Why are investors so reluctant to buy Efirium? Experts’ opinion on ETH yields against the backdrop of Bitcoin

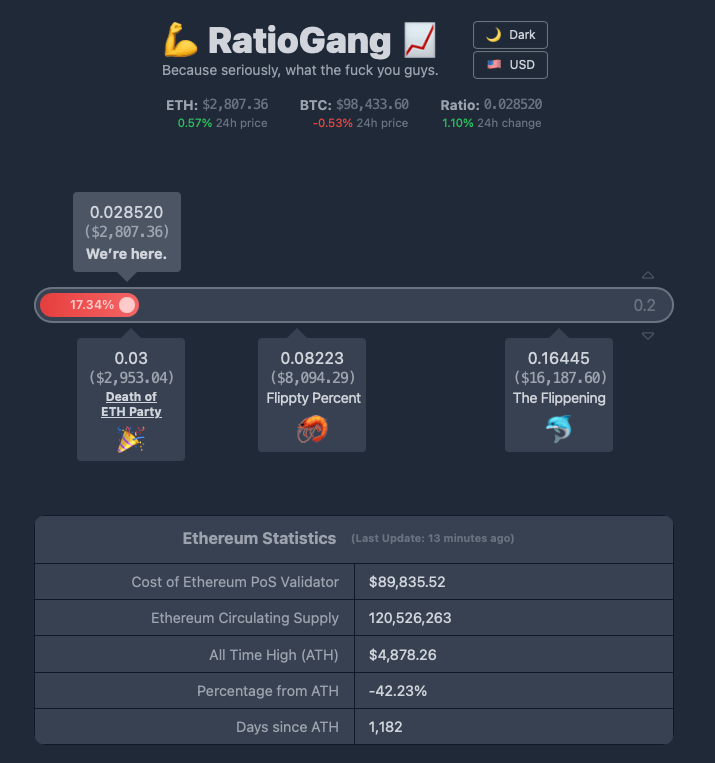

The ratio of the price of Efirium to Bitcoin has dropped to a record low for the last few years at 0.027. Overall, the chart of the ETH/BTC trading pair continues to steadily decline since reaching a local peak in mid-2022. Experts attribute this trend to the clear superiority of the Bitcoin-ETF in popularity, as well as various technical complexities of the Eth ecosystem.

Why has Efirium fallen?

In the past month alone, the value of Etherium relative to Bitcoin has sagged by at least 13.8 percent. Since mid-2022, the ratio of the price of ETH to the price of BTC has fallen by more than 70 per cent.

Efirium to Bitcoin price ratio

Bitcoin’s price has grown by 121.4 percent over the past year, but the return on Etherium has only been 46.2 percent over the same timeframe.

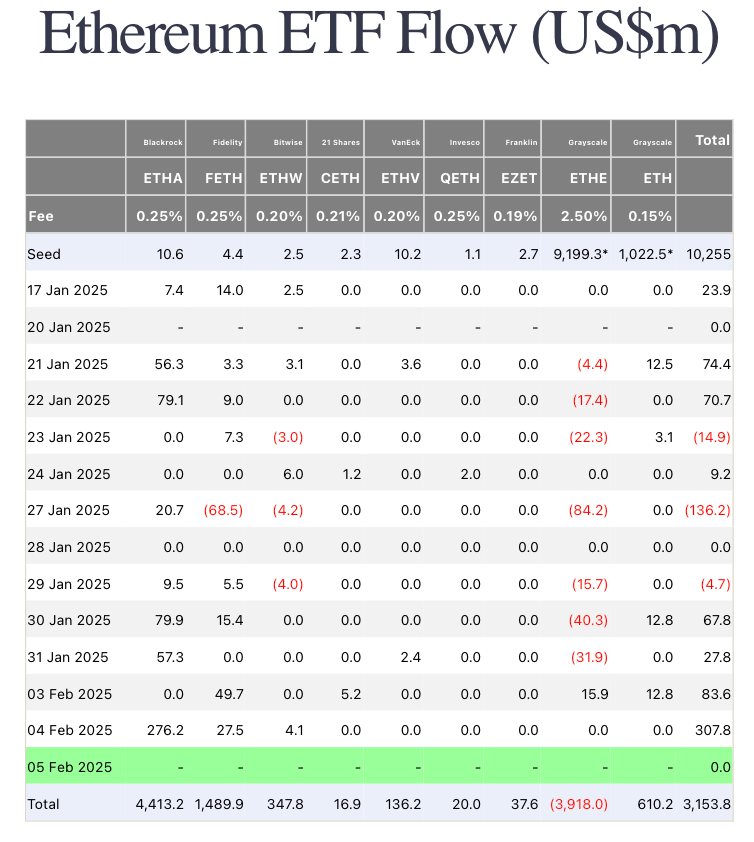

It’s worth noting that the gap between the two coins has only widened with the launch of spot ETFs. Bitcoin-based instruments managed to attract more than $35 billion in capital in 2024, while exchange-traded funds based on Efirium attracted only $2.6 billion over the same period.

