the mining giant completed its $155 million acquisition of GRIID in October 2024. In December, CleanSpark also announced the closing of a $650 million convertible bond offering.

So far, things are looking up for Bitcoin to become a familiar investment across countries and major companies. However, to activate this process, we need to wait for updated crypto regulation rules in the US. After that, there will be many more people willing to get involved with the coin.

You can find more useful information about cryptocurrencies in our chat room. We look forward to seeing you there today.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.