Trump delayed imposing duties on goods from Canada and Mexico. What does this mean for cryptocurrencies?

Last Friday, US President Donald Trump announced his decision to impose additional duties on goods that are imported to America from Canada, Mexico and China. The situation created uncertainty in the markets and caused them to crash as what was happening could well have escalated into a trade war. However, overnight, tensions have eased considerably – although they have not completely disappeared.

Why the US imposes duties on imports

The possible imposition of duties on imported goods has become an instrument of political pressure on the countries in question. However, 25 per cent tariffs on goods from Canada and Mexico would have made such products noticeably more expensive and less attractive to end consumers. Thus, the importing states risked serious losses.

Canadian Prime Minister Justin Trudeau

The reaction of investors was related to the fear of this situation. After all, additional duties would affect prices and lead to an increase in inflation, which the U.S. Federal Reserve has been fighting against for the last few years.

Accordingly, bankers would not be able to continue to reduce the base interest rate, and thus the pressure on the economy would continue. Under such conditions, market participants' interest in risky assets is usually low, which is why the crypto sphere experienced one of the biggest sell-offs in its history.

Trump presented the new initiative as a desire to fight the spread of fentanyl “on the streets of America”, in which the countries in question were involved. Moreover, his arguments proved convincing.

Last night it became known that the US President postponed the imposition of duties on goods from Mexico after a conversation with the head of the country. In return, Mexico undertakes to send 10 thousand troops to the border with America to control the influx of migrants and at the same time to stop the flow of fentanyl.

Overnight, a similar deal was reached with Canada. So duties on imports from that country will also not be imposed for at least 30 days. Obviously, if the protection of the state border with the US is effective, in the future such tariffs will not be introduced at all.

The cryptocurrency market reacted positively to the news. For example, Bitcoin after the local bottom at the level of 91 thousand including got to 102 thousand.

15-minute chart of the Bitcoin BTC rate

Since then, the cryptocurrency has sagged, but the situation is still better compared to yesterday.

