US national crypto reserve: what decision will the Trump administration make on it?

David Sachs, who is responsible for policy in cryptocurrencies and artificial intelligence, considers Bitcoin “a great tool for preserving value.” Judging by his words from an interview with CNBC, creating a national US crypto reserve is currently one of the priorities of President Donald Trump’s administration. Sachs is also in favour of innovations related to stablecoins, as they contribute to the growing popularity of the dollar around the world.

Why buy bitcoins?

Bitcoin has earned its popularity as a pioneer of a new industry, Sachs added. Here is his commentary on the matter, as quoted by The Block.

Bitcoin came along first. It was the first digital currency, the industry’s original and strongest project. BTC has been around for over a dozen years. No one has ever hacked it.

The person in charge of crypto and AI policy in the new US presidential administration is David Sachs

Earlier this week, David Sachs was the administration’s spokesperson at a conference during which he outlined the boundaries of Trump’s new crypto policy. In general, the creation of a national reserve, which would be made up of confiscated and acquired bitcoins, is now one of the government’s top priorities. It is also one of Donald Trump’s high-profile campaign promises.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

In his CNBC interview, Sachs touched on the more global topic of crypto regulation in the country. He continues.

I was at the Capitol today and met with the leaders of the House and Senate Banking and Finance Committees. They are firmly committed to holding a bill this year to provide the clear regulatory framework the digital asset ecosystem needs to support innovation in the United States.

In an interview with CNBC, Sachs also mentioned that the government wants to bring innovation in the area of stablecoins. According to him, such tokens have the potential to ensure the dominance of the U.S. dollar in the international market. Currently, the financial flows associated with these coins are mostly offshore, but this may change in the near future.

On top of all this, major changes are taking place at the US Securities and Exchange Commission (SEC) – the regulator’s attitude towards the crypto industry is changing. A newly created task force on cryptocurrencies is now working to determine which cryptocurrencies are securities. We have already talked about this and other priorities of the agency in a separate article.