Inflows and outflows from Efirium-ETFs

In an interview with Decrypt, Derive.xyz’s head of research Sean Dawson did note the positive outlook for the cryptocurrency – but over the medium to even long-term.

This means that calls are more expensive than puts, which could indicate positive sentiment ahead of Q3 and beyond.

Experts at analytics platform CryptoQuant attribute the relative fall in the value of ETH to the performance of its blockchain. Here’s the commentary.

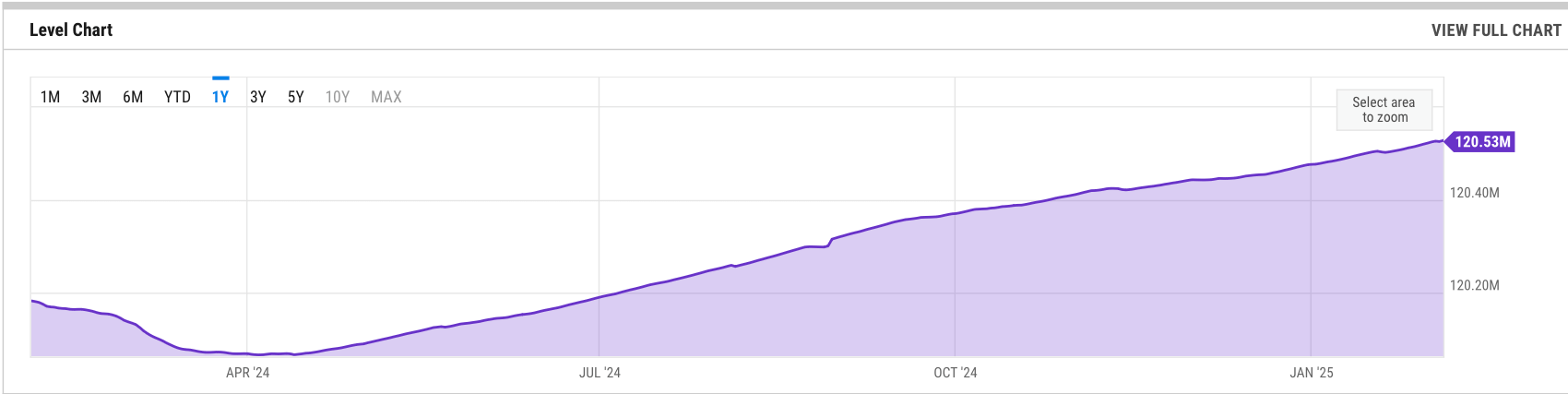

Etherium continues to lag behind Bitcoin in terms of returns. This is partly due to the fact that ETH has once again become an inflationary asset.

Recall, ETH can be a deflationary asset when, due to heavy network usage and high fees, the volume of coin burn exceeds the rate of new ether issuance. However, this has not been the case recently. For example, over the past month, the cryptocurrency’s total supply grew by 45,357 coins, which corresponds to an annual growth rate of 0.45 per cent.

Efirium supply growth

CryptoQuant added that such figures raise concerns about the situation.

While this may seem like a minor increase in supply, it is significant because Efirium was supposed to become deflationary after the Merger.

Merge is the name of the procedure of Efirium's transition to the new Proof-of-Stake algorithm, which took place in September 2022. Now, the altcoin's supply has actually increased and is at about the same level where it was before the transition to PoS.

What will happen to Efirium in 2025?