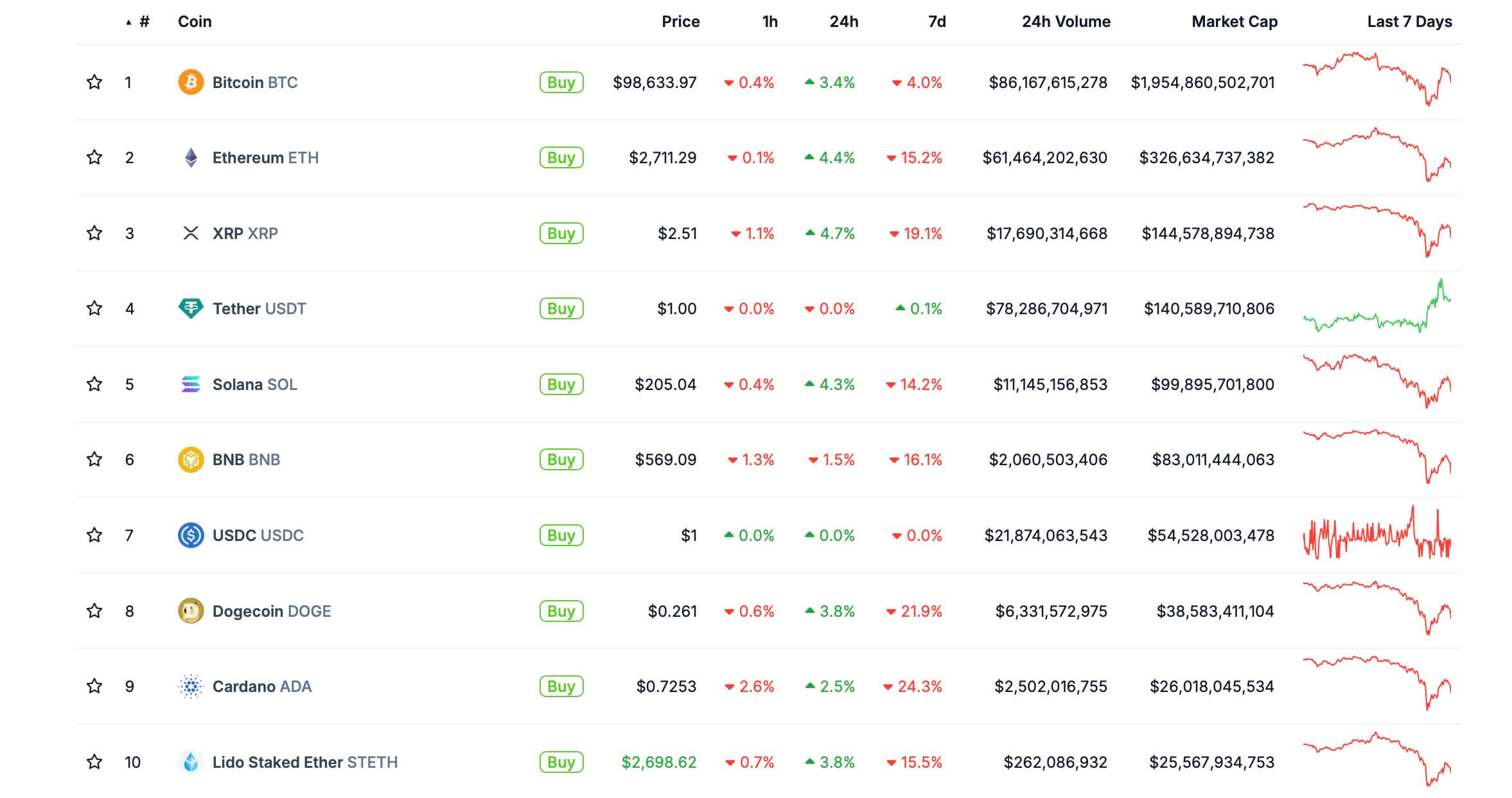

This is what the table of the largest coins by market capitalisation looks like. Most of the participants of the rating showed growth on the scale of the day, but for the week, the minus in some cases is still tens of per cent.

The largest cryptocurrencies by market capitalisation

According to Brian Rudick, head of research at GSR, the scale of the potential chaos remains unknown. Still, 10 per cent duties on goods from China remain in force, in addition, the country’s government has imposed retaliatory tariffs on products from the United States, which really threatens the beginning of a trade war.

Also, Trump has previously allowed 100 per cent duties on products from BRICS countries if they decide to abandon the dollar and launch their own currency. Here is Rudick’s retort, which Decrypt cites.

Market participants should now consider that Trump is willing to implement all of his other proposals. Cryptocurrency tends to be correlated with traditional assets, so amid the decline of traditional markets, it’s not surprising that the crypto industry has been hit even harder.

As we’ve already noted, the China problem is still unresolved. And this poses risks for financial markets. Here’s what Presto Research analyst Ming Yung had to say on the matter – his commentary is cited by The Block.

Although Bitcoin is often referred to as a digital alternative to gold, many investors still perceive it as a risky asset. In this context, China’s retaliatory 10 per cent tariff on US goods is likely to put pressure on risk assets, including cryptocurrency, as well as the stock market.

However, as the current V-shaped recovery has shown even before the corresponding announcement, the initial market reaction may have been overly harsh. The long-term implications depend on whether this is the start of a major trading escalation or remains a one-off event. However, we expect volatility to remain high as tariff news continues to influence market sentiment.

A similar view was voiced by Justin D’Anetan, head of sales at Liquifi. He said the initiative with Canada and Mexico could only be “first shots” and a cover for Trump’s real plans. Still, “the real escalation is unfolding with China, and Europe could be next in line.”

And here’s what Nick Ruck, head of LVRG Research, had to say.

If the situation escalates into a full-blown trade war, it will intensify the sell-off in crypto assets, unless the U.S. manages to negotiate a cancellation or delay, as it did with Canada and Mexico.

In the end, analysts confirm that the situation remains uncertain. Still, it will be harder for Trump to agree with China beforehand than with the leadership of Mexico and Canada.

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

Will cryptocurrency grow in 2025

Despite the problem in the global economy, a positive has also been found for cryptocurrencies. Last night, Donald Trump signed an executive order that calls for the creation of a Sovereign Wealth Fund.

Senator Cynthia Lummis, who supports cryptocurrencies, called what is happening a “big deal” or “₿ig deal”. It is possible that the initiative would involve the US government hoarding bitcoins and other coins, something Trump talked about during the election campaign.

US Senator Cynthia Lummis

As it became known in mid-January, the US national cryptocurrency reserve may actually consist of coins whose developers are located and operate in America. Later, there was a version that the government would not buy additional BTC, but instead keep the previously confiscated coins.

Trade duties have become an effective tool for the US to pressure other countries. However, the situation with China may turn out to be different. Which means that for now, it is likely too early to claim that the worst is over for the markets. Therefore, cryptocurrency holders should be ready for any development.

More interesting things are in our crypto chat room. We look forward to seeing you there.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.