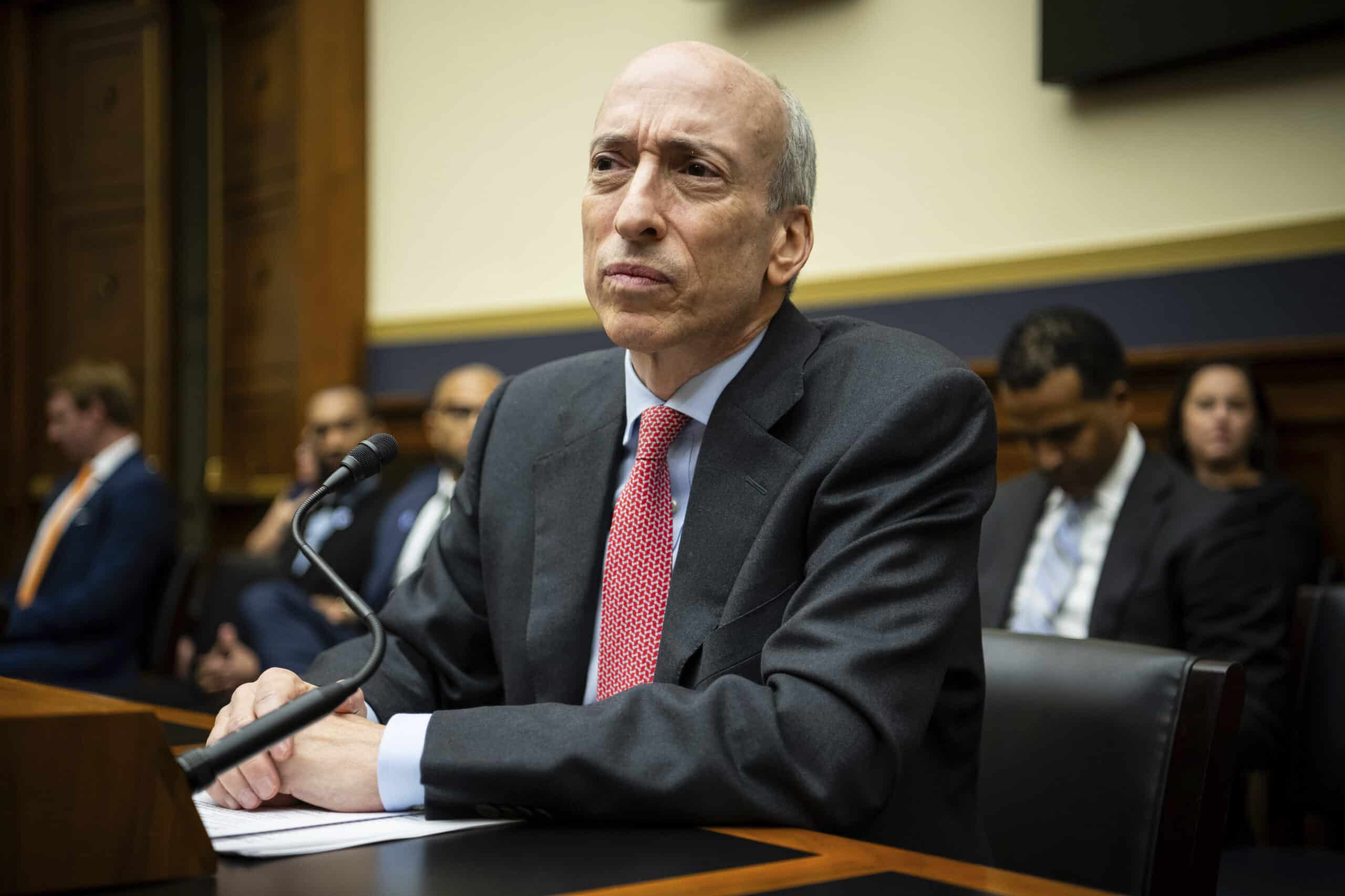

Former SEC Chairman Gary Gensler

The situation has changed dramatically with the early retirement of former SEC Chairman Gary Gensler on the day of Trump's inauguration. The regulator will now cut its dedicated cryptocurrency enforcement unit, moving some lawyers to other departments.

Who’s buying bitcoins?

The idea of launching a national crypto reserve was realised back in 2021 in El Salvador. Then in September, the country made Bitcoin an official means of payment and began to gradually accumulate coins.