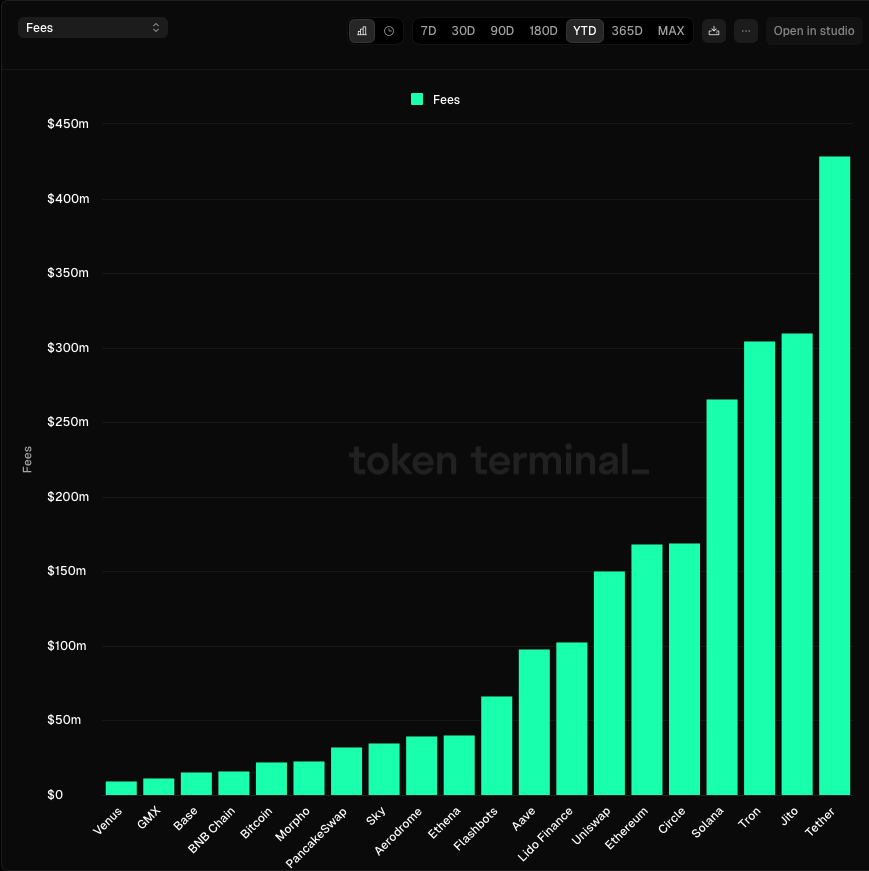

Compared to other similar projects, Efirium also shows a lag in ecosystem revenue from the commissions that validators receive. According to the Token Terminal portal, ETH ranks sixth in the ranking, behind USDC and Solana.

Ecosystem profitability by commissions for the year

A negative trend is observed in the number of active validators in the network: this indicator decreased by 1 per cent last month. Ecosystem participants are becoming increasingly anxious due to the postponement of the Pectra upgrade integration, which we mentioned the day before.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Plus according to Apollo Crypto’s head of research Pratik Kala, Etherium doesn’t have enough large buyers. In the case of Bitcoin, this is MicroStrategy, which has been actively accumulating BTC on its balance sheet since 2020. Also, we should not forget about entire countries buying coins. Among them since the autumn of 2021 is El Salvador, whose purchases continue even now.

And here’s a rejoinder from Auros managing director Le Shi.

Over the past year, BTC has dominated institutional capital inflows and market attention, especially while awaiting approval of a spot Bitcoin-ETF. Efirium, meanwhile, has shown relatively weak price movement despite its growing popularity among institutional-level players. This is especially true given the existence of Blackrock’s BUIDL fund, which utilises the Ethereum network.

Internal tensions between organisations involved in the technical development of the ecosystem are also adding to the pressure on the price. Earlier in January, Ethereum Foundation CEO Aya Miyaguchi was criticised after a mistranslated interview from Japanese. Users thought she was speaking out against the spirit of leadership that allows blockchain developers to find ever new solutions in an attempt to outperform competitors.

This prompted harsh remarks from Vitalik Buterin, the creator of Etherium – he even hinted at the possibility of changing the organisation’s leadership.

Vitalik Buterin, the creator of Etherium

In the same week, the Etherealise project was launched with the support of the Ethereum Foundation. It is aimed at finding and attracting large Wall Street investors to the Etherium ecosystem. Experts hint that internal friction and unsuccessful search for new large investments lead to pessimism within the community. Hence the negative trend in the ETH to BTC value ratio.

Finally, Efirium simply hasn’t been the best choice for investors during the current bullrun. When Bitcoin first took the $100k level in early December 2024, ETH was at $4k. The second time BTC rose above that mark, $3,900 was given for ethers, and the fourth time it was $3,400.

Finally, after the grand liquidation of the crypto market on Monday, BTC again managed to get to 100 thousand. And even then, ETH was already at $2,700, which clearly indicates the priorities of investors at this stage of growth.

In general, there are enough reasons for the unconvincing growth of Efirium compared to Bitcoin. Still, if we do not take into account the lack of large buyers like MicroStrategy, the cryptocurrency is becoming more and more inflationary, despite the previous promises of the developers. Also, we should not forget that Eth uses a scaling model based on second-level networks like Arbitrum. And this definitely draws investors' attention from Etherium to other products.

Want to stay up to date with all the crypto news? We are waiting for you in our chat room.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO STAY INFORMED.