What will be the basis for the new stage of cryptocurrency growth: the answer of CryptoQuant analysts

In 2024, the crypto market experienced two major growth phases. The first took place at the beginning of the year – shortly after the launch of spot Bitcoin-ETFs in the US, when large institutional investors were able to get in touch with BTC without any problems. The second period began following the election victory of US President Donald Trump, who supported the coin industry during the election campaign. Now, CryptoQuant experts have revealed what will be the occasion for the next such period.

What will happen to cryptocurrencies in 2025

CryptoQuant analysts have shared their opinion on what’s happening in a new report that focuses on the realm of stablecoins. We are talking about tokens from different companies like Tether and Circle with a stable value, whose rate is usually linked to the dollar. And it is the sharp increase in the supply of such assets that could cause the cryptocurrency industry to jump.

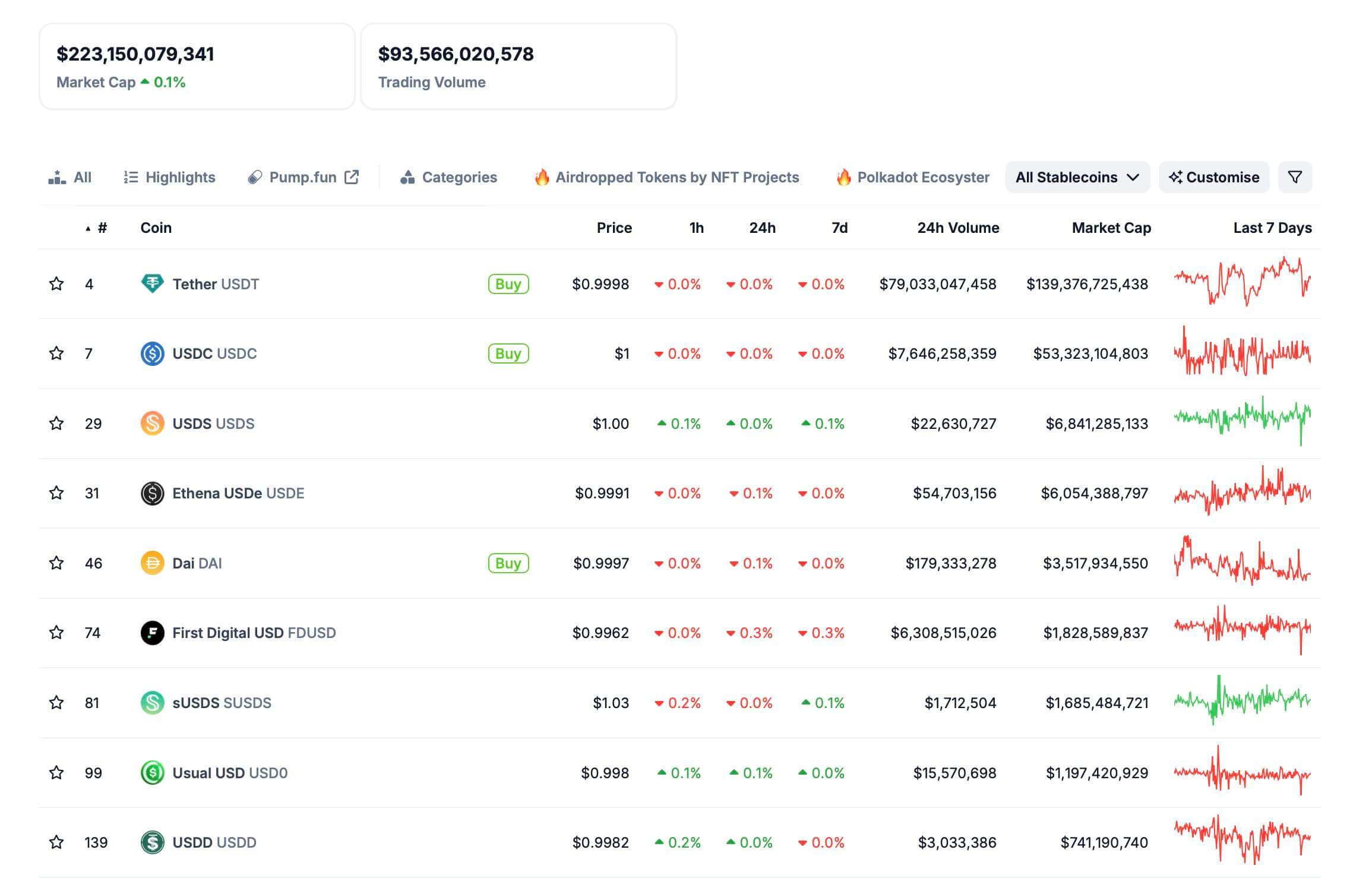

The largest stablecoins by market capitalisation

Experts note that liquidity conditions in the coin market improved significantly after the US presidential election. That is, it has been replenished with new players and capital, thanks to which trading operations with different assets have less impact on their rates. Here’s a rejoinder cited by The Block.