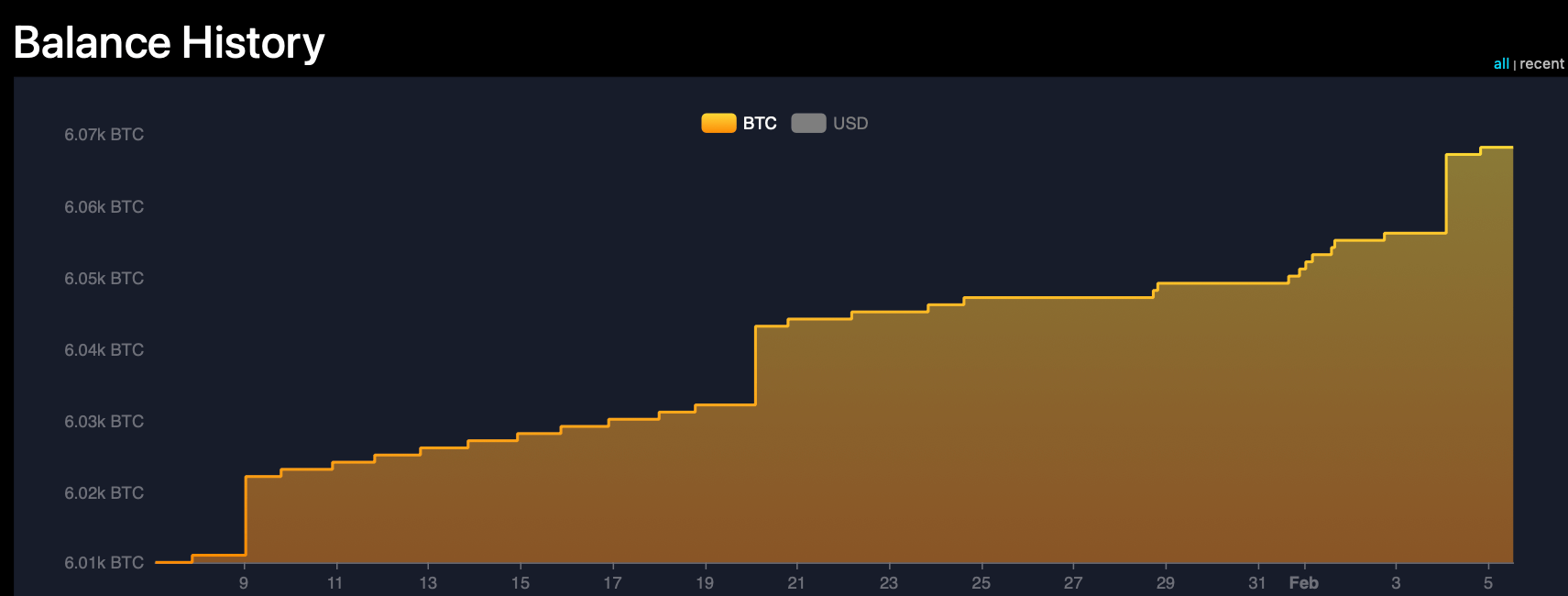

The last two acquisitions took place on 4 February, Cointelegraph reported. The government bought first 11 and then another 1 BTC for a total value of about $1.1 million.

El Salvador government cryptocurrency wallet balance change statistics

In total, as of 5 February 2025, El Salvador government wallets have 6068.18 BTC in their balance sheet with a total value of approximately $595.1 million.

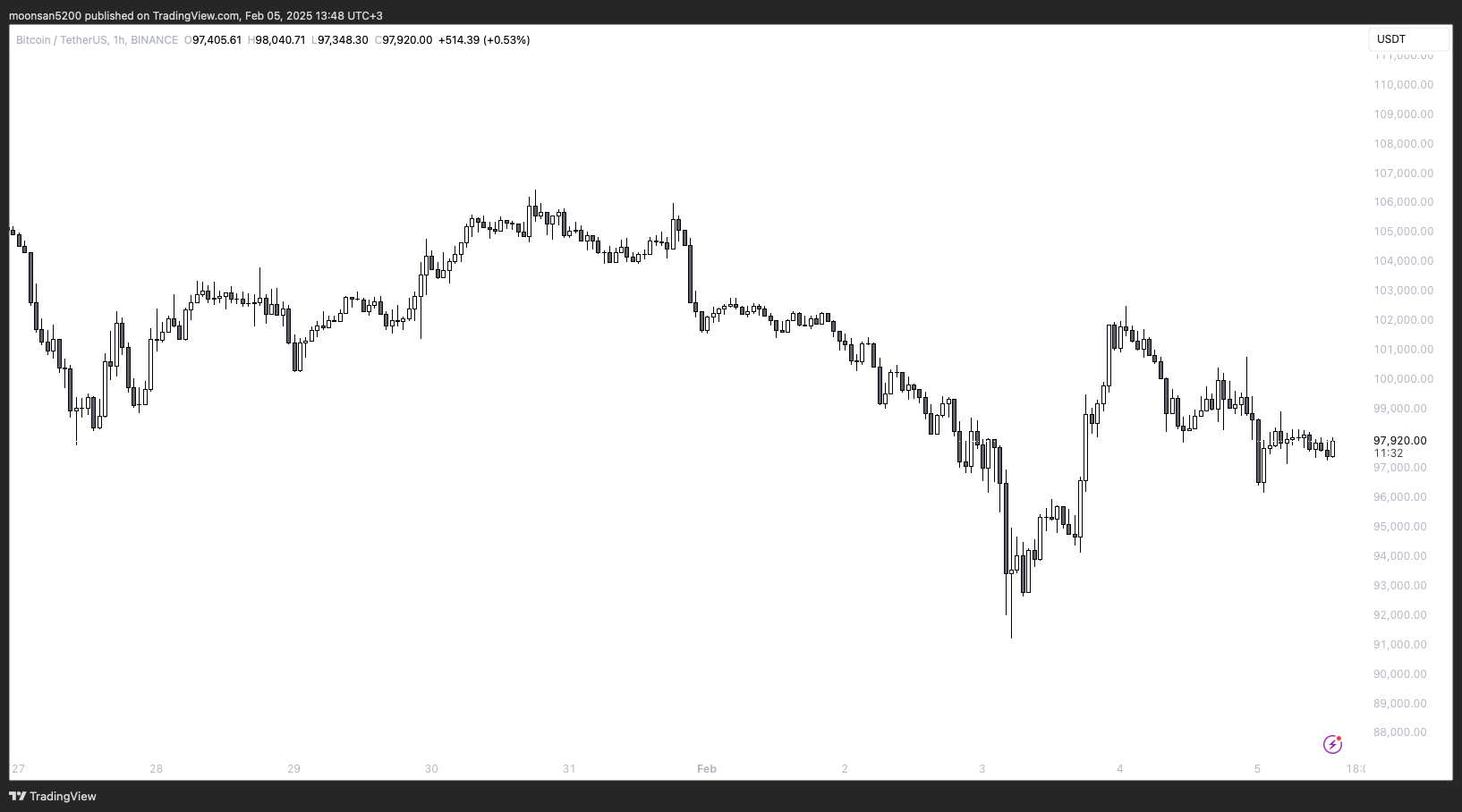

Hourly Bitcoin exchange rate chart

On 4 February, the BTC exchange rate was declining all the way down to a low of $96,150 in a trading pair with USDT on Binance. The day before, Bitcoin’s low was $91,231, the reasons for which we broke down in the article “Cryptocurrency Market Experiences One of the Largest Liquidations in History”.

The additional bitcoin purchases by the Salvadoran government came after President Nayib Bukele struck a $1.4 billion funding agreement with the International Monetary Fund last month. As part of the deal, he agreed that his government would deviate from some accepted norms for dealing with the crypto market. In particular, the adoption of BTC by the private sector has now been made voluntary, and in addition, the government will withdraw its direct involvement in supporting the national cryptocurrency wallet Chivo.

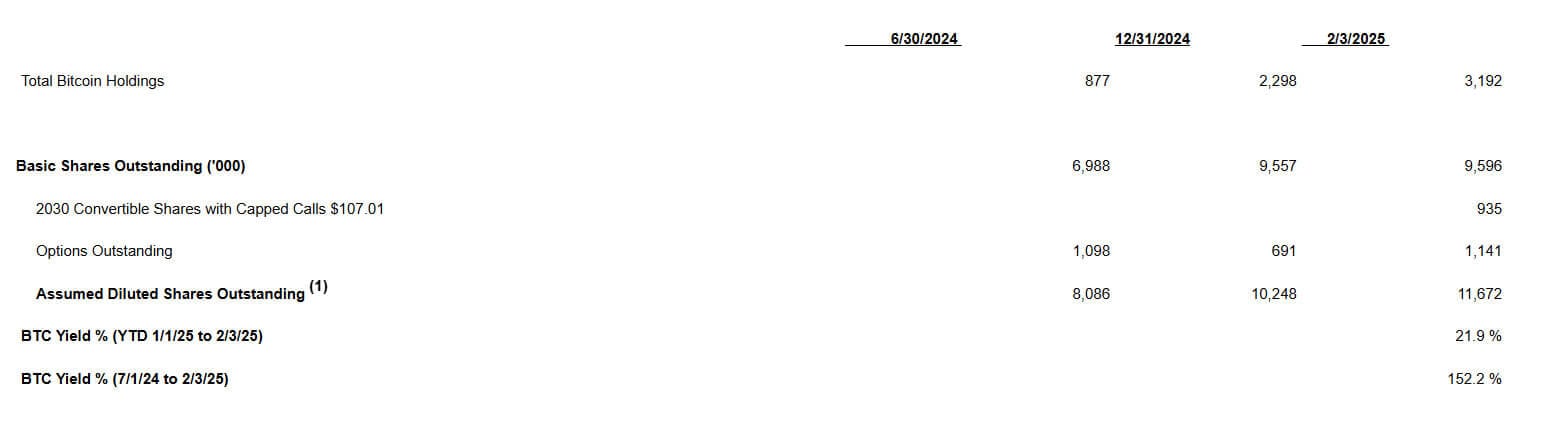

Another report on the acquisition of a digital asset was shared by Semler Scientific, which operates in the healthcare technology niche. A press release dated 4 February noted that the firm purchased $88.5 million worth of bitcoins between 11 January and 3 February. The average transaction price was $101,616.

Semler reports profitability

Analysts at Semler Scientific also reported a cumulative return of 152 percent from July 1 to February 3, which is since adopting the bitcoin acquisition policy. Overall, the firm’s return over the past year has been 22 per cent.

As of 3 February, Semler Scientific holds 3,192 BTC on its balance sheet that were purchased for a total of 280 million at an average price of $87,854 per coin. At the current price of Bitcoin, the total value of the investment is about 313 million.

Semler Scientific funded its crypto investments through a senior convertible bond offering and monetising a portion of its minority investment in Monarch Medical Technologies.

Renewed government officials in the US openly support the regulation and popularisation of cryptocurrencies. And while this does not guarantee the prospect of a national Bitcoin reserve, it is still a possibility. So investors here are left to follow the topic and make appropriate decisions.

Cryptocurrencies are an interesting topic to discuss. Join our chat to share your thoughts on the industry.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.