Historically, the rise in liquidity through stablecoins has been linked to the steady growth of crypto markets.

Analysts recalled that in mid-December, the total capitalisation of such tokens took the $200 billion mark for the first time. Thus the indicator grew by 37 billion from the beginning of November, when Trump won the election.

Stapled deposits to centralised cryptocurrency exchanges rose from 30.5 billion in early November to the current 43 billion. And since traders are more likely to wind up such tokens on exchanges to buy other coins, the trend suggests that market participants are becoming more interested in what’s happening on the market.

The total value of stablecoins is an important source of liquidity for trading on exchanges, and its growth is usually accompanied by an increase in the value of cryptocurrencies.

Overall, stablecoins continue to be one of the most popular uses for digital assets. They allow residents of troubled economies to access dollars and thus protect themselves from the depreciation of local currencies against inflation. In addition, stablecoins provide an opportunity to protect their capital from possible government and bank interference.

Tokens with a stable value are increasingly in demand among users around the world. Thanks to this, the total volume of transfers in such assets in 2024 totalled $27.6 trillion. This is 7.6 per cent more than the corresponding figure for Visa and Mastercard transactions, which reached 23.8 trillion.

Circle’s USDC token proved to be particularly popular among users in 2025. During January, its capitalisation grew by 18 percent, significantly outperforming the results of other well-known coins.

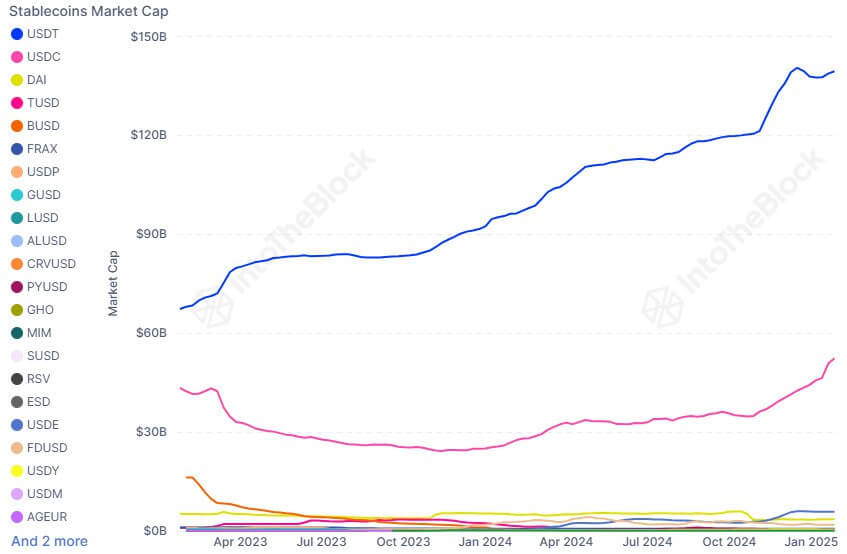

Changes in the capitalisation of stablecoins in recent years

IntoTheBlock analysts attribute what is happening to the regulation of digital assets in EU countries. Still, USDC remains the key stablecoin that complies with MiCA regulations.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

How much does Tether earn?

Issuing steblecoins remains a lucrative endeavour. As reported by the issuer of the largest token USDT company Tether, at the end of 2024, its profit reached 13 billion dollars. In 2023, the figure was 6.2 billion, meaning it more than doubled in the past year.

According to Decrypt representatives, this puts Tether on par with the biggest Wall Street companies. For example, Goldman Sachs previously reported $14.28 billion in profits last year.

Tether executive Paolo Ardoino is the head of the company

On top of that, the giant hit new highs in the number of tokens in circulation, the amount of U.S. Treasuries at its disposal, and its reserve of funds. Here’s a comment on Tether CEO Paolo Ardoino’s report.

Tether’s Q4 2024 report reaffirms our position as a global leader in financial transparency, liquidity and innovation. Tether continues to set the gold standard for stability and trust in the digital asset market.

Earlier this week, Ardoino announced the upcoming launch of USDT on the Bitcoin network and the familiar BTC-based Lightning chain. In this way, the company will surely strengthen its own position against other stable token issuers and will be able to build up its market capitalisation.

However, there are risks for USDT as well. As it became known last night, the crypto exchange Kraken will delist this stablecoin in the EU until 31 March 2025. The reason for this was the MiCA regulatory rules, which this token does not comply with.

Although on a global scale, this event is unlikely to affect the company’s leadership in the field of similar tokens.

The data confirms that stablecoins continue to be in demand by digital asset enthusiasts. Their total supply is growing, which means that investors are bringing more and more capital into the crypto sphere. Well, this traditionally leads to better market conditions.

Look for more interesting information in our crypto chat room. We are waiting for you.